I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Southwest Rapid Rewards® Performance Business Credit Card

Chase’s 100,000 point offer for the premium Southwest Airlines business card will earn you enough points for a Companion Pass as soon as you’ve spent enough to earn the bonus. And now is the perfect time to do it, too, because you can get true maximum value (nearly two full years of a Companion Pass) if you get the card soon.

Here are details of the Southwest Rapid Rewards® Performance Business Credit Card initial bonus offer.

- 70,000 points after you spend $5,000 on purchases in the first 3 months.

- Plus, earn an additional 30,000 points after you spend $25,000 on purchases in the first 6 months.

Your $25,000 spend can earn you 125,000 points or more, which is the standard requirement for a Southwest Companion Pass. And these points, doubled via the Companion Pass, buy about $3750 worth of travel.

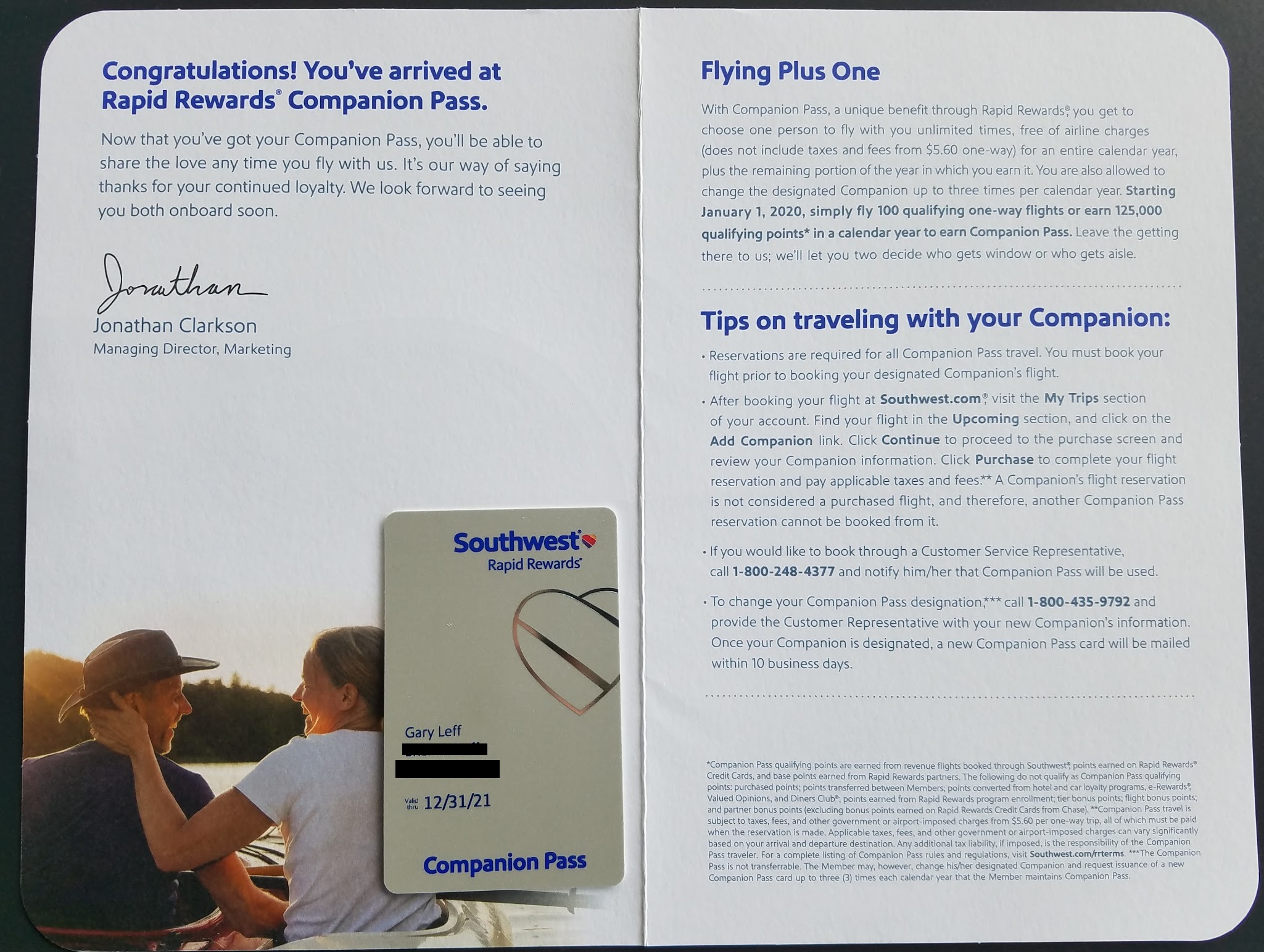

What’s more the way a Companion Pass usually works is that once it is earned it lasts for the rest of the calendar year in which it is earned, and the full next calendar year.

- If you get the card now, you can earn the bonus in 2021.

- And since you’ll be earning the Companion Pass in 2021, that Pass will last from that point forward in 2021 and also all of 2022.

I was one of the first people to earn a companion pass this year. I’m set for 2021. I used this exact strategy – I signed up for a smaller offer on this card last fall and hit all of the required minimum spend in my third month.

They actually send you a physical card in the mail, even though everything you need is all electronic.

There are (4) things to know about applying for this card.

- In order to be eligible for this bonus you cannot be a current cardmember of this card, or received a new cardmember bonus for this card within the past 24 months. Having another Southwest card, or another Southwest business card, doesn’t make you ineligible.

This new cardmember bonus offer is not available to either (i) current cardmembers of this business credit card, or (ii) previous cardmembers of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.

- This card is subject to ‘5/24’ which means Chase will generally only approve you if you’ve had fewer than 5 new cards in the last 24 months.

- It’s a small business card, but you’re more likely to be eligible for one than you think. Chase says that getting a small business card is one of the things you should do as you start your business, that it’s often the first resource many business owners look to as they start to grow. A small business card allow you to separate business from personal expenses and builds the credit history and identity of your business. Several readers have reported better luck with approvals over the past few weeks.

The Southwest Rapid Rewards® Performance Business Credit Card has a really great offer, that many readers will be eligible for, but it requires a good deal of spend to earn the full bonus. You may be a lot closer to that spend than you think though if you put all of your spend on it and potentially pre-pay a few bills.