I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Chase has a new offer for the Southwest® Rapid Rewards® Performance Business Credit Card: earn 80,000 points after you spend $5,000 on purchases in the first 3 months.

Ongoing earn with this card is 4X points on Southwest® purchases; 3X points on Rapid Rewards® hotel and car partners; 2X points on rideshare as well as 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases. These points count towards earning a companion pass.

Cardmembers receive 9000 bonus points each year after cardmember anniversary; a statement credit for Global Entry or TSA PreCheck fees every four years; reimbursement for four upgraded boardings per year (A1 – A15 boarding purchased at the airport) when available; plus inflight wifi credits. That’s a package that makes the card’s $199 annual fee well worth it.

Here’s the thing, I actually needed to work through whether this was a better offer, or reduced offer, compared to what was available previously. The earlier offer was to earn:

- 70,000 points after you spend $5,000 on purchases in the first 3 months.

- Plus an additional 30,000 points after you spend $25,000 on purchases in the first 6 months.

That was 100,000 bonus points total. This is 80,000 points total. However,

- You earn more points with your first $5000 spend with this new offer (80,000 vs. 75,000)

- That extra 30,000 points from the earlier offer required a ton of spend, the new offer does not

- This new offer is more generous per dollar spent to earn it,

- 80,000/4000 = 16 points per dollar

- 100,000/25,000 = 4 points per dollar

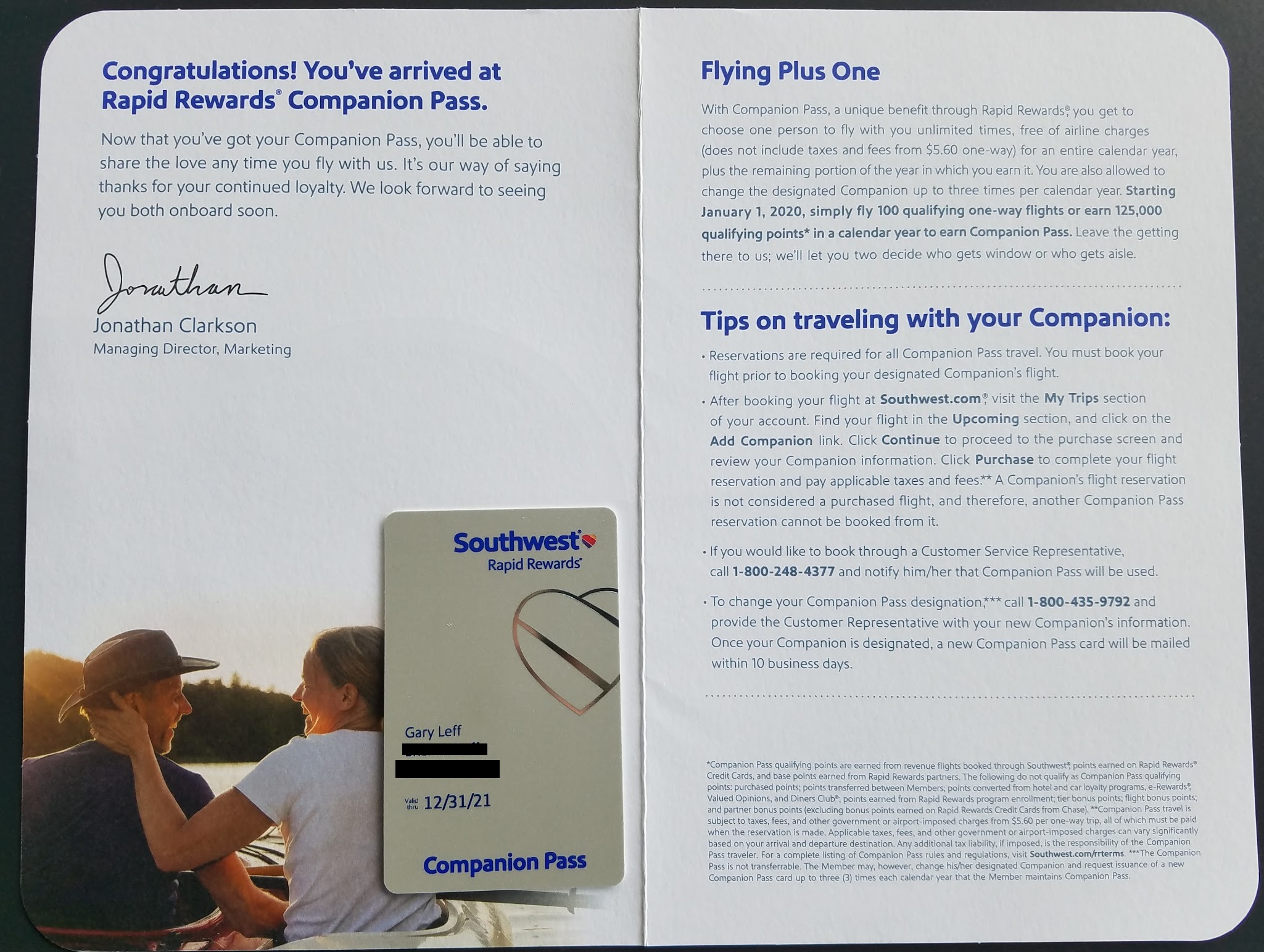

- All Rapid Rewards accounts that were open December 31, 2020 receive 25,000 Companion Pass qualifying points and 25 Companion Pass qualifying flights this year.

- With the Companion Pass you can bring a second person along with you on your travels. You need to earn 125,000 eligible points in 2021 for a pass that will be valid through the end of 2022. And Southwest credit card initial bonuses and points-earning from spend on those cards count towards companion pass.

- So earning the bonus on this card gets you at least 85,000 of the 100,000 points you’ll need this year (provided you had an account open December 31, 2020).

- You can earn the rest through credit card spend, hotel bookings through Southwest’s portal, flights, or other qualifying activity. But there’s not far to go.

For most I think this is going to be the better offer, more points up front without a big spend requirement, although those who easily put big spend on cards might prefer the earlier one since it knocked out all requirements for Companion Pass in a single go.

Southwest® Rapid Rewards® Performance Business Credit Card:

As predicted, the outrage over Southwest’s devaluation didn’t last long. Exactly one day.