Offer expired.

When I bought a condo in 2006 I earned six figures in United miles for being referred to a realtor. Basically they were rebating a bit more than half their commission in the form of United miles.

There are opportunities to earn miles for mortgages as well, and for using a moving company. Big dollars are involved in real estate, so big miles are too.

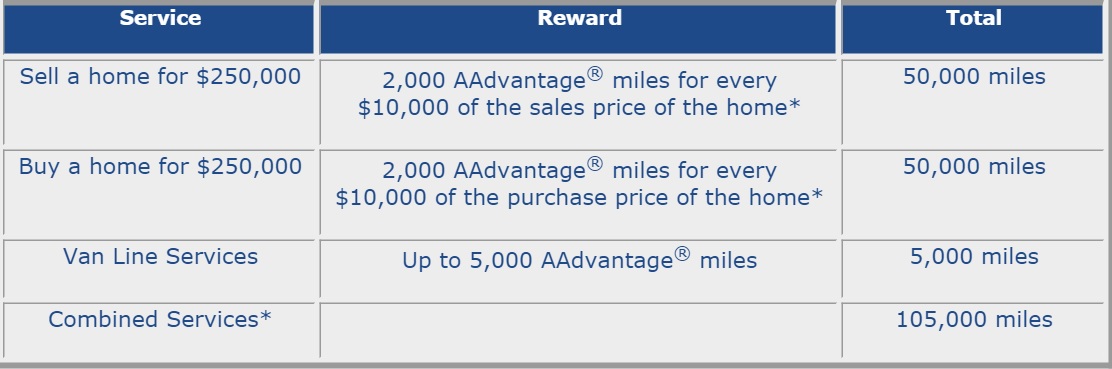

American Home Miles will give you American AAdvantage miles for the real estate transaction, miles for working with them on your mortgage, and miles for using the moving company they refer you to. In each case they’re rebating a portion of commission.

Miles from Home will give you American AAdvantage miles for real estate transactions and mover referrals. They don’t do miles for mortgages.

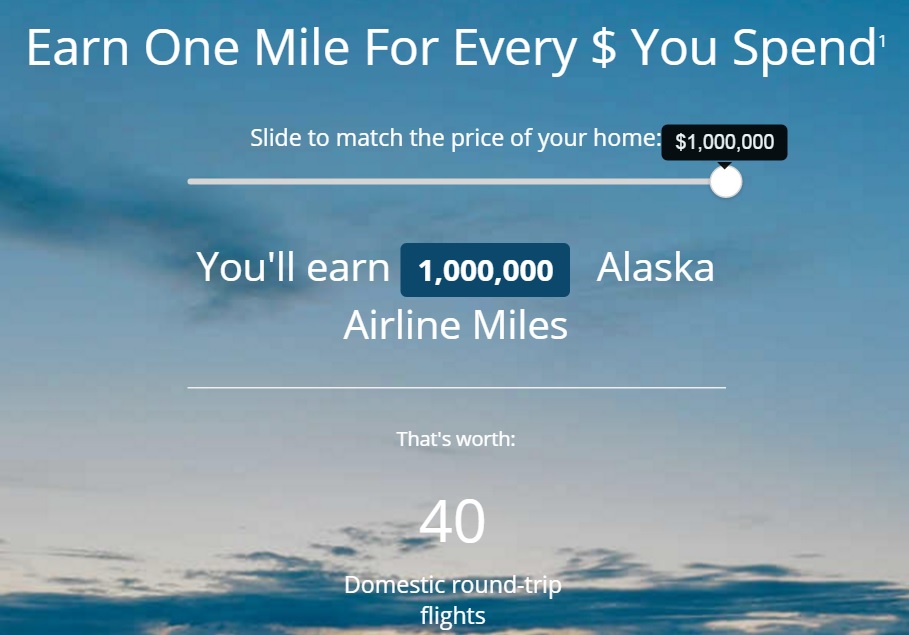

You can also earn 1 Alaska mile per dollar spent on real estate through FlyHomes.

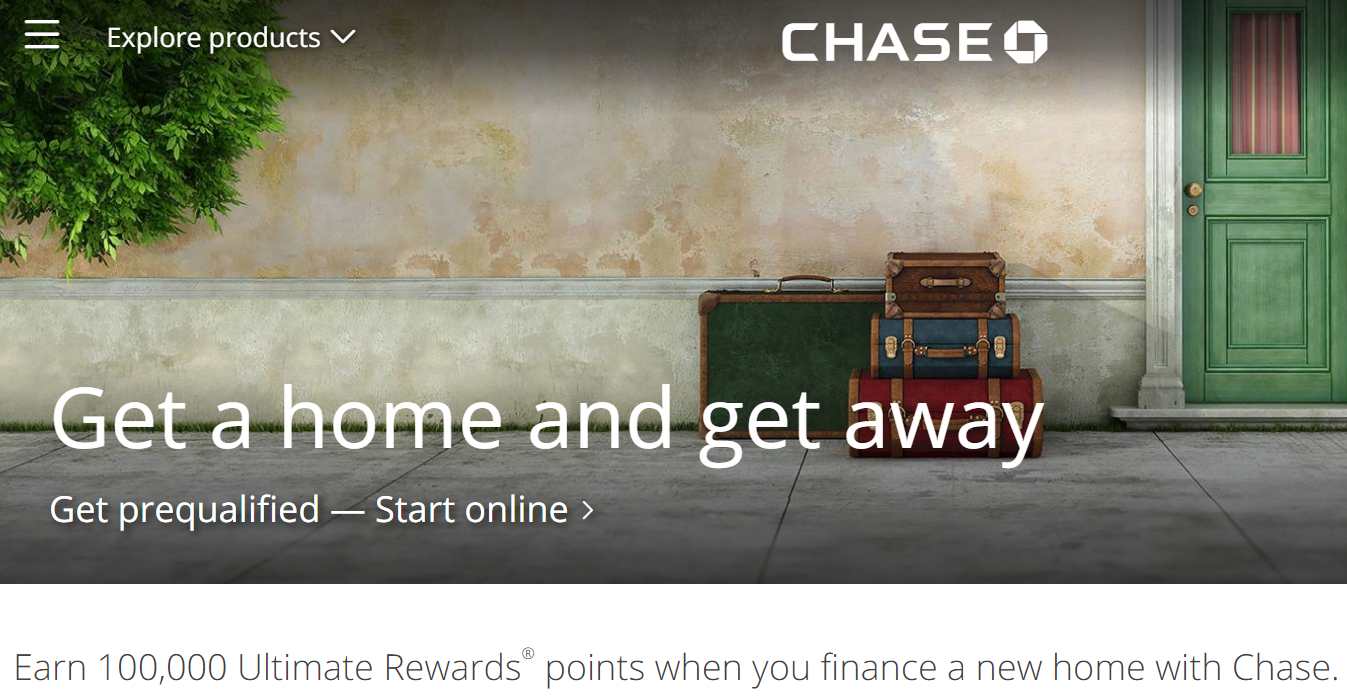

Via One Mile at a Time existing Chase Sapphire, Chase Sapphire Preferred, and Sapphire Reserve cardmembers have a limited-time opportunity to earn 100,000 Ultimate Rewards points for new residential first mortgage. This is available through August 6.

JT Genter points out that this stacks with a current $595 cash back offer.

Compare the best available rates, of course, I value 100,000 Chase points at $1900 so it’s a nice rebate that contributes to the overall value calculation of a mortgage.

Big miles from Chase for mortgage financing is hardly new. Years ago it was possible to earn big miles opening a home equity line of credit and repaying it immediately, folks earned hundreds of thousands of miles this way for very little out of pocket. It’s nice to see a big offer back, even if it’s not available on refinances.

Terms and conditions:

Customers must have Sapphire, Sapphire Reserve or Sapphire Preferred credit card prior to 05/07/2017 to be eligible for this offer.This offer is only available for new, residential first mortgage purchase loans submitted directly to Chase. Applications must be submitted between 05/08/2017 and 08/06/2017. Chase mortgage loan must be funded and closed in order to be eligible to receive 100,000 Ultimate Rewards points.

Upon the customer’s enrollment, Chase will review the account to ensure the eligibility criteria are met. This offer is not transferable, is limited to one per property at any given time, and may be discontinued at any time without notice. 100,000 Ultimate Rewards points will be posted to the Primary Cardholder’s account within 10 weeks after closing a purchase mortgage with Chase.

Your participation in the program may result in the receipt of taxable income from Chase and we may be required to send to you, and file with the IRS, a Form 1099-MISC (miscellaneous income). You are responsible for any tax liability, including disclosure requirements, related to participating in the program. Please consult your tax advisor if you have any questions about your personal tax situation.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

This was interesting. What do you have on refinancing bonus points?

There are typically much better ways to save money in residential housing. Even if you might benefit from this Chase offer I’d bet you’d find better offers for less money or fees somewhere else…

When going for something as big as a mortgage Chase points are probably the least of my concerns. I want the best deal possible/lowest interest.

Always worth doing the math, but given that Chase’s mortgage rates appear to be 25-50 bps higher than their competitors, unlikely that this is a very valuable deal.

Hi all! This American Home Miles program is still running and not expired like the page says You can still see all points offers at AmericanHomeMiles.com.