The federal government argued that JetBlue is an important competitor to keep independent, in part for its low prices and for the passenger demand that it stimulates, when they wanted to break up the carrier’s partnership with American Airlines. JetBlue was the antidote to major airlines, and wanted to keep them from being co-opted.

Now, JetBlue says in court, the government shouldn’t be allowed to switch positions as it seeks to prevent them from acquiring Spirit Airlines. JetBlue and Spirit filed a motion in limine to estop the Department of Justice from taking inconsistent positions.

Just last year, DOJ touted JetBlue as the antidote to the dominance of the legacy airlines (American, Delta, and United) and persuaded another court in this District that JetBlue is a “maverick” airline that makes it less likely for airlines to coordinate. United States v. Am. Airlines Grp. Inc., No. 1:21-cv-11558-LTS (D. Mass.) (the “NEA Case”). In this case, in an effort to stop the JetBlue/Spirit merger, DOJ is saying the opposite: the transaction should not be allowed to proceed because it will facilitate collusion between JetBlue and its airline rivals post-merger.

JetBlue argues that the government cannot advance one argument to beat the partnership with American and then take the opposite position in this case.

I believe the government was wrong in its opposition to the American Airlines partnership. JetBlue was a disruptor 15 years ago. It no longer is. They do offer slightly more legroom in standard coach than American Airlines, United, and Delta (but not more than Southwest). They offer free wifi and TVs (so does Delta). And they also offer basic economy fares like the major carriers do. JetBlue once offered a materially better product and low prices but that no longer remains the case.

However the government’s position that JetBlue is somewhere between a low cost carrier and legacy airline, a bulwark against the majors that the government doesn’t want to see co-opted but also one with the potential to co-opt, doesn’t seem all that inconsistent to me. In other words, it’s not simply dialectical – it’s far from incoherent to say that JetBlue is neither fish nor fowl.

Indeed, acquiring Spirit Airlines means,

- taking planes out of the low fare, low cost business model

- making Spirit’s assets more like those of major airlines

There will be fewer assets in the U.S. deployed in the Spirit-Frontier model post-acquisition. I’m not sure that’s enough to make DOJ’s case, though JetBlue’s shareholders should certainly be unhappy with how much the airline had to overpay (and that it’s already had to pay in part even if the deal falls apart) to win this agreement and that if the deal closes they’ll be moving Spirit assets out of a higher margin business model to a lower margin one.

However, as JetBlue notes in its filing, the Department of Justice lavished extensive praise on the airline in its trial against the Northeast Alliance:

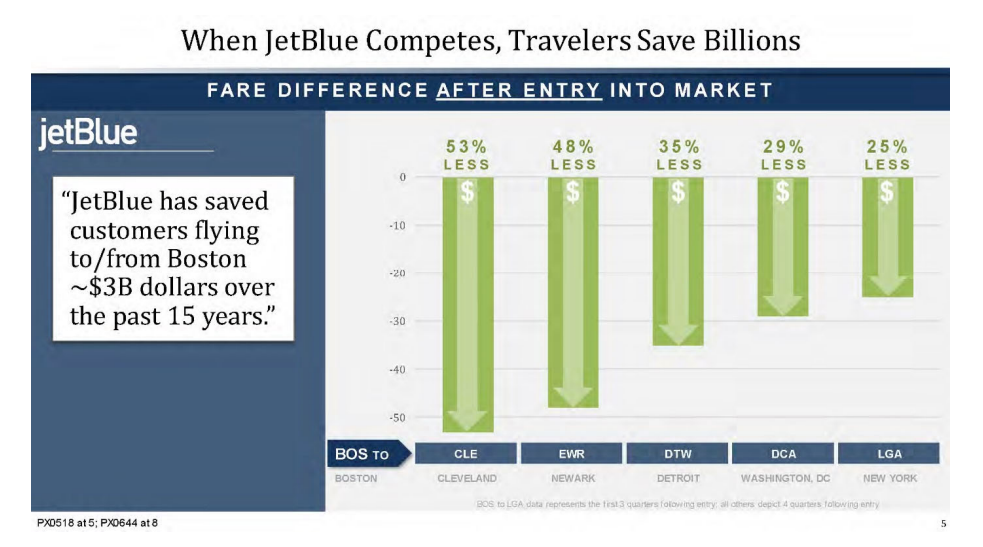

“The ‘JetBlue Effect’ describes the decrease in fares that occurs after JetBlue enters a market, or the increase in fares that occurs after JetBlue exits a market. PX0562 at 2-6. The JetBlue Effect takes its name from an MIT study that determined that when JetBlue enters a market, other competitors lower their fares and passenger demand increases. Land (JetBlue) Dep. 29:20–30:4, Apr. 28, 2022.” Plaintiffs’ Proposed Findings of Fact ¶ 46, NEA Case (Dec. 2, 2022), ECF No. 332 (“NEA Proposed Findings of Fact”). This JetBlue Effect arises because, as DOJ repeatedly proclaimed, JetBlue offers a unique value proposition – low fares and high quality – that allows it to discipline the legacies in a way other low-cost airlines (like Spirit) cannot. S

This was literally from the Department of Justice, just last year:

The federal government claimed:

- “JetBlue is unique among low-cost airlines.”

- “JetBlue differentiated itself from other low-cost airlines by offering not only low fares, but also high-quality service.”

- “JetBlue’s high quality of service allowed it to compete effectively against the legacy airlines in ways other LCCs and ULCCs could not.”

- “While AA, United, and Delta—‘legacy’ airlines—were busy consolidating, JetBlue was attacking the harms that consolidation inflicted on passengers.”

- “For more than two decades, JetBlue served as the legacy airlines’ foil in the northeastern United States.”

- “JetBlue is a close competitor to legacy airlines and is able to constrain their pricing.”

- “The JetBlue Effect produces lower prices and higher quality service on routes where JetBlue competes.”

- “Consumers benefited from competition between JetBlue and the legacy airlines.”

- “Travelers benefited from the JetBlue Effect whether or not they flew on JetBlue.”

- “In total, competition between JetBlue and the legacy airlines has saved travelers billions of dollars.”

This is, at a minimum, awkward for the government’s case against JetBlue acquiring Spirit Airlines.

In June JetBlue agreed to divest Spirit Airlines assets at New York LaGuardia to Frontier once the merger closes. (Frontier will probably be better off than if they’d have succeeded in a deal for Spirit!) JetBlue and Allegiant now have a deal for Spirit’s assets in Boston and Newark, plus for five Fort Lauderdale gates.

JetBlue is getting planes and pilots, gates and slots, but won’t be growing in the places where it and Spirit have the greatest overlap or where JetBlue is strong and growth is most constrained. Their anti-trust case does seem strong, and even post-merger JetBlue would not be among the four largest competitors in the U.S. domestic market.

The Biden administration opposes nearly all concentration for its own sake, but one senses that – if JetBlue hands the administration another win while continuing to hammer away at their case – they might be able to come to an agreement. Ironically consumers would have been better off with a formidable competitor of American and JetBlue in New York that could have been a counterbalance to Delta and United than with taking Spirit Airlines out of the ultra low cost carrier game. The DOJ picked its battles here poorly.

Gary, your assessment is correct. Nevertheless I despise companies who build a business on drip pricing and punitive fees levied on less informed or less capable customers. Good riddance to Spirit’s business practices.

This should not be a surprise at all. The people pulling the strings will do whatever they need to get what they want to happen.

Federal government argues against reduced competition, then … argues against reduced competition? What’s inconsistent about that?

I expect two faced dealings from the Department of Just Us. I hope they won’t get away with it. All airlines that have survived have had to grow or die. JetBlue is no different. The takeover is in the best interest of JetBlue since the government is not going to chip in cash to support them. They did the governments bidding for the Northeast Alliance so they should be allowed their prize. I have had good luck on JetBlue with good flights and good cabin crews. The one time they were way late they gave enough in vouchers that the vouchers covered most of the cost of the next year’s flight.

Spirit has lost $1.5B in the last few years alone and is barely profitable for the last decade. it’s lower fares can’t last. They have been subsidizing them with shareholder capital and are running out. JetBlue is a discount carrier, just one that doesnt’ nickle and dime its customers like Spirit does. If the DOJ wins this case, Spirit will either fold or merge into Frontier which will raise its fares to economic levels, so consumers lose. Their fares won’t be much lower than Jetblue, but the product will still be terrible..

The DEM run DOJ will twist it anyway they deem fit to see a Republican state business go under , but they will lose in the end.

Randy,

JBLU has been at the bottom of the US airline industry for several years in terms of profit margins. They are not a financial success story either.

And Spirit just further reduced its profit guidance.

The heyday of post-pandemic travel is coming to an end as demand falls and fuel prices go up.