Many people know that you can get free annual copies of your credit report from each of Equifax, Experian and TransUnion at AnnualCreditReport.com, a website created by the 3 major credit bureaus to comply with the Fair and Accurate Credit Transactions Act. This may prompt you to dispute inaccurate information on your report.

But that’s hardly the only repository of information about you, or the only place that government and businesses go for information. For instance, Lexis/Nexis compiles consumer information – and you can request a free copy of your file with them as well, which also gives you a path to dispute inaccurate information about you.

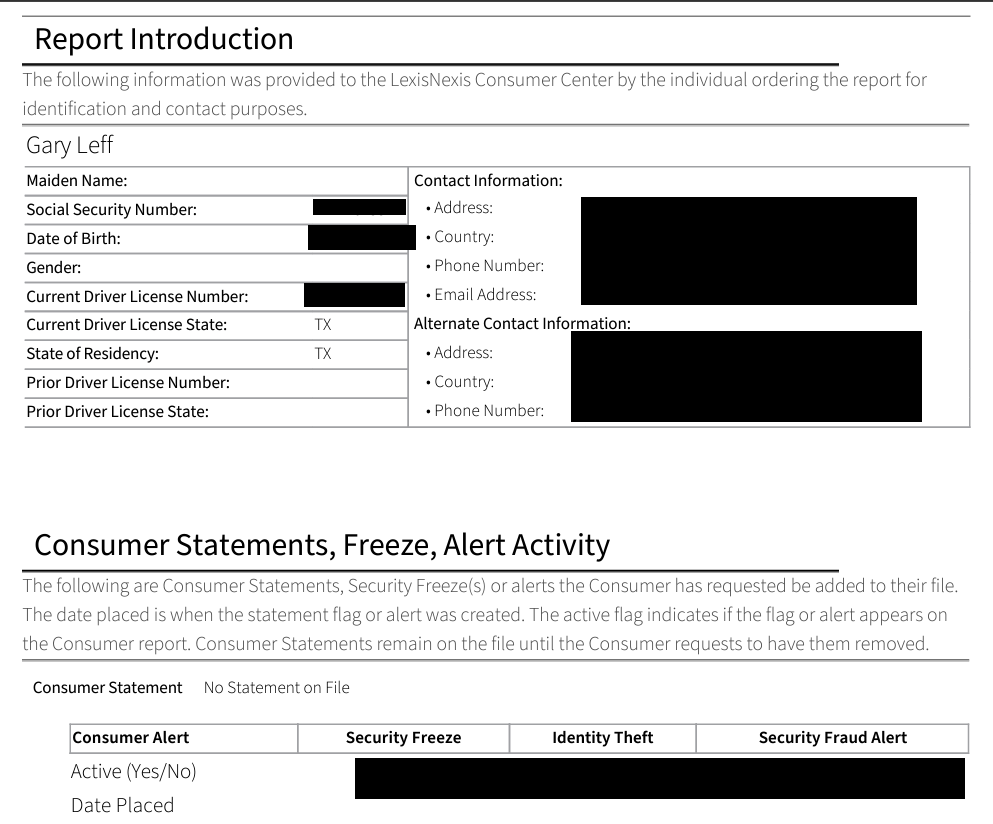

I ordered mine and found that American Express had just requested information about me. The report had every address I’d lived at since I was in college. It had my insurance policies, and claim information. It contained my work address, my social security number, and phone number history. It had every variation of my name (with and without “Mr.” as well as with and without middle name or middle initial). There was also one data source that had consistently slightly wrong variations of names and addresses tied to my record.

- I ordered my report online

- Then I received a letter in the mail telling me how to access that report

- It contained a URL and a password for accessing the report.

Oddly anyone with that letter can access the report you’ve requested – so if your mail is misdelivered or someone else in your household opens it, be aware that there’s no additional verification of your identity once you enter the URL and password contained in the letter.

However, my report didn’t contain anything especially sensitive – my drivers license number and social security number were only partially shown (with most digits listed as Xs) – though address history is something that can be used as part of identity verification requesting information about you elsewhere, opening bank accounts, or obtaining credit.

In all, the file that I downloaded was 58 pages, and I learned that my insurance company requested the information with a recent renewal and a bank requested it as well as part of a business account-opening process 18 months ago.

You may find your file interesting, at a minimum, or you may find inaccuracies that you want corrected. In much the same way it’s worth reviewing your credit reports, it’s worth having a look at your LexisNexis risk report as well.

Have a look at the MIB Medical Information Bureau You might be surprised.

People need to know that newer cars are collecting every bit of data about your driving habits and the car companies are selling that data to LexisNexis who in turn sells it to insurance companies. People’s rates are going up and they are finding it it’s data from their cars. Whenever you download the car manufacturers app or activate the infotainment system you are giving them permission to access and sell your data. If your vehicle has a 4G connection you can bet they are accessing your data.

I have the option of having them not share the data as I am a California resident. What are the downsides of doing so?

(Other than less marketing material)

Thank you for this link. It is very helpful to know this information.

Insurance companies were determining car owner insurance rates based on some car’s computer data being sent over the air. This rate hike stuff was part and parcel of LexisNexis’ Risk business line and even without tickets and accidents, car owners rates were being hiked based on things like breaking too suddenly too often.

Lots of people volunteer to share their data with insurance companies by way of OBDII attachments or an app the monitors their driving habits. There is supposed to be a reduction in rate for driving “safely” but there’s no definition provide of what “safely” is and they’re going to use said data against you when it comes time to re-price your premium.

Nope, no thanks.

Not really sure I understand the argument here in the comments about driving data. Insurance has an information asymmetry problem. People know whether they drive safely or not — and for those who haven’t watched dash cam compilations, safely means avoiding hard acceleration or braking, and avoiding certain times of day (e.g., 2am). Insurance companies have found a way to reward those who drive safely by offering a discount based on driving data. These voluntary, opt-in programs do explain what factors go into the calculation in general terms. Those who know they drive more safely provide the data, receive a discount, and the base risk pool becomes riskier. So, sorry that I’m no longer subsidizing your bad driving habits?

The state farm drive safe app is a joke ! I drive less than 3k miles a year, no tickets/accidents/claims. And yet my insurance premium from state farm has doubled!

The issue with the above report is it is after the fact (ie: passive detection).

I subscribe to a credit monitoring program which alerts me when someone applies for credit in my name or with my address (active notification). It also gives me a heads up when a major data breach occurs just like the recent records beach at AT&T. Considering one third of the US population has or had an AT&T account at one time or another, this is a BIG issue. Just recently, my state DMV had all drivers license, auto registration, and other important data records breached. We were offered free credit monitoring for one year.

Another issue of late is the sale of your home without your knowledge. Property sales can be done online. Someone claims to be you, signs the paperwork on line, sells your summer house or rental property, money is wired, account closed, and you’re stuck holding the bag.

I’m waiting for the day when someone steals your FF miles or club room pass. The day is coming!! Just a few days ago, someone snapped a photo of a boarding pass and the gate agents failed to react properly. If not for a full flight, the gentleman would have gotten a free ride.