Spirit Airlines is in talks with bondholders about a pre-packaged bankruptcy that would allow the airline to reduce debt in exchange for equity. This move would potentially allow the carrier to reject leases on aircraft grounded due to engine problems. Twenty one Airbus narrowbodies are currently in storage (or heavy maintenance) out of 94 with Pratt & Whitney Geared Turbo Fan engines, according to Cirium fleet tracking data.

Out of $3.3 billion in debt, one third of that comes due in under a year, and it must refinance or extend the debt by October 21 under covenants with its credit card processor agreement.

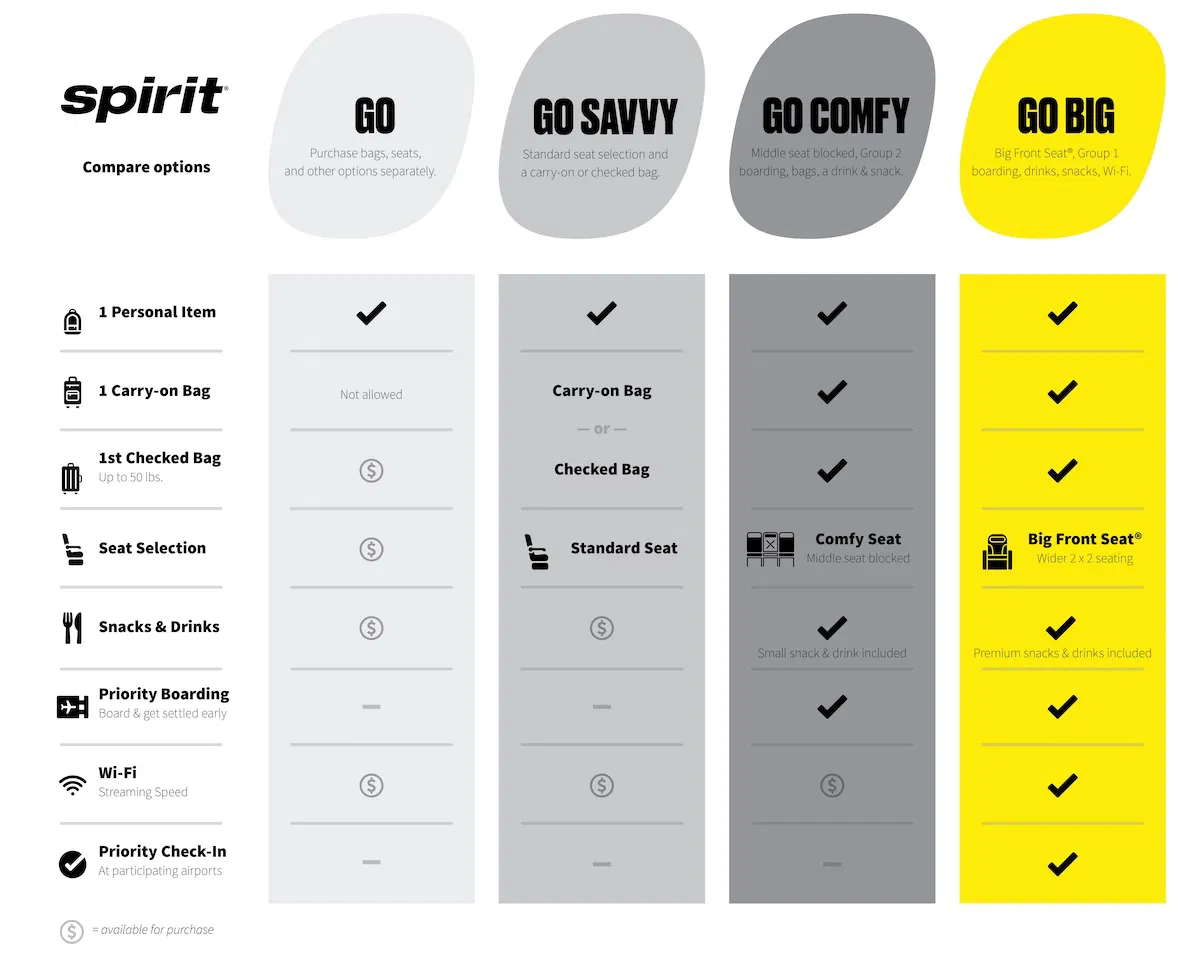

Once among the most successful airlines in the industry, Spirit hasn’t turned a profit in five years. They’ve recently announced a move to sell bundled fares, a drastic shift away from its fee-based a la carte merchandising model.

And this past weekend they pulled more than 30 routes from their schedule. In total, Spirit Airlines capacity is contracting 20%.

The latest Diio update had the following adds (Green), and removals (Red) of domestic routes by major carriers this week. pic.twitter.com/Tl6QBukKRf

— AdrianWaltz (@AdrianWaltz) September 28, 2024

Spirit is one of many victims of misguided Department of Justice and DOT competition policy.

- JetBlue is struggling, cutting costs, and shrinking – and finds itself under the thumb of Carl Icahn – because the federal government blocked its partnership with American Airlines – increasing the market power of United and Delta in New York and Delta in Boston.

- The low-fare, fee-based segment is being dealt a blow by Spirit Airlines weakness after JetBlue’s acquisition of Spirit was blocked by DOJ.

- And now flying between the Hawaiian islands could see less competition because DOT imposed conditions on the Alaska Airlines acquisition, requiring maintenance of that airline’s inter-island flying, and making it harder for Southwest Airlines to maintain its service.

According to aviation analytics company Cirium, Spirit has been operationally reliable cancelling just 0.71% of flights so far in 2024 which is second in the industry behind only Southwest and has operated approximately three quarters of its flights on-time. This represented a huge turnaround from the era that ended about 8 years ago when their ultra-low cost model meant giving short-shrift to operations.

The carrier represents about 5% of U.S. airline capacity and is the only airline serving Latrobe, Pennsylvania, and Atlantic City, New Jersey. Spirit’s average fare in June and July was $68 one-way, excluding taxes and fees, compared to an average of over $200 for American, Delta, United and Southwest.

Yikes! Shareholders will probably be wiped out. Too bad I didn’t buy any stock option puts on SAVE..would’ve made a fortune.

I still believe there is too much overcapacity right now. We’ll see.

Another ideological victory for the Biden/Harris Administration which is a loss for the American people and the US economy. Central economic planning by technocrats ends in disaster almost every time, and the result will be no different here.

Spirit has been running as a charity for the last five years. The engine problem really hurt them. I’m not sure if there will really be a big ULCC market when the Big-3 invented and use Basic Economy as a competitive weapon in whatever volume they want. The end of the Spirit story will be government intervention harming consumers.

@ Gary — Good to see them joining the handout line with Delta, et al.

At this point surely it’s better to just fold and rebrand, they have a better chance of attracting “better” customers.

Spirit would need to creditors to take a haircut and swap debt for equity. They would also need pilots and flight attendants to take wage concessions which would put them well below other airlines. The Chapter 11 would be messy.

Seems as though the ULCC business model can’t withstand the test of time.

The bleeding always stops. One way or another.

JetBlue’s stock is up 16% today on the news. American’s is up 6%. United up 5%. Delta up 3%.

This is great news for the borderline-LCC competition, who may see bonafide LCCs go the way of the dodo.

@ Tim — Yeah, just stick out your hand for some more free money, like Delta!

Once the ULCCs fail or have to have their businesses restructured so that they are no longer ULCCs, the lowest fares of all of the other carriers will increase, maybe significantly. If Spirit was to go bankrupt, would the government allow JetBlue to buy it’s assets or would the government let a much larger company buy them for more while creating even greater monopolization in the market?

Another great DOJ success story! Jobs saved! Money saved! More competition!

Oh, wait….

Bankruptcy created by government blocking merger. This will benefit the same airline that tried to buy them without having to spend any money. Government did another great job.

@ Bob — Yeah, governement incompetency at its finest. I never undertood what they were thinking on this one. Hopefully at least one of these smaler players (B6??) comes out stronger on the other end.

The whole DOJ/Judge Young saga smelled extremely fishy. Now even more so after Alaska has been allowed a second acquisition with far more problematic market concentration without any divestitures or concessions. The DOJ’s idea of antitrust enforcement sure seems to benefit some airlines more than others. Consumers, JetBlue and especially Spirit employees got mugged for what appears to be very corrupt and political reasons. Absolutely outrageous that DOJ antitrust is being used to assassinate small airlines trying to survive in an oligopoly market while falsely claiming to be acting in the interest of the consumer.

Don’t blame their issues on the failed jetBlue acquisition. That would have NEVER worked and 100% guaranteed bankruptcy from the ‘new’ jetBlue after eliminating Spirit. No way could taking on all of that debt plus all of that expense of gutting all planes. The ONLY way that combination could ever work would have been for them to file bankruptcy. At that point, all of the promises made would be gone (like CEO promises pre-merger actually EVER hold true anyway…).

Spirit was the reason the Jet Blue and American northeast alliance was overturned. They complained and made an argument to stop it regarding competition but then couldn’t stand up under their own argument. Blame the DOJ all you want but Soirit dug their own grave.

If you measure success using the only correct metric, return on investment, Spirit has never truly been successful.

There was a period when their profit margins were high, but their revenue relative to capital investment was so low that they never returned any significant amounts as a percentage of investment.

To illustrate with hypothetical numbers: Delta might take $100 of investor capital and generate $50 in annual revenue with a premium product, earning a “thin” margin of 10% and returning $5 to investors. In contrast, Spirit might take the same $100 but generate only $20 in revenue with a low fare product. But even with a doubled margin of 20%, they would return just $4 to investors, who are worse off (they make more money with Delta’s thin margins).

Only people ignorant of finance (like this blogger) would say that Spirit was ever a good business model (“look at those fat margins!”)

Thankfully the government stopped the merger, otherwise Spirit would have taken down jetBlue’s investors with it, especially given how much new debt would have been taken on to close that deal.

The only viable merger would have been the one between Spirit and Frontier – compatible business models and complementary networks. But the Spirit shareholders got greedy, and overruled management in favor of the very obviously stillborn JetBlue offer.

Now those shareholders are paying their well-deserved price.

And as others have stated above – with the introduction of Basic Economy by the network carriers, there really are few remaining reasons to fly a ULCC. For the same fare on a network carrier, you get the same transportation from A to B, *plus* the routing redundancies of the network carrier during irrops, meaningful mileage earnings, etc.

I was hoping that the merger would be approved. Why? Because I hate Spirit and especially JetBlue. It would have been wonderful to see them go broke and declare Chapter 7. Guess it’ll be done separately, and hopefully Breeze goes down with them.

Low cost cattle class airlines need to go away. It has been a race to the bottom on the service front.

Spirit will be stuck with older jets which will require more maintenance, inspections, and down time. Not the best business plan.

An opportunity to pick up NEO airframes on the cheap. DL, UA, F9, B6, & AA take note!!

Why all the hate for Spirit, Frontier and JetBlue? Their continued existence holds down prices at AA, DL, UA, AS, WN. Even without flying them, they benefit customers at other airlines.