Delta Air Lines stock soared this morning on word that they’d beated analyst expectations for the second quarter and reinstated strong finanial projections for the rest of the year – when last quarter, with uncertainty around tariffs and their effect on the economy, the airline felt things were too uncertain to stand by any forecast.

The earnings call, though, was enlightening. Coach demand is down, premium demand continues to grow, and that’s shaping the airline’s strategy.

Here are (9) key takeaways. I’ll save a 10th for a separate post that speaks to Delta’s ticket pricing strategy.

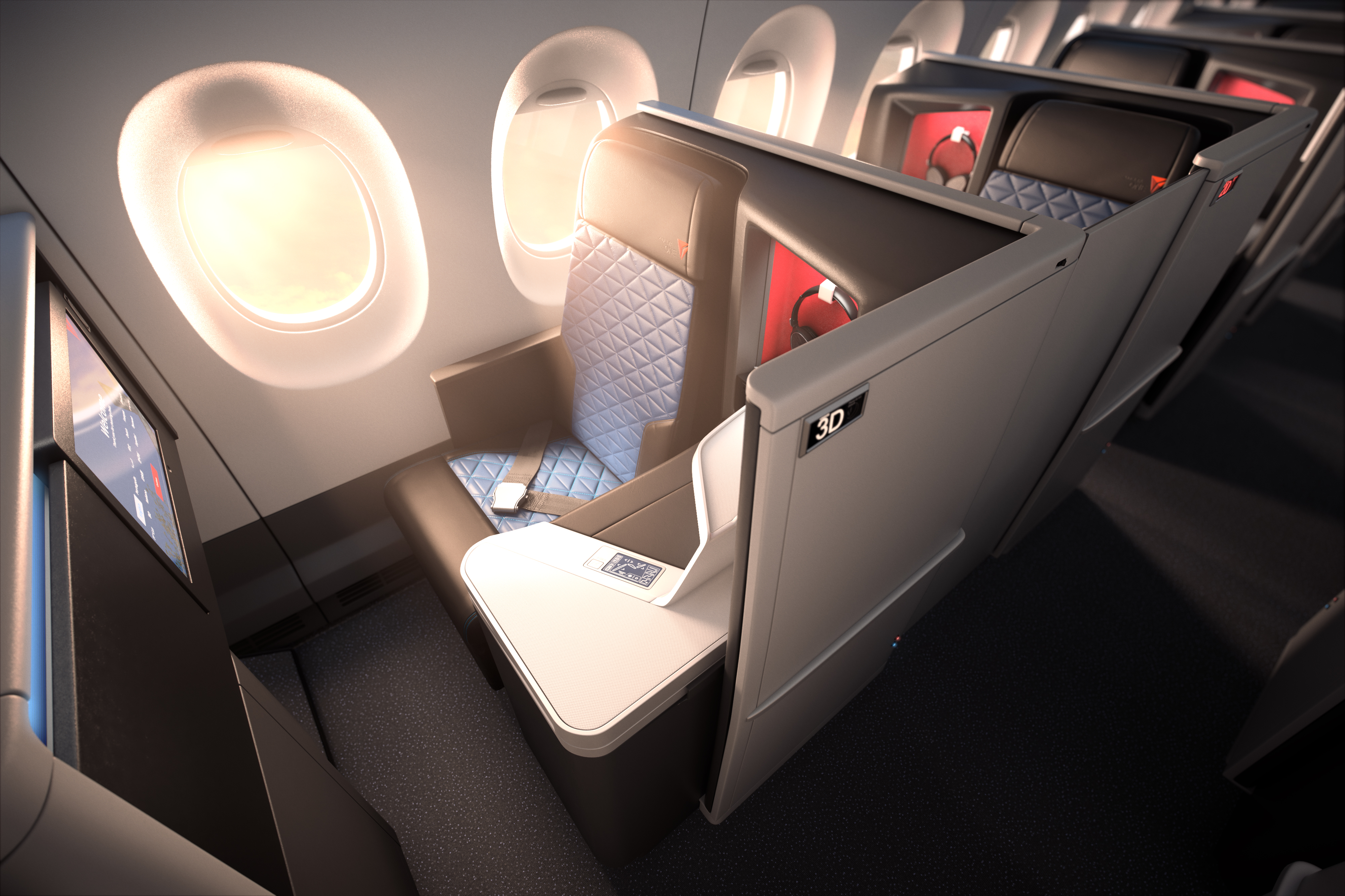

- Delta is looking to add premium seats to existing aircraft. And this also reflects a renewed desire to offer upgrades. Delta’s President Glenn Hauenstein shared that they see premium business continuing to grow and that they want to add premium seats to planes in order to sell more premium seats but also to upgrade more.

I think there’s nothing in any of the forward bookings that would have us indicate that there’s a diminishing demand for premium cabins or services. And so as we continue to look reevaluate even now the LOPA is on the airplanes and put more and more premium, we are able to do two things. One is sell more of it and two is accommodate more of our heaviest frequent flyers with upgrades, which is something we wanna continue to do to provide additional value to them.

Hearing Hauenstein speak positively about upgrades is unusual. He’s led the charge against upgrades and to monetize every premium seat possible, even for small amounts of money. They’ve been willing to upsell long haul business class for as little as $299 instead of allowing upgrades.

In 2009, 81% of Delta’s first class seats were filled with awards, upgrades or employees. 11% of those seats were filled with paying passengers, and 8% were empty. Now about 12% of first class seats go to upgrades. Other airlines have largely followed Delta’s lead, preferring to sell seats to non-frequent flyers for tens of dollars domestically instead of offering upgrades on a complimentary basis to customers spending tens of thousands of dollars annually.

- Tariffs hurt U.S. aviation. and they’re seeing trouble in travel by the auto and manufacturing sectors, precisely areas of the economy that the administration ostensibly wants to help with their efforts – these are counterproductive.

CEO Ed Bastian offered,

We’re not planning on paying any tariffs for aircraft deliveries, and that’s a pretty strong point of view here on the Delta side. That said, we are encouraged by the progress that we see happening in the discussions in Washington.

We are heartened by The UK, US acknowledgment in the the recent trade agreement that the 1979 Aviation Act where there would be no tariffs and and on a a reciprocal basis would be honored, and we hope that template will continue in future negotiations. This is our industry is one that’s maybe unique in our country’s economy in which the size of the surplus that we throw off, given the strength of our industry for aviation and aerospace, is the largest in the world. And this is not an area where tariffs would do anything but hurt U. S. Companies and consumers.

Meanwhile, later in the call, Hauenstein shared:

[M]ost most of our, survey results indicate that [businesses] are going to spend the same or more, and they usually do that. So we’ll we’ll see as it materializes. But as far as the sectors go, really, the favorable sectors are banking, consultancies, and technology, and the laggards are autos and manufacturing, which is kind of surprising given the way the the government is trying to bring manufacturing back. So hopefully, will turn around here in the not too distant future.

- Declining travel to the U.S. by Europeans is partially offset by the tanking U.S. dollar. That makes foreign-source revenue more valuable. Peak travel periods have also spread out into shoulder seasons, helping to offset weeakness as well. Here’s Hauenstein:

I think there’s clearly less travel coming out of Europe, but currency changes have offset a lot of that in terms of the total revenue coming out of Europe. So lower customer accounts, but higher yields given the currency has appreciated more than 10% over the past few months here. And so those kind of balance each other out with just a slight negative.

And what’s really driving us in the peak being a little bit lighter than the shoulders is this change in demand set from the peak summer months when everybody’s on vacation, prices are really high, places are crowded, Europe’s hot, and to times where it’s a much more pleasurable, experience, cooler temperatures, lower, hotel rates. And so I think we’ve seen this systematic shift.

And this is not a one year issue. This is multi years that the peak is getting less peaky and the shoulders are getting stronger. And that’s happened over a three, four, five year period since back to coming out of COVID.

- Delta expects $8 billion from American Express this year. Card spend – and revenue from American Express – were up 10% in the quarter, according to CFO Dan Jenke. And Hauenstein says they’re on track for $8 billion:

In the quarter, we saw a record level of spend on our card portfolio, highlighting both the strength of our customer and the appeal of our program. Renumeration from American Express was $2,000,000,000 up 10% over the prior year growth and momentum in new card acquisitions. We remain on track for full year remuneration of approximately $8,000,000,000 providing durability to both earnings and cash flow.

- They’re still planning to strip down business class benefits and charge extra for those. They call it ‘segmentation’ and they want to do to premium cabins what they did to economy (with basic economy, main cabin and Comfort+, or they’ve described it in the past ‘good, better, best’):

[S]o we’re highly focused on continuing to provide improved service to those customers and more segmentation. And I think the segmentation that we’ve done in main cabin is kind of the template that we’re going to bring to all of our premium cabins over time because different people have different needs.

And the more choices we can give customer with the more price points that provide value, the better I think the answer is gonna be for Delta and for our customers. So it’s all about giving people more choice, more pricing options and more products and services in every cabin.

In response to a question for CNBC’s Leslie Josephs, Hauenstein said that they won’t commen on specifics “until we roll it out” however they’re “testing it with customers today, and we’re doing a lot of surveys.” The delay in rollout has nothing to do with tech, which he says they’re ready on, “but we wanna make sure that customers understand what we’re putting in market and that they find value in it.”

- Business travel isn’t fully back. Ed Bastian acknowledges that flexible schedules – not having everyone in the office every day – and the ability to do some meetings virtually in ways we didn’t used to be able to – means that “15% or 20%” of business travel hasn’t returned. He frames this as an upside opportunity but really it’s a systemic change to the business.

We shouldn’t lose sight of the fact that business travel, while it has returned, is still very much in line with where it had been versus where the size of the economy is today, particularly the growth rate. On any true comp, have easily another 15% or 20% of business travel that isn’t being done, that used to be done. And I think with all the new tools and flexibility models and being in person is more important than ever in this turbulent world. I think there’s going to be a lot more opportunity yet to see business growth.

- Customers are starting to book farther in advance again – a little bit. Everyone holds off booking until the last minute in times of uncertainty. We saw last minute ticket purchases during Covid (is there going to be another outbreak? am I going to be allowed to travel where I want to go?) and there was a move to last-minute travel during peak uncertainty around tariffs in April. But consumer confidence is coming back, and earlier purchasing of tickets is normalizing.

According to Hauenstein,

So yes, the booking curve has shifted in. And generally, there’s a outside of a hundred and twenty days forward, it hasn’t deteriorated that much. Inside of a 120 down to 90, it has or actually down to 60, it has. So there’s a piece in there that’s moved closer in, and we tend to build a lot inside the month, which we didn’t do last year because a lot of those tickets were already sold.

So we have seen indications that it’s starting to move back out again, and I think this is very correlated to consumer confidence. As confidence returns, people will continue to book further out, which if that happens, have a very favorable impact to cash flow in the coming months.

- What flights are being cut with coach demand down 5%. They’re dropping early morning and night flights, and Tuesday and Wednesday flying, according to Hauenstein. And so is everyone else.

So how we’ve done with it, and I think a lot of the industry, you listen to what they’re all doing, is we’re all taking the weakest trips out, which is what you would expect airlines to do. And they tend to be on off peak days, so Tuesdays and Wednesdays, and they tend to be at off peak times pre 6AM or post-twenty-one hundred departures. So that’s really where we’ve concentrated in trying to eliminate those and consolidate that travel back onto the peak a little bit more.

- They’re working on ‘overflow’ space for clubs. In response to a question from the Wall Street Journal‘s Ali Sider, Hauenstein claimed that crowding in lounges is entirely the fault of weather but that they are doing contingency planning to address that, and that crowding will otherwise be eliminating in 18-24 months.

We are continually working to eradicate the lines and crowding at Sky Clubs, whether or not that’s building new and better Sky Clubs. We didn’t mention, for example, that the D Sky Club last quarter in Atlanta opened up replacing 8,000 square feet with 26,000 square feet. So we have a lot of plans to continue to address the places where we are constrained. Now one of the issues with the constraint is, and particularly with the weather that’s been in New York this year with thunderstorms almost every day with flights being delayed, is that you can’t build a club big enough for lengthy delays. So I think we’re we’re trying to look at alternatives that we can use as overflow in those instances.

But I think generally by structurally non-IROP days, we should have almost all of our crowding issues solved in the next eighteen to twenty four months.

Delta’s latest earnings discussion revealed a major shift in attitude and planning around bringing back upgrades, slashing premium cabin perks that come from buying business class, and promising to eliminate Sky Club overcrowding within the next 18-24 months. There was a lot more packed into this earnigns call than there usually is!

UA: 204 aircraft with far more Polaris Suites/plane been flying for years

DL: <80 aircraft with Delta One Suites with far fewer/plane

25 UA aircraft with new Polaris Suites and Studios will be flying before 1st new Delta One Suites whatever that will be arrive in 2027?

we get it.

you have only said it 10,000 times already.

You still can’t grasp that an inferior product is still inferior no matter how many times it was installed.

and UA hasn’t been able to turn its supposedly better product into higher profits.

Instead of repeating the same tiresome thing over and over and over again, how about you tell us why DL has managed to outperform UA for years and UA still hasn’t closed the gap w/o ripping off its employees even though UA pollutes more air than any other airline..

UAL Q1 2025 Net Income: $387M, 2024 Net Income: -$124M

DAL Q1 2025 Net Income:: $240M, 2024 Net Income:: $37M

UAL reports Q2 on the 17th

and UAL has SIX AMENDABLE labor contracts as of 6/30/2025.

Their earnings will go down as they increase pay and pay retro or they will have a discontented workforce.

in the 2nd quarter, DL had $2.1 billion in GAAP net income. Let’s see how UAL does.

The AFA contract is the only one that has been open for any amount of time and therefore are due a significant raise. The rest of the groups have all had post-Covid pay raises. The mechanics (IBT) only became ‘amendable’ at the end of last year. All the IAM deals became amendable two months ago. UAL has stated their earnings guidance includes any new deals. Nice try though.

@ Tim — Exactly, just look at the inferior crap on the DL 763s. Delta will get rid of this by WHEN exactly? Once a POS, always a POS. It didn’t become outdated, instead it ALWAYS sucked.

@ 1990 — Congrats! Even as 1K, I wouldn’t dare try for such an upgrade without a backup plan (cancelling). The melt thing is nasty. UA serves the appropriately named “Airplane Chicken” as an option. It is pretty good, although I prefer their cold Chicken Cobb salad.

Most American vacationers would be wise to avoid peak summer travel to Europe if they can. Not only is it crowded, but the Europeans are almost shockingly bad at providing air conditioning. Would you want to go to NYC in July if most indoor spaces had no AC? That’s Paris in July. Even 4 star hotels that claim to have AC in Paris often don’t have truly functioning AC.

chopsticks,

DL specifically noted in its earnings call that there is a shift in travel to Europe from the US because of crowds and heat. Given that many of the travelers are high income couples whose kids have left the house, there is no reason to go during the summer.

It is great to extend the season

Gene,

you and others LOVE to harp on the DL 767s while failing to acknowledge that a smaller and smaller percentage of DL’s summertime peak season flights are operated by both versions of the 767 and a small double digit by the 767-300ER. Half of the 767-300ER fleet is used for Hawaii and domestic flights including transcons – where UA uses its 777-200s which do not even have direct aisle access business class.

UA also has 757s which are flying as far as continental Europe and those planes do not have direct aisle business class.

and DL just announced that it is starting summer seasonal SLC to Lima, Peru service – using a 767-300ER. AA and UA both largely use narrowbodies, many of which do not have lie flat business class at all – to LIM and other parts of the northern part of S. America while DL uses the 767-300ER during at least parts of the year to UIO, BOG and LIM.

I can’t wait for the day when you are absolutely drained of your tirades when DL keeps the remaining 767-300ERs on flights to S. America and Hawaii on flights that compete against AA and UA narrowbodies and UA’s domestic configured 777s.

Tim Dunn says: Gene, you and others LOVE to harp on the DL 767s while failing to acknowledge that a smaller and smaller percentage of DL’s summertime peak season flights are operated by both versions of the 767 and a small double digit by the 767-300ER.

Delta has 60 767s or a third of their 176 aircraft wide body fleet.

Delta won’t finish retiring their 767s until 2030 and they won’t be getting the new interiors.

United’s entire international wide body 204 aircraft fleet has Polaris Suites including their 767s.

Correction: The 767-300s won’t be retired until 2030. The 764s will be around longer.

More room in first class will translate to more money, not more upgrades. As long as I’m happy to pay an extra few hundred for the seat, they’re not giving it to you for free. And I’m happy to pay it. Maybe there’ll be more upgrades when the premium market softens or crashes and there’s excess capacity, but they won’t happen as long as they can sell it.

I’m okay with unbundling. When the dust settles, you’ll be able to get on the plane or in the class you want for the lowest possible price, and then from there everyone can pay individually for any extras they want. I used to know a guy that traveled with nothing but wallet, car keys, boarding pass, and maybe a book (pre cellphone days). Why should his ticket have cost him more so I could check two bags for free? If someone is okay with a middle seat, why should they pay a higher price so someone else can pick an aisle seat for free? It seems like the ultimately fair system. Everyone gets on board at a base price, and after that you aren’t paying dime one so someone else can select extra niceties for themselves for free.

I haven’t been in a SC for years despite having access via Amex Plat. Too much bedlam. And I can’t see waiting 30 seconds in line for sad meatballs and potato salad with so few seats. I actually liked them better back when the only food was the little triangle tubes of hummus with carrots and celery and spicy Chex mix. Maybe a cookie. But they were quiet and uncrowded and lots of outlets.

Now I just grab a premade sandwich and water and find a seat at an empty gate. I suppose if one wants to flex, they’d find a bar stool and order a burger and beer that they pay for themselves and let the hoi polloi wait in line for free sandwich segments. I did, though, find great value in the SC when I transited through DTW after 9pm when everything was closed and my connection didn’t leave until almost 11p. Gotta say the meatballs and potato salad were pretty good then! I almost never get the free SC drinks though, so I guess I’d see more value if I did