Banks survey customers all the time, including about potential changes that may not come to fruition. Sometimes change is real, other times the possibility is ephemeral.

Recently Chase surveyed Hyatt cardmembers about new benefits for the product to make it more appealing. Whatever they ultimate come up with, it definitely is real that they’re considering updating the card now that they’ve re-signed Hyatt as a partner.

Citibank is surveying some Prestige cardholders about new benefits and earning structure.

The card lost access to American Airlines Admirals Clubs when flying American; the free golf benefit; redemption of points at 1.6 cents for American Airlines flights or other airlines at 1.33 cents replacing it with 1.25 cents across the board; and rebate of taxes on fourth night free hotel benefit.

Citi Prestige No Longer Provides American Airlines Lounge Access

Citi just updated the Prestige card in July to be a metal card (albeit lighter than other cards), offer online reservation of 4th night free benefit and ability to use points to pay for hotels while redeeming fourth night free (at 1 cent per point). But you shouldn’t book online because it’ll potentially mitigate elite benefits and hotel points-eaerning. These hardly offset the card’s losses.

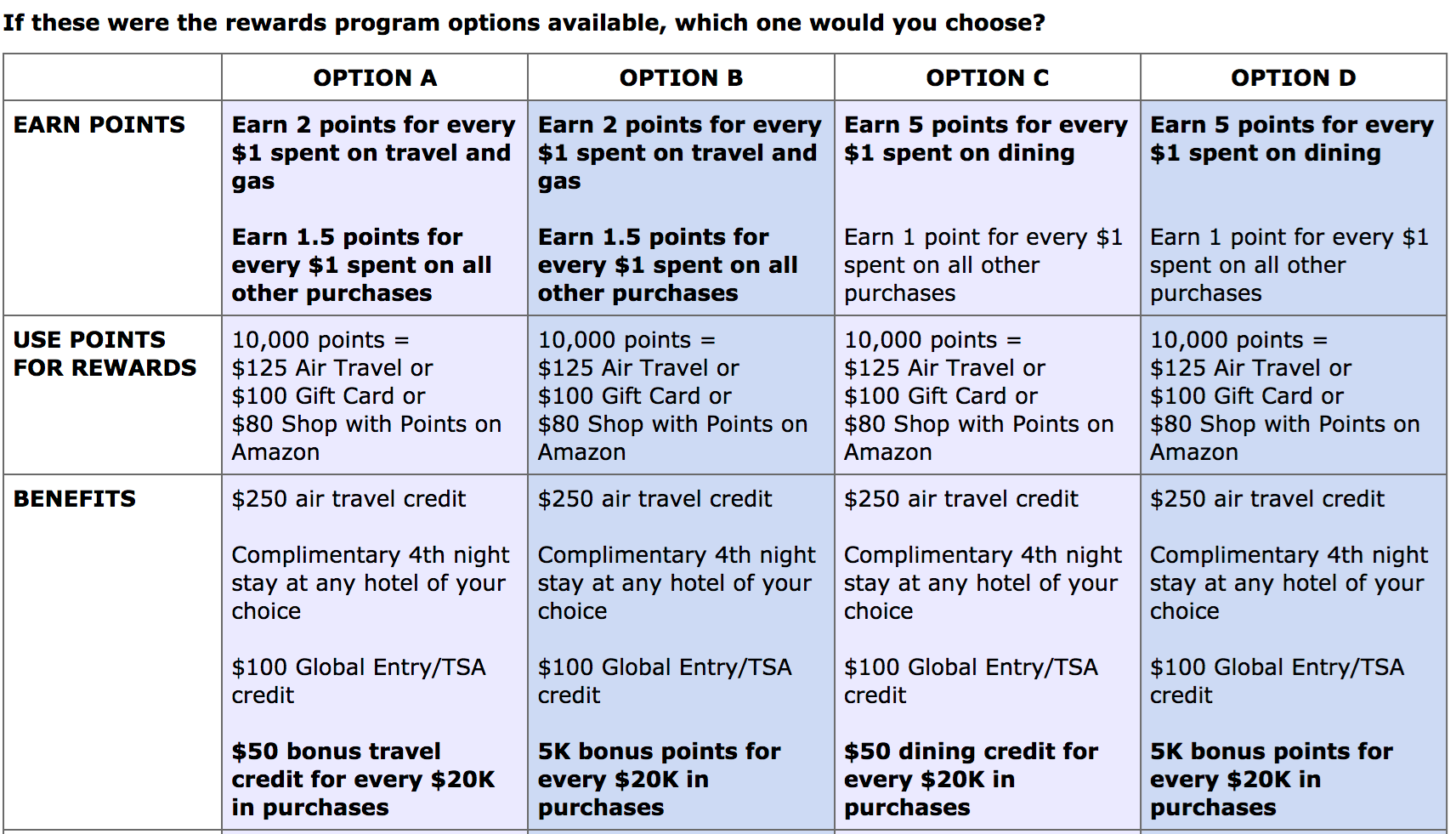

Perhaps Citi is realizing this. Here are (4) of the earning and benefits packages presented in one survey:

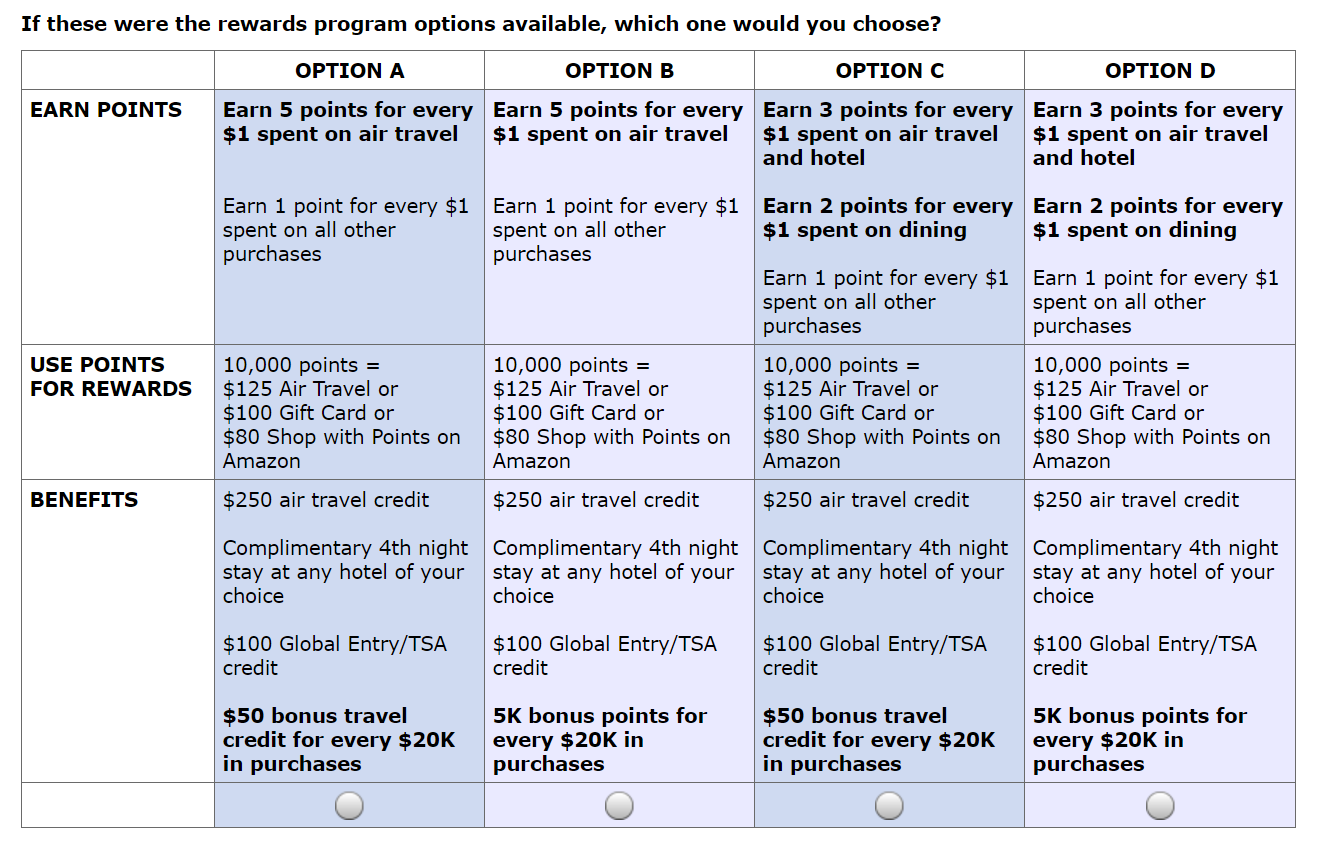

- All four of these options would increase mileage-earning compared. I personally like 5 points per dollar on dining because at 2 points per dollar it wouldn’t be my go-to card for travel (even paired with 5000 bonus miles for every $20,000 spent). Even at the current 3 points on air and hotel it isn’t.

- All come with the option to spend points on retail instead of travel. But they already offer cash value at a penny, so what’s the benefit here?

- All come with a $250 air travel credit. Customers are also surveyed about a higher credit. To make the devalued card worthwhile a higher credit would be nice, only the 4th night hotel benefit is truly unique.

- All options in this graphic include 4th night free at hotels. However other surveyed options include 3rd night free but limits on use e.g. twice per year. It’s concerning that they’re surveying new limits on the best benefit the card has, cost cuts when they need to invest more in the product.

Here’s the version where air travel credit potentially goes up to $300:

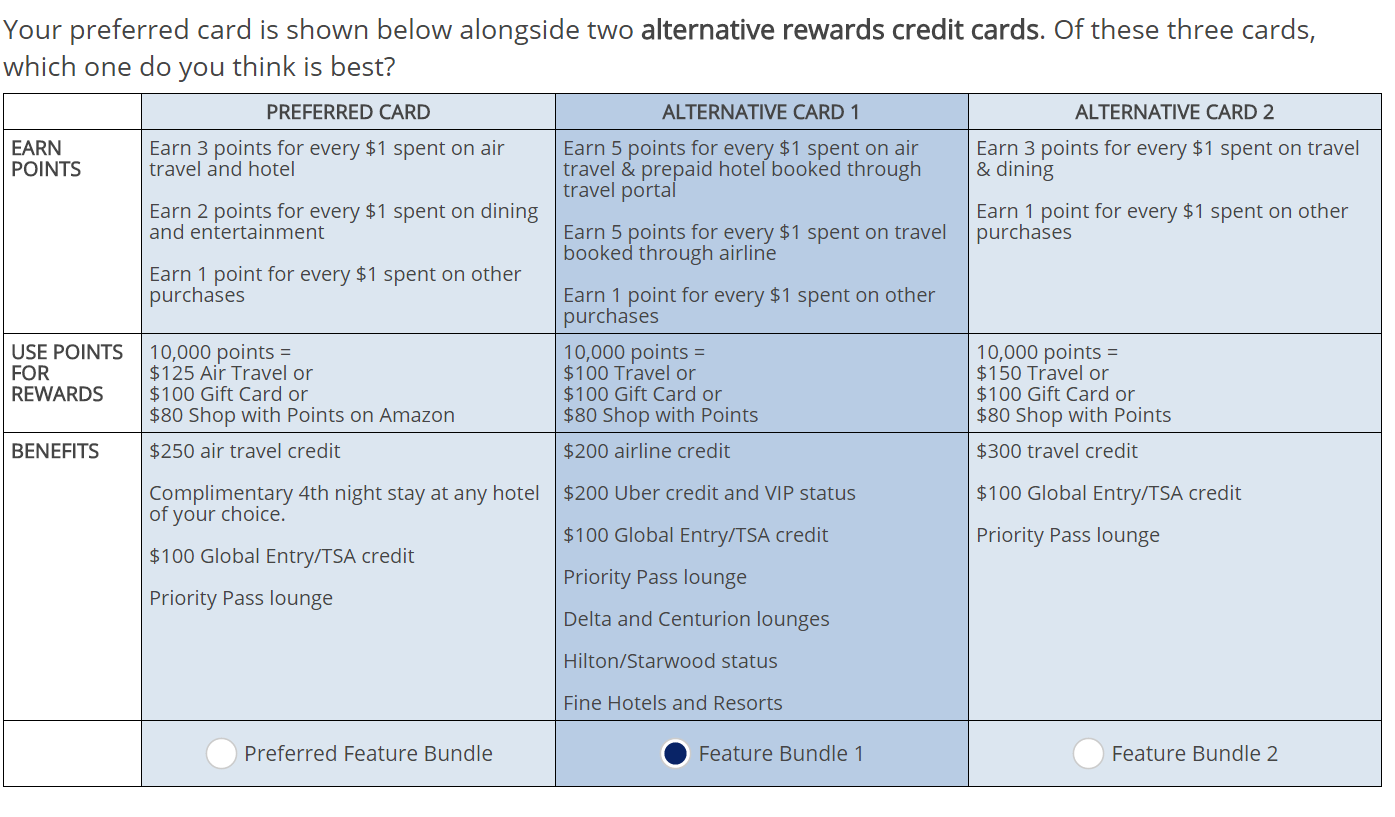

And here’s one that particularly fascinated me, they compare Prestige pretty directly to American Express Platinum without naming the card, they even mention Centurion lounge access.

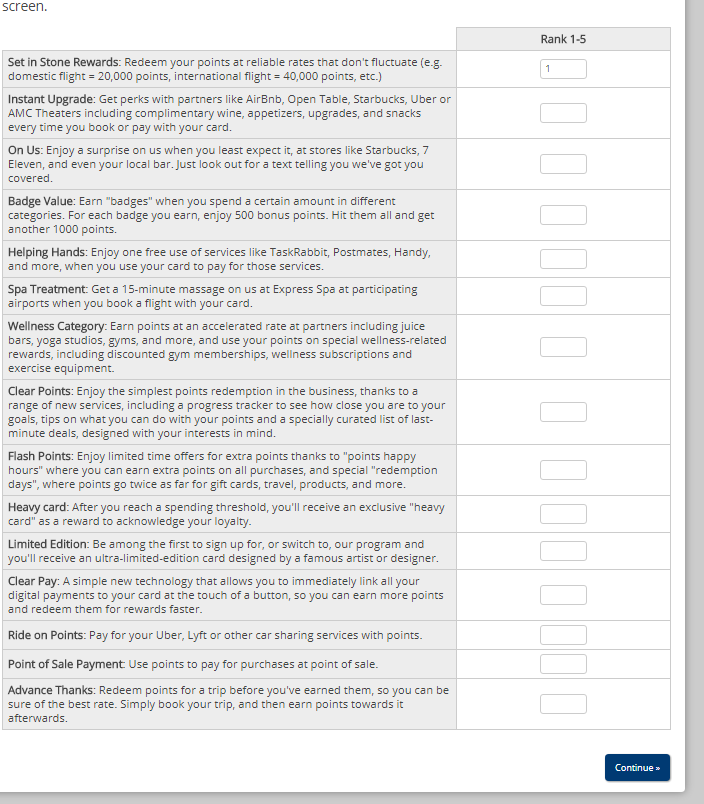

As part of the process they asked cardmembers to rank order different kinds of benefits. This is interesting because it shows the kinds of buckets that they think of benefits as falling under.

MilesTalk offers more screenshots of potential changes Citi is surveying.

Though a Prestige card holder, I didn’t get the survey. But for what it’s worth, I think that if Citi wants to attract and retain Prestige card members and keep them shelling out the high annual fee, it will go with the 5X points for dining or travel or preferably both. That’s a big draw (for travel spending) that Amex Business Platinum cards (which I’m getting, with that benefit being the biggest draw) and Chase Reserve have, though Chase shoots itself in the foot with the 24/5 rule.

Not worth it to me since they got rid of the golf benefit. Throw a free round in and I might consider again.

5 points-per-dollar on dining would do the job on keeping the card towards the front of the wallet. The gas/grocery bonus space is non-luxurious and already offered by other cards (Amex Everyday & PRG); leaving the Prestige as an also-ran.

On the other hand, I think the CSR would remain first-choice for most customers with its broad 3x category. 5x dining would only make the Prestige competitive with the Amex Plat for the 2nd high-end card in people’s wallets. Maybe that’s their goal, with the hopes that CSR devalues its way out of 1st.

Citi did the 5x dining for years as well with the forward…

Interesting… I’m curious whether Citi aims to compete directly with Chase/Amex (eg, copying the earnings structure exactly), or carve out something they’re best at (eg, 5x dining points). Limiting the number of times per year you can take the hotel credit while shortening the stay requirement is probably their way of broadening the appeal while limiting the losses for the 2% who live in hotels and undoubtedly drive a huge portion of the cost of this benefit. I think the average family of full-time workers probably doesn’t stay somewhere (on their own dime) 4 days or longer more than once or twice per year. This feature is absolutely what differentiates the card, but without AA lounge access or unique transfer partners, it’s not enough to justify the annual fee for me.

Citi gutted the value proposition of this card by removing the Admirals Club access, removing the annual free golf rounds benefit and averaging the 4th night free credit (in lieu of crediting the actual cost of the 4th night).

Some of the proposed bonuses for spending $20K on the card are laughable. $50 dining credit? $50 travel credit? That’s a miniscule .0025 bonus.

I still get more than the annual fee out of this card due to the travel credit and the fourth night free benefit, so I keep it. Those are the make-or-break benefits for me. However, 5 points per dollar on dining would be mighty attractive.

As I’ve said in previous comments, since I don’t golf nor fly AA, those benefits were wasted on ***me***. (Once again, proof that “no one size fits all.”) That said, virtually EVERY question/option presented in the survey represents a FURTHER DOWNGRADING of benefits — from (as @Grant points out) a $50 dining credit to the idea of limiting their 4th Night Free benefit.

In every Comment Section, I “screamed” at them they need to INCREASE their benefits in order to remain competitive with CSR and Amex Platinum, not decrease them further!

/\/\/\/\/\/\/\/\/\/\

THREAD DRIFT: Again, speaking strictly for myself, I’m *not* crazy about the Amex Platinum’s 5x on *pre-paid* hotels — far too often, travel plans change. So I (personally) would receive 5x on airfare, but only 1x on hotels, and THAT isn’t worth it to me. I’d rather receive 3x on BOTH than 5x & 1x.

Furthermore, if Citi changes to offering 5x on dining and 1x on everything else, that might make it my “go to” card for dining — I’d continue to get more points on airfare by using other cards, but no one offers 5x on dining! — but I certainly wouldn’t use it for anything else! And as such, it probably wouldn’t be worth keeping.

I have the Citi Prestige and Chase Sapphire Reserve. Some random points:

I would like it if Citi would provide primary coverage for rental car CDW as Chase does.

The Citi travel insurance benefits are better – you get benefits with a 3 hour delay, vs. 6 hours with Chase. Also, I have found that Citi is much easier to deal with for price protection (found lower price after purchase) than Citi.

The 4th night free has been devalued because you now have to pay the tax for the 4th night.

With all of the cards giving Priority Pass the lounges are more crowded, and more and more seem to have time of day restrictions for Priority Pass.

Maybe I am in the minority but I never stay in a hotel for 4 nights and basically 5 days. Even on long 2 week trips I am in and out of a city in 3-4 days so 2-3 nights. It’s been a while since I’ve done a resort type vacation but that’s the only time I would do 4+ nights somewhere

I bet more people do 2 3 night stays a year vs “unlimited” 4 night stays a year. So as someone who is unhappy with my Citi account and is thinking of cancelling the 3rd night free is enticing if it happens

Now just get some better transfer partners!

I just product changed my prestige to a double cash card. I saw no reason to keep it with the loss of AA lounge access since I have PP lounges via the CSR card. Upping the airline credit and offering 5x points on dining would make me consider using the card for 3/4 of the year when the freedom isn’t offering 5x on dining. Either way I don’t regret closing the card. I have emptied my TY points account . I have the CSR which gives most of the same benefits and if I ever got rid of that or it got devalued I’d pickup the amex plat again. Its a shame because for awhile my prestige card was my favorite card in my wallet.

I do miss the AA club access, but I still do use my Prestige card for airfare and for 4 night stays. Limiting the 4th night benefit would likely have me canceling the card. On the other hand, 5x for dining would move the card from my desk drawer to my wallet.

The 4th Night Free benefit is going to end up being worth about $1500 to me this year alone. If they mess with that too much, they’d have to do some pretty compelling points earnings to compensate, or it’s just not worth having compared to the CSR.

Was the survey meant to be copied and made public on a blog, or was the recipient supposed to treat it confidentially?

I’ve read about the benefits that some premium US credit cards offer to overseas cardholders (including I think the Citi Prestige) and one that stands out that I would like to see them offer their US cardholders is free private chauffeured car/limousine rides to/from the airport. In some cases I think the cardholder gets around four such free rides per year and they cover a pretty long distance (up to 90 miles some cases). This would be a pretty unique benefit in the US and one that I would really enjoy and would help the Citi Prestige differentiate itself after dropping Admirals Club and free golfing benefits. Odd that it’s offered only overseas and not in the US.

@Sam —> never heard of this, but it would cost Citi far too much money if this benefit would offered in the States.