The Suntrust Delta Debit card was a lucrative mileage-earning tool for a long time. I’ve been writing about it since 2009.

Since it’s been a debit card that earned 1 mile per dollar charged, it’s been useful to many in the past buying money orders and depositing those back into a bank. And it’s been a highly efficient way to earn miles for paying taxes since debit transactions incur a miniscule flat fee while credit cards incur a pretty hefty percentage of the total payment.

They even offered 30,000 miles as a signup bonus and with the business debit card you could get extra cards on the same account and earn the bonus for each.

Even after debit transactions stopped being profitable for banks, Suntrust continued to offer a signup bonus for the card even.

Two and a half years ago it became possible for people with no access to a Suntrust branch to get the card online. Then Suntrust stopped issuing new cards last year.

On Saturday the value of the card will be effectively over even for existing cardmembers. It gets more expensive at the same time it becomes almost worthless as a mileage-earning tool.

The annual fee for the card goes up from $75 to $95, except:

- ‘Signature Advantage’ customers with less than $100,000 on deposit pay $75

- ‘Suntrust Premier’ customers and ‘Signature Advantage’ customers with $100,000+ on deposit pay $25

- The business debit card goes up to $120 per year.

Mileage-earning will be capped at only 2000 miles per 30 days (4000 miles for Signature Advantage accounts).

What’s more, it will only earn 1 mile per dollar for Signature Advantage accounts — everyone else earns just 1 mile per $2 (Delta purchases receive double the earning).

I’ve earned huge mileage out of the Delta debit card. My recent business class Australia trip was booked with miles earned from this card, and I have plenty of Delta miles left. It’s been the primary way that it still made sense for me to earn SkyMiles.

Debit cards are no longer financial windfalls for banks. It’s no longer worth incentivizing transactions since the Durbin amendment to Dodd Frank financial reform eliminated the profit for banks from debit transactions. The rewards debit card is almost entirely a thing of the past.

I’m truly sad to see this development, but the underlying economics made it inevitable and mostly I’m surprised how long it continued to last.

Still, I was sort of mad. I paid a $75 annual fee for this card in January for a set of benefits. They were gutting the benefits. How is that fair?

So I logged into my account and messaged Suntrust. I told them they should either wait to devalue me until my card year was up, or at a minimum give me back my $75. They did a bait and switch, and aren’t delivering what they promised for my $75. (Sure, I got plenty of value out of it already…)

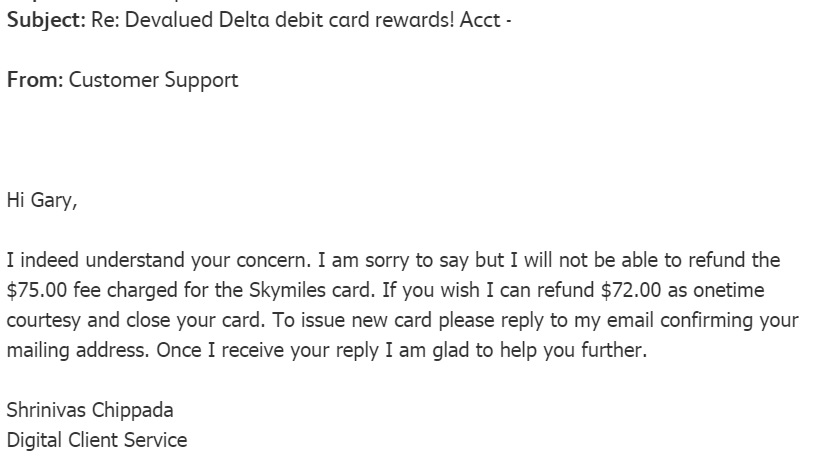

- They said no to my request for $75.

- They’ll give me $72 instead.

If you’re not going to use this debit product anymore to earn miles, you might as well ask for your money back!

One thing to realize about Durbin and Debit. The regulation on interchange caps back to the banks at ~$0.25 per transaction is limited to Financial Institutions with less that $10B in Assets. This means smaller banks and credit unions still earn full interchange on Debit. They can therefore afford rewards (potentially).

Although the Airlines haven’t found a home for their debit programs yet – you imagine the card industry brands are looking to create a union between Airlines and operationally ready smaller financial institutions to capture these flows.

@Mike Except UFB devalued their AA debit card and they are under the threshold.

One open question on the new terms is whether the 2,000 per 30 day cap is per account or per card, the latter meaning an account with two cards is capped at 4,000 per 30 days. The letter announcing the new terms says per card.

Just made my last IRS payment today, now to close account.

So, if I use the card to spend $4000 per month I will get 2000 Skymiles. If I maximize this I will get 24,000 miles a year in exchange for the $95 plus the lost revenue for keeping a $3000 balance (I could get $30 a year from Ally bank for that). So 24,000 miles for a cost of $125 = 0.5 cents per mile. That is under the best scenario.

All I can do is use it to:

-> pay the IRS – but can one make 12 payments a year?

-> load RB – but I have other means for that right now

-> load AFT – but the costs are high to load and offload.

Anything I have missed?

I still have 3 months left on my current annual fee of $75. Perhaps I’ll wait and see if anything changes.

Any word on whether today or tomorrow is the last day to earn DL miles under the expiring terms? It seems kind of ambiguous weather July 25 marks the first day of the new program or the last day of the old program…

How did they calculate $72? I’ve never heard of someone getting an annual fee refund from ST. You didn’t pull a DYKWIA, did you?

@Mark,

My interpretation is that today is the last day. One could ask if purchase date or posted date will count => will purchases today count?

Gary, you wrote: “I’ve earned huge mileage out of the Delta debit card”. Unless you were paying huge taxes every month, I cannot imagine that you did go to Walmart or other store to purchase money orders and depositing them to banks.

@Frank – tax payments are explicitly mentioned as non-earning by new T&C. Yes you are missing couple of things where you can pay your bills, if you have matching bills.

@Sergey – some people had many BB accounts. 6 cards gives you 30k per month, every month. And this is not even close to what some people cycled through this card.

@Putkin, what do you mean “matching bills”? Do you mean, say, a credit card bill? A Utility bill? Anything where the name on the account matches?

@Putkin: I understand the methods of earning lots of miles from DL debit. I just cannot imagine that Gary does that – in my mind, he (or any blogger on BA) is above of doing this. They value their time much higher than skypesos.

My $75 fee just posted in June, so I’ll probably keep the card for another year. 24,000 Skypesos for loading Bluebird is worth it. If I keep $3K in the account, my only cost will be the fee + the lost interest on $3K. Works out to about .3CPM.

@Frank – meaning the service that you choose, that accepts debit for payment for low or no fee, has the payees that you actually need. There are two that I use one starts and ends with E the other with O/D.

Thanks for the update. As I paid my property taxes (a month early) today to get the free miles, I was thinking I should ask for a refund, too. The question is whether I’m better off with getting (most of?) my annual fee back, or paying a few bills at Walmart at the now reduced earnings rate. Probably a coin toss, but it certainly would be easier to take the money and save the hassle of my local Walmart’s inefficient service desk.

If I keep the card, does anyone know when the 30-day limit period starts? Like if I earned 5000 miles today, when’s the next time I can use the card to earn miles?

Paid taxes yesterday on the 24th. Checked this morning and they are still pending, so I am assuming I won’t get the full miles. Ugh! It has always processed the same day before.

@Putkin, thanks! I needed that to remember that first one – been some time since I used them (after they changed the rules) but that will work for a few transactions.

Which IRS payment service does one use that worked to obtain Skymiles? I made a payment in May and was denied Miles. Would appreciate hearing of any success paying taxes this year and your methodology, thanks in advance.