During Southwest Airlines Investor Day, they – like so many airlines – blamed Boeing extensively for their problems. Boeing has had myriad production problems, and hasn’t been able to deliver planes on time. And in Southwest’s case, they expected to have the Boeing 737 MAX 7 in their fleet today. That plane isn’t certified yet. So they’ve been flying larger aircraft to Hawaii, and between the Hawaiian islands, which means more seat capacity than they want.

But when Southwest blames Boeing for their being overstaffed, it’s a bit of a stretch. Southwest is pulling back on growth plans, just as other airlines are. Every airline says there’s too much capacity in the industry, though of course they prefer other airlines to fly less.

For Southwest it’s an especially tough sell when airline CFO Tammy Romo says explicitly that they have “too many planes” ordered for current (new, scaled back) growth plan.

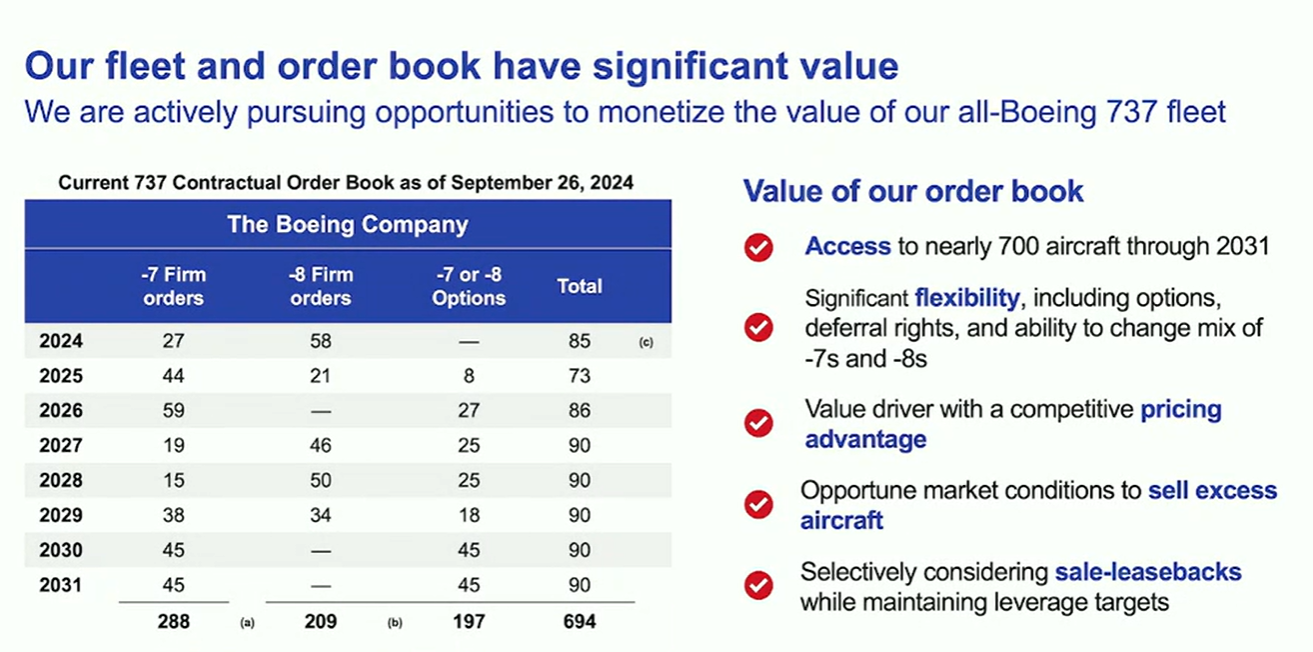

CEO Bob Jordan, in his opening remarks, says that they’ve achieved compensation from Boeing for its delays – delays that, ultimately, have been good for Southwest in many ways – through credits on future deliveries. And he wants to “unlock” that economic value.

Romo describes their plan for “excess aircraft we don’t need” as “pursuing direct sales of -800s” and also “sale/leasebacks” in order to reduce aircraft capital spending.

They’re not planning to sell their delivery slots. But when they take delivery of new planes, that’ll leave them with too many aircraft, so they will sell planes currently in their fleet. There’s not much of a market for Boeing 737-700s. They’re going to fly those longer than planned, in part because of the delayed MAX 7 program, and retrofit them with new seating arrangements. The larger -800s have a better market value.

Ultimately Southwest will fly less because they aren’t making much money on the seats they’re flying today. Their plan doesn’t even aspire to 10% operating margin until 2027, with all of the changes their making to their product. That’s because they haven’t just had the wrong product to grow, but also because their costs have risen.

@ Gary — Crappy used planes is usually right up DL’s alley. However, DL is so cheap they probably won’t want to have to spend anything redoing the interiors, so they will want them for next-to-free. Maybe an airline in a third-world country will take them. Like, half of the airlines in SkyTeam…

Sell the planes to United. They seem to aspire to be a bigger airline with more planes than Delta.

Delta may be happy to buy some of that older junk. After all, they seem content with a lot of their dated fleet.

Nothing like stepping onto a 717 where the 1990s come rushing back and the in-flight entertainment is the window seat…if you’re lucky.

I would image Boeing controls the capacity to sell production slots, not the airlines.

However, the airlines may sell the planes as they roll off the production line or do a sales-leaseback to minimize capital outlays.

However, in the Investors Day handout, the Southwest CFO bangs on about maintain their prized credit rating compared to the other airlines. The balance sheet would be bogged down with too many aircraft in a sales-leaseback situation.

I wouldn’t mind United getting those planes. They’re old, but they’re Boeing, so therefore better than the A319s and A320s they have, which are literally falling apart. Besides, any Boeing is better than any Airpus, because it’s American, and America is better than Europe. I’ve lived in both, so I can make a judgement on that.

Southwest’s days as an independent carrier are slowly coming to an end. Another wave of consolidation is coming for the industry, regardless of who wins the White House. NK, F9, WN, and B6 are all going to be in play.

As usual, social media is the last place to find the truth.

United has the oldest fleet among US airlines.

They committed to a massive Boeing fleet order – larger than Southwest’s – but can’t get airplanes any more than WN can.

As the article says, WN Is not selling its delivery positions. It is talking about selling aircraft in its fleet in order to generate cash.

This is all being pushed by Elliott that wants to get more money out of its LUV investment.

WN has long had one of the best balance sheets in the industry – and they just announced buying back stock to boost the share price even more (don’t even go there, Gary). Airline stocks are up heavily today for multiple reasons.

Delta is Airbus’ largest customer and one of, if not the only airline customer, not leasing company, for every family model in Airbus’ portfolio.

DL is getting its widebodies delivered on-time this year and managing its narrowbody fleet via delays – and getting compensation – often from Pratt and Whitney as a result.

WN will be a very changed airline. They won’t be growing as much but neither will UA be growing anywhere near as much as they thought they would grow either.

Crappy old planes? Ed Bastian will be calling if he’s not doing so already.

There never was any question about Southwest’s fleet plan. They were always going to phase out their -700’s and -800’s as their MAX 7’s and MAX 8’s came online. The only question was always how fast they would retire the older planes.

That they haven’t had to take their MAX 7’s and take on the added expense is a gift from God.

Southwest’s statements about their fleet is deliberately fuzzy because the message they are sending is to the investors (remember this is what this event is all about). They want to reassure them that they have a plan for all phases of their operations and that capital expenditures are under control.

Replacing a -700 with a MAX 7 makes no meaningful difference in system capacity.

The other issue is the deafening silence about Denver. Like in Atlanta, Southwest is a distant #2 with no prospect of changing that. The immediate changes surrounding ATL are that flight from discontinued cities are simply being redirected towards places where Southwest dominates-Jacksonville/Jackson-Nashville instead of Jacksonville/Jackson-Atlanta.

There has to be more to come because getting rid of 8 or so gates in Atlanta will impact more than just what they’ve said so far.

WN Is not a distant number 2 in the DEN local market. UA has long pushed far more connecting trafffic through DEN than any other and THAT is why they have so many more flights. WN carried the largest number of local DEN passengers for more than a decade – which was a huge shame for UA.

UA has grown faster than WN in the past few months and retook the #1 position in the DEN local market but DEN Is not a weak point for WN.

There are other markets that will be cut by WN but DEN is not likely to be very high on that list – if at all.

Tim, you’ve said before that UA has the oldest fleet. Curious how much the gap has narrowed over the last few years, since UA has taken delivery of approximately 250 new planes while retiring close to 50 30-ish year old planes.

I’m sure the gap has narrowed but I don’t know by how much.

all of the major airlines report their fleet age in their annual reports and use 12/31 as the date because all US airlines end their fiscal year on 12/31.

Between those reports there are several sources.

airfleets shows that UA’s average mainline fleet age is 16.2, DL’s is 15.2, WN is 11.7, and AA’s is 13.4

AA purchased a lot of planes over the last decade and are slowing their fleet spending so their fleet will age faster than DL and UA.

DL bought about 250 aircraft over the past 10 years and is now retiring (at least this year) about half of the number of aircraft they are taking delivery of… I think they will take delivery of about 45 planes and retire 20-25.

UA’s position of having the oldest fleet means they simply cannot keep holding onto older aircraft or their maintenance expenses – including for overhauls – will get higher and higher.

As much as some people want to believe otherwise, UA will be growing at a faster rate.

It is notable that DL is spending proportionately more on widebody aircraft so are getting better efficiency gains than UA which is more focused on domestic growth; new generation widebodies are 20-25 more efficient per seat than their previous generation. Domestic narrowbody aircraft are about half of that level of efficiency.

Fleet age ultimately doesn’t matter; the cost to operate an aircraft does. UA will grow but at a much slower pace. Boeing can’t deliver the aircraft it promised to UA or anyone else while Airbus is sold out.

Perhaps WN’s decisions will put a few more 737s on the market over the next few years but there are airlines around the world that are looking for airplanes; it makes far more sense for small carriers to pick up a few airplanes here and there than for one of the big 3 US airlines which will spend a lot of money to create uniformity – or they will have a very complex fleet.

Air Canada is the airline always looking to buy junk.

Also they have NO common planes they buy anything from anyone and have the worst on time performance in NA.

Ok why are we not talking about the jokers at Boeing who reject a 25% raise and want a 40% raise! These are the stooges that cannot rivit in a straight line. They, not management, have been making inferior products for at least a decade and they want a raise?!? They should get 50% paycuts until they make excellent products again!

Seems like all you do is write shitty hit pieces on Southwest. You said they’d close a couple bases too…. I think you just like writing over sensationalized BS to generate clicks.

The only three words in Elliott’s investor presentation that mattered were “unlevered balance sheet.” Southwest will end up at the end of this with no assets and a lot of debt, and then Elliott will be out of the picture. They will have gotten the buybacks and/or special dividends they wanted, and US taxpayers will be on the hook for future bailouts. This is the way of American business, but we are all the poorer for it.