I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Reader Wings has two questions.

What’s the Best Opportunity to Earn Rewards for Big Upcoming Expenses?

The first question:

I am going to do a 25,000 dollar remodel on a home. What is the best credit card strategy for maximizing earning potential for this type of spend. I have Platinum SPG and 1K United status.

The single most leveraged thing you can do with big spending is use it to meet the minimum spend requirements to earn signup bonuses on new credit cards.

This much spend is a great opportunity to get cards whose up front spending requirements are large.

The second most leveraged thing you can do is earn spending bonuses. The question here is what kind of expenses you’re going to have exactly — are you paying a contractor, or buying things at stores like Home Depot? If the latter, you may be able to earn spending category bonuses buying gift cards for the stores that have the supplies you need (eg Home Depot gift cards at an office supply store).

If you don’t have the opportunity for leverage then you want to use a card that earns the most possible. The biggest value for unbonused spending comes from:

- Amex Everyday Preferred (offer expired) since if you use the card 30 times in a month, you get a 50% bonus on all points earned that month. As a result you can earn 1.5 American Express Membership Rewards on all spending, transferrable to programs like Delta (Skyteam), Aeroplan (Star Alliance), Singapore Airlines (best for Singapore’s first and business class awards), and British Airways (great for domestic short distance awards that start at just 4500 points apiece). I value the return at 2.7 cents per dollar spent.

- Starwood Preferred Guest® Credit Card from American Express has the most/best transfer airline transfer partners (albeit not good for transfers to United) and earns the most valuable single points currency overall. I value the return at 2.2 cents per dollar spent.

Is Now the Right Time for an American AAdvantage Status Match?

Here’s Wings’ second question:

I am a frequent flyer (200,000 miles a year) based out of SNA. I fly out of LAX on PS flights and when it makes most sense but favor SNA. I am very curious about the AA program and am considering a status match. Do you think this would me a good move for me? If so, when is the best time to try?

I don’t have enough information about your travel profile to know whether or not American is a good fit for you. I certainly favor American myself – largely because 100,000 mile status on American is ‘real’ top tier (at United top tier is revenue-based and opaque Global Services status, while American’s revenue-based recognition Concierge Key is mostly help during irregular operations plus the ability to redeem miles for upgrades without a co-pay). That and because American’s international first class awards are reasonably priced.

In order to know if American is a good fit, I’d need to know:

- what in addition to transcon flights (Los Angeles – New York) you fly?

- whether or not JFK versus Newark matters to you (United is about to abandon JFK entirely)?

- what class of service you’re buying and how much your tickets usually cost (if you buy cheap coach fares then you’re not doing well on long flights under United’s revenue-based earning, if you buy business then there’s an opportunity to upgrade to American’s first class).

- what you want to do with your points (United tends to be better for business class awards to Europe and Asia, American for first class awards)

In general when you do a status match or challenge you want to do it in the back half of a year so that your status earned through the challenge will last not just until the end of the current elite year, but for the whole next year. Some programs like Alaska’s Mileage Plan make you wait until closer to the end of the year for that.

Now that we’re in the back half of the year, it’s worth going for that American status challenge if you’re interested in flying American a fair bit over the coming year provided you’re on a course already to requalifying for United’s 1K status.

In fact, I would jump on the opportunity because via Traveling Better, the traditional status challenge offer may close or change September 23.

That’s not actually what you want. That’s the option to pay a fee and earn Gold or Platinum status. However changes afoot could signal that now is the time to challenge even to Executive Platinum status.

If you’re a United 1K it’s worth calling up American AAdvantage and telling them you are considering switching and is there an opportunity to match your current status?

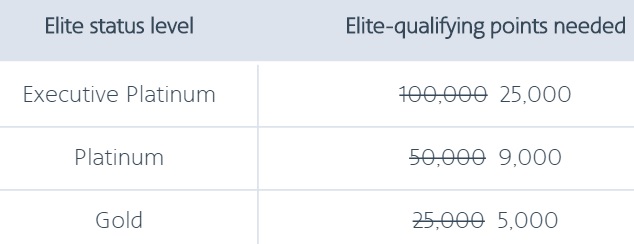

There’s a targeted offer right now for expedited status including to American’s top Executive Platinum status tier. Flying between September 14 and December 23 and earning the required points determines your status level for the coming year.

Note two things:

- Points are not miles. Points are calculated by the miles flown multiplied by a factor that can be less than or more than 1 based on the fare class flown. The idea is to privilege higher fares.

- Even if the offer page appears to let you sign up, you will not actually be registered unless you were targeted for this offer. This one is being presented to folks on LinkedIn.

This is an exclusive offer only for select AAdvantage members who receive this message from LinkedIn and who do not hold AAdvantage Gold, Platinum or Executive Platinum status as of September 14, 2015. AAdvantage elite status members are not eligible for this offer.

That’s why you want to call. American has been most open, over time, to offering status challenges that give you status during a 90 day period and an expedited path towards keeping it when you call them and can demonstrated top tier status with United.

I would caution against leveraging bonus categories by buying gift cards for home remodeling, or at least consider the implications. While there is great potential to really rack up points, it depends what kind of work and purchases we’re talking about. By using gift cards you lose all purchase protections, and if I’m spending $25,000 mostly on services to install a new floor or remodel a bathroom, I’d personally prefer trading the extra points or discounts for good purchase protection from something like the Amex Platinum card. The extra points aren’t worth the trouble if the contractor doesn’t perform as expected.

If you can price out the work and materials separately, you can use your new credit card to buy the materials directly through an airlines shopping portal. I once saw a strategy where a guy bought lowes gift cards at staples to take advantage of 5x points on a chase ink plus, then used the lowes card to buy the renovation materials through an online portal giving 3x AA or UR points.

so: $5000 spend got:

50,000 signup points

25000 UR points from staples

15000 UR or AA points from online portal

Total 90,000 points on $5000 spend

Are the 10,000 Elite Qualifying Miles earned with the $40k spend on the Citi Executive / AAdvantage Card also points or just miles?

@greg just elite qualifying miles