The airline industry is a herd business, and Wall Street enforces conformity. An airline that outperforms financially has the space to innovate and plow its own path. An airline that’s struggling can either get in line or face calls for change from investors.

When the bulk of the industry says basic economy is a revenue driver, and an airline resists basic economy, they can get away with it if they’re delivering Southwest Airlines results. Alaska Airlines, which struggled as it worked to integrate Virgin America, had so such rope.

Where it’s still been able to stand out is in its Mileage Plan frequent flyer program.

- Alaska still awards actual ‘miles’, points earned based on distance flown.

- Their award chart remains relatively reasonable with most of their partners. They haven’t devalued redemptions the way that U.S. competitors have.

- And they do a good job delivering on elite benefits to MVP Golds and 75K members.

Despite being hobbled by a less aggressive co-brand credit card issuer in Bank of America, Alaska reports in their fourth quarter earnings call that they “saw double-digit percentage growth in our revenues” from Mileage Plan and that comes on top of “incredible years of growth in our loyalty program since the acquisition.”

The financial performance of the program demonstrates that charting their own course – investing more in marketing – drives customer loyalty and revenue to the airline and helps them to compete effectively against less generous airlines. With Delta’s buildup of a hub in Alaska’s home base of Seattle, Mileage Plan is a unique differentiator from dumpster fire redemption program SkyMiles.

In May Alaska plans to reveal the ‘owners manual’ it has been developing, and the document will include how they make money by delivering value to customers and creating loyalty – what a concept!

The owners manual will serve to build on this history by documenting and memorializing goals in several areas including free cash flow generation, leverage, returns to shareholders, ROIC and pretax margins. It also discusses the factors that have driven and will drive our continued success including the way we serve customers, how we offer value to and create loyalty with guests. And the critical importance of operating with excellence and being a great place to build a career for our people. As Ben said, we will share this in May at our Shareholder Meeting.

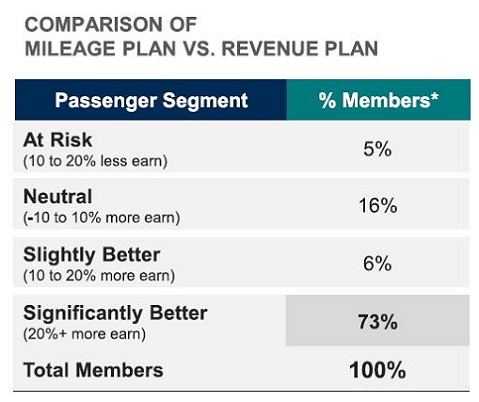

Alaska Airlines actually told the truth, that moving to a revenue-based loyalty program would only benefit 5% of members.

The truth is it’s been a big cutback at Delta, United, and American. And Alaska knows that rich marketing spend benefits their bottom line. As their Managing Director of Loyalty explained a year ago, “We love rewarding our members with miles based on how far they fly – not just how much they spend – and easy-to-earn elite benefits.”1

There is no doubt that Alaska has had some problems integrating Virgin America’s equipment, employees, planes, *and* loyal passengers into their fold. As one of those loyal VX passengers, I’ve experienced many of these issues first-hand, and yet I have “flown through the turbulence,” so to speak, and have become a dedicated and loyal (as much as possible) AS flyer.

Why? (After all, many regular readers of View from the Wing have complained about AS, and done so loudly.) It’s simple. First, while no one — including me — denies the bumps in the road, I find that Alaska’s Customer Service reps are second to none in resolving any problems that arise, and they do so easily and swiftly without the problem ever increasing in irritation and rising to the level of becoming an “issue.” Secondly, not only can I use my AS miles for redemptions over a wider domestic network, but with such a variety of international carriers that — even with the loss of Skyteam members Air France/KLM, Korean Air, and Delta — I can fly to far more places than I ever could with Virgin America. Third, the VALUE that I receive on those flights FAR EXCEEDS the 1.8¢/point valuation given to AS Mileage Plan miles by most bloggers. I have regularly received 10¢ and even 20¢ per point in flying in business class on carriers like Emirates and Cathay Pacific.

Is Alaska perfect? Of course not — show me one airline that is. Do I still miss Virgin America? Yes, but AS has done a very good job of “easing the pain,” and once they open up their Alaska Lounge at SFO (something VX never had), all will be well…

I’m not a fan of BofA but I would not underestimate the value of the card. Everyone I know (including casual travelers) has this card and often the spouse has one as well. The $99 companion fare is a huge draw – better than a CP on WN as the fares on AS are often better.

We’re retired leisure travelers who followed UA’s rules and guidelines. We stayed “loyal” through their bankruptcy and made to earn our Million Mile Flyer designation before the CO merger with one last flurry of flights. We also signed up for lifetime memberships in Silver Wings in the early 2000s. We know how all that turned out. They’ve just done something similar to the RCC/UA Club “lifetime” members.

In contrast, when our cruise line of choice, Oceania, reduced some of the perks in its very generous loyalty program, they grandfathered the benefits for those who had already earned them.

Alaska’s routes and partner arrangements won’t work for everybody, but they do for us. In several years as MVPGold75Ks since we status matched from our last year as UA 1Ks, we have yet to have a negative experience or to meet an unfriendly employee on AS. That counts for a lot too.

I agree with all the positive things JBL wrote. Alaska is simply a better-run airline than its competitors. Mileage Plan is a big part of that equation, but so is superior customer service and other features.

Love flying Alaskan Airlines. On time and pleasant crews!

There is a long history of smaller airlines offering more generous frequent flyer benefits than their larger competitors. Alaska is only the latest example. As a consumer, it’s a great reason to “pick the underdog.” But what “works” for Alaska probably wouldn’t be profitable for the larger competitors.

With AA on the way out the door their domestic foot print is about die unless you live in the Pacific Northwest, Alaska or Hawaii. I also suspect LATAM and Korean will be leaving with additional pressure from DL. Too bad they failed to seize an opportunity when they had it with DL.

Alaska has always been my favorite airline.

Clean planes,best customer service, good mileage program, flexible rules.

The crew seem much. Less stressed then any other airline, although SWA has given me an extra carry on with their card, and actually talen pictures with me and the whole crew.Crazy fun.

The only problem I have with Alaska is that for mobility challenged people they used to allow you to sit next to the bulkhead, and now they are frequently requiring you to back many rows, or pay more revenue.Also why does. A service animal get to displace a disabled person? Since lay Dr Dan Muffoletto ND President http://www.psychicteaz.com

@Jason Brandt Lewis

You say that you “regularly received 10¢ and even 20¢ per point in flying in business class on carriers like Emirates and Cathay Pacific.” However, if you you wouldn’t ever pay $10,000 to fly business class, then the miles are not really worth that much. Personally, I don’t think I’d ever pay more than $2000 out of pocket for any business class one way international ticket so Alaska points won’t ever be worth more than 4 cents each to me. Nonetheless, I really like Alaska and the mileage plan.

PS I did redeem 100K miles for Emirates first to Colombo once before the devaluation and loved it, but I would never pay $20,000 for that ticket so I can’t say I got 20 cents of value per mile.

@Rico —> I understand your point about not spending “x” amount of money, and so (you think) the point value is different. I disagree. It is having these miles that allows me to fly in J (or F) on international carriers. I have never *purchased* an international flight in anything above Premium Economy, but would I prefer to fly Business? Of course! Who wouldn’t? But if I were limiting myself to burning points for Premium Economy tickets for my wife and I, I wouldn’t do it. I’d buy the two tickets instead,¹ get the points and *then* burn them on flying internationally in J.

_______________

¹ Unless I were also having to buy tickets for my two adult children as well. Then we’re talking about “beaucoup bucks” — four or more OPE tickets really add up fast!

for 2 years i have looked for first class redemption’s and have not found any to redeem an Alaska or competitors for first class travel reservations could only apologize with no advise. any advise?

I can only tell you that — if you are talking about redemptions on *other* carriers, and not on Alaska itself — it is those other carriers that free up the seats and “give” some to Alaska. In other words, it’s not really something Alaska can control…unless you are trying to redeem on Alaska itself.

In terms of advice, I can only say that you have to be flexible in your travel plans. There are times when seats open up shortly before the departure date. I don’t know about you, but that always wreaks havoc on my travel plans as I am someone who typically makes vacation plans well in advance…

For all of my admittedly west coast focused domestic biz travel, I switched from Southwest to Alaska years ago and have never regretted the move. A ton of 1st class upgrades as MVPG, good service and good enough planes (that are improving monthly with the retrofit).

The lounges are nothing special, but solid. I use my AMEX benefit so the annual pass only costs me $100/year. Damn good deal for how much I use Alaska and Admirals Club.

I’m sitting on 500,000 miles and will be taking a nice biz class trip to Japan with my wife in 2020.

Alaska has my loyalty. If a major blunder happens I guess I’d switch to Delta. I would never consider American, United of Southwest.

I fly out of Orange County the most and we call Southwest “the Disney express”. I have no problem with kids, but those flights are brutal when heading to a business trip and it is filled up with families carrying tons of strollers and Mickey gear.

The problem is Doug Parker is to arrogant to adopt to better management and CEO methods

I find it next to impossible to find F award seats or even upgrade seats for 2 people for connecting flights such as SMF-SEA-ORD. I wouldn’t use miles for relatively short flights like SMF-SEA and now they are dropping their SMF-OGG flight. The AS Mileage Plan just doesn’t provide really any benefit for us.

I just checked on Alaska Airlines.

JFK-HND Feb 9 First Class on Japan Air is available for 70K Alaska Air miles + $19

A return HND-JFK on on Sat February 15 in First Class on Japan Air for 70K miles + $19.

Sounds like a good value to me. I am busy, otherwise I would be grabbing it now.

@Rico

https://www.travelcodex.com/devils-advocate-valuing-award-redemptions-at-full-price/

Love the comment, “dumpster fire redemption program SkyMiles.”. Alaska is a great run airline. Will be interesting to see what supplier they go with for the next gen aircraft.

Desparado, what Amex card are you using to get that$100 annual lounge pass?

@Scott That Devil’s Advocate article has some good points. Thanks for sharing. Nonetheless, I’d still have a hard time telling a friend or family member who isn’t in the game and has 20K miles they’ll never redeem in their account, “Just get these two credit cards and you’ll have $20,000 in travel fun flying 1st class (one-way).”

@Scott and Rico,

The price paid for something is more a function of opportunity cost and time value of money. If you can find a flight on JAL for 70,000 AS miles plus $19, then the cost will look like this:

+$19 tax

+$700 standard AS domestic redemption at $0.1/pp (adjust up for miles and money F/Y/M class with status) or $735 if spending $35,000 and earning 2% back plus 5% interest over a year.

= $754 + ($6,000) = $5,246 (3.6 cpp). This is kind of like accounting for the base value and remainder as opportunity cost. It’s not ideal. Below I think is more realistic.

Now I would further devalue that ticket cost by the average price paid for a F ticket on that flight. If there are 16 seats, 2 of which are full fare, 6 are discounted to $3,000, and 8 are made available for mileage redemption, the average cash cost per seat is $1,875 plus the airline’s cost per reward seat. Since airlines charge roughly $0.02 cpp to purchase them with discount deals (Alaska offers 50% bonus all the time), then 70,000 miles cost $1,400. If we take the average between these two prices offered by airlines, we get $1,637.50 each seat.

If we use this “price” as the real price paid per seat, our 70,000 miles are worth:

$1,637.50

+ $19

– $35 interest cost ($35,000 in credit card spend 2% back and 5% interest)

= $1,621.50/70,000 = $0.023 cpp

You probably should also subtract the residual value of the miles you would otherwise earn if paying cash for these tickets. If you value those at the same amount, you get maybe 6,772 miles jfk to hnd. That is $155.75.

$1,621.50

-$155.75

= $1,465.75/70,000= $0.021 cpp

Once again, this gets us close to what most people are willing to pay for a seat: $3,000 round trip. Anyone wealthy enough to blow $6,000 on a one way airfare will buy the full fare, but since there are barely any of them offering demand, the airline discounts in stages to fill the other seats.

This model is now changing though, as even Alaska is bumping mileage burn for availability. You will see $280,000 miles for a J on Aer Lingus. If miles are worth $0.20 each, then a buyer is valuing this flight at $56,000! That can’t be right.

Anyway, this is why I think the rule of thumb to value an airline mile for its cash acquisition cost is the best method. You don’t need to hoard miles and have any opportunity cost. You keep your cash invested. When you see a flight you want to book, you buy the miles. Or once a year you buy when they have a mile bonus sale.