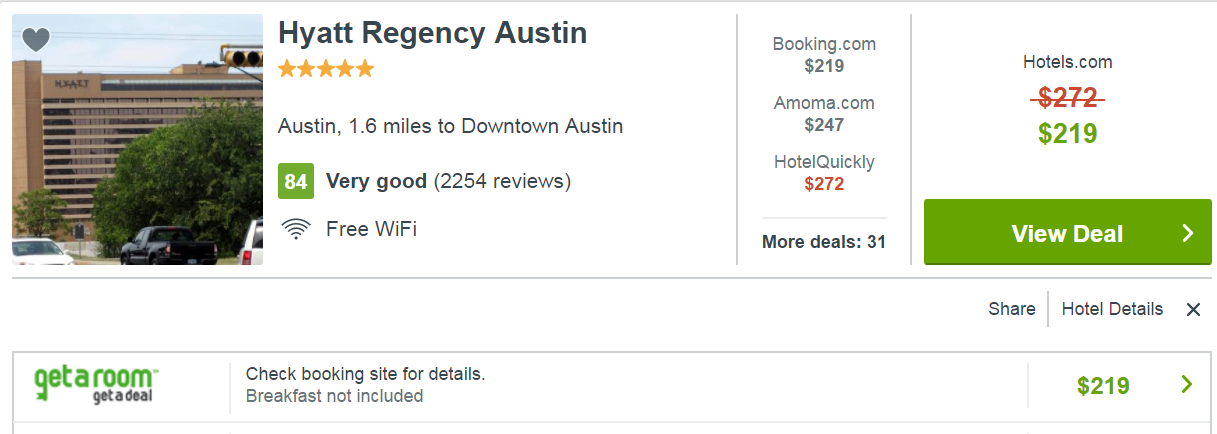

Hyatt informed its hotel owners last week (subscription) that it intends to terminate its distribution agreement with Expedia. This is a negotiating tactic to drive down the commissions it pays. If they don’t reach a new agreement by July 31, then on August 1 we’ll see Hyatt properties disappear from Expedia and related brands (Hotels.com, Orbitz, Hotwire, Travelocity, Wotif).

Expedia Doing the Commission Dance… Flickr: Juggernautco

Hyatt’s note to owners calls this “a powerful step to reduce distribution costs by shifting bookings to lower cost and more flexible channels.” They think they can move more bookings to Hyatt direct channels, and that the World of Hyatt loyalty program can help.

- The program isn’t compelling for most guests, certainly not more compelling than before. It’s arguably better for those who are able to earn top tier elite status. Millions of members see only the program’s earn and burn proposition and that hasn’t changed. Elite levels below top tier are uncompetitive with other chains.

- However one key change is that up through March 1 Hyatt would honor elite benefits (but not offer accrual) on stays booked through third parties. World of Hyatt took this away, the change to the program I hate the most.

- So at most World of Hyatt will shift a small percentage of room nights being booked by its top tier elites away from third party booking sites, although even there it’s not clear that the median top tier member even knows about this change.

Park Hyatt Dubai

At the same time that Hyatt properties may lose some of their business, they’re going to be going to be seeing higher costs and lower payments from the chain.

- Hyatt says, “In support of this sales and marketing plan, Hyatt is reallocating existing budgets, as well as reinvesting money hotels would have otherwise paid to Expedia for its commissions and marketing fund.” Effective July 1 fees for owners of North American full-service properties and select-service properties worldwide increasing 7% (from $1,435 to $1,535 per room per year for North America full-service hotels, 3.5% to 3.75% of rooms revenue each month for select-service properties worldwide). The increase doesn’t apply to full service Hyatt properties outside North America.

- Hyatt properties are likely to see lower reimbursement for reward night redemptions. Hotels are paid a discounted fixed amount per room night redeemed by program members, but receive an override equivalent to their average daily room rate when they’re close to sold out (95% occupancy). Hotels will find themselves hitting 95% occupancy less often.

Hotels that rely heavily on online travel agencies will be significantly harmed in the short term. For U.S. hotels this will skew towards those with strong international demand such as Hawaiian hotels.

Andaz Maui

Apparently though some Hyatt properties have already been harder to find on Expedia (a ‘dimming effect’) because of disputes between Expedia and the chain. Those properties are already receiving fewer bookings, so will be impacted less by this move. Hyatt claims this ‘dimming’ by Expedia hasn’t had a significant effect and convinced them they could escalate things.

Hyatt is telling owners that given commission savings they will only need to replace 80% of business from Expedia to break even (but this would require the replacement business to come at no cost).

So will this work? Commissions are down from where they were a decade ago but are still seen as one of the biggest potentially controllable costs that hotel chains have. Larger IHG wasn’t successful in its gambit with Expedia, and Hyatt is a small player — it’s not clear most Expedia customers would even know they aren’t seeing Hyatt hotel options in most cases (if someone explicitly was looking to book Hyatt they’re not likely to start with Expedia).

However Hotels magazine notes several factors working in Hyatt’s favor:

- The scale of Priceline’s Booking.com, which Hyatt doesn’t give up in picking its fight with Expedia’s brands.

- Metasearch sites drive an increasing number of ‘OTA’ bookings, including bookings made by Expedia’s own sites. Kayak is owned by Priceline, and though Trivago is owned by Expedia they show hotels and pricing from non-Expedia channels as well.

Expedia is likely to take a hard stand though, because if they cave to Hyatt they’re going to see significant pressure from larger chains. Hotels notes that Expedia, with deeper pockets, could outspend Hyatt on keyword search for its own properties.

Ultimately given Hyatt’s size they aren’t big enough to ‘win’ they need Expedia more than Expedia needs them. Both sides lose something not having Hyatt’s properties on Expedia’s booking sites. So Hyatt is likely to be back, not with a major win but with some incremental gain in somewhat lower commission and perhaps more customer data. The question is how long it takes, and how costly it becomes, to get there.

Hyatt does need to get this figured out somehow. I went through an interesting conundrum at work which speaks to this issue. We are a large firm, we are on the Fortune 100 best places to work in America (just like Hyatt). Our people travel a whole lot, and stay at Hyatt a whole lot. We had a Hyatt sales rep, who was super helpful to our company. I know, because I set up a lot of events at Hyatt, and I worked with her. Here is the conundrum. We had a 5% chain wide corporate code. At the same time nobody ever used it, because the member discount or other front line discounts off BAR were always more. We got dropped and lost our corporate rep because “according to Hyatt” we didn’t spend very much. But I was able to determine Hyatt was only “seeing” three percent of our company’s spend – i.e. in 97% of cases persons were not using our corporate code, and they claim to then have no way to track. This whole situation is exacerbated now that WOH benefits don’t flow on Egencia bookings. Because, at least with Egencia our Hyatt code is a “populated at first” setting, but when people go outside Egencia, the rate of usage of our corporate code approaches 0%. This is all such a mess. WOH benefits should be available no matter the channel. Hyatt should track corporate spend in ways that don’t require use of only one corporate code. And Hyatt should have some resolution/analysis process before they drop a corporate client that is obviously a “big firm” with thousands of employees who travel off their sales rolls completely. I hands down love Hyatt, they execute our events great,, and no way am I leaving the brand – but this whole sales/tracking/elite benefits yes versus no – its a bit of a mess that makes my job harder, not easier.

“the World of Hyatt loyalty program can help.”

Haha! Have they talked to current members?

Cool. Maybe there will be more award inventory!!!

if they cave to Hyatt they’re going to see significant pressure from larger change

chains. Gary, are you using speech recognition software to type these posts?

Poster on another site posted this quote from another article.

“The brand also cited its relatively new guest loyalty platform, World of Hyatt, which was launched in March 2017 to replace Hyatt’s Passport program, is intended to build a stronger community of guests, with enhanced perks and increased engagement.”

The above is simply delusional. Most people who book vacations and don’t care about points for vacations will do a package, if Expedia removes Hyatt, they won’t even know to look.

As having worked in hotels for many years, albeit in India, I feel its only correct that accruals not be allowed on third party bookings. My reasoning is that the hotel gets screwed on paying out an egregious commission to the OTA, and to then have the points payout effectively reduces the individual hotel revenue.

In addition to that, most people booking through OTAs are not liable to be very loyal, in my experience. They happily switch hotels for an INR 200/- (USD 3) per night rate difference.

I foresee even more pushback against OTAs. Wait till Marriott wakes up from its slumber and starts dictating terms to the OTAs.

Also the customer service for OTAs like Expedia, etc, in my experience has always been horrible, whether for the paying customer or the hotel in question

Once upon a time hyatt was a leader.

Perhaps Marriott and ihg will follow this particular move in very short order — it would be ideal if the larger better chains set up their own ota, possibly offering smaller chains and independents. The sooner that Expedia disappears completely, better for customers,

I read the title “Hyatt paying chicken…” then I was like, what kind of company use chicken as currency? Ah I’m getting old.