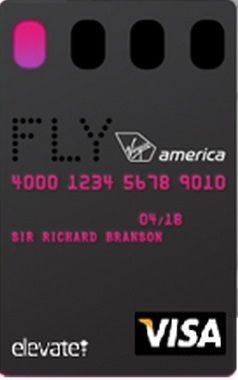

Virgin America’s co-brand credit card relationship soured with Barclaycard, for reasons that were never disclosed. The bank and airline parted ways, and there’s been no Virgin America credit card on offer for months. That has now changed, which MileCards flagged earlier today.

There are two cards, both issued by a bank I had never heard of — Comenity Capital Bank.

It’s a darned sexy card. It’s one that Virgin America regulars looking for help towards elite status may be interested in (and Virgin America regulars flying with a companion will be able to get value out of keeping), and a card that can be strategically useful for partner awards (most with high fuel surcharges). And it’s good to have a card from a secondary bank with a signup bonus out there again. But it won’t be a card most will find useful.

The basic card is very similar to the old Virgin America card issued by Barclays. There’s also a $149 premium version of the card that can contribute towards elite status.

- Both offer one point per dollar on spend (3 points per dollar on Virgin America spend), a $150 companion discount each year ($150 off the second ticket), and first checked bag free (including for a travel companion).

- The $49 annual fee card gives 15000 points after $1000 spend within 90 days; the $149 annual fee card gives 20,000 points after $1000 spend within 90 days and waives change or cancellation fees on Virgin America flights, allows earning up to 15,000 points towards elite status each year (5000 status points per $10,000 spend), and allows members to roll over status points towards the following year (a la Delta).

My rule of thumb is that Virgin America’s points are deflated, that one Virgin America point is worth about 2 points in a European airline frequent flyer program. Their points are reasonably good, then, for redeeming on partners (with fuel surcharges). And the credit card is reasonably good at acquiring those points — since the price of partner awards is low, and the card earns one point per dollar, it’s like earning two points per dollar with a ‘regular’ award chart.

You can use the points for about 2.2 cents apiece towards travel on Virgin America, or for fixed-point redemptions on their partners.

If you were going to use the points for Virgin America travel, you’d be better off with a Barclaycard Arrival World MasterCard which (including the 10% rebate on points spent for travel) nets 2.2% back for travel spend. You could use the points for travel on Virgin America (essentially paid tickets), or for any other travel expenses.

Where this does get a little bit interesting is partner redemptions. They do have partners, none of which offer out of this world value but some of which can be strategically useful, for instance:

- Emirates. New York – Dubai roundtrip on Emirates is 95,000 points plus ~ $1400 in taxes/fees. New York-Milan roundtrip on Emirates is 59,000 points and ~ $670 in taxes/fees. One-way awards are permitted. Still, Alaska Airlines is generally a better partner for one-way awards and Japan Airlines a better partner for roundtrip.

- Virgin Atlantic. JFK-London in Virgin Upper Class is 35,000 points roundtrip plus ~ $1000 in taxes/fees.

- Virgin Australia. Los Angeles – Sydney is 80,000 points roundtrip in business class and over $900 in taxes/fees (compare to 160,000 Delta miles but no fuel surcharges). Short-haul business class within Australia is quite reasonable.

- Singapore Airlines. Short-haul regional business class on Singapore can be quite attractive, eg. Singapore – Bangkok roundtrip is 13,000 points and ~ $45 in taxes/fees

- Hawaiian. Hawaiian Airlines West Coast – Hawaii is 20,000 points roundtrip in coach, so the credit card gets you that. First class is 50,000 points. And no fuel surcharges apply.

If you really want Virgin America points this is the way to get them, American Express Membership Rewards points transfer but at a rate of 2:1. But I would recommend spending on this card for many customers. Still, having a signup bonus again available, and from a bank that I bet you have no other cards from, isn’t a bad thing.

(Note that cards in this post offer credit to me if you’re approved using my links. The opinions, analyses, and evaluations here are mine. The content is not provided or commissioned by American Express, by Chase, by Citibank, US Bank, Bank of America, Barclays or any other company. They have not reviewed, approved or endorsed what I have to say.)

- You can join the 30,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Comenity Bank also issues Harrah’s/Caesar’s total rewards credit card

Gary,

I just used VA miles to fly Emirates 777 C SYD-CHC for 15,600 points and $50YQ each. Considering the cost for revenue into/out of NZ and very limited awards available on Qantas and nothing on Air New Zealand, this was a great sweet spot in the award chart. Plus, Emirates has the follow-on A380 routes from MEL/SYD-AKL.

Comenity issues a lot of store-branded cards (e.g. Express, Victoria’s Secret, Pier 1 Imports), so I’m surprised to see them in this part of the credit card market. Diversification is good though.

Not sure, but I think you may be missing a semantically critical “not” in the penultimate sentence of the ultimate paragraph.

The no change fee perk is extremely temping. Also it is not clear from the t&c if you can use the companion tix for F. If so, that is also not a bad deal if you can stack it with a sale/promo code VX frequently runs. I will have to look into it.

I wish UA would get a little more creative in their offerings, especially if you are already a Premier member or greater who more or less receives all the standard car perks already.

Update to previous post #5: Now I realize it is not a $150 companion ticket, though a $150 voucher you can use if you have two people on a reservation. Not bad for a $150/year card, but not quite as lucrative as you could possibly get with a companion cert.

Comenity was founded by Limited Brands and now issues cards for other brands, as well. So if you think it’s a sexy card, that’s because Victoria’s Secret is the issuer.

Amusing to me: they’re based in Utah.

“Fuel surcharges” (actually the “we won’t publish our prices honestly “charge) kill the value of the program in my opinion. The comment that it won’t be a card most will find useful is right on target.