Brian Sumers reads the SEC filings on the Alaska Airlines acquisition of Virgin America, and walks through the timeline of negotiations that brought us to a deal.

- There were actually four airlines interested in Virgin America, including one major US carrier that dropped out because they determined the federal government likely wouldn’t allow them to buy the airline.

- In December Alaska was potentially interested at $44.75 a share. But by the end of February they had to be coaxed into making a real offer at $45.

- Bidding frenzy kicked in between JetBlue and Alaska with Alaska one-upping JetBlue each step of the way and finally agreeing to pay $57 a share.

Here’s why Alaska said they did it. They gain a significant presence in important airports, resources that would have been hard for them to acquire quickly on their own. There weren’t other airlines out there they could buy to grow quickly. This makes them a big player in California.

Alaska has wanted to focus on upside rather than price, because the price — nearly double what Virgin America was trading at before takeover speculation began — is ludicrous. It’s a classic case of winner’s curse. While Alaska might not have been able to buy the same assets elsewhere, that’s the wrong question. What else could they have done with $2.6 billion? The answer doesn’t have to even be in the airline industry. They could have sold themselves. They could have taken the proceeds, and the $2.6 billion from the Virgin America deal, and given it to John Bogle to invest.

Still, Alaska will likely be a stronger airline with these assets once they get through the pain of integration. Mergers are never easy. They’re saying they can make more of these assets than Virgin America could (an airline that only finally started making a sliver of a profit with the lowest fuel prices in its history). They claim their loyalty program, and their co-brand credit card deal, are key to this.

It’s notable then that the airline isn’t planning to go revenue-based with its frequent flyer program.

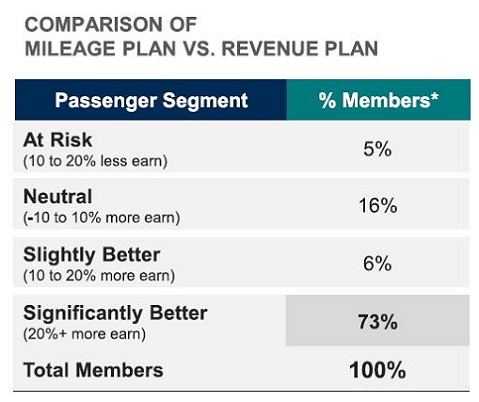

Alaska Airlines explained 16 months ago what was obvious to most members, that the majority of frequent flyers would do worse under such a system.

Cranky Flier interviews Alaska’s Executive Vice President and Chief Commercial Officer Andrew Harrison who shares the carrier’s thinking on sticking with a miles-based frequent flyer program.

- They think staying miles-based gives them an advantage. Revenue-based could have made sense for competitors with rising airfares and less of a need for marketing spend. But with yields falling (which Wall Street is punishing American and United for especially) now probably isn’t the time you want to change your program in that direction. Even though that’s the unfortunate timing American finds itself in.

- They’re not going to change right away. Although they make the case why a miles-based program makes the most sense for them, they won’t say they’re not going to gut their program later.

[W]e are basically the only carrier left in the US that has a miles-based program. What we’ve shared with Wall Street and what we continue to believe, is we’ll continue to study and understand the benefits and even opportunities we have by staying in a miles-based program.

But to the extent that we get to a point where we believe a revenue-based program is better for our customers then we would obviously make that change. But I think there’s a very real argument today especially in a declining yield environment that we have something really good here.

And we have a fantastic program that we, even with all the competitive capacity that’s coming to Seattle, our program has done nothing but continue to grow at a very high rate. We also know that the vast majority of customers when you look at the average fare are well-rewarded on a miles-based program in our program. We have boosters for the very high end.

…[C]hanging to a revenue-based model, that’s a lot of time and a lot of research. So we are miles-based today, we are going to continue to be miles-based today. If we need to change we’ll do that at the right time.

If anything the merger may buy us time in which Alaska Airlines Mileage Plan remains one of the most valuable programs out there, and the only major program in the U.S. that hasn’t gone revenue-based. Their focus will be on integrating Virgin America; becoming one airline. While both carriers use Sabre there will still be significant IT challenges. And you don’t want to upend your customers even more in a time of change.

On the other hand, if they could make the IT work and they were convinced they should go in a different direction they could use the merger as a reason to introduce a new program once the two airlines have integrated. 2018 might be a stretch for that, but 2019 could be plausible.

Since Alaska is emphasizing that the deal works for them, and that they’ll get huge value out of it, precisely because of their loyalty program — leveraging Mileage Plan in California — it would be strange to see them undercut the program’s value proposition right as they’re merging. Taken together with their public statements about the value of being the only major program that’s miles-based in the U.S. and the IT hurdles in overhauling the program at the same time their IT resources will be focused on integration, it makes sense that they’ll stay miles-based.. for awhile.

I’m hoping this puts pressure on AA. Any updates on the timing of their RDM change?