I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The first two things anyone interested in frequent flyer miles and travel should do is sign up for Award Wallet to track your points and get a Chase Sapphire Preferred Card to earn the most points in a highly flexible, valuable currency, quickly.

Don’t even think about them, take my word for it, just do. You’ll thank me.

Why Chase Sapphire Preferred is a Key Tool for Any Savvy Frequent Flyer

The Chase Sapphire Preferred Card: Earn 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $625 in travel when you redeem through Chase Ultimate Rewards® Introductory Annual Fee of $0 the first year, then $95

You can earn another 5,000 bonus points when you add your first authorized user to the account and make a purchase in the same 3 months from account opening.

The card earns 2X points on travel and dining at restaurants & 1 point per dollar spent on all other purchases worldwide.

Points can be transferred to the program you want them to go to — you decide later which one (based on who has the award space you need) and in what quantities.

You can choose from United, Korean, Air France Singapore Airlines, British Airways, Virgin Atlantic and Southwest. That gets you all three major airline alliances, it gets you the extra award space offered to Singapore’s and Air France’s own members. And it gets you non-alliance airlines Virgin Atlantic and Southwest (which has no change for redeposit fees if you need to cancel a trip).

Singapore Airlines Suites

Points transfer to hotels as well, Hyatt is an especially good value but Marriott, Ritz-Carlton and IHG Rewards Club are options too.

Why Award Wallet is a Key Tool for Any Savvy Traveler

Regular readers of the blog know that I use Award Wallet to track my miles and points.

The free version of the service suffices for most. You enter your frequent flyer account numbers and passwords. Then you can update most of your account balances with a single click and see them on one page. You can log into your accounts with a single click.

When I first signed up I realized quickly I was happy to pay the minimum required for their premium membership that included expiration date tracking for many of my accounts.

To me signing up for an Award Wallet account is one of the very first steps to take getting started in this hobby. Not only does it help you manage your points, but it also notifies you of changes to your travel reservations. That’s saved me on several occasions. Sometimes it’s an aircraft change, or a seat assignment change, and I’m able to fix my booking in advance while there are plenty of options rather than finding out at the airport with slim pickings at best.

I also feel more confident that my miles are protected when I track them with AwardWallet. I see changes in my account balnaces right away, since I hit one button to update my accounts each morning. If someone was stealing my miles, I would know right away and probably before they actually traveled with them. AwardWallet also ensures I know when miles post, which helps in tracking down miles I am owed rather than earning miles and merely hoping they post.

Sign Up Free, Upgrade to Premium Free

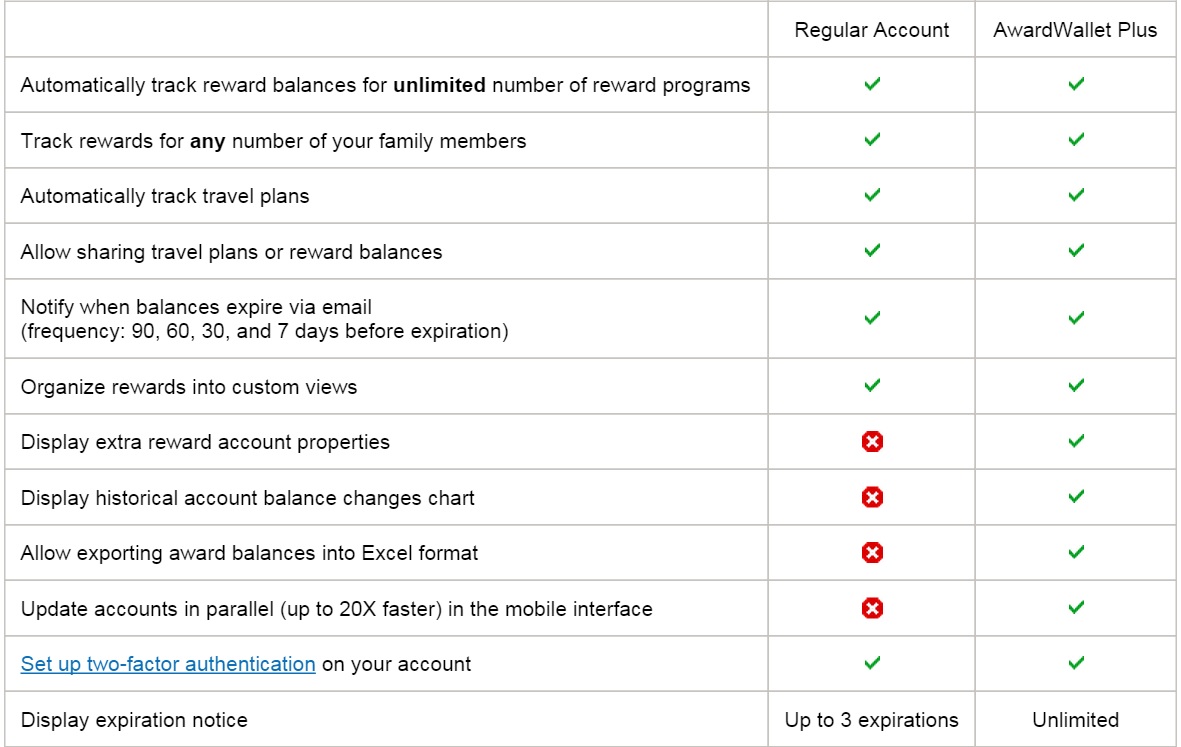

Most benefits are provided free, however there are extras that come with the ‘Plus’ version of AwardWallet, like expiration tracking for the majority of your accounts. Here’s the comparison:

Here are 86 free upgrade links that will let you take your existing free account and give yourself premium service for 6 months.

They’re likely to go quickly, I apologize if they are gone by the time you try them. Hopefully readers may be willing to give away their own upgrade coupon links in the comments as well.

Here’s my AW coupon code: free-nqxgkj

Thank you for the Premium Awardwallet code! Safe Travels!

Thanks, Gary. I finally was fast enough!

thank you GARY

If you haven’t done this yet, don’t waste your time, it’s already too late….

I totally don’t get why you do this. There is no time listed for this post, so no way to even begin to guess if there is any use in trying. There are 77 codes to try, and tens of thousands of people signed up for this blog. So presumably somewhere between many hundreds and several thousand people waste their time futilely trying code after code, and getting nothing from it. 🙁

wow, I just found one not used. I feel like I did when I won a cd from a radio station…

Maybe it’s just me, but I don’t particularly like the idea of entrusting all of my IDs and passwords to a 3rd party website. I’ll stick with my super awesome excel spreadsheets thanks.

Go one! Thanks so much 😀

After a couple of failed attempts the Award Wallet website locks you out for 5 minutes too. Appreciate you doing this Gary, but maybe on the next go-round encourage users to post which codes they’ve used? That way we can determine which ones (if any) are still available, and it’ll hopefully save your readers time.

For now, I’ll keep on trying a few codes, getting locked out, and then trying more codes until I make my way through the list.

PS – PLEASE POST if anyone else has already tried all the codes. It seems like it lets you try 5 codes at a time before locking you out, so in theory it should only take 86 minutes to try all codes.

I urge everyone to use 2-factor authantication with Awardwallet. That way, you will be protected even if your password is compromised.

Here’s mine

free-vobaoy

Here’s my AW coupon code: free-nggjgo

@STG ” in theory it should only take 86 minutes to try all codes”

I can pretty much guarantee that none of the codes will still be there after anywhere near 86 minutes. Apparently I gave up too soon though, as it seems after trying 10 randomly selected codes, and then giving up. a couple of people still found a working one after I quit. Having gone thru this several times before, tried all 77 codes, and not found a working one, I was loathe to do all that again.

I would argue the 2 most important things a new hobbyist should do is 1) Check your credit score, and 2) Determine your travel goals.

Someone with 3 kids wanting to save cash on their trip to disney certainly doesn’t need award wallet and would likely benefit more from cards other than the CSP. They would need a drastically different strategy from DINKs wanting to see the world in luxury.

And without a good credit score and history of financial responsibility, applying for a new credit card is likely to cost a person significantly more in the long run than the 50K points they would earn.

But I’m not a travel blogger, so don’t mind me 😉

Thanks @djp_707! Used your code and it worked!

@Robert, I gave up too… The 5 minute lockout was too annoying.

@C Diddy, totally agree with you, especially on the credit score. Every time someone asks me about CCs I tell them to make sure they know their credit score and how additional cards might affect their credit rating. And fun fact, apparently some credit card companies don’t like housewives. A friend’s wife applied and they told her she could only use ~her~ income, not household income. She was declined and now that shows up on her credit history too.

@STG, I thought the law was changed a while back so that the credit card company is required to accept household income.

if anyone else needs a referral code you can use mine (thank you to the people who posted before me for their code as well, finally made an account since i could never find a working code):

free-vzmoht

@Mike, that was my understanding too, and it looks like we’re right: http://www.consumerfinance.gov/about-us/newsroom/the-cfpb-amends-card-act-rule-to-make-it-easier-for-stay-at-home-spouses-and-partners-to-get-credit-cards/. It’s possible she just had a bad CSR (I think she tried to do it over the phone).

I’ll follow up with her. I think she wanted the Chase Sapphire, in which case I can get a small referral bonus too :-).

My code is free-jcoihy. I have enjoyed using AwardWallet since Gary posted it time before last. However, I believe it is only good for another 2 months. Do they only run in 6-month increments?

@Joan H thanks for the code! I do think they’re only 6 month increments.

I still have SEVERAL of the codes available! 🙂

free-jcoihy