Elliott Management took roughly an 11% stake in Southwest Airlines and called for a special shareholders meeting on December 10th to elect their own slate of directors, putting the ex-CEO of Air Canada in charge as Chairman and firing the CEO.

Already in response to the activist investor, Southwest has made the biggest changes in its history along the lines of what Elliott has asked for.

- assigned seats

- extra legroom premium seating

- redeye flights

- route cuts

- partnerships with other airlines

- selling planes

Yet Elliott is unsatisfied. True, they haven’t done everything or as quickly as Elliott has demanded. They aren’t doing basic economy or checked bag fees, for instance, and their premium seating is just extra legroom. But the more Southwest does in response to Elliott’s demands, the more aggressive Elliott has become. I learned this in first-year poli sci as “Munich Syndrome” (appeasement increases aggression).

More likely, though, it simply points to Elliott’s demands never really being Elliott’s demands. They had a good case that the airline was complacent and slow-moving. But they didn’t have actual solutions for the business model, because the basic problem with Southwest Airlines is that they’ve outgrown their model. They were the most consistently profitable airline for decades – racking up 47 straight years of profits, even through 9/11 and the Great Recession – with a simple formula. They had low costs, a single fleet type, and simple customer-friendly policies.

They just can’t keep growing without changes, and won’t return to their historic lower costs. They need to abandon simplicity for growth, but that complexity will mean greater costs too. And that means Southwest is unlikely to be Southwest again, though they still have advantages – primarily that they are still a differentiated product in the market, and with employees who largely don’t hate their jobs and that difference shows against American Airlines and United.

Elliott packaged together some basic ideas which amount to “copy the things other [underperforming] airlines do that Southwest doesn’t” because they needed to say they were for something even if those things aren’t likely to make a difference.

Basically, Elliott is pitching Bud Fox’s 3-point plan for turning around Bluestar Airlines in Wall Street (1987):

One: we modernise. Our computer software is dogshit. We update it. We squeeze every dollar out of each mile flown. Don’t sell a seat to a guy for 79 bucks when he’s willing to pay 379. Effective inventory management will increase our load factor by 5-20%. That translates to approximately $50-200 million in revenues. The point being, we can beat the majors at a price war.

Two: advertising. More, and aggressive. We attack the majors.

Three: expansion. We expand our hubs to Atlanta, North Carolina and St Louis. And we reorganise all of our feeder schedules.

We gotta think big, guys. We’re going after the majors.

Elliott says they want to squeeze more revenue out of each passenger, and reorganize Southwest’s schedules, just like Bud Fox – whose prior experience in the airline industry was as a ramper – proposed in the film.

Of course, Charlie Sheen was never going to be the real President of Bluestar. He would simply oversee the dismantling of its assets. The company had a desirable balance sheet where the underlying pieces were more valuable than the carrier itself.

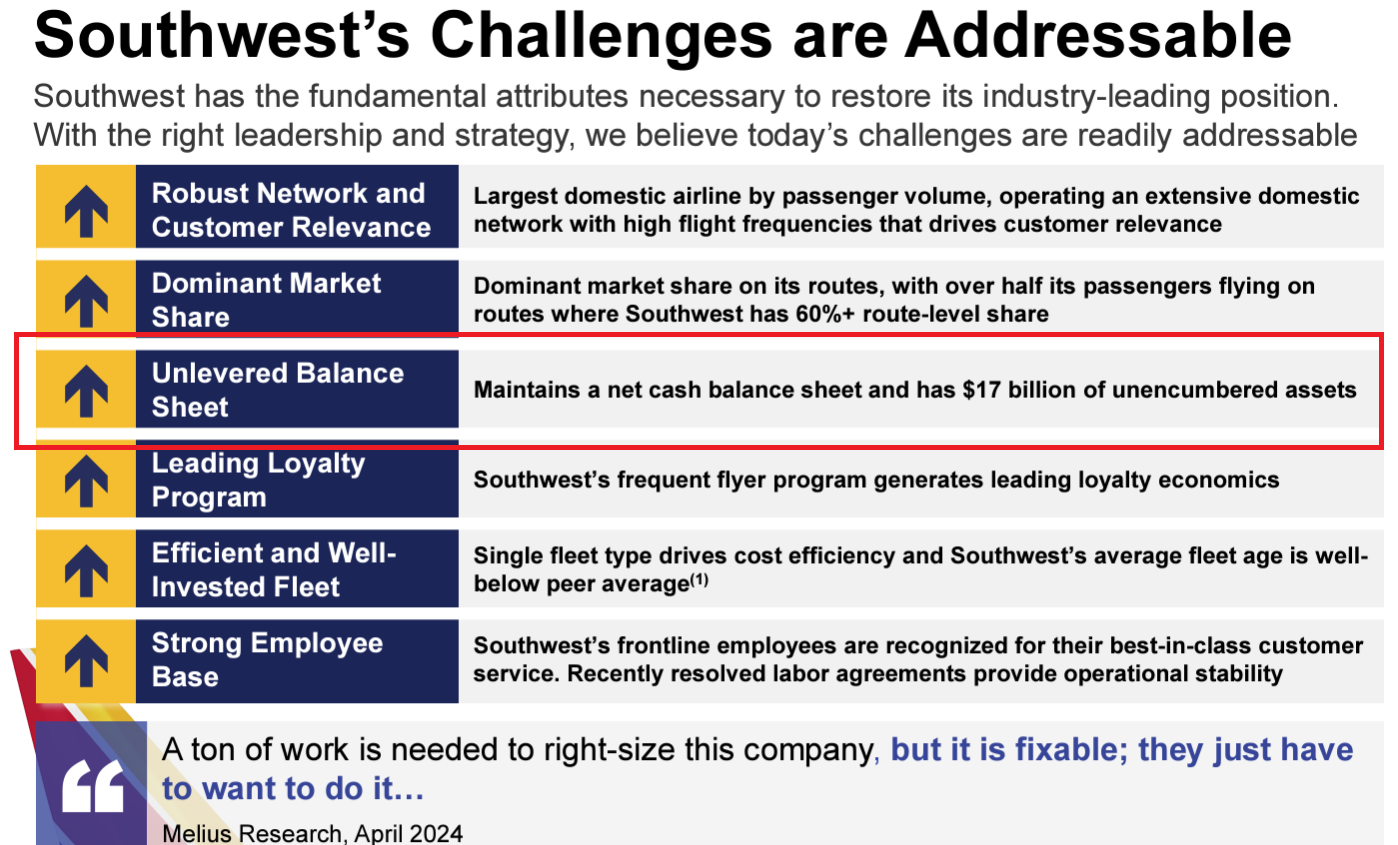

Gordon Gekko controlled 12% of Bluestar stock. Elliott has 11%. And Elliott has told us what it finds attractive about Southwest. Let’s first look at the item I’ve highlighted in their summer presentation: “unlevered balance sheet.”

Here’s a company that can load up with debt. That can fund share buy backs. And not just that, under pressure from Elliott Southwest is already planning to sell planes. In the film, the plan to finance the Bluestar deal was “liquidating the hangars and the planes.”

But that’s not all. Elliott loves the frequent flyer program. United, Delta and American have raised $6.5 to $10 billion each against the future income streams of their loyalty programs, while Southwest simply pre-sold miles in large quantity at a discount to Chase to generate cash during the pandemic. Southwest’s Rapid Rewards program isn’t nearly as levered. (Even Spirit was able to generate a billion in cash from mortgaging its loyalty program and the market is still ripe, as Alaska is raising $1.5 billion against Mileage Plan.)

Everyone is taking Elliott seriously, noting correctly that the airline has underperformed and failed to maximize its assets, and suggesting that current management doesn’t deserve to stay and execute on its own turnaround plan – without every questioning the seriousness or sincerity of Elliott’s own plan. But all you have to do is watch a famous old movie to get up to speed quickly.

While my general view was that Elliott wouldn’t have called for the special meeting if they didn’t think they would win, they are reportedly in negotiations for board representation but not total control. So perhaps they are uncertain. We’ll see what they have to get – whether it’s Bob Jordan’s departure, or guarantees of more borrowing to fund buy backs – in order to call off majority board representation to flush who whole company.

It’s what I feared. Bye, WN.

Let me understand this correctly:

Elliott who has no real understanding of the airline industry is charging in to takeover WN with drastic charges to the entire operation.

Sure, times have changed and companies need to adapt to modern times. Southwest has its history of making a profit year over year but now things have changed.

The historic Holiday Meltdown of 2022 was a historic disaster for SW which just points out that the computer system is a dinosaur system.

I am a stock holder and am worried about the future of Southwest Airlines!

Companion Pass is next on the chopping block I bet, though it’s pretty much the only thing distinguishing them. Or they’ll at least probably require BIS for some of it and not a couple hundred bucks in CC signup per two years.

I remember touting the CP back in 2006 or so and everyone at FT laughed at me. NOBODY was getting it. Now there is a Facebook group for it with about 70k members and growing madly. And every single one of them knows the trick: get 2 CCs now, a CP in January for two years, grab ~165K redeemable points worth a couple thousand bucks, never spend a dime after the SUB, drop the CCs after one year, and repeat. I’d love to look at the financials on that.

People at United and American don’t “hate their jobs”… that’s about as false as you can get. Typical misinformation to obtain views and status!

Maybe the way to get rid of Elliot is to declare a large dividend that puts most of the cash in investors hands and out of the reach of Elliot. This will make what is left look less attractive.

I get the feeling Gary wrote this before finding out Elliott was having negotiations and essentially is planning his exit since he isn’t going to win control.

Southwest does have to fix its technology issues and control the costs. Their fares are already high compared to competitors but people still use them due to free bags, loyalty and the companion pass.

They also have to provide better service on longer flights. One round of drinks on a 4+ hr flight doesn’t cut it. The FAs are getting good pay now, time to earn it. Doing goofy jokes and handing out a couple of bags of chips isn’t sufficient.

bye bye WN

“I learned this in first-year poli sci as “Munich Syndrome” (appeasement increases aggression).”

And yet Obama, Biden and Harris still haven’t learned that lesson. Their billions sent to Iran as appeasement are being used to fund attacks on Israeli civilians, which we are in turn paying billions to defend. Nice job, Obama/Biden.

Harris ran an airline?

Tbh anyone at AA who doesnt hate their job probably should

Non-mentioned in any of these discussions: SW has adopted a ‘poison pill.” If a shareholder buys more than x% of its stock, if the Board pulls the trigger every current shareholder, except Elliott, will have the right to buy a new issue of shares at a hefty discount. That dilutes the bidder’s interest below x%, , and the cost of the takeover rises to impossible. With that option available to SW, Elliott has to move very carefully, not make the Board mad, negotiate with the Board to persuade it not to active the Pill. Almost inevitable, nasty lawsuits from both sides, SW has time to turn things around. Importantly, it’s not facing any hard-deadlines from lenders, Unions, Boeing; it can also pay Elliott to go away. Greenmail. Even nastier, a “Flip-Over”: it gives SW shareholders the right to buy Elliott’s stock at a huge discount if it’s successful in acquiring control of SW.

WN seems desperate …. It’s a very sad look and situation for them. I smell furloughs and çonsessions coming [and soon] for their work groups. Herb K. is rolling over in his grave that is for certain.

The poison pill was always the ultimate threat that Herb himself held close to his chest. He always said He’d never be bullied by Wall Street on how to Run Southwest Airlines .He also said he’d Run Southwest into the ground before he let some Wall Street investors try and take the lucrative assets from the Employees of Southwest. Gary Kelly knew that and Bob Jordan Knows that. The evolution of The Southwest seating structure was being evaluated and studied well before Covid happened. This switch has been a long time coming for Southwest.

In some respects WN can actually thank Elliot to a degree because an organic Transformation would have pissed off more open seating Southwest loyalist. But with Elliot’s public bashing and threatening proxy fight gave Southwest the opportunity to finally pull the trigger on the inevitable switch. Now Southwest can truly evolve and fix all the shortcomings that plague their operations for over the last decade. I’m talking about FAKE Pre Boarding scammers who have diluted the Business Select and Early Bird products to unprofitable levels.

Now WN can clean house fix the problems All the while Being able to Blame Elliot . Spin they were ultimately forced to change shifting open seating loyalist anger and to Hate Elliot and not towards Southwest.

This proxy fight has made Southwest the underdog maverick again up against the Big Bad Evil Wall Street.

Southwest isn’t a fictional BlueStar Airline it’s scrappy Texas airline at it core and if Elliott wants a Fight the Employees still have that Red Belly War Bird mentality so It’s a Fight they will definitely get. Like Herb Most Employees would rather BURN down the entire company down VS letting Elliot rap and pillage the company that they all LUV.

Any scenario of a Hostile takeover situation that Elliot has them ousting the Management of Southwest with them injecting their own outside players to Run the company will fold like a house of cards and all these lucrative assets will lose value quickly when everyone revolts stock price will be devalued so much LUV trading will be Halted. Elliot will be remembers and studied as the investment group known for ruining the moment successful airlines in Aviation History for the next few decades.

Elliot needs to be smarter about this approach. I listen to the podcast with the Guy from WestJet . Working with Bob Jordan maybe the next best solution for Elliot. They collectively should envision a better Solution like a more worldly growth strategy and sign on with Boeing to Launching the 797 within the next 5 years and take WN to even bigger heights.

#IT’SOURSOUTHWEST

Elliott is a perfect poster child for the unbridled greed that is what’s wrong with America. Rich assholes screwing everyone else over just to become even more rich is wrong.

Very good analysis!

But there’s only one thing they’re interested – making money in a short amount of time.

They can either do that by finding a buyer right now or levering up the company, distributing dividends to themselves, and selling the stock (“exit”) as a sick carcass for someone else to fix. The rest is complete smoke and mirrors (lies) to get their people elected. They have zero willingness (or capabilities) to fix a business, especially one in a notoriously cyclical industry so late in the business cycle.

You should have a separate blog for this stuff so that you’re taken seriously and not as the joke who writes the Enquirer of travel covering junk (“Delta First Class Passenger Grinds Snacks Into The Floor, Steals AirPods From Seatmate”) for clicks.

Agree that Companion Pass is gone. At least for those who earn it solely from the credit card Companion Pass is a function of them not being able to offer frequent flyers anything above and beyond. They have no extra legroom, no first class, nothing. Bags are already free. Early boarding isn’t enough. Once they have extra legroom, that’s the perk you get for flying them all the time. And maybe a one time BOGO coupon for the year.

The AC President will ensure they fly to Canada. That is another technology limitation they have which is easily fixed with some technology investment.

Elliott is exactly what main street doesnt like about wall street.

Its sad that Elliott is willing to destroy a company for enrichment of themselves and screwing over hundred of thousands of employees and shareholders work over the companys history…..

Elliott should be shamed in the media for thier unethical behavior…..

Thanks for this, Gary. Beat me to it, but your blog actually has readers so I really don’t mind. 🙂

Maybe Herb did not like the fact that Gary pushed him out. Gary is the major reason for Southwest failures. Bob is another 30 plus year employee who is behind the times. The systems at Southwest are so outdated down to basic items needed to run a day to day operation. Staffing levels are a joke company wide unless you are in HQ, which is entirely overstaffed. This company needs an overhaul and needs to cut the fat. The top management never talks to the frontline employees while passing out raises to each other. Southwest has a long ride in front of them and with the current leadership not many have faith in the company leadership.Southwest is at fault for ruining its legacy, the leadership has no to blame but itself and Gary and its Board of Directors

Typical. Go into deep debt to fund stock buybacks that won’t provide value long term. Although the pump and dumb crowd will do well.

@Ralph I know 2 pilots who worked their career at US Airways then AA. They did well for themselves and provided for their family. Working for one of the US big 4 airlines today is a relatively secure (and if a pilot or manager), well paying job with great bennifits. If you worked at Spirit, I would be concerned.

“Maybe Herb did not like the fact that Gary pushed him out.” That’s funny! You don’t know the history of SW: James Parker, from the SW Legal Dept, succeeded Herb in 2001 as Chief Executive Officer, made a mess of things till 2004, including getting Unions mad at him. He WAS pushed out, Gary was named CEO to replace him, got things settled down. From 2001 the President and Chief Operating Officer, and finally just President of SW from 2001 to July 2008, was Colleen Barrett, who was Herb’s legal secretary before SW was an idea. And who became the highest-ranking woman in US aviation. So much for PhDs and MBA’s, Colleen had a 2-year degree from a secretarial college in Vermont. She ran SW for six of its most profitable years. Little known: Colleen never learned to drive. Afternoons she’d stand around in the SW Parking Lot at Love Field till somebody recognized her and gave her a lift home. Also a great way to hear what co-workers were really thinking!

The funny thing is that unless you can get a Wanna Get Away fare, the rest of them are always more expensive than the competition. So I don’t get how they get called a low cost airline.

Elliott ought to just go away or else be made to go away.