I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I have my Bilt Palladium Card (See rates and fees) and I’m using it as much as I can.

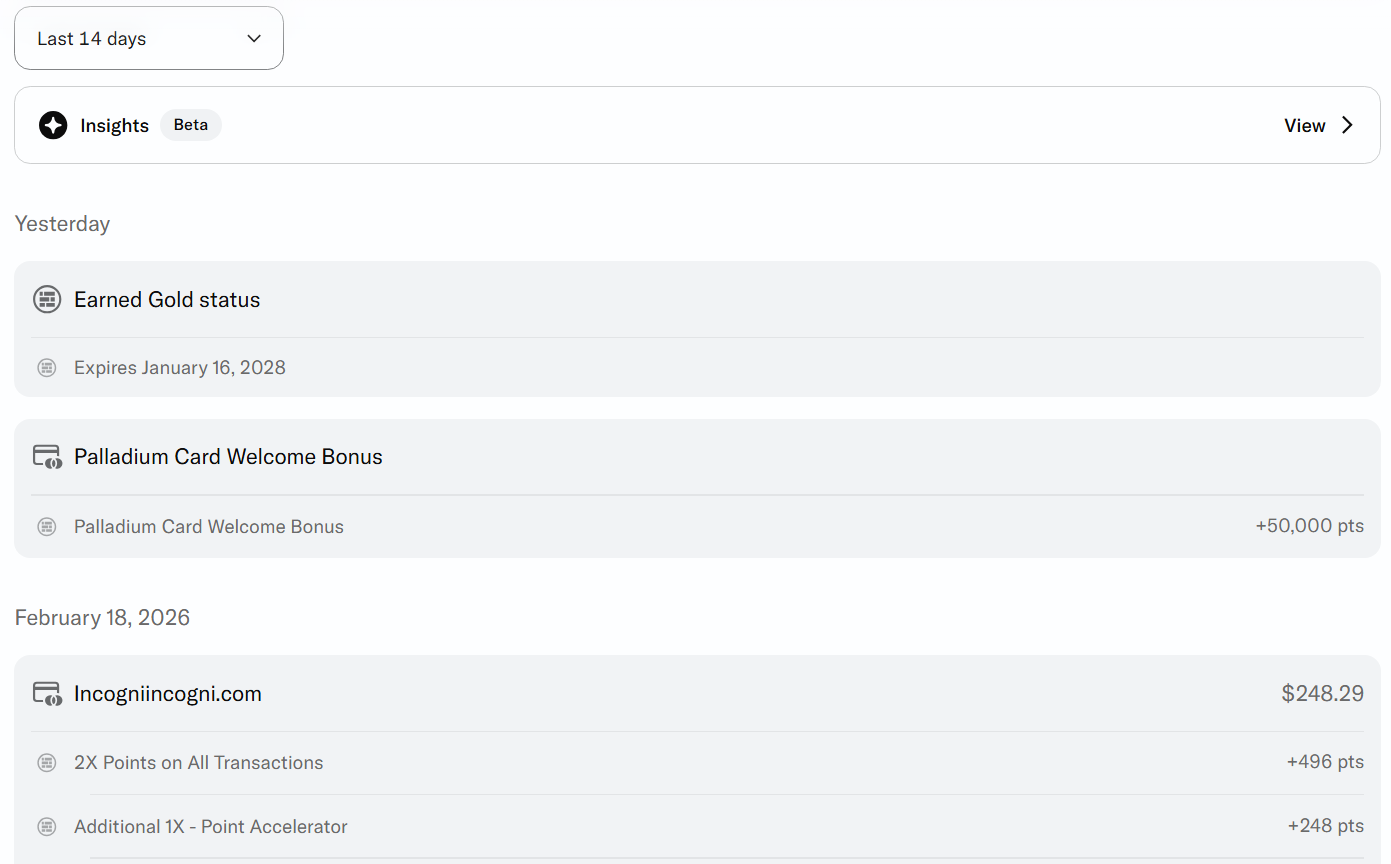

The card’s initial bonus offer is 50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash.

The 50,000 Bilt Points initial bonus posted quickly to my account. It put my Bilt account balance over a million points, which has been a personal goal. I have seven figure balances with Chase, American Express and Capital One also. I did not have to wait for the next statement close:

I’m a Bilt Platinum member, but Gold status that’s included in the card offer ‘posted’ once I achieved the card’s initial bonus as well. That actually turns out to be useful because the status is valid for the rest of the current year and the full next year. My current Platinum status (earned last year) is valid for this year only. So if I somehow don’t earn it again, I have a minimum of Gold in 2027.

Gold status means:

- Free Go Puff delivery

- 1:1 Rakuten points transfers

- Higher Rent Day points transfer bonuses

- ‘Home Away From Home’ hotel benefits (akin to Amex Fine Hotels & Resorts)

- Early access to Rent Day experiences>

Platinum adds a free BLADE flight each year and Air France KLM Gold status offer. I’ve been using both of those (Flying Blue Gold gets me priority check-in and boarding, free checked bags, and free exit row seats on Delta).

On the statement you’ll also see that I charged the Rakuten ‘Incogni offer’ which let me buy Bilt (or Amex) points at 1 cent each to this card.

It earned the Palladium card‘s base 2 points per dollar but an additional point from ‘accelerator’ – another option that Gold unlocks, earning an additional 1 point per dollar on up to $5,000 spend by redeeming $200 in Bilt Cash. And I earned about $10 in Bilt Cash from the transaction. Spending $5,000 on the card earns 5,000 bonus points with points accelerator – and another $200 in Bilt Cash which is enough for the next points accelerator. And you can do it up to 5 times per year.

Truthfully, I’m not even maximizing. There’s actually a strategy to earn 4x on all everyday spend with this card.

Go to the r/biltrewards subreddit.

The 50k points are no where near worth all of the issues you’ll have to deal with as a Bilt customer

I would really love it if Bilt shifted some of their affiliate marketing budget to having working customer service for their $495, but here we are

“account balance over a million points…has been a personal goal”

HUH. Earn and burn – are you new here?

@Vin – I do that too 🙂