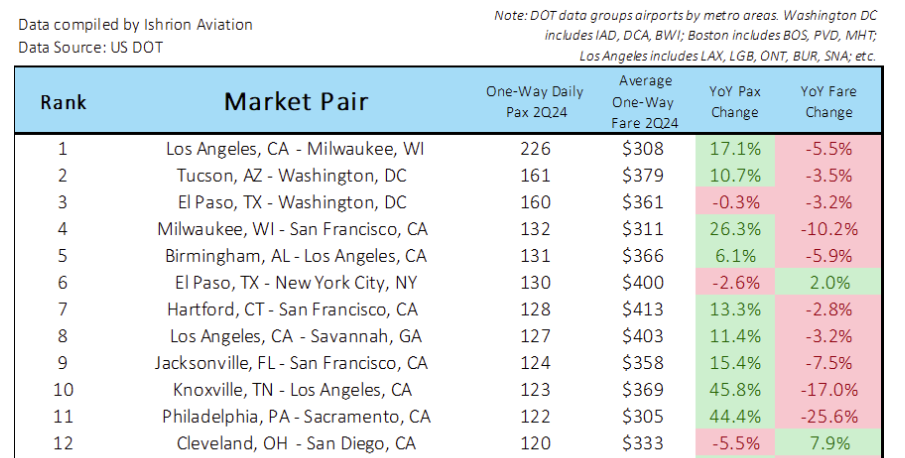

Ishrion Aviation went through Department of Transportation data to find the 100 markets (city pairs) with the most passengers per day that don’t currently offer non-stop flights, and also looked at the fares people are currently paying to connect between these cities.

*Top 100* Unserved Markets in the Contiguous United States:

Expanded my list to 100 unserved city pairs based on new DOT data using daily one-way passengers, fares, and passenger/fare change.

Full details: https://t.co/bH7HqLOuNG pic.twitter.com/7YPMOGStLg

— Ishrion Aviation (@IshrionA) October 23, 2024

This Data Doesn’t Tell You How Many People Would Take A New Non-Stop Flight

Looking at the current number of passengers per day between two cities isn’t enough to tell you whether a route can work.

- Not every market needs to be daily, so having too few passengers on average per day to fill a flight doesn’t mean a route cannot work.

- Not everyone wants to fly at the same time so having one flight won’t necessarily pick up all of the passengers trying to fly between a given city pair (there are also corporate contracts, frequent flyer programs, and other consumer preference considerations that might stand in the way).

- Adding a non-stop flight can be stimulative – people would travel if they could get there more quickly (lower cost in time to make the journey). A day trip might make sense when there are non-stop flights but not when it requires connections. People might travel more often, or might substitute in-person instead of zoom.

- Markets like DC (Washington’s Dulles, National and Baltimore) are combined. People might not travel from Baltimore to Dulles to pick up a new non-stop. Geography of combined regions like this matter.

Los Angeles to Milwaukee used to be served by Southwest and also by Spirit. Maybe it would work now, but it didn’t work well enough for two airlines to maintain.

Even being number one on this list is not a guarantee of success. In fact, my basic model is that airlines not flying a given route is usually for a reason. Even when they offer service, that new service may not succeed.

United used to fly San Francisco – Milwaukee and JetBlue used to fly Hartford – San Francisco. Breeze San Francisco – Charleston – that’s a long way to fly (and so expensive to offer) for a thin market.

Still, airlines are very much on top of these. Alaska is going to fly New Orleans – Portland and Boise – Orlando, for instance, and Southwest has started Sacramento – Kansas City; Albany and Rochester – Las Vegas; Austin – Milwaukee; and Birmingham – Phoenix. Delta is launching Boston – Pensacola.

View of the Las Vegas Strip

Challenges Route Planners Overcome Projecting Whether A New Route Will Work

Route planning teams often have something like their top 100 markets on a board, constantly keeping an eye on opportunities to launch service, and staying updated on airport conditions and competitive moves.

They do this internationally, too. I’ve long been surprised that no one has re-entered the New York JFK – Budapest market, for instance.

Delta and American have tried it seasonally in the past, with American picking up where Delta left off but neither making it work. oneworld member Malev Hungarian went bankrupt in 2012. At one point LOT Polish tried it. I’m not aware of any regular non-stop service since then.

Knowing how many people fly today between two cities isn’t enough. The lack of passengers may just be because the route isn’t served.

When Spirit Airlines was controlled by Bill Franke, they had something of a seat of your pants way to find new routes that other airlines weren’t flying. Former CEO Ben Baldanza shared that they evaluated the potential of flying Fort Lauderdale to Armenia, Colombia – a place that hadn’t ever had service from a U.S. airline – they couldn’t really look at existing air travel between the two cities.

Instead they looked at telephone data and remittance data to get a sense for ties between the U.S. and the Latin American city. They wanted to know how frequently people were calling, and how much money and how often was being sent overseas. It was enough that they guessed there was an air travel market there. El Edén International Airport only has service to Bogota, Medellín, Panama City and… Spirit’s service to Fort Lauderdale.

Another Franke airline, Volaris, has sent people to bus terminals to count passengers traveling on a route.

What Makes A New Route Profitable?

A route doesn’t just need to fill up, it needs to be the best use of an aircraft. For instance, West Coast – Upstate New York or New York – Fresno might have the passengers but longer flights take more aircraft time, so trade off with multiple frequencies to closer destinations. You need to be able to earn more revenue off of a longer distance flight to not only cover its higher cost, but to cover the opportunity cost of what else you could do and earn with that aircraft.

You’re more likely to see an airline with a hub at one end of one of these routes try it because then you might pick up some connecting traffic as well to help make it work. Where there’s no hub, and the number of passengers traveling a route is low, it’s less likely to succeed.

At the same time, operating a new flight that attracts passengers from other airlines can help the profitability of your other routes, by keeping those passengers loyal – they feel they have to take that non-stop, and since they’re flying you they stick with you on their connections too.

And it can make an airline more relevant in a market, encouraging those customers to engage the frequent flyer program and take the co-brand credit card. Card revenue needs to be accounted for when evaluating the financial success of a route.

How Do We Get Missing Non-Stop Service?

When it takes too long to reach an airport, it can make sense to drive. When it takes too long connecting it can make sense to drive. But that’s not as safe as flying. It’s more time-consuming and therefore economically costly than flying non-stop. And it limits access that communities have to vital services, family connections, and business opportunities.

More non-stop flights – serving more cities, and avoiding hubs – is an important policy goal. New technology aircraft, such as short takeoff and landing electric aircraft, should drive down the cost to make more routes possible from more places. But that will only work if American Airlines, Southwest, and the big pilot union aren’t able to crush competition by eliminating part 135 operations that will make that flying possible.

Is that data from the GDS? I think it was called MIDT data…how good is it with so many booking direct?

I notice there are quite a few city pairs in WNY and the west coast.

The example of MKE-LAX is funny… Midwest Airlines used to fly it a couple times a day and filled them up. Then AirTran flew it up to 3 times a day, usually full, but also was timed for connections to BOS/LGA/DCA/BWI.

LOT flew JFK-BUD nonstop until a couple of years ago.

It would be interesting to know what number the one-way daily passenger number needs to be to peak an airline’s interest. I suspect the number needs to exceed 200 daily passengers to even assume you might capture 100 daily passengers. You can’t get everyone to switch and I’m betting 50% utilization is about as high as you can go.

LAX-MKE screams for an American Eagle flight.

UA at one time, pre-merger, flew BDL-SFO on the A320.

Seems like there’s money to be made using an A220-100 between MKE-LAX. The route isn’t big enough for SWA to resume service using a 143 seat 73W, but the smaller 109 seat A220 appears to be a perfect fit for the full fare coach crowd.

Technological change can change the viability of routes too. Major recent example, the A321XLR is opening up East Coast-West Europe routes previously too “thin” to be viable for direct service.

TUS to DC and NYC both high on the list and needed. There used to be IAD to TUS. I would think there is strong defense contractor demand on this route, and plenty of leisure demand too. Personally, these flights would save me many connections per year.

In addition to YX, NWA flew LAX-MKE at least once per day, some periods twice per day when competition was getting “hot” over at YX.

At LAX, YX had the “honor” of being the last airline offering service on a D9S (DC9-30) used for the LAX-OMA route.

Aero California was operating DC9’s (DC9-14).

YX offered great service on their MD88’s, all with 2×2 seating. Nice meals with wine and that damn baked on-board chocolate chip cookie!

SO_CAL_RETAIL_SLUT

I didn’t look at this list closely so maybe I missed some airports but I noticed a lot of airports not on this list like St. Louis, Denver, etc. I guess those are being served perfectly?

YX used to fly MKE-SFO and MKE-LAX. It used to be my favorite US airline.

I used to fly YX a bunch from DCA to MKE. Much better than flying NW (a bottom of the barrel airline at the time) and the other US airlines.

I am surprised. I always bemoan the lack of non-hub non-stops from my home airport. I could only find one route on the list. Anybody else share this surprise from their base?

I am surprised that Sacramento (SAC) to San Antonio (SAT) is not in this list.

I’m sure there is good demand between Sacramento (SMF) and San Antonio (SAT). Sacramento is a fast-growing market, and would definitely benefit into adding nonstop service to more unserved destinations.