I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

New Marriott Credit Cards

Marriott did a deal with both Chase and American Express for new Marriott credit cards. Chase gets the bulk of the personal business, but American Express gets to issue a premium personal card. American Express gets the small business cards. And cardmembers keep their legacy products.

Both banks are issuing new products, and making changes to existing card products too. So in addition to speaking with Marriott about the changes I reached out to Chase and American Express as well to learn more and they were both forthcoming.

Chase is Introducing a New Marriott Card May 3

I spoke with Vibhat Nair, Chase’s General Manager for their Marriott relationship, who shared details of the new Marriott Rewards Premier Plus Credit Card which will launch May 3 and have a 100,000 point initial bonus offer.

Points-earning for unbonused spend will double from the current card’s 1 point per dollar up to 2, and spend at Marriott and Starwood properties will be 6 points per dollar.

The new card will come with a more valuable annual free night certificate, redeemable for any hotel up to those with a reward price of 35,000 points.

The card comes with Silver status and 15 nights of elite status credits, and $35,000 spend on the card in the year earns Gold. However there will be no way to spend towards additional elite status nights — the new rule across all card products is that you can earn 15 elite night credits total from cards.

While existing customers with a Chase Marriott card won’t be eligible to sign up for this product as a new customer and receive the 100,000 point bonus there are going to be targeted upgrade incentives offered between 10,000 and 50,000 points (though those amounts may be adjusted).

Normally customers in their first year with an $85 card wouldn’t be able to upgrade to a $95 card.

That’s because it’s illegal for a bank to change ‘price’ of a credit card on a customer within their first 12 months. However to make it possible for new cardmembers to upgrade they will extend the $85 annual fee to anyone in their first year with that legacy card product.

Al Maha Desert Resort

Legacy Chase Cards Will Be Updated Soon, Too

Chase is not converting their existing cardmember portfolios over to the new product automatically. The legacy cards aren’t changing at all for now.

However they will be making announcements of changes to the Ritz-Carlton card and Marriott small business card in late June or early July. We don’t know exactly what those changes are yet, but Marriott’s David Flueck says the Ritz-Carlton card “will end up with same or similar value proposition as the Luxury Card coming from American Express in August.”

W Doha

The New Premium American Express Luxury Card Coming in August

Courtney Kelso, American Express’s Senior Vice President of Charge, Co-Brand and Loyalty, Global Commercial Services, described the new Starwood Preferred Guest® American Express Luxury Card as offering “$2000 in annual value.”

On top of opportunities to earn points, the card is designed to offer “more value in luxury perks across hotel stays and perks to ease broader travel experience>”

Earning: 6 points per dollar at Marriott and Starwood properties, 3 points on US dining and on air travel, and 2 points on all other spend.

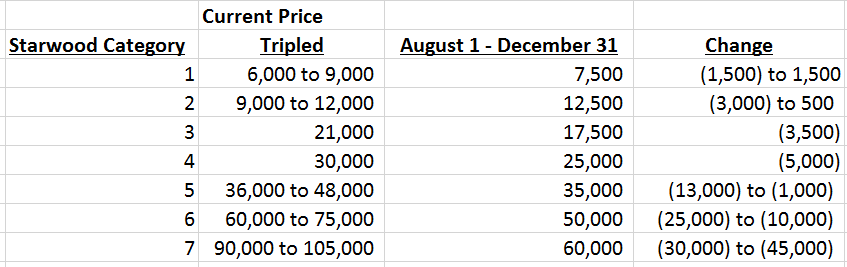

This seems like a loss in earning power compared to the current Starwood card, since the 1 point per dollar that earned equated to 3 Marriott points and this will earn just two points. However the cost of hotel nights will largely be going down, too. Here’s the chart in place August 1 – December 31:

We’ll have to see how this really shakes out for hotel stays when we know which hotels are assigned to each category.

However since points transfers to miles multiply by 3 and earning on this card only multiplies by 2 the card is no longer as powerful earning airline miles as the current Starwood card has been.

The card has a $450 annual fee offset by a $300 annual statement credit for purchases at Marriott properties. American Express confirms the credit will be triggered by charging your room rate to the card so it’s not just for dining and other on-property spend. The card also comes with an annual free night at renewal good for hotels that would cost up to 50,000 points (category 6).

This new Luxury Card looks very similar to existing SPG American Express products. Perhaps that’s because we’ll see new Marriott program branding some time next year.

Credit: American Express

You get automatic Gold status and $75,000 spend in a calendar year will earn Platinum status which is a big improvement. You also get 15 elite night credits each year, useful if you’re trying to qualify for status based on stay activity. However you will not be able to earn more than 15 elite nights from a credit card, regardless of how many co-brand cards you have.

What’s more an existing cardmember who upgrades to the Starwood Preferred Guest American Express Luxury Credit Card will have the spend they’ve already done during the same year count towards the $75,000 threshold for Platinum Status.

You’ll get Priority Pass Select with unlimited visits and up to 2 guests is included, along with unlimited Boingo internet, premium in-room wifi on your Marriott stays, and no foreign exchange fees.

As far as the signup bonus so far they’re mum other than to say there will be a “rich welcome bonuses shared closer to August launch” and also that existing Starwood card customers will see “rich upgrade bonuses” to move to this product.

Al Wadi Desert Resort

Legacy Starwood American Express Cards

You’re not going to be able to apply for the Starwood Preferred Guest® Credit Card by American Express in the future, since Chase gets exclusivity of the basic personal cards.

However cardmembers get to keep their cards. And American Express will also continue to offer the Starwood Preferred Guest® Business Credit Card from American Express. Starting in August — although the day in August has not yet been firmed — these $95 annual fee cards will also move to 6 points per dollar at Marriott and Starwood properties and 2 points elsewhere.

The cards will give you automatic silver status (which is sort of like they currently give you “Preferred Plus” although that status came with 4 p.m. check-out). They also give you 15 elite nights each year, but you can’t double dip on those elite nights with other cards.

There will be an annual free night at anniversary, valid at properties up to 35,000 points as Marriott’s David Flueck explained to me. Someone spending less than $30,000 a year on the card and using their points to maximum effect for hotels could come out ahead because of the changes to earn. But I view the annual free night – worth well more than the annual fee – as a reason to keep the card, not a reason to spend on it.

You’ll still have no foreign transaction fees, Boingo internet, and premium in-room wireless internet as a cardholder.

Business cardholders, though, are going to lose Sheraton club lounge access. Courtney Kelso suggests they’re going to “work to make the business card as valuable as possible in the newly unified program” however there won’t be any grandfather of existing cardmembers to keep this benefit — even if they’ve just acquired the card or just paid its annual fee.

The business card will add better points-earning categories. The new category bonuses will be 4 points per dollar on US dining, gas, wireless bills and shipping. So there are some things that get better (like category bonuses and annual free night) that offset the losses to earn for unbonused spend and Sheraton club lounge access.

Sheraton Macao

Overall Changes

Chase is doubling earning power on their current card — which was a card good for the signup bonus and annual free night, but not for spend. American Express is going to offer parity on earn for unbonused spend.

I imagine that’s something which was a part of threading the needle on having two card issuers for the brand and new Marriott credit cards. Otherwise there’d be competition for consumers based on earn, and neither bank would wind up making what they need to in order to justify the deal.

I do like the ability to spend $75,000 in a year for Platinum status. That’s better than the offer that’s been around on the Ritz-Carlton card in the past because (1) that spend will earn two points per dollar, rather than one, and (2) it comes with the new Starwood-like elite benefits rather than Marriott elite benefits — and across the chain.

I’ll be looking forward to both new cards launching. I don’t have the Marriott card and a 100,000 point signup bonus will be very tempting. And I’m hoping for a good upgrade offer on my Starwood Preferred Guest® Credit Card by American Express which I’ve held for 17 years.

How does this affect the current Chase Marriott cards that get 1 elite night credit per $3,000 spent? As someone who will be likely within striking distance of 50 nights, I plan on using that to get extra elite nights.

To be clear, in regard to the credit cards, for those of us who have the existing cards that give us one night per $3,000 spent, will we be able to keep those cards, or are they being eliminated in favor of the new ones.

Why would I use a card that gives 2/3 point per $ spent, when I can get 1.5 or 2x from the everyday preferred or Blue Business card?

Spending $75k:

AMEX SPG Luxury card: 150k Marriott points (50k SPG): Worth $1,350 (2.7 cents per point)

AMEX Blue Business: 125k MR points: Worth $2,375 (1.9 cents per point)

Is losing $1,025 in points worth receiving Platinum status?

@Amol – that goes away

Gary, will chase still offer Marriott Business card after August? If not, assuming Chase keeps the existing business cards($99 fee, 2x earning, FN up to 25k), do you think they would make the business cards more competitive vis-a-vis the new Amex Marriott Business card ($95 fee, 3x earning, FN up to 35k)?

Thanks for the scoop!

How is the very more valuable. It’s still cat 5 or less after 8/1. More cheap hotels?

So if we have existing cards from Chase, should we cancel them so we can apply for the new ones?

Ugh, losing the $3,000/elite night option? Guess I’ll be scheduling a lot more meetings at Marriotts next year.

Here is another comparison with 50k spend (assuming MR still allows transfers at the same rate):

AMEX SPG Luxury card: 100k Marriott points (33k SPG)

AMEX Blue Business: 100k MR points= 33k SPG (more when bonuses are available) plus a whole bunch of other transfer options

I see very little incentive to put any spend on a Marriott branded credit card.

Does Marriott gold still get free breakfast next year?

Any word on the Ritz $100 Visa Infinite air credit? That’s one of the only reasons why I keep the card at this point, I hope they don’t remove it… I don’t see any mention of this on any of the blogs..

@Gary – any word on when? If I currently have the card after paying the annual fee, chance to use that to top off my Marriott nights this year and lose it next year?

@J – Legacy Chase business cards will still stay, Chase says they will be sharing updates about those, if I had to GUESS they will be similar to the spg business but I cannot say for sure

@chesterwilson the Amex business card earning 2 membership rewards points per dollar up to 50k spend is a fantastic earning card

@Ad – Marriott 50 night status gets free breakfast next year.

Currently Marriott calls 50 elite nights Gold

Next year Marriott calls 50 elite nights Platinum

@Tom Chase isn’t providing that update yet

@ Gary — It sounds like we will end up way too many people qualifying for Platinum, meaning a continued lack of meaningful suite uprades. Oh well, I guess I will stick with IHG RA and maybe Hyatt Globalist.

5/24 on new Marriott personal card by Chase?

@Gary I agree the Blue Business is a fantastic spending card. The Amex SPG was as well, for many years I would put most of my spend on that card. The current changes will change that value proposition for many people.

Also Gary, the $75,000 spend on Amex isn’t necessarily the same as on the Ritz card. I got the equivalent of a 75-night elite status with the Ritz spend, the Amex card will give the equivalent of 50-night status. Of course, this is a product of how the tier names are changing compared to number of nights. Marriott Platinum now isn’t Marriott Platinum in the future.

I’d be shocked if the RC card doesn’t eventually get bumped up to 2pts as well. Any idea if this card is going to be discontinued (for new applicants) or will Chase be able to continue to offer it?

Gary do you know which cards “upgrade” to this card?

At the moment you get 15 nights for getting the Chase Marriott Business card in addition to the 15 you get from the personal card. My reading is that will be changing to 15 nights total?

@Beachfan, yes subject to 5/24

Marriott 50 Night (Gold) this year is given breakfast that comes as a credit card benefit. As of August, mid-tier and even premium credit card holders are looking at a devaluation with this benefit. Obvious difference from the Hilton Honors program. Comment on this as a perk of the credit cards that will lower the appeal?

I currently have the Chase Marriott card now. If I cancel right away, would I be eligible for the 100k bonus for the new Chase card come May 3rd?

I am really close to lifetime platinum (about 1 year away). If i don’t reach by August, do i have no opportunity of earning it now?

“The new card will come with a more valuable annual free night certificate, redeemable for any hotel up to those with a reward price of 35,000 points.”

How is this a more valuable free night certificate? We have been getting a free night up to category 5 and the price at a category 5 (during standard season) will be 35,000. That sounds like the same value. Further, it sounds like the certificate won’t be good for a night in a category 5 during peak season, which would mean that this certificate will be less valuable.

Will there be a free night with the legacy business cards as well as the legacy personal cards?

@gary – For 2018 platinum requalification, can we aggregate nights from Marriott and SPG credit cards? In theory, this means we need only 25 nights in 2018 (15 Marriott cc + 5 SPG personal Amex + 5 SPG business Amex).

@Gary, would appreciate a post on options for those who have been putting significant unbonused spend on the SPG card.

@chesterwilson, thanks for your analysis.

Gary: Any words whether the fee will be waived for the first year of the new Chase card?

@Gary I signed up to grab the 75k benefit on the old Marriott card just before the latest was announced. Worth calling to ask them to wait and send me the new card instead or will it be possible to grab the points from both?

Am I correct that platinum status through a card willl not get you 5 suite upgrades?

To close open Amex SPG cards or not? Sounds like it will be a new product, thus bonus eligible.

How about Marriott business card by Chase? Apply now or wait?

So many decisions 😉 But seems like some (hopefully) nice opportunities coming up.

@farnorthtrader: Do you mean the Chase Marriott card gives an Annual free night certificate?

@ad the clear answer is no you will not get breakfast next year with gold status. The number of nights to hit plat have been lowered though.

Gary,

I got the Amex SPG card just last week, with the bonus being 25,000 Starpoints by spending $3,000 in the first 3 months–thus I should get this as it will be concluded before August. I assume these Starpoints will then get converted to 75,000 Marriott points soon thereafter.

My deal with Amex calls for earning 3 Starpoints (current equivalent of 9 Marriott points) per $1 of ‘everyday’ spend. But the new proposition calls for earning only 2 Starpoints (equal to 6 Marriott points) per $1.00 in spend.

Question: Will I still earn 3 Starpoints (9 Marriott points) on everyday spend through my first anniversary of having the Amex SPG card? Or will Amex change my earning rate at some point during my initial year of holding their card?

If they change it, then I did not get the deal that I “bought” when I applied and was approved for the Amex SPG card–before any of these changes were announced. I also think that as of last week, Amex certainly knew EXACTLY what the changes were going to be yet they continued to advertise and promote their card based on 3 Starpoints per $1.00 of spend.

Bait and switch????????????

@Alan I asked Amex about this and they are not grandfathering features which surprised me.

“… existing customers with the Marriott Rewards® Premier Credit Card won’t be eligible to sign up for this product as a new customer and receive the 100,000 point bonus..”

I currently have both the SPG Amex and the Chase Marriott card now, and no status other than that conferred by the cards. If I cancel the Marriott card now, would I be eligible for the 100k bonus for the new Chase card after May 3rd? And if approved for it, would there be any point in keeping the SPG Amex?

Alan, didn’t you get the fee waived the first year anyway? I agree it’s a huge downgrade and I’ll cancel my and my wife’s SPG AmExes as a result (cards we were putting at least $30k each on). But I’m unclear on how you “bought” something, if you didn’t have to pay for it. Sure, you made a small initial spend, but you got a sign-up bonus in exchange.

@shza

True, I did not pay a current cash consideration for my new SPG card. Although I could argue that I indeed incurred a charge for it, but that the charged was simply waived. I know, a technical argument and not the point here.

Cash is not always a necessary component of a purchase. In my quesry, I use ‘bought’ in the sense that Amex agreed to exchange certain items of value (Starpoint signup bonus, certain status within SPG plan, additional Starpoints to be earned in varying amounts by taking certain actions like using it at SPG properties or for ‘everyday spend’, etc.) in exchange for me spending at least $3,000 on the card within the first 3 months of opening it. If I live up to my side of the agreement ($3,000+ in 3 months), then it is not unreasonable for me to expect Amex to live up to its side of the same agreement…at least for the initial/current year. While Amex might (and likely will) stand behind some legalese, I would expect a company with as solid a reputation as American Express to stand behind the clear intent of their existing agreements. Or as Gary stated, to “grandfather” their current Agreements (contracts?) until the end of current anniversary cycle of the card.

Will the legacy SPG card now offer gold status after $35K spend, like the new Chase card?

Lipstick on a pig.

If I pay $450 and still can’t get the old earning rate this is a joke. CSR is better by leaps and bounds.

The way bloggers are couching their writing on these changes makes me sure they are heavily compensated by that Flueker.

The AmEx luxury card is a disappointment. The only way I’d consider it is if they revised their 2pts/dollar to 3, or somehow offered a higher earning rate on regular categories.

@Gary —> Yes, well . . . this certainly does change things. The question is where to go now. For me, the problems are “simple” (if anything in this world is really simple).

I currently hold both the SPG Amex personal card *and* the Chase Marriott Rewards card. If I understand correctly, these cards will continue (i.e.: Amex and Chase are *not* replacing the cards with new ones), the earnings will change to be the same as if we *were* getting new cards. Do I have that right? This changes the reason(s) to hold the card. As things currently stand, I put some non-bonus spend on the card due to the ability to transfer SPG points to airlines w/the 5k bonus, as well as using for Starwood and Marriott stays. I don’t really use the Marriott card (got it for the sign-up bonus); I earn more points using my SPG card for Marriott stays.

With the announced changes, it *seems* to me that there is no zero reason to put non-bonus spend on either card, and no reason to keep both.

It seems to me that I earn more using the CSR/CSP and/or Citi Prestige cards than the new rewards cards.

And as for $450 AF cards, it also strikes me that the Hilton Aspire card is better than what’s being offered with the high-end SPG Amex.

Am I right? If not, what am I missing?

Does the SPG Luxury Card charge a fee or authorized users, and will those authorized users get the same benefits?

I.E. – with the Amex Platinum card, authorized users got their own Gold status on Hilton/Starwood, their own Priority Pass accounts, etc.

Will it be the same here?

@Gary Leff: Thanks for all of the info. One thing confuses me, though: You say, “…since points transfers to miles multiply by 3 and earning on this card only multiplies by 2 the card is no longer as powerful earning airline miles as the current Starwood card has been.”

My understanding is that for most SPG>airline transfers, the rate remains 1:1, so wouldn’t that make the new SPG cards, with their spend category bonuses, more valuable for those of us who want to use the cards to earn points to transfer to SPG’s various airline partners? What am I missing?

Never mind, Gary. I see my error. Thanks.

I have the Chase Marriott card (got last year for the signup bonus), AmEx SPG personal and business cards. I put all spend that doesn’t get a better bonus elsewhere on the AmEx SPG personal for the 1.25 miles per point transfer, and keep the business card for lounge access. The AmEx SPG personal card gives me what’s now called Gold, which is useless at Starwood but provides lounge access at Marriott.

Seems I should immediately cancel the Chase Marriott card so I can apply for a new one in May 5/24 means I’m prohibited from a new Chase card if I’ve opened more than 5 cards from any issuer in past 24 months? If so, I’ll have to count.

Seems no point in the the AmEx SPG business card, since lounge access is going away, and no point in the AmEx SPG personal card since lounge access at Marriott is going away, and no point using any SPG or Marriott card for “default” spending (spend without a better bonus) since it won’t earn 1.25 miles per dollar for general spend.

I read somewhere that if you received a signup bonus for a Chase Marriott credit card in the past 24 months then you can’t get the new card and new bonus, even if you cancel the current card. Can anyone confirm this?