On July 1 American Express is ending the ‘20% rebate on points when you redeem using the Pay With Points benefit’ on the American Express Business Platinum card. (The personal Platinum card lost this in 2012.)

I really didn’t care, because Pay With Points is not a valuable feature of this card for most. Sure, the rebate meant you could get 1.25 cents per point in value purchasing paid travel with your points (that earn miles and count towards status) instead of one cent. And 1.25 is better than 1.

But:

- It’s not nearly the value you can get transferring points to miles.

- If you’re getting only a 1.25% rebate towards paid travel, you should be using a different card (Barclaycard Arrival+ for instance gives you 2.2% towards travel, and other cards have valuable category bonuses that help you earn faster).

If Pay With Points is your redemption choice, you’re using the wrong card for spend in my view.

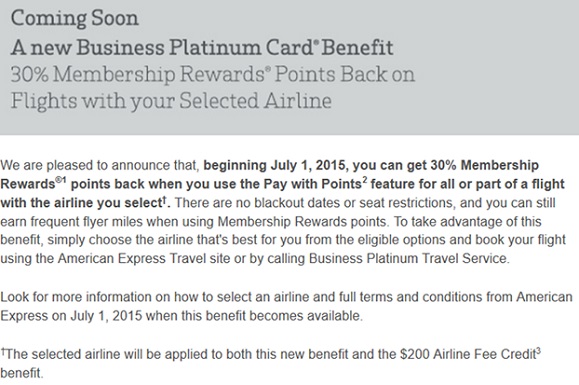

American Express is replacing the benefit though. Instead of a 20% rebate, you can actually get a 30% rebate but only on the same airline you designate for your annual $200 fee credit.

This allows American Express to increase their ‘top line number’ to 30% while simultaenously limiting their cost or exposure.

It does not change my evaluation of the benefit of using Pay With Points at all, however.

If they wanted to do something interesting, they could expand this program. Sadly it’s too valuable to make that likely.

(HT: NYCUA1K on Milepoint)

How does this “simultaneously limit their cost or exposure”? Dollars booked with MR points are going to be the same regardless of the airline they’re booked on, no?

@Eric – Last year I flew on four airlines, but with this promotion would have only been able to use my points towards one of those flights. While this benefit sounded great at first, if I get 10 percent more only 25 percent of the time, it’s a net loss for me.

Hadn’t thought of that. I just wouldn’t use membership rewards to book this way on flights where I wasn’t getting the bonus, but I guess some people might still do so. If someone books enough flights with a gold card, getting a 42% bonus on those points (up from the current 25%), while earning status, I think it’s a lot stronger than is suggested in the article.

@Gary — I think that you may be too quick to dismiss the value of this benefit. I think one needs to assess things in an actual situation to determine the its absolute and/or relative value, and here’s why.

In addition to getting back 30% of the MR points that one uses to purchase a ticket with the AMEX Purchase with Points option, which would is exactly the same as purchasing a ticket with cash as far as the airline is concerned, one would earn (a) redeemable miles, including any elite and/or class of service bonus miles, if it is a premium ticket, that one would earn if one had purchased a revenue ticket and traveled with the airline, (b) elite-qualifying miles, and, (c) where applicable, elite-qualifying dollars. On the other hand, if one transfers the MR points to miles, one would be able to book only an award ticket, which would not earn the additional redeemable miles, or miles/$$ that count toward elite qualification.

Getting 30% or 1 of every 3 MR points back is not bad at all, but then to get the additional redeemable miles as well as the elite-qualifying miles and dollars seems HUGE to me. In fact, I just convinced myself that AMEX’s Purchase with Points option in conjunction with the new 30% back benefit may be the more valuable option under most scenarios.

@Gary – Here is a scalable scenario:

Suppose a return JFK-SFO ticket to travel in business or first-class on UA p.s. goes for $1K. This would require 100K MR points. With the new 30% back benefit, one would get back 30K MR points. On top of that, I am a UA 1K so that under the revenue system I would earn

$1K * 11 miles/$ = 33K UA miles

after the trip because as far as UA is concerned I’d paid $1K in cash for the ticket. Furthermore, because this a revenue ticket from UA’s perspective, I would earn just over 5K premier-qualifying miles (PQM) AND $1K (less taxes) premier-qualifying dollars (PQD), all of which is quite a lot. What do I mean by a lot? Suppose that one does the above with a FF program (e.g. DL) that, unlike UA, can transfer MR points to miles 1:1. We can calculate the total number of miles that one gets back by simply summing 30K ( MR points = miles from 30% back) + 33K (miles from flying) = 63K miles. This means that one did not pay 100K MR points for that $1K ticket. One paid just 100K – 63K = 37K MR points, and also got PQMs and PQDs in the process. That is tough to beat, IME.

Oops! Error! The miles from the revenue system above are wrong:

$1K * 11 = 11 K miles and not 33K (I did the modeling with a $3K ticket but then decided to change to $1K when writing the comment).

But the point remains… 44K back rather than 67K + the PQMs and PQDs.

“In addition to getting back 30% of the MR points that one uses to purchase a ticket with the AMEX Purchase with Points option, which would is exactly the same as purchasing a ticket with cash as far as the airline is concerned”

And so is using Barclaycard’s 2.2% cash back to purchase the same tickets.

Last I checked, 2.2 > 1.3. Which is Gary’s point.

The only scenario where this makes sense (is better than a cash back card) is if you are earning the MR points in bonus categories on other AMEX cards. If you are earning two or three points per dollar and redeeming them at the new discounted rate, then your are doing .65% to 2.08% better than earning Arrival miles.

Splitting hairs, but I think it’s actually 2.06 percentage points better (everyone says arrival is 2.2, but really it’s 2.22…. splitting hairs clearly).

The question shouldn’t be whether it makes sense to use the card to get membership rewards (when you get 2-3 points, yes. if not, no), but whether redeeming them in this manner makes sense.

Essentially, can you get better than 1.42 cents per point when transferring to a MR partner versus spending them via this redemption? I suppose if you’re someone who “values” points by how much the airline is charging for some first class product you would never buy with cash, then you could get greater “value” for it. I value them at what they are worth to me and what my opportunity cost is. I don’t want to give up 100,000 points for something the airline says is worth $10,000, when the 100,000 points could get me four flights for $1420. To me, I’ll have to pay for the other 3 flights out of pocket (or forego cash back along the lines of 3% via discover It miles).

If there was no such thing as status then I’d likely transfer most points and shop around for the best deals via points, but it would still be based on my opportunity cost and not what the airline has priced something at. If you’d never be willing to pay anything near $10,000 for 100,000 points, then you don’t “value” the points at 10 cents and that’s not the “value” you’re getting.

Okay, rant over 😉

@eponymous coward said: “And so is using Barclaycard’s 2.2% cash back to purchase the same tickets. Last I checked, 2.2 > 1.3. Which is Gary’s point.”

Gary had two points only one of which applies and it is not the one comparing the AMEX Biz Plat’s 1.3% back to the Barclaycard’s 2.2% since it is not much of point unless the question were whether to GET the AMEX Biz Plat or Barclaycard. Heck, my UA Explorer gets 2% back and I may even get 5% back with my Discover It card if the stars are aligned just right.

The situation I considered, which is common enough, is one in which one already has the AMEX Biz Plat card — because of its many other benefits — and one has used it to accumulate a bunch of MR points. @Gary said, “It’s not nearly the value you can get transferring points to miles.” That is the point I addressed and it seems clear to me that it is better to use AMEX’s Purchase with Points option than to transfer to airline miles because the only thing one would be able to got out of the miles is an AWARD TICKET, which would not earn the redeemable miles, elite-qualifying miles or elite-qualifying dollars that one would earn with the Purchase with Points, in addition to the 30% back.

Careful using Amex pay w points for hotel stays. I booked a $470 room in DC and was charged 63,000 points. Even with 20% points back from my platinum card, that’s still less than 1 point/dollar. Turns out Amex charges 1.33 points/dollar on hotel bookings. Didn’t see that anywhere in their fine print. Oh well….I’ve got a lot of Amex points, but this is a true ripoff for higher end card users. I’ll be dumping Amex platinum in favor of Ritz Carlton card–$300 ANY airline rebate, club upgrades, great concierge service in line with platinum Amex concierge.

For my situation, I agree with DCS. I also agree with Gary when he says “I really didn’t care, because Pay With Points is not a valuable feature of this card for MOST.” (emphasis mine). For me, as an Exec Plat, I find value in the pay with points feature.

@Nevafazeme — You might wish to consider this analysis that makes the plausible point that the 30% back benefit is a valuable feature of the AMEX Biz Plat for MOST:

http://travelcodex.com/2015/04/is-the-new-amex-30-pay-with-points-rebate-better-than-we-think/