Delta and United now award miles for flights based on the cost of a ticket instead of distance flown.

Though the airlines would have you believe that ‘on average’ they’re awarding the same amount of miles under the new program as the old, and just redistributing those miles — more miles to big spenders, and fewer miles for less expensive tickets — that’s not really true.

Instead, these airlines are spending less on marketing, awarding fewer miles, even as they make the miles they award less valuable.

Both United and Delta require spending at least 12.5 cents per mile flown to earn elite status as part of their revenue-based elite rules. But they both require an average of 20 cents per mile flown just to break even with the miles that had been earned under the old distance-based system.

(Both airlines even limit the miles that can be earned by top spenders.)

How many fewer miles are Delta and United awarding than they did before? They don’t release those numbers, but we can get a sense based on the revenue details they share.

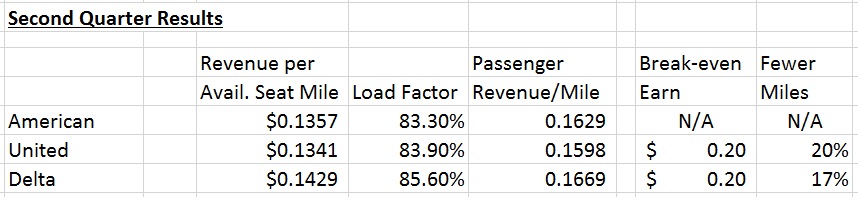

I took the second quarter Passenger Revenue per Available Seat Mile (PRASM) and load factors for each of the 3 largest airlines in the US to come up with each carrier’s revenue per mile flown during the quarter.

And then I compared that to the ‘break even’ earning for both Delta and United under their revenue-based mileage earning systems to see how that compares.

Both United and Delta have lower average fares than would be necessary for passengers to earn the same amount of miles as they did prior to the new revenue-based earning systems went into effect.

I’m prepared to believe that the reductions aren’t as significant as these numbers would suggest — it’s conceivable that the average fare purchased by a loyalty program member is higher than by a non-member. It’s not obviously so and the airlines don’t release that information.

Eventually, though, inflation alone will cause mileage-earning based on revenue to exceed that based on distance.

Under a revenue-based redemption system you expect the earn and burn side of the equation to balance out, since ticket prices are higher increasing earn but higher ticket prices increase redemption costs as well. But neither American nor United are quite there yet. (And revenue-based redemptions don’t preclude devaluations, as Southwest has shown on multiple occasions, because they can — just as banana republics find it too tempting to devalue, so do airlines).

“conceivable that the average fare purchased by a loyalty program member is higher”

Conceivable? You mean certain? It’s why loyalty programs exist in the first place!

The question is how much higher.

Kind of misleading header – should read “UA and DL issue fewer RDM overall under revenue-based scheme.” Some passengers earn fewer miles but some earn more. With fares rising even non-elites may be earning more on the short, expensive routes. Also not clear if fewer miles are earned under the entire program which includes miles sold to partners.

Really the only people suffering are those who fly long distances on cheapo fares – not exactly the customers that the airlines need to incentivize.

@Boraxo I’m re-reading the title and I don’t see the confusion, I think I make clear that some earn less and some earn more but than overall fewer miles are earned ad delta and united. If I said something like “You’re Earning Fewer Miles at Delta and United” that would be misleading, but it’s neither my title nor my argument.

Anyway, not trying to mislead anyone, I think the content makes clear what’s going on.

And I think I explain why they’re doing it, they’re spending less on marketing, they don’t need to invest to fill marginal seats. And I even make the point in their favor that I haven’t seen elsewhere that inflation alone will cause revenue-based earning — absent downward adjustment in miles per dollar awarded — to ultimately exceed miles-flown systems.

But it is very much NOT the case that “those who fly long distances on cheapo fares” are the “only people suffering.” An $800 transcon roundtrip loses miles, not just the sub-$200 fares available on American today for DC/BOS-LAX.

@jason – not quite, it’s to shift wallet share, average fare could very well be the same just purchased much more frequently.

Obviously we shouldn’t base our opinion of airlines based on the facts, I’ll feel much better when DeltaPoints douchbag and MJ Knows Nothing About Travel can download and share their “enlightened” perspective upon upon the sheep. I can feel DeltaPoints douchbag ginning up a Delta Reserve Amex card pimp posting….it’s coming soon!

I almost posted a comment last week about how the blog seemed to be turning into the I-hate-Delta-and-the-TSA blog. I thought it was too snarky, but it’s getting out of hand. Holy cow — it’s getting tedious.

Gary

I think we get the message that Delta sucks. Can you move on to more interesting stuff and positive things? I am starting to miss the bi-monthly credit card round up….

Not everyone will find the same things interesting or noteworthy that I do. And that’s ok.

Gary,

Keep fighting the good fight. I enjoy how you continue to shine a light of truth on how skewed the revenue based frequent flyer programs are in favor of airlines and not beneficial for the consumer. I feel that in some way you are letting American Airlines know (whithout actually telling them) it’s not the best course of action to take with their Frequent Flyer program once the merger is complete. At least that is my hope. As I pretty much have flown Amerian exclusively for the last 10 years. I really would like them to keep things as they are. I fear they won’t . But what I don’t understand is how people feel they have a right to tell you what you should or shouldn’t blog about. If people don’t like the topic, scroll down the site and read someone elses blog. That’s what I do.

I have a rough idea with respect to airline accounting of what an available seat mile is, but the cost and revenue part of the equation throw me off, particularly with respect to award flights and partner joint ventures. (However, I suspect that the fuzzy cost part of these metrics trends high before executive stock options are issued and trends low when the CEO’s job is on the line. Revenue is harder to fudge). Example: Are frequent flier miles and award flights part of CASM and PRASM? My understanding is Yes with many convoluted adjustments. Is Delta issuing substantially fewer miles at a lesser cost than before on its balance sheet? Yes, based on my understanding of human nature, not airline accounting.

@Gary

Where are you crediting your flights to now for each alliance?

A domestic revenue flight on United goes to which program?

A domestic revenue flight on Delta goes to which program?

A domestic revenue flight on American… Obviously goes to American for now.

But I’m pretty curious what you do with flights on star alliance and sky team to prevent orphanage.

I don’t understand the visceral reaction to changing towards a revenue based program. Hotel programs have been doing this for years.

@Dan hotel programs aren’t very rewarding for in-hotel spend outside of bonuses that are far more frequent than with airlines, though on the redemption side most hotel programs (other than accor) are award chart-based.

@Vinhsynd – “it depends”

I credit United flights to Singapore if cheap long distance, to United if short and expensive… No orphan points with Singapore because I can transfer in from Chase/Citi/Amex/SPG to top off.

I credit American to American of course.

And I haven’t been on a revenue Delta flight in awhile.

@HighPlainsDrifter award passengers won’t distort PRASM since outside of taxes (where fuel surcharges don’t apply) won’t bring in revenue. The cost of transporting an award passenger are part of CASM.

Thanks, This has inspired me to read the last (2014) Delta 10K in which: ‘We defer revenue for the mileage credits related to passenger ticket sales and recognize it as passenger revenue when miles are redeemed and services are provided.’ Awards seats in 2014 were 7.5%% of all offered Delta passenger seats. The actual value of what a SkyMile is is apparently based (as of 2013) on some sort of combined market basis – what they sell for to Amex, Hertz, the shopping portal etc. not their potential redemption value, which after three recent devaluations has obviously dropped (ouch!). So a non-medallion books a ticket, gets 5 SkyMiles per $, the ‘market value’ of those SkyMiles is moved to deferred revenue and PRASM declines a like amount. When they redeem a reward the number of SkyMiles times that ‘market value’ gets moved to revenue and PRASM increases the same amount. Prediction: The deferred revenue pool drops like a rock in 2015, as Amex issues fewer SkyMiles and most coach class tickets earn fewer SkyMiles as well, while the relative cost of each award soars to its new ‘dynamic’ value.

http://mobile.nytimes.com/2015/08/01/your-money/in-deltas-frequent-flier-magic-trick-not-just-rabbits-disappear.html?_r=0

Omg Gary you are a legitimate celebrity now.