JetBlue surprised by earning $25 million in the second quarter. That should be their strongest quarter, but they didn’t lose money. And they announced they’re going to be spending a lot less on aircraft, which caused their stock to pop – up over 20% in early trading, though this trailed off somewhat.

It’s striking that less growth drove higher share price, underscoring how badly the market has thought of the airlines prospects. Normally growth is valued but that requires a likelihood that it will be profitable.

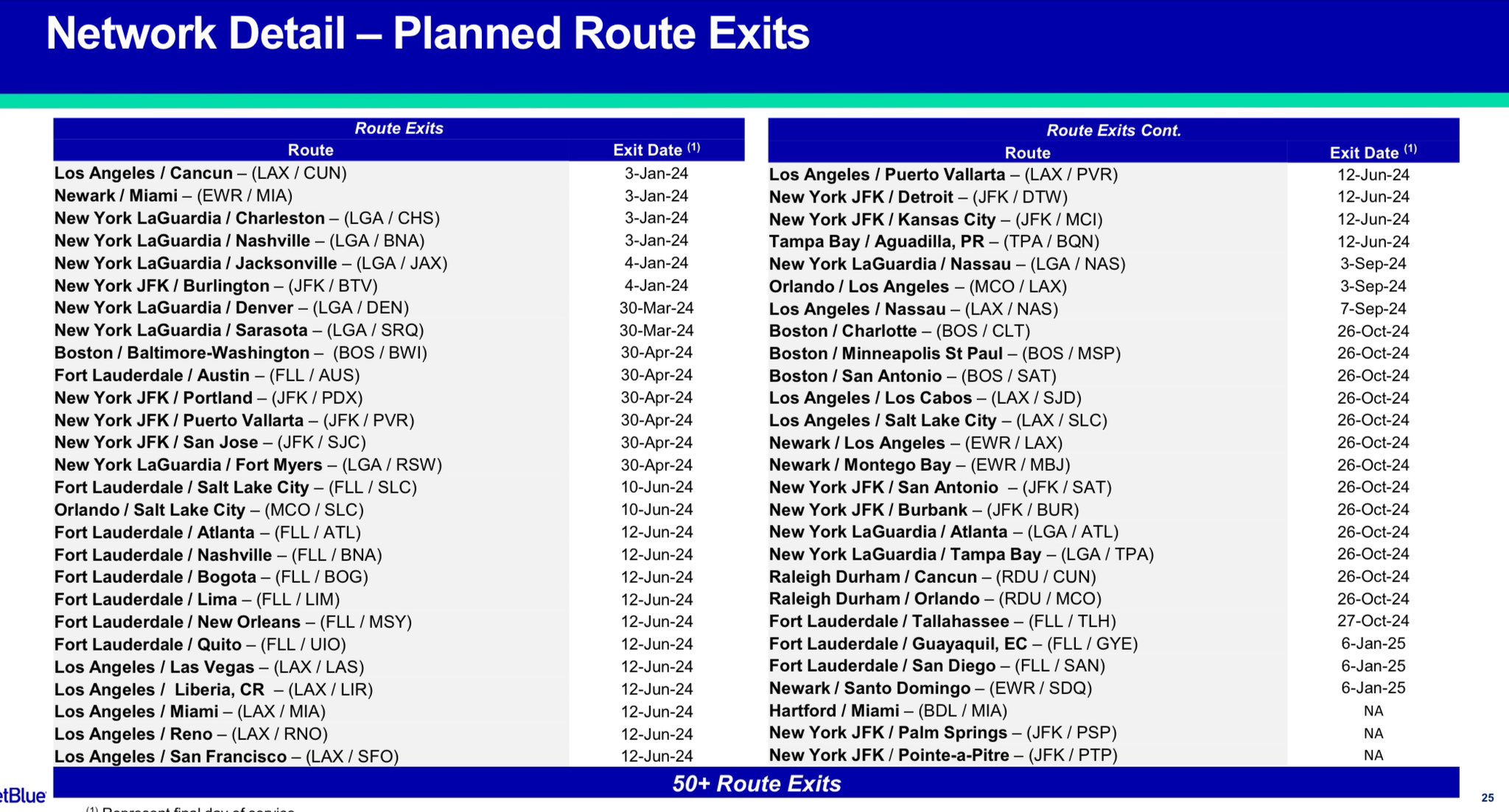

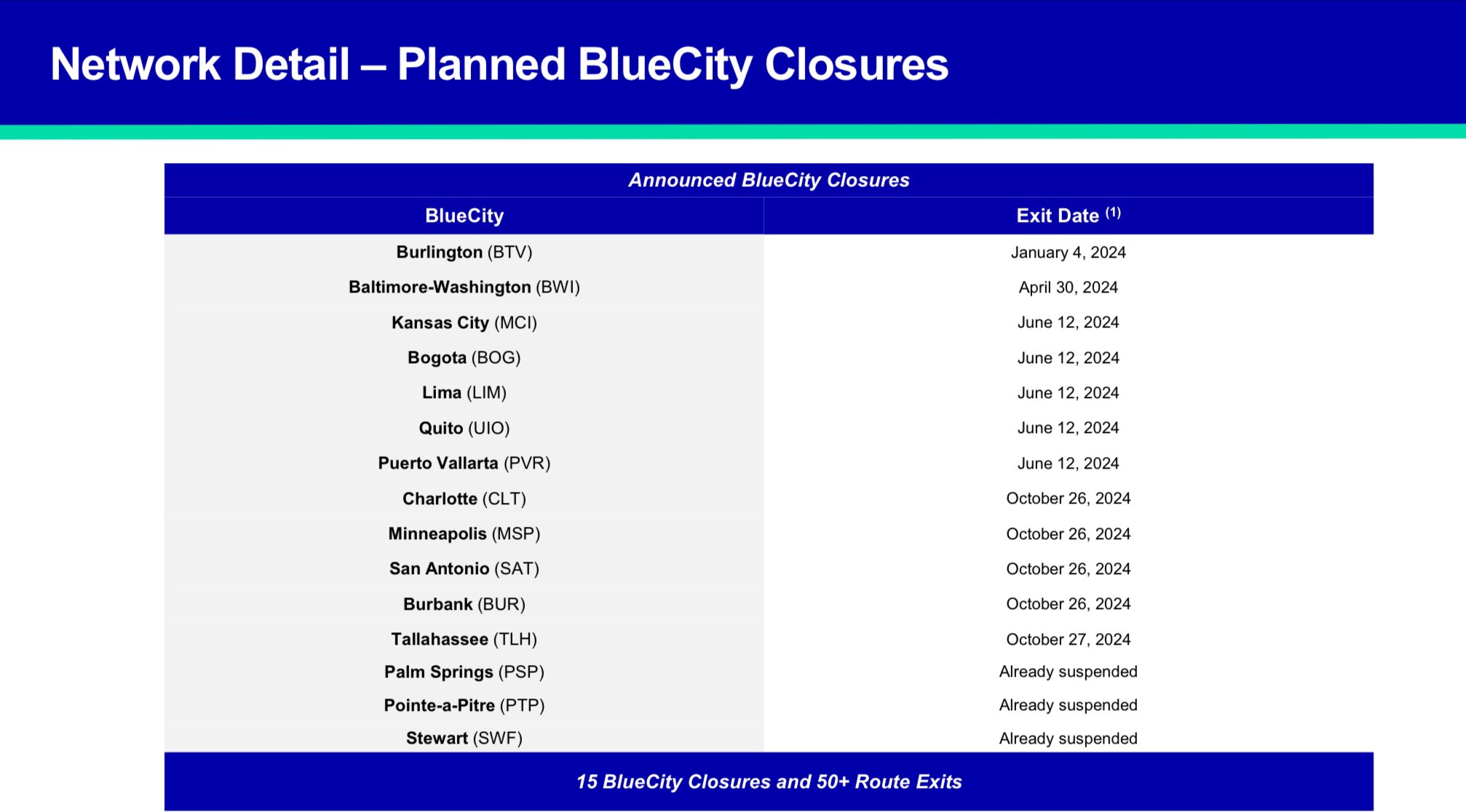

JetBlue has been trying to retool its business, which has underperformed for 15 years but finally cost its Chief Executive his job. Now they’ve been looking for revenue anywhere they can find it (such as continuing to lead the industry in checked bag fee increases) while dropping unprofitable routes out of places like Los Angeles and scaling back loss-making adventures in Europe.

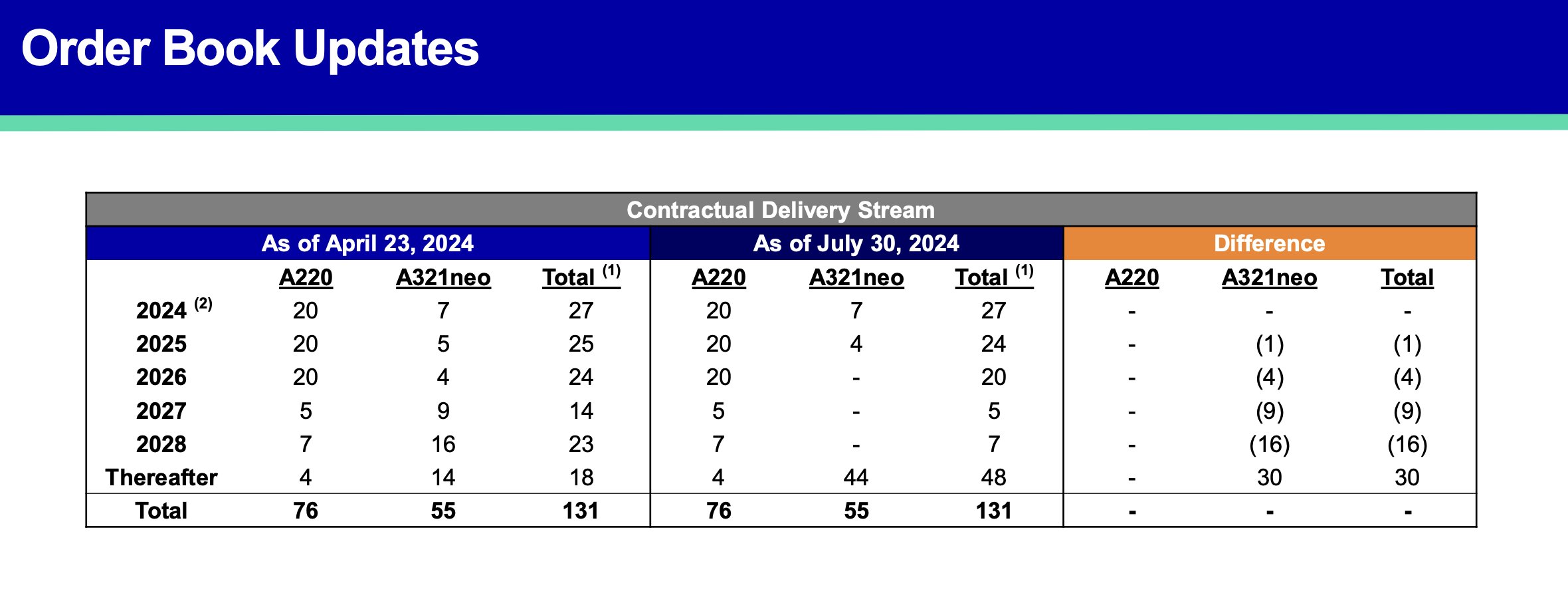

The big reveal was that they will be reducing plans to buy planes, deferring orders past 2030. And without new A321XLRs coming this decade that means a lot less Europe ahead than in earlier plans and a longer way to a fleet refresh.

JetBlue Is Scaling Back Aircraft Orders

While blaming their engine manufacturer, JetBlue is deferring delivery 44 Airbus narrowbodies – including 30 A321neos that would have come between 2025 and 2028.

They’re Scaling Back The Network Dramatically

JetBlue has dropped 50 routes, and announced elimination of service to 15 cities entirely.

What’s JetBlue’s Focus?

JetBlue says their focus is on the “core franchises” of leisure customers, visiting friends and relatives, and cross-country flying from New York, Boston and Florida – plus to Puerto Rico and the Caribbean.

While they wouldn’t describe themselves as “walking away from” corporate travel, they are no longer “designing the network for corporate” like they once tried to.

The strategy is called “JetForward” and involves a leisure network along the East Coast and “enhancing our existing product offerings” (“enhancement” in the airline industry is never good for customers).

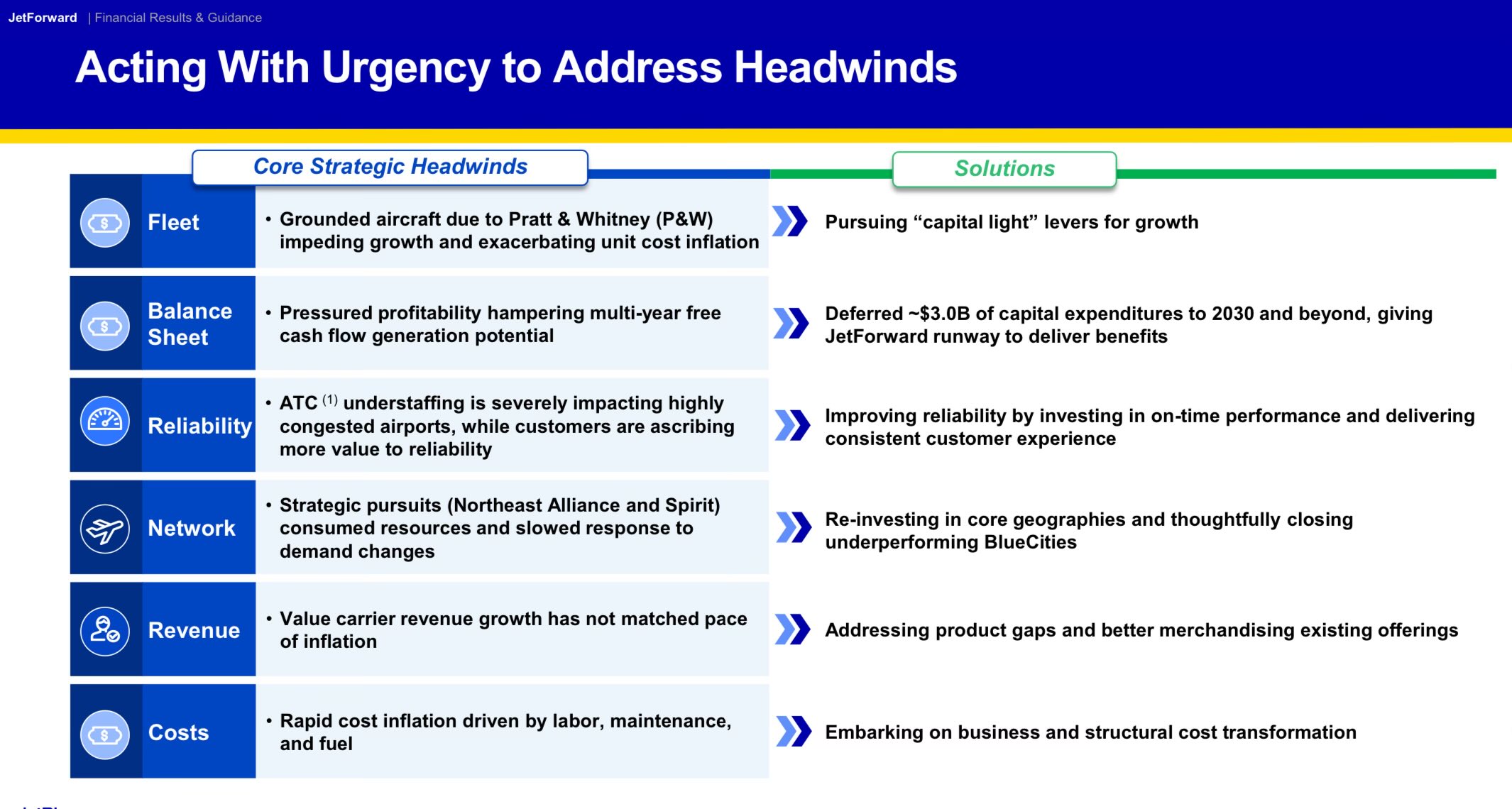

- They’re cutting capital spending and seat growth (which hopefully raises fares) by deferring $3 billion in aircraft.

- They blame their reliability issues on air traffic control, which is a very small part of the story, and say their solution is to… improve reliability. How? By investing in improved reliability.

- Their network cuts, they say, are because they were slow (distracted by partnerships and mergers) to adjust routes that were losing money.

- They’re going to add a domestic first class to sell in future years and “better merchandis[e..] existing offerings” which means more fees.

- And they’re going to lower costs through strategies to lower costs.

Government Anti-Trust Cases Backfired, Sacrificing Competition

The American Airlines partnership gave JetBlue a big opportunity to grow in New York. But they needed planes and pilots for that, so they did a deal to buy Spirit Airlines. I thought they were substantially overpaying, and they’d be better taking the cash and diversifying out of the low profit airline industry than sinking more cash into a merger. But it was a bold plan to scale.

Without that plan, JetBlue is flailing – and so is Spirit. The Department of Justice claimed they were preserving competition by preventing JetBlue and American from together being big enough to compete with Delta and United in New York. And they claimed they were preserving the low cost business model by keeping Spirit out of JetBlue’s hands.

Instead both JetBlue and Spirit are weaker than ever. JetBlue is shrinking and becoming more like a legacy airline, and Spirit is abandoning its low base fare brand in favor of bundled fares and first class. Those interventions in the name of anti-trust haven’t worked out well – and American Airlines is flailing in New York, too.

JetBlue needs to get back to what made them popular in the first place, if they want to be profitable again. They need to scrap plans to shrink coach for first class and make it the best economy class in the industry again. Free wifi and snacks, more spacious seating than competitors with IFE/live TV at every seat. Direct routes only from hubs, less “spoke” model the mainlines use. Keep it simple and stay in your lane, B6.

As an OPM flyer, its hard for me to choose JetBlue.

Ever since status is based on spend, I can inflate my spend by various methods like waiting to book etc (not my money anyway!) on any of the big 3 – and bonus, redeemable miles are also based on spend, so it pays to inflate spending when its not your money!

JetBlue is not shrinking… their fleet will continue to grow in the coming years even after mandatory returns and retirements. Reduction of growth is not shrinking.

I know this is really about JB and its turnaround effort. But in hindsight, its a crying shame that the guberment blocked the Jet Blue-Spirit merger. Both will now be downsizing and less competitive with the big boys than ever. If a recession happens soon, one or both could be entering bankrupctcy. If that happens and liquidation is the end result, then many a guberment regulator will have more than just egg on their faces.

The program has mostly sucked and their prices high and their footprint small where they fly

Added to that honey they shrunk the seats!

Like Virgin America they lost their cool factors of course for different reasons.

It used to be cool to fly Jet blue

Now why would you fly them?

There only hope was piggy back on American

Spending my own money or points, I will choose a JetBlue nonstop every time over United or a connection on Southwest. The in-flight coach experience is world class.

Funny, JetBlue has virtually no corporate travel demand to begin with so it is ironic they are not going to chase that segment any longer.

Dropping New York-Detroit sucks. I can’t imagine there are many people flying the surviving Detroit-Boston flight.

“And they announced they’re going to be spending a lot less on aircraft”

Okay, the PW issues on the neos is alarming. Half the neo fleet grounded until the refurbed engines show up. 3 -6 months grounded. I’ve not seen a business traveler on B6 out of MCI. B6 is realizing that they aren’t a biz airline unless in BOS JFK DCA. The Europe thing is a total ego play. There is no way B6 is making $$s doing it. Get 330s or just give it up.

So they’re going to be like Eastern Airlines without the widebodies

It is too bad their core franchise doesn’t include customers West of the Mississippi. I guess they have divided the USA with AS. You can’t be all things to all people.

That being the case, maybe time to cut the cord on my Barclays B6 card seeing as there are few routes left where I might use the perks.

I have had good experiences flying on JetBlue since 2016. I expect to be flying on JetBlue in October but the price will be a lot more than it was and the flights will be much longer. Hopefully they will rebuild their schedule to include the nonstop flight I used to fly again. I may be able to use mileage to cover the cost on this flight.

While Jet Blue (B6) says the partnerships consumed resources, an obvious low hanging fruit would be to codeshare with AA, which would be allowed. AA has a lot of West Coast and global flying out of NY, and AA needs bulk to compete with DL and UA in NY and BOS. B6 doesn’t have the bulk to compete to the Midwest and West, doesn’t have global any real global. While AA thinks it satisfies analysts and New Yorkers by saying they can “focus on originating traffic in NY,” that’s a pipe dream, as is AA’s double downing on trying to offer less for more and hoping it will work. Even DL and UA rely on connections to fill their flights out of NY. B6 has what AA needs, and AA has what B6 needs, and it’s impossible to get what they need any other way. Why they haven’t

Appears to me that B6 has decided to borrow a page or two from the Alaska Air playbook by attempting to gain relevance by, in essence, becoming “super-regional” with a network focused east of the Mississippi – particularly along the span of the eastern seaboard.

@FNTDiamond the BOS-DTW routes on JB are down to twice a day E190’s. That’s only 200pax a day and enough to keep Delta honest. This a a hub market for both so DTW based O&D isn’t the biggest factor in filling the seats. The Delta flights, and I’ve been on many this year, are running with less than 5 empty seats, so there’s still room for JB in the market

Flew for the first time on Jet Blue from Fort Lauderdale to Cancun. I was very impressed with the leg room and the video screen on the seat back. We departed on time and arrived slightly early both going and returning. I am an experienced business traveler and have flown all the major airlines. I will definitely be flying Jet Blue again!

@Sedward,

AA and JB had the Northeast Alliance and then they had to break it up due to antitrust threats when pursuing Spirit. It’s a pity because it definitely would help both airlines. I loved when I could get nonstop to Denver and get my miles and benefits from AA.