When Marriott launched the Bonvoy program in 2018, combining the old Marriott Rewards and Starwood Preferred Guest, the most expensive redemption for any hotel was 60,000 points. Then they introduced ‘high and low season’ pricing and a new more expensive category 8, pushing up the most expensive reward to 100,000 points.

Unfortunately a year ago they abolished award charts altogether and promised only that price increases would be muted in the first year of the new system. Even then some redemptions went from 70,000 points to 100,000 points.

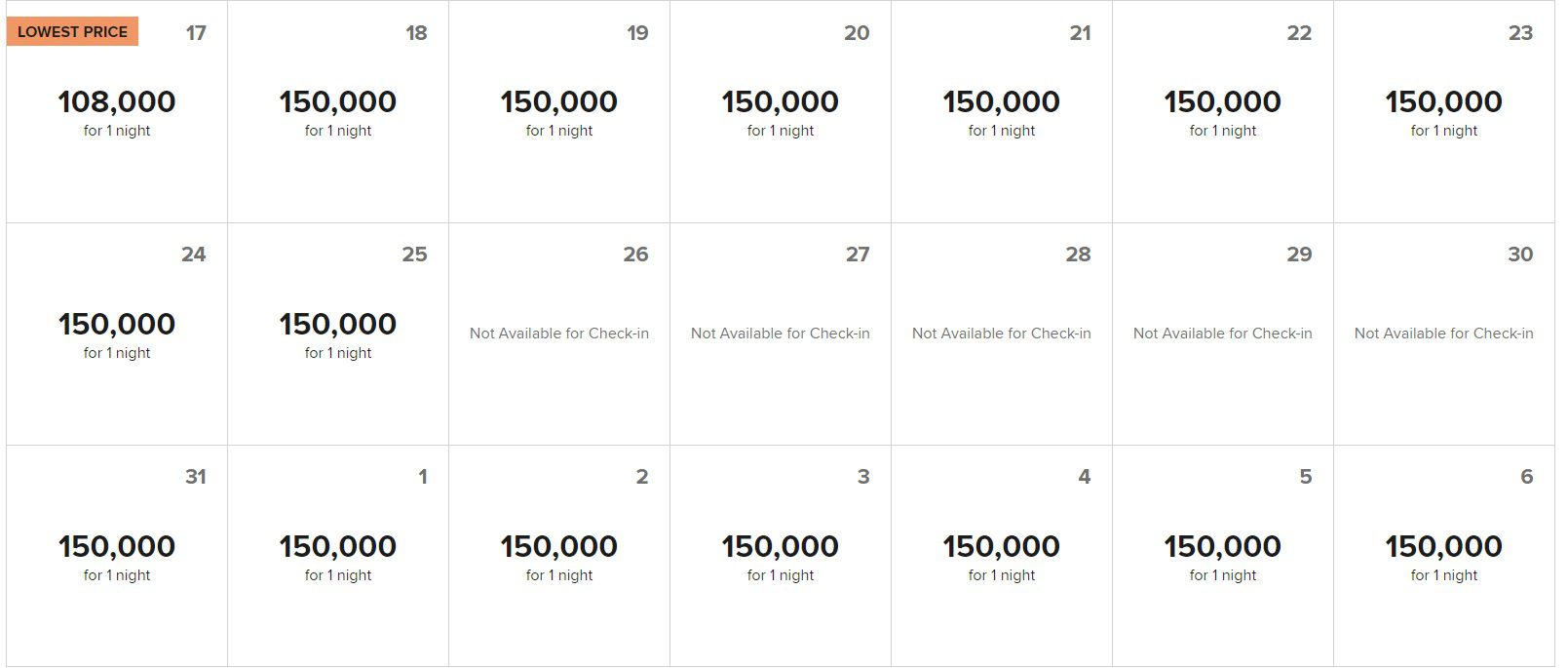

Now that the first year has passed, gloves and constraints are off, and properties can cost up to 150,000 points per night. Take, for instance, the Ritz-Carlton Maldives:

- During rainy season points prices range from 92,000 – 106,000 points per night

- Pricing runs 108,000 – 130,000 per night during normal popular times to travel

- And peak dates, where they offer redemption nights (e.g. not the week between Christmas and New Year’s) you may 150,000 per night.

Here’s the end of December into January:

You’ll now see Al Maha and the St. Regis Bora Bora pricing up to 126,000 points although that can now continue to rise of course.

North Island was always a special case, with pricing in its own league for instance 365,000 points against a $7,000 room rate. Now there are no more special cases as such, just whatever Marriott wants to charge you for a room. Notably Marriott did not even tell members about this change. They just raised the price cap, and so can presumably do so whenever they wish with no notice at all – that’s the opposite of loyalty.

Dynamic pricing means no longer getting great value for points. There may be times when you’ll get better value (when rates are low and award prices used to be high). In those case you shouldn’t have spent points, and spent cash instead. Now the ‘great values’ of the past are going away, since redemption prices rise to meet higher rates. There’s no longer a reason to go out of your way, in most cases, to build up points balances with Marriott, and I’ll be looking at the extent to which I should revisit my 60 basis point valuation of a Marriott point.

I have to ask. Isn’t this hurting Marriott’s credibility and long term longevity of their rewards program? There seems to be no reason whatsoever to earn Marriott points. If Bonvoy is not sticky and we all no that Marriott no longer guarantees anything. Why stay at a Marriott unless it happens to be the cheapest on offer via Priceline or similar?

Have been chatting with a few people while traveling and it seems like no one wants to stay at Marriott’s anymore. I haven’t stayed at one of their hotels in close to a year. But I have been staying a lot at Hyatt’s and IHG hotels.

I’m curious to hear what others have to say about this.

I mean, let’s be honest: We all knew this was coming. Assuming the banks don’t collapse and we don’t enter a global recession like 2008, I think it’s likely all the nice hotels in Paris, London, Rome, the Caribbean, Hawaii, etc. will start pricing at 150,000 points per night or more during peak season. Already in late 2022 and early 2023, top hotels in Paris were regularly 100,000 points per night. I’m sitting on 5 million Bonvoy points. This hurts me but not as much as someone just getting started. Now all those credit card promo offers barely cover one night at a nice hotel in an aspirational destination. How is anyone just starting ever going to accumulate enough points for that honeymoon trip when there isn’t even an award chart? I write this from the Presidential Suite at a full-service Bonvoy property in the UK that is only 20,000 points.

@EndlosLuft: Neither Hyatt nor IHG are good replacements for Marriott. Hyatt doesn’t have a full-service footprint that works for anyone in the USA outside major cities. In Europe, it’s largely an after-thought. Hyatt is moving into the resort space, which is notable. They seem to have effectively given up on opening new, full-service hotels. Probably because hotel owners and developers these days don’t want to build or operate full-service hotels. Profit margins are considerably higher at limited-service brands. As for IHG, IHG has a footprint that can compete with Marriott but they have way, way too many dumpy Holiday Inn and Crowne Plaza properties. Kimpton is a small footprint. Intercontinental and Regent even smaller. And not all Intercontinental properties are good.

It’s been this way for the last month… been talked about all over flyertalk

Travellers should not be loyal and stick with any carriers or hotels these days. Why would one wants to pay more, accept incovenience, be loyal to any program that gets nothing in return? Not only Marriott, but United, Delta.. are same way. 600K mikes to claim a one-way ticket. Anything works and saves cash, it would be the way to go.

As a lifetime elite, the program has lost its value and I no longer accumulate points with Marriott. They are biting off their nose to spite their face, targeting their most loyal, paying customers with these massive devaluations.

The long time saying is still true. Earn and burn your points and never bank them. The airlines and hotels will constantly devalue their programs and you’ll be left with very little.

I think we can still get oversized value for Bonvoy points if you book way in advance and have a bit of luck. We’re staying at the Bora Bora St. Regis 5 nights in April. Overwater Superior, Villa, 1 King, Lagoon view, Lagoon access. 392000 points (1 night “free”) plus $2000 upgrade surcharge. looks like this room is going for about $3600 a night, so this feels like an OK value….

So conflicted with Marriott a and Bonvoy as I close in on lifetime Platinum. Last night at Marriott Redmond, WA – just a sloppy operation – M Lounge closed despite website and room TV info saying 24/7 (no sign at the lounge, just try to get card to open door), make you return to the desk in the morning and wait for a breakfast voucher, etc.

I think this is actually a pretty incomplete and misleading post. You can do better, Gary

Sure – Marriott nights can cost up to 150K. But that is useless without the context of the cash price. The Ritz Carlton Maldives costs over $5,000 a night during the time period you cite. So the redemption value is 2 to 3 cents per point at least – and you say you are going to revisit your (outdated) 0.6 cents per point valuation down? It should be going up…

The top cost for a Marriott point going from 120K to 150K is part and parcel with the cash pricing for resort and other in-demand hotels during peak times increasing 30%, 40%, 75%, and in some cases 100%. In the current environment, ALL hotel points haves have increased meaningfully, increasing the reason to accrue these points, not decreasing them.

Paul – If you believe Gary’s valuation of Marriott points of 0.6 cents per point, redeeming $4,352 in Marriott points and cash for a stay that is achieving a fair market price of $18,000 Is much better than “OK” value – it is outstanding value. Hotel points values are woefully out of date as they have not taken into account hotel room inflation.

LOL to all that said that the 85k cert was a fair tradeoff when Amex bump the cost of the Brilliant to $650. “…now you can top of the cert and make it 100k…” they said.

$300 in dining credits at $25 bucks a month and a 85k cert that isn’t anymore useful than the 50k cert was. Hahahaha, suckers.

@Anthony – I think you’re missing the point of this post, which is certainly not limited to the Ritz in the Maldives, and also not intended to say “Marriott points no longer have value” though they have less value than they did a week ago.

(1) rooms cost more points, in some cases up to 150% more points than when the program was introduced before the pandemic, and up to 25% more points *than a week ago* [no meaningful inflation over the course of a week] and (2) they did this WITHOUT SO MUCH AS A WORD to members.

That is concerning to me, but in any case SOMETHING MEMBERS SHOULD KNOW and update their priors with.

Gary – Did you “update your priors” in terms of points valuations when the cash price for a beach / resort / vacation stay in any popular destination globally went went up 100% or so from 2019 to 2023?

Sure Marriott points have less value today than they did a week ago. But their value had risen significantly due to the devaluation of cash when it comes to vacation hotel stays. That’s the point

@Anthony –

1. Marriott didn’t REDUCE award pricing when prices were depressed in 2020

2. Overall prices, say for instance at U.S. hotels, haven’t risen

3. Points prices have certainly risen faster than retail pricing, but remember that Marriott is NOT GENERALLY PAYING ADR FOR REDEMPTION ROOMS. They may charge you more points but that doesn’t mean the hotel is earning more. This is about the program’s improving economics.

4. Many hotels – including it the Maldives! – aren’t actually more expensive.

I think you need to check your premises here. Again, my point is that Marriott did not tell members that points prices are in some cases skyrocketing, so it’s important to cover this. The fact that they do not communicate this to members is, in my view, troubling.

FNT – Let’s say someone wants to redeem 600,000 points for a five night Ritz Carlton Maldives honeymoon and they are starting from scratch…

You can get 555K Marriott Convoy points pretty easily:

Chase Sapphire Preferred – 90K in branch

Chase Marriott Boundless – 100K

Chase Marriott Bountiful – 85K

Amex Platinum – 150K

Amex Gold – 90K

Amex Green – 40K

Buy the rest during a sale.

Gary – the programs economics shouldn’t really matter – all that should really matter is the market value of the room, in cash, compared to the number of points required. You have to remember that when people were thinking about fully dynamic pricing, they were worried Marriott would move to an actual 0.7 or even 0.5 cents per point redemption scheme across the board – taking the price per room at hotels like this Ritz Carlton to 400K or so per night. That didn’t happen – the ability to get outsize returns on points versus the market value is still there. The fact is I am burning more hotel points and ever now, all at much higher redemption values than quoted for all of the major programs. This is not a Marriott defense here – this is a point that I think bloggers are undervaluing hotel points, and that 150K at the top is actually fair.

I will never stay there so it doesn’t matter to me

That said it’s about 1050.00 dollars a night on points not that bad based on cash rates?

I think there are better examples of Marriott hotels where cash is far cheaper than using points. I’m loving IHG now for select redemptions 4th night free etc

On slow nights it’s amazing depending on the hotel.As low as 120 per night us or less

In 3 days with the Hyatt bloodbath devaluation kicking in I’ll reduce spending 75% with them

They lost credibility with me over greed

They all suck now equally so it’s all about finding sweet spots

@Anthony “FNT – Let’s say someone wants to redeem 600,000 points for a five night Ritz Carlton Maldives honeymoon and they are starting from scratch…”

what follows is a joke, right?

On the bright side, it’s favorable to have the option to burn 150,000 points for a night somewhere than to have that property/date blacked out altogether.

No question, Marriott shot itself in the foot (so to speak) by heavily increasing the number of points required for a room redemption.

I predict that Marriott’s overall future business will decline as a result of its unrealistic points devaluation.

Many travel writers offer Marriott credit cards in their blog. The blog writer gets a form of commission for people getting the new Marriott credit card using the link provided by the blog writer. There will be fewer people responding to the credit card offers when it gets known that the credit card bonus is markedly less in value as it once was just last year.

Considering that Marriot credit cards yield only between 80,000 and 100,000 points for new card holders, what is the point in getting a credit card that often will not pay for even one redemption night at a Marriott? Some Marriott credit cards include a free night “anniversary” bonus if the card is kept current during the second year of holding the new card. Most anniversary bonus nights only carry a 35,000 points value. What kind of room does Marriott offer for 35,000 (Marriott will allow the member to add up to 15,000 points to the 35,000 “free night” certificate). Even with the 15,000 added, it will be next to impossible to use the supposed “free night certificate”

Soon, my current “titanium” status with Marriott will die off from not using Marriott as I did for many years. Fortunately, the Marriott points I have accumulated in my account can be converted to airline miles.

Marriott – shame on you for your poor business decision that will likely cause Marriott to lose a lot of loyal customers and cause less income to be earned by the hotels

.

Dmg – the standard Hyatt Chase bonus is 30,000 points. The Hyatt top tier night costs 45,000 points – basically exactly the same markup (50% of the credit card sign up bonus) as a Marriott 100K offer (to 150K top night redemption). It’s the same thing!

TD – not really.

“Hey – I want to secure a product with a market value of up to $20,000 (a five night stay at luxury overwater villa in the Maldives) by using my good credit to sign up for credit cards. I can do that by signing up for six credit cards. Should I do it? Yes!”

Points values of all sorts are destroyed. I was wondering when a blogger – many of whom rely on the allure of valuable points – would mention this. None of the shill-bloggers have yet.

I saw a Hilton in Rome for 2.6 million points a night. Points value? “Revisit” away.

Anthony: ‘Let’s say someone wants to redeem 600,000 points for a five night Ritz Carlton Maldives honeymoon and they are starting from scratch…’

You then list 6 cards lol with almost $2K in annual fees & around $20K minimum spend.

Or they could grab one Sapphire Reserve (90K) & one Ink (75K) for $550 in annual fees, $10K minimum spend and stay 5 nights at the Park Hyatt Maldives.

Well played, Marriott.

I wanted to book a room at the St. Regis Florence. Room type available for award booking on-line (“Deluxe” room) in November, but even though same room type is available for sale in June, no award availability.

Guess I missed it when the no-blackout dates promise was rescinded.

I miss Starwood.

This seems like another opportunity to educate the masses, so, here we go, using Hilton Honors as as Exhibit A because it’s the only program whose implementation of dynamic award pricing I have modeled thoroughly.

That claim is not only demonstrably bogus, it also reflects a complete misunderstanding of how correctly implemented dynamic award pricing works. Mathematical modeling of Hilton Honors’ implementation of dynamic award pricing that I did back in 2017 and I repeated recently has revealed the following key features of the scheme:

1. In Hilton Honors’ implementation, premium awards and premium awards only are dynamically priced in synchrony (linearly, in fact) with revenue room rates within each property.

2. Standard awards at each property, on the other hand, vary just slightly under a cap that sharply deviates from the values that they would assume if they varied according to the linear equation that is used to dynamically vary and set the rates of premium awards.

3. As a result of the discontinuity where premium awards end and standard awards start and of the fact that standard awards are capped, it will always remain possible to get outsized redemption values at Hilton’s top-end properties, especially in conjunction with the 5th award night free.

The preceding concepts are admittedly too abstract for most to grasp. No to worry, because I did make plots of the results as that is generally how mathematical modeling can be best evaluated and appreciated. I suggest you download the plot that shows the result of my modeling of Hilton Honors’ implementation of dynamic award pricing at the link below and display or refer to it while reading the rest of this comment. It is the only way any of it makes sense.

http://bit.ly/3TJMlO4

I derived the data for the plot by doing dummy bookings for award stays at WA Los Cabos Pedregal. Taxes and/or other fees are not included, but otherwise everything else was real at the time I did the dummy bookings.

[Referring to linked figure]:

Note that there are two straight lines with different slopes when one plots award costs or rates in points (x-axis) vs. corresponding revenue rates in $ (y-axis). The steeper line is for standard awards and the second, less steep line is for premium awards. What is clear is that premium award rates change absolutely linearly, i.e., dynamically with revenue rates, with a sharp break where premium awards end and standards award begin. Importantly, the slopes of standard and premium award lines directly yield the corresponding redemption values. You can see, based on the slopes, that while the redemption value for premium awards at WA Los Cabos would be just 0.29 cent/HH point (awful!), that for the highest-cost standard award (150K HH points/night) would be an OUTSIZED 1.4cents/HH point.

What the preceding says is clear: dynamic award pricing has little effect on the redemption values of standard awards because in Hilton Honors’ implementation of the scheme only premium awards are dynamically priced, while standard awards are capped. For all practical purposes, Hilton Honors might as well still have a standard awards chart!

Bottom line:

Contrary to what self-anointed “travel gurus” universally claim, dynamic award pricing — if implemented as HH did — does not prelude the achievement of outsized redemption values, especially at high-end properties.

That conclusion will remain true for as long as HH standard awards are capped and revenue room rates do not drastically decrease.

Parenthetically, I did a similar mathematical analysis (published on now-defunct MilePoint travel forum in 2017) within days of Hilton Honors announcing their migration to dynamic award pricing. The analysis has held for 6 years and there is no evidence that it will stop being valid any time soon.

LOL. That is a reflection of yet another universally misunderstood concept. Everyone, without exception, lumps together two different concepts of points currencies, leading to contortions like the ones quoted:

On one hand, there are face values of points currencies, which are assigned by each program and are, thus, fixed and objective, and; on the other hand, there are redemption values of points currencies, which do not exist until points have been redeemed according to individual preferences or circumstances, and are, thus, highly subjective.

Nobody should need to “revisit” or revise the face values of points currencies (0.6cpp in this case) due to a few redemption values (2-3cpp in this case) being out of whack (up or down) because only Marriott can change the “face” value of its points currency. We, the consumers, can only alter the “redemption” values based on how we elect to spend our points.

What bloggers publish cannot be referred to “redemption” values. They are more like the “face” values of points because they reflect the average of many many redemptions, some lower than “face” value, some higher “face” value, leading to a mean value approaching the face value of a point as assigned by a program.

@Anthony – the Hyatt cad bonus was reduced to that, and has never been aggressive, the card hits above its weight in the Chase portfolio and they don’t need to bribe customers to take it with big up front bonuses it seems

Gary, simple question: What percentage of nights are priced at 101,000 points or more?

You know why I’m asking.

I became a platinum member for life which is not an easy thing to do. They said there would be a gift for anyone who became a platinum member to thank them for all the 10 years you know I mean it wasn’t at least 50 nights a year with Marriott or Marriott brand hotels. What was the great gift for the loyalty? Luggage tags that’s right luggage tags

Shouldn’t be wasn’t should be WAS

@DCS “modeled thoroughly”.

First off, good work here. But you leave a lot of questions just lying there.

1. How many dummy bookings for that resort? How many in each (standard vs premium)?

2. Dummy bookings done across all seasons?

3. Did you do any other locations besides 1 resort in Mexico?

“Thorough” examination of Hilton’s pricing would require some pretty heavy statistical modeling. Which of course, you may have done. It it’s not particularly reflected in 1 static image showing 7 data points, though. If you’re indeed pointing to 7 non-random bookings as thorough, I am afraid your methodology is a tad weak, no matter how many terms you throw in to try and impress us.

@ Origami

Your points are well made. However, when the data points fall so neatly onto the line there is clearly a very high correlation.

I dare say that if the full details of the exercise were explained that most herein would have even more of a brain embolism than their typical meltdowns into denialism.

FWIW I’ve run the data for some airline programs, not with high levels of statistical rigor to satisfy the referees and editors of a research paper, but enough to illustrate the proposition that under some dynamic pricing models there is a very obvious correlation between redemption value of points and the revenue rate of the product. QF FF for example offers very closely to AUD6 per 1000 points in their cash offset and anytime dynamic pricing. The same applies to gift cards bought from VA and hotels rewards procured using AS miles (but at different redemption values). In these cases the redemption value is remarkably consistent within each.

In some other programs that falls apart (e.g. Delta) – dynamic pricing is decoupled from the obvious revenue rates. You only need a few data points to show such a discrepancy……;)

The key message here is that people continue to confuse “standard awards” with dynamic rewards and make misplaced presumptions about dynamic pricing. I’ve yet to read a travel blog that gets it right.

The other key message is that so long as the majority audience herein is utterly fixated on their erroneous perceptions of point / mile valuations they have little chance of grasping the big picture….;)

@Origami — The questions you asked simply want to establish whether my conclusions or claims are generalizable, and the answer is that I did plenty to know that the conclusions are not only general, but also that they are independent of the answers to any of your 3 questions.

1. The number of dummy bookings per hotel was determined by the types of rooms offered, which was typically 1 or 2 standard rooms and several “premium” rooms. Then I simply plotted awards costs in points vs. revenue room rates.

2. I did dummy bookings randomly for my favorite hotels, as long as there was at least one standard room available for booking with points, as “premium” rooms are always available for booking with points because they are indistinguishable from “premium” revenue rooms. That is, if a “premium” room is available for cash booking, then it is also available for booking with points. It’s why “premium” award costs are almost always exorbitant. A good analogy would be airline so-called “Any Time” awards that can be booked with miles as long as seats are available, but they’d cost you an arm and a leg.

3. I modeled mainly my favorite ‘aspirational’ hotels & resorts, but I also did model several of my other favorite hotels in Asia to ensure that the conclusions are general.

Note that the modeling does not address the question of availability of standard awards, nor does it tell you a priori what value you’ll always get for a redemption at given time or hotel or etc because that was not the purpose of the exercise. The modeling was done to understand how Hilton Honors’ dynamic award pricing works and to establish its general consequences, and it did achieve those objectives (see the long explanatory comment above).

BTW, I just added more plots to show that the 3 main features of Hilton’s dynamic award pricing scheme are not a fluke. The discontinuity between dynamically priced premium awards and standard awards that makes outsized redemption values possible can be visualized even better by plotting

redemption values (cpp) vs. awards costs in points

Please follow the link provided above to find such plots, which I just added, not only for WA Los Cabos, but also for WA Maldives.

Hotels increasingly seem to be on the airline loyalty program bandwagon: devalue the rebate currency (to lower the company’s costs per point redeemed) while dangling the carrot of elite status benefits to keep customers hooked despite point devaluations.

I hit Lifetime Platinum when I was with Starwood and was grandfathered in to Marriott, then into Bonvoy. I used to try and accumulate SPG points and had some amazing trips on points, but I no longer try to accrue Bonvoy points. There’s no reason to do so because the number of points required to get free night is just absurd. Add to that, the watering down of perks and there’s no reason for me to seek out a Marriott property. I just look for whatever brand is close to where I want to be and I what I want to pay. In fact, I’ve found that I will stay at hotels where I have little to no status because they treat me better than a Marriott property would. It’s a crap brand and not getting any better.

@DCS

Thanks for the added information. This is much clearer with more data.

Not sure why people are pounding on Gary. I just stayed at the Ritz in Bachelor Gulch-i booked 2 rooms on points during Spring Break (read VERY high season) and spent 478,000 points for 5 nights (10 nights total) that exact same trip booked now would cost me more than double, assuming there was even a points eligible room available

Marriott clearly know what their point gouge practice will upset/alienate their demographic but they can care less for the following 2 reasons.

1. They are too big/arrogant to lose their base since there’s no other competitors have the same footprints as Marriott’s nowadays.

2. They have more and more timeshare owners want to spend their points on redemptions for hotels/resorts and this is one of the biggest selling point for their timeshare.

Best way to make more $$$ fr these timeshare owners is make them pay more points than b4 for redemptions. And make them pay even more $$$ to upgrade their timeshare ownership to get easier redemptions. The majority of readers here knew the timeshare scam so we won’t fall into the perpetual hole but that doesn’t mean we won’t suffer the consequences.

As long as Marriott keep selling their timeshare scam we will keep seeing them gouge on points redemption.

Hilton points are pretty much junk, but at least they give you insane amounts of points to compensate that. Especially if you have their AmEx card – it’s like 27 base points per dollar and that’s on top of the crazy-high bonuses like an extra thousand per say or double per night then even with more points per X amount of stays. They are not valuable, but they give them out quite generously so it basically evens out.

Marriott is quite stingy with dishing out their points and requiring so many of them makes them far less valuable than even Hilton. I used to look at them as much better as they wouldn’t hand out many but at least didn’t require many.

I am titanium for life at Marriott. I have many points. I use the points for a night here and a night there at low cost properties. The only perk with a dime is the 4:00 check out. Other than that the points have been devalued so much that I don’t even care about it anymore. Marriott got and devalued the point program and waited for the Starwood loyalist forgot how good of a program that was. Most Point programs are a joke right now though. The co branded cards have devalued most programs and the airlines and hotels use loyalty program to falsely build loyalty as most do not understand how to value points.

Marriott is an infant in gouging compared to some Hilton properties. Last time I looked the Biltmore Mayfair in London was charging 350,000 points per night and sometimes its in the 400,0000s. THATS PER NIGHT. They call it a premium room but with only five standard rooms in its inventory they are doing this and getting away with it. Every night of the year booked as much as a year out. I’ve not looked recently but I am sure it has not changed from last year and earlier the year. Insane, usurious, the height of greed. It’s the Hilton Honors program that sets the Hilton points rates and the local properties have to grin and bear it. Who would book under these rates? Let’s get upset about this folks. Not the Marriott gouging.

The loyalty programs aren’t dead. What is dead is the value of the points…the value of spending on the hotel cards and pretty much the value of getting new cards for bonus. Cash back beats spending on a hotel or airline card 95% of the time. Sooner or later people will understand it.

That is just a misunderstanding of the Hilton Honors program. Please study my posts above to see how HH standard/b> and premium awards obey different “mathematical” and “economics” laws. Where you see only premium awards at Hilton properties, other programs would simply show no awards available. You simply have to decide for yourself which of those two situations is more annoying.

The reason Hilton shows the availability of premium awards instead of simply showing no availability at all is what makes these awards so expensive: they are indistinguishable from cash booking [no separate inventory, no capacity control, no blackout dates], meaning if a premium room is available for booking with cash, it is also available for booking with points. Refer to exorbitantly priced airline “Any Time” awards to fully grasp difference.

As for “Marriott [being] an infant in gouging compared to some Hilton properties”, I suggest we wait and see how BonVoy implements dynamic award pricing, because if, e.g., they simply let “redemption prices rise to meet higher rates”, the consequence would be a permanent loss of outsized redemption values that this site and others have automatically associated with dynamic pricing.

If I were you I would pray that BonVoy would copy Hilton Honor’s implementation of dynamic pricing, which has been around for 6 years without doing any damage other than that which travel bloggers have imagined it would do. 😉

Marriott executives are now on a short term jolly. They know they are circling the drain and that historic corruption will slurp them into the sewer eventually. The sudden “retirement” of Craig S Smith (Group president, International until February 2023) was little reported but I can assure readers here that this is simply another unexplained high-level “dismissal” related to merger infractions / cover-up and other related corruption

“Dynamic pricing means no longer getting great value for points.”

BS.

I never had any interest in these aspirational properties partly due to the types of people they attract.

Nicely located and well reviewed Marriott properties can still be found with great points/$ rates.

For example, the recently renovated Westin New Orleans that treats Platinum members very well was going for in excess of $400 on recent weekends in April (a great time to visit New Orleans). I was able to snag a reward room for ~ 43,000 points, well over 1 cents per Marriott point without adding in any taxes and fee that accompany cash rates.

Thus, the contention is false.