American Airlines and their credit card partner Barclays have updated the offer for the credit card they market inflight. And with this change, American Airlines is again encouraging flight attendants to hand out paper applications on board to passengers, even while they’re reducing the rest of their service levels to promote health and safety of cabin crew and customers alike.

American Airlines has two banks issuing co-brand consumer credit cards.

- Barclays cards are marketed inflight and in the airport (but not within 100 feet of an American lounge)

- Citibank cards are marketed through all other channels

Flight Attendant Standing At the Door As Passengers Deplane With Card Applications, Pre-COVID 19

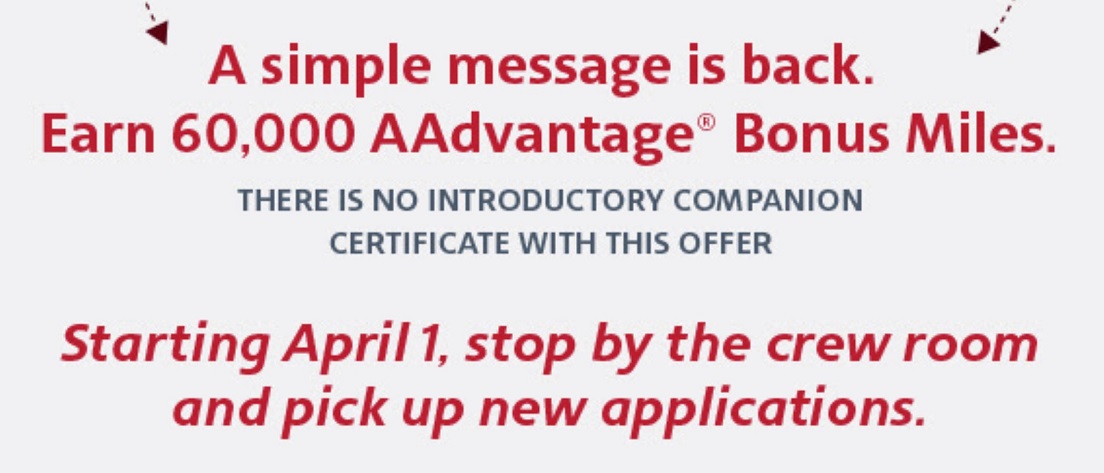

It’s the Barclays card whose offer has changed. The standard offer for the AAdvantage® Aviator® Red World Elite Mastercard® has changed. It’s now 60,000 miles with first purchase and paying the annual fee. The card no longer offers a companion ticket as part of its initial bonus offer.

And since that means the inflight offer changed, American Airlines sent out a message to flight attendants who have been through training to qualify to pitch the card inflight. Message: “New offer starts today. A simple message is back – Simply 60k.” (Those few customers still on board) get 60,000 miles, flight attendants get $50.

A spokesperson for American Airlines shares,

In the most recent guidance to flight attendants, those who voluntarily participate in the AAdvantage Cash program can request that only those who are interested press the flight attendant call button to receive an application.

The new application highlights the option to apply online, which not only simplifies and expedites the application process, but also reduces the amount of physical handling before processing.

It’s an odd time to be reminding flight attendants to be marketing the card, and to bring the paper application to a customer’s seat. The airline isn’t offering on board snacks in order to promote social distancing but promotes flight attendants handing out paper applications to customers.

On the one hand it probably makes sense to suspend inflight card acquisition at this time. On the other hand, if they ceased the program one industry insider suggested to me that the airline might not be eligible for payments from their bank partner for failing to meet the contractual minimum number of new accounts.

and so has DL and UA and SWU and so on. REALLY. . .Why not change the name of your SLOG (not a typo. . .figure it out) to why I hate AA so much.

REPORT NEWS, TRY TO BE POSITIVE and TRUTHFUL. . .give it a try, might be a nice change of pace.

@sunviking82 – what I write is truthful. the truth is not always, and indeed often is not, positive. sorry to share that grim reality with you, but i am confident you can handle it!

LOL. . .thanks Gary. . . see what other carriers are doing verses demonizing just one. UA is an absolute diaster right now and don’t have a clue what to do. DL and AA seem to have a plan and doing their best when things are changing on the fly.

My hat is off to all these folks for dealing with this, just was we all are in our businesses. My company is changing messaging, practices to keep people safe at home. It’s difficult for sure.

Thank you and everyone for letting me blow off some steam. This craziness is not excuse but glad I have other to share with!

EVERYONE BE SAFE!

Will I run into trouble applying for this card when in mid. Feb I applied and got the Citi AAdantage Platinum select card? (50000 bonus points have posted…

In your experience is it took to get the Citi and the Barclays card within a couple month. (I would cancel the Barclays card after getting the bonus)

Kindly advise, Gary. Thanks

Nothing stops the pimping of shiny bits of plastic*

*except losing the affiliate program

Actually, they’re not. I should know. I’m an American Airlines flight attendant.

@sunviking82 — I fly a lot each year, mostly Delta. Though I still end up occasionally flying AA, US, and B6. I’ve also flown WN a couple of times.

Only on AA and UA have I encountered flight attendants doing credit card announcements in flight (though it’s 60/40 I’d say; not every flight). Can’t stand the announcements to be honest.

On Delta, I’ve never heard the flight attendants make a credit card announcements.

Maybe Delta flight attendants do credit card announcements in flight, but from my 48+ flights a year, I’ve yet to hear one.

In my opinion, AA should let the flight attendants focus on customer service for the entire flight, instead of pressuring them to do sale pitches.

My last AA flight there is no pitch,

I should receive money and credit card pictures from the bloggers though no problem

@sunviking82 our “thought leader” can “claim” to report the truth. (The defensiveness in his response was noticeable) Reality usually is, it’s massaged to fit his agenda. In this case, the headline leads one in a different direction than the “truth” blogged in the content. Seems like rather than “reminder to pitch the cards” it’s pure truth is, it’s more about a change to the card promotional message. In fact, the blog content even quotes “those who voluntarily participate”.

Just like a few days ago, a blog post about the potential For his “beloved” airline to eventually furlough flight attendants. I guess we are to believe it is the only airline to face the potential to furlough? He’s obsessed with one airline and anything he can do to malign the company even if it means bending the truth.

For several years I was an avid follower of this blog. I learned a lot about earning and using credit card bonuses and points. I continue to enjoy benefits i otherwise would have never known about. Fortunately I know how to apply That knowledge but also learned there are other sources reporting card strategies. Thanks to them, I can get fair information without regularly dipping in the cesspool that’s been fostered here.