The Wall Street Journal says that Wells Fargo had to overspend to break into co-brand credit cards, and that as a result they’ve slowed down in the space.

Their first two deals were Choice Privileges and Bilt Rewards. And the piece has a bunch of details about the Bilt deal that should be pretty encouraging for Bilt cardmembers. With Bilt they were too generous, so the bank isn’t making money, and they’re locked into a long-term deal to keep doing this. But Wells Fargo comes across here as savvy, pivoting their focus to building products that are more profitable and encouraging consumers to use those, even as they’ve been willing to experiment creatively and learn, while recruiting younger customers.

It’s such a strange piece – it seems framed to make Wells Fargo look bad but just describes how they’ve limited their losses while trying new things, and learned from their experiments. But we do get a lot of fascinating insider details along the way.

Bilt Rewards Founder Ankur Jain, Bilt-Wells Fargo Launch Party

Wells Fargo Has Been Moving Slow In Co-Brand

Wells Fargo built a team to go after co-brand deals. The head of that team that was brought in to build the business left around a year and a half ago (a different executive runs co-brand now). So it seems strange for the Journal to have picked this up now.

It’s expensive to wrest co-brand deals away from existing bank partners. Usually a deal is worth more to the incumbent, which has already spent on marketing and built a cardmember base. So you assume you have to overspend to beat them out for the best deals.

That probably made more sense in a zero interest rate environment. Cost of funds is cheap, and the discount rate you apply to customers is low – it doesn’t matter if a deal takes 10 years or more in a spreadsheet to pay off, because 10 years from now is almost as good as today. Now that interest rates are higher, it may be harder to justify some of those speculative expensive bets.

And even during ZIRP they reportedly modeled too aggressively, for instance that they’d pick up more cardmembers revolving balances and in the case of Bilt that they’d be able to do more cross-selling of mortgages (higher interest rates don’t help with this either).

The Journal reports that while Wells Fargo still has an Expedia card in its launch pipeline, they aren’t currently bidding on new co-brand business, instead focusing on their own branded products like the new Attune card and the excellent Autograph Journey card.

Economics Of The Bilt Rewards Mastercard

Wells Fargo and Bilt Rewards aren’t going to like having specifics spilled on the economics of their deal, but they’re certainly fascinating to read.

- “More than one million accounts were activated in the first 18 months, many by young adults. ” And with nine months since then, they’re card base is going to be even bigger. As a no annual fee card they probably don’t have many accounts being closed (annual fee co-brands have high attribution.)

- “Wells is losing as much as $10 million every month on the program as savvy customers flock to the card” they rebate too much to the customer, and haven’t made it up on volume.

- “Executives made internal projections on key revenue drivers, such as the likelihood that cardholders would carry balances, that turned out to be inaccurate.” Again, it is “savvy customers” signing up for this Wells product! “Wells expected that around half to three-fourths of dollars charged to the card would carry over from month to month, generating interest charges. The reality ranges between around 15% and 25%.”

- “About six months after the credit card was launched, Wells began paying Bilt a fee of about 0.80% of each rent transaction, even though the bank isn’t collecting interchange fees from landlords.” Bilt actually gets paid on rent transactions, and at an amount greater than what using points to pay rent and Amazon bills costs them. Most of their redemptions aren’t by savvy folks transferring points to travel partners.

- “Wells also pays Bilt $200 each time a new card account is issued.” Even if Bilt was just breaking even on points-earning and redemption, that’s still $200 million and growing.

- “The bank assumed around 65% of card-purchase volume would be nonrent, generating interchange-fee revenue. The reality is inverted.” I’m doing my part with non-rent spent, saving up bills for the first of the month (double points on rent day) and using the card for dining purchases especially. But I have a legacy card from before the Wells Fargo relationship. I have to imagine that Wells didn’t buy the ‘back book’ because the deal isn’t profitable for them. I wish they had – because my Evolve Bank card doesn’t have tap to pay.

This actually has Wells Fargo coming across really well, for any thoughtful observer. Most people will probably read ‘they’re losing $10 million a month’ as though that’s a bad thing. It really isn’t.

- They experimented with new programs to see what it would look like to build a co-brand credit card business.

- They did small deals like Bilt and Choice to start.

- It didn’t work out as well as they’d hoped, and they pivoted – not just in the kind of deals they’re doing, but in which products they’re aggressively marketing (“Wells has replaced some of its marketing of the Bilt card in branches, on its ATMs and elsewhere with that of its own general-purpose cards.”)

$10 million per month is nothing for Wells Fargo, consider of course that Chase has reportedly lost at least a cumulative $2 billion on Sapphire Reserve. And that’s often viewed as a success!

According to a Wells Fargo spokesperson,

As with all new card launches, it takes multiple years for the initial launch to pay off. We look forward to continuing to work together to…make sure it’s a win for both Bilt and Wells Fargo.

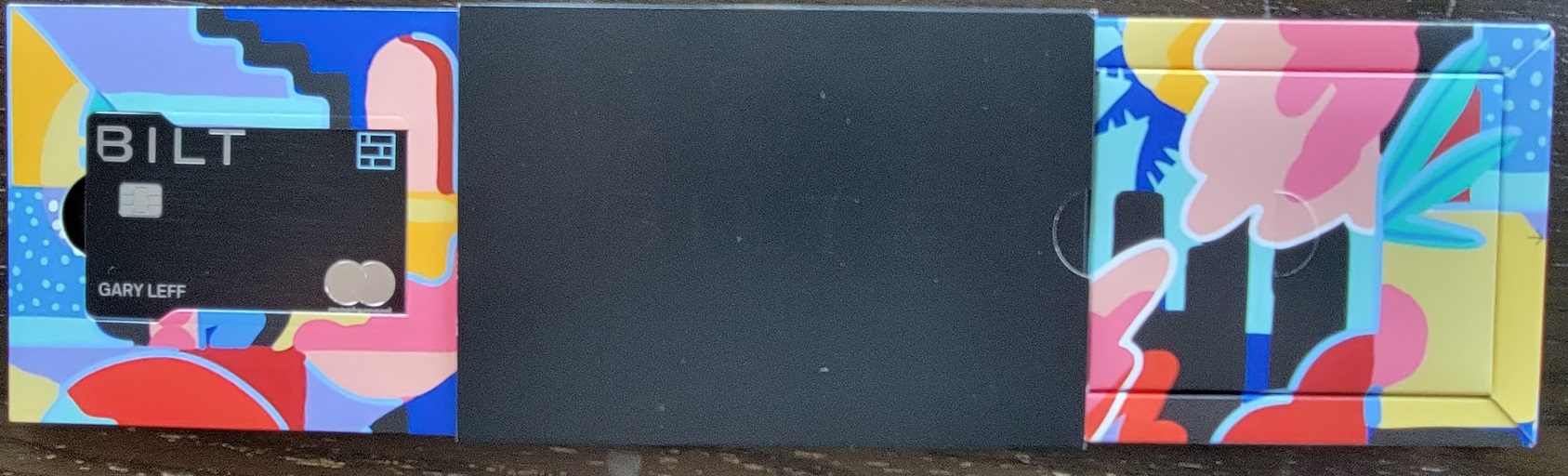

Bilt Mastercard Welcome Kit

The Bilt Card Has A Deal To Be Too Generous – Until 2029, And Likely Beyond

Co-brand card agreements are usually 5, 7, or 10 years. Over the last 7-8 years they’ve skewed longer. The last Delta Amex extension was for 10 years. I’d guessed that Bilt only had a 5 year deal because they were new, and that partnership launched in 2022 so the deal would run to 2027. It turns out to be a 7 year deal to 2029.

The Journal reports that the bank and Bilt have been in discussions of how to improve the economics of the program for the bank in order for it to make sense for the bank to extend the deal.

But even if that didn’t happen, the deal doesn’t end any time soon. And with rapid cardmember acquisition for a desirable customer segment Bilt is in a much stronger position than when they first signed on with Wells Fargo. Their Chairman is the former Chairman of American Express. They’d be in a strong position to get a new deal. And they had Evolve issuing cards before Wells. Bilt cardmembers should be able to rest easy.

A Bilt spokesperson shares,

This is an inaccurate representation of our strategic partnership with Wells Fargo. Following our co-brand card’s successful launch in 2022, we have been impressed by the early traction and growth and we are committed to a long term partnership with Wells Fargo that benefits all parties, most importantly – our customers.

This Was A Fun Read – With Important Takeaways

I love reading these insider details, almost as much as the players involved probably hate their being published.

I think both sides come out really well here – Wells Fargo aggressively experimented, found something wasn’t working, and pulled back while they retooled.

Meanwhile Bilt Rewards has a lucrative program in place for a long time that consumers benefit from. There’s a lot more revenue for Bilt, and a longer contract in place, than I’d realized. And that makes this a more secure, longer-term play that naysayers have imagined.

It seems these executives always over state revolving balances. While people do that did Wells think this would be common on peoples rent charges too? Seems like an overly aggressive assumption.

I don’t use the card for rent. Just 3x in dining. Hopefully I’m helping 🙂

Rent Day has become vapor ware

Something was forced to change

In Wall Street parlance, Wells is the “dumb money”. That former AmEx chairman/CEO isn’t too smart either (just look at how AmEx created all those manufactured spending opportunities under his watch).

Perhaps this explains why Bilt rounds down for anything above .5 on all transactions while I have never seen any other card not round up for anything above .5. Is this an effort to save money and is this legal? Below is just one example. A letter to WF went unanswered. Gary, perhaps you can investigate since I presume this saves WF quite a bit of money.

1 pts

$1.77

I feel like the cows will eventually come home for Bilt, there is no way to generate interchange fees for rent payment so that’s just a hook to get customers and an ongoing cost center. Maybe they will innovate and grow enough to stay relevant and someone will purchase them?

I mean I could have told Wells Fargo that customers savvy enough to collect points for paying rent weren’t going to carry a balance at that rate. They come off looking a bit idiotic

Closest thing they’ve had to a sign-up bonus were a few lucrative transfer bonuses. Imagine then being shocked that the majority of your card holders are “advanced” at points/miles and don’t carry balances. Average person isn’t signing up because “ooooh they had a 100% transfer bonus to FlyingBlue!” Only us weirdos know what that means. Kerr should do some reflection and realize the more lucrative potential client base doesn’t speak advanced points/miles and simplify the program

Wells Fargo invited people to play the points game underestimating there are masters at this hobby.

I flew around the world first class and stayed at beautiful hotels for free…20 day trip.

One has to take WSJ news for what it’s worth. The once great business Journal has, like the rest of the news industry, lost its way to become a positions advocate instead of an informant. Contemporary readers will be familiar with a slate of pet positions the Journal writes slanted hit pieces about on the regular. They are obsessed with negative stories about Elan Musk, and with demonizing both Israel and Jewish people in general. Sign of the times. All of which is to say, the WSJ has targeted your travel rewards. It’s one of their agenda items, running stories about how the rich are getting vacations paid for while you little people get hosed at restaurant check outs because somehow your small charges fund their large lifestyles.

So, when you see a hit piece in the Journal casting very savvy banking executives as dolts for attracting clientele by offering credit card points programs, realize this is not straight news that came from the Journal out of a vacuum of journalistic purity. They’re using this story, or what they’ve twisted it into, to advance their editorial ideologies, spreading silly opinions but doing it on the news pages.

Notwithstanding socialistic Journal attitudes and articles, I think you should stop short of mourning the end of bank competition and marketing, because the banks will continue to do what has garnered them profit lo these many years.

Problem with the card is that it incentivizes usage exclusively for paying rent and restaurant tabs. If it paid 3x at grocery stores, gas stations and everywhere else, I would’ve qualified for a high tier status again despite the rewriting of the rules. But with that rewrite and the 1x lid, they have written their card out of relevance at the register.

In this space, after yet another piece on this site peddling Bilt back in January ’24, I wrote the following:

In this space, after yet another piece on this site peddling Bilt back in January ’24, I wrote the following:

to which commenter Hornet retorted…

…not realizing that they were putting the finger exactly on the problem: Bilt was too good to be true because while everyone seemed to benefiting, no one appeared to be footing the bill. Now we know: Wells Fargo was the butt of the Ponzi scheme from which the 34-year-old who founded Built has become billionaire…à la FTX’s crypto wiz kid, SBF,…leaving Wells Fargo holding the bag!

Wells is the Target to Chase’s Walmart: Not big enough to have anything I’d want unless it’s a screaming value

@David: Correct on gthe WSJ having a persistent bias against Elon Musk.

LOL on the ‘their chairman was the chairman of American Express’ – Dimon, Moynihan, Fraser, Fairbanks, or any other CEO of a bank large enough to invest in the kind of rewards Bilt has addicted itself to doesn’t care that their chairman was chairman of Amex.

At this point it’s all about numbers and Bilt rode vanity metrics based off engagement from some super gamers who wisely milked it quickly. Good for the WSJ sniffing out it was more hype than viable in its prior form.

I wonder how many bloggers were offered ‘equity’ in Bilt to promote it

This article makes me want to sign up for a card to make WF lose money. Also it’s crazy that WF pays BILT $200 per new cardholder, yet there is no sign-up bonus.