American Airlines lost $473 million in the first quarter. That’s about what was broadly expected – I’d been saying $450 million. They attribute a $200 million revenue hit to the flight 5342 disaster in January. Weakness is primarily in domestic coach. They note,

- “Strong demand for international travel from U.S.” so it’s too bad they early-retired all of those international aircraft.

- Premium cabin revenue and paid load factor are up, so I’d suggest it’s too bad they delayed adding premium seats to narrowbodies and removed premium seats from widebodies.

Interesting facts shared include that AAdvantage members are responsible for 76% of premium cabin revenue, and membership is up 6% year-over-year. Spending on their co-brands is up 8% year-on-year.

Managed business travel which they had walked away from but are now attempting to rebuild, was up 8% in the first quarter. They expect to recover their full relative share by the end of 2025. Aggressively courting the business, making generous deals, will bring back businesses that want the best deal.

American had blamed their revenue underperformance on lack of managed business travel. Now they say they’re getting that business bad, so one analyst wanted to know… why aren’t we seeing the improved revenue benefit? CEO Robert Isom blamed uncertainty in the current environment even though of course Q1 was before Liberation Day tariffs were announced. They later noted that main cabin demand is hurting and government business has fallen off, which is significant for the majority carrier at the close-in Washington National airport.

American pulled their 2025 financial guidance but still expect to be profitable, and political commentary focused on reforms needed to make visas easier and more accessible (good luck with this administration) and air traffic control reform. Late in the call, when asked about paying tariffs on Airbus aircraft deliveries, Isom talked about making travel competitive and that they produce a trade surplus. So that must mirror the arguments they’re making to the administration.

There was quite a bit of discussion around Chicago, given that:

- American is set to lose gates at O’Hare, since they didn’t rebuild their schedules post-Covid. The airline argues that the airport lease doesn’t permit the reallocation yet.

- They’re now ramping up those schedules.

- And United has called out its relative gains at the airport.

Vice Chair and Chief Strategy Officer Steve Johnson said “If United is gaining share in Chicago they’re gaining it from someone other than us” and noted that they’ve been profitable in Chicago in the past, have been there for 99 years, and have a loyalty customer base – though concedes “we understand we’ll probably always be second place in Chicago.”

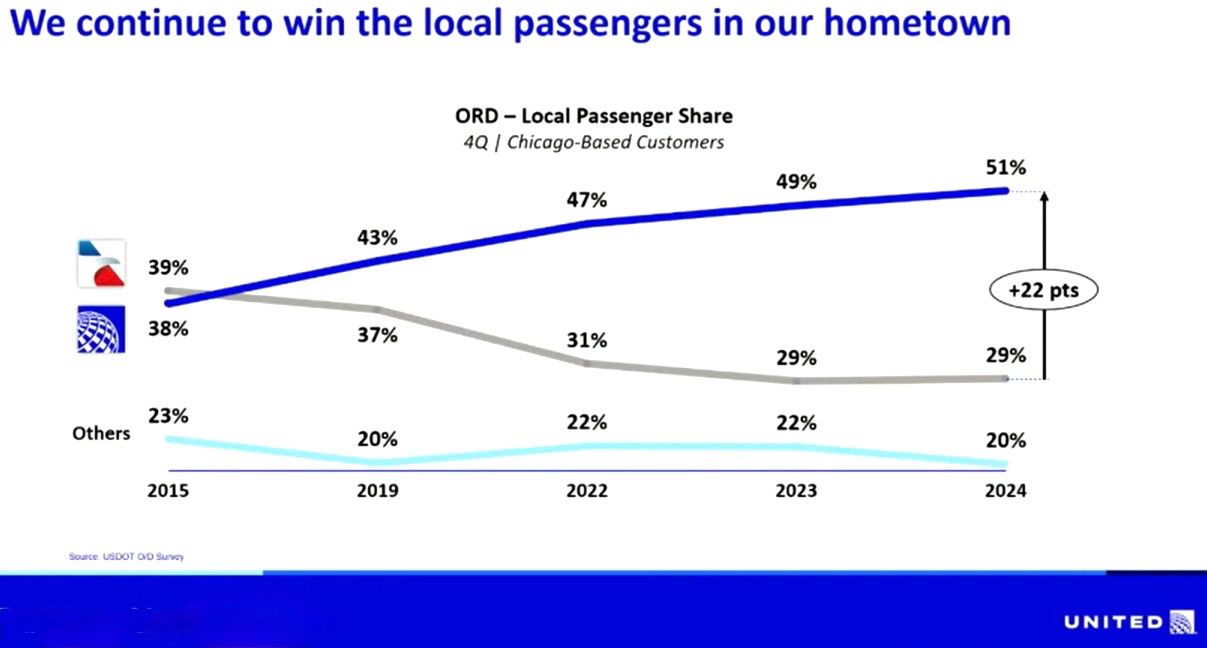

United says that over the past decade American’s share of local traffic in Chicago has declined from 39% to 29% while theirs has grown from 38% to 51%. Of course American’s share has shifted to United because the share of total flying has shifted – though of course United’s numbers suggest they are also taking away share from others.

As they dispute the city’s redistribution of gates away from American and to United, they do say they can manage their announced schedule ramp up even with reduced gates, they start to see a problem with further increased flying next summer.

Robert Isom ended the call reiterating the airline’s renewed emphasis on customer focus and premium products, and noted that he expects “exciting news in the next week or so regarding American’s position at DFW.”

It’ll be interesting to see what that is – the airport is six months into construction on the new terminal F, which includes expansion of terminal E for check-in and security since the new terminal lacks a headhouse – every passenger who is not connecting between flights both arriving and departing from that terminal (a small percentage of passengers) will need to take the train to or from another terminal.

“Drag”?? Umm, people died. Have some respect. Sheesh!

I know you mean well, Gary. And your later characterization in the post of this as a “revenue hit” is more appropriate. You’ve been generally honorable in discussing and describing the tragedy of AA5342, and its relevance to the industry. I meant to playfully over-reacting earlier, you know, in-just. No real offense taken (unless someone else wants tries that accident on the typical boogeymen again. I’ll wait for those folks here… then call them out, yet again.)

*in-jest (how I wish we could edit these some times.) At least you know I’m not ‘AI’ because I often make errors on here. Bah!

Seems a lot of this was self inflicted. The retirement of widebodies and PMAA 757s (internationally configured) which meant AA lost lucrative premium capacity. The overemphasize on DFW and CLT. The decision that cutting corporate sales and that flyers would just book direct on aa.com.

None of this will be easy, cheap or quick to fix.

Regarding AA 5342, $ 200 million is a lot of cash for an accident fully attributable to a military aircraft colliding with them (not to mention ATC re-routing them to a different runway at the last minute). I’m not a big fan of the litigious nature of society, but it seems reasonable for AA Management to open a dialogue with the relevant authorities about having them take responsibility for this.

Things like force checking of carry-on roller bags when it is not necessary and less than stellar customer service by a small number of flight attendants have been drags on getting more people to switch to American. These things do take a toll that is accounted for later. I agree that Flight 5342 is better characterized as a tragedy than a disaster.

American should file a lawsuit against the US government, whose military caused the collision over the Potomac. The Flight 5342 was a tragedy, not a disaster, and a tragedy that should never have happened and was totally preventable. The rest of the financials for Q1 illustrate American remains a poorly led and run airline, which moves in fits and starts and completely missed the full boat on premium and international leisure-premium revenue. The US economy is headed for a deep recession and American’s unrelenting “sunbelt and domestic focus” won’t help it one bit.

@TexasTJ I cannot imagine that an administration that refuses to:

– acknowledge the worst security lapse in recent history;

– acknowledge erroneous deporting people;

– take responsibility for the worst April on the NYSE since the Great Depression;

– immediately blamed the mid-air disaster on DEI

would ever admit an agent of the government was responsible for this disaster subsequently compensate AA and the families of those lost.

But, hey, maybe a Christmas miracle will take place.

@ Gary — American has sucked for 20 years and will continue to suck without new leadership. Even with new leadership, they will likely suck. I never trust that AA will get me where I need to be on time and without drama and horrible airports. I will still fly them when it is best for my wallet, but that has been quite rarely the last few years. The Exec Plat elite benefits are are a joke, and so I am fine with my middling LT Plat status. If the would a) get rid of the moronic policy of making it cost more to attain vs retain status and 2) make SWUs of value, I might pay them some attention. As much as I hate to admit it, Delta Diamond is actually worth something (for now).

Wow Gary, you nailed in on the financial projection – very nice.

Gotta love the corporate spin on ORD, you guys aren’t fooling us!

Looking forward to see what’s in store at DFW, a top 3 US airport of mine.

Tragedy still hits home. I’m scheduled for my first nighttime arrival at DCA soon and I’m sure that will be extra sentimental – safe travels everyone.

@1990 – you being AI would be quite the plot twist!

I also believe a DFW announcement involves Terminal F. It’s been tight-lipped about who is going to get gates in F and how many. Even if it’s a shuffle, between new gates at F and the A & C expansions, AA will easily be over 1,000 flights a day by the end of the decade. Who knows, maybe even larger than DL at ATL?

Labor relations have been horrendous at AA for years. Twenty two years ago AA had a bankruptcy filing all ready to go unless the unions agreed to significant concessions, which they did. One reason AA management waited to file Chapter 11.

One of the issues with the ULCC business model is that it looks at the customer is someone to nickel and dime to death and that encourages the rank and file to have distain for customers. It assumes that as long as you give out a really low fare you’re only obligated to give what is minimally legally required. Nothing more.

AA’s financial report continues the same theme of industry-standard or higher costs and industry lagging revenue.

AA is the largest carrier by domestic revenue but gets less passenger revenue per seat mile than DL which operates longer stage length flights; AA has a shorter average stage length, even domestically, than DL.

If AA and DL got the same revenue per seat mile on an adjusted stage length basis, DL should have lower RASM but that is opposite of what happens.

there is still too much capacity in the domestic system. DL and UA are getting fares high enough to cover their costs while AA and WN are barely skimming above the water in the peak seasons – and losing money in the off-peak seasons.

and, no, Mikey. AA at DFW is not anywhere close to passing DL at ATL. DL at ATL is 90% mainline while AA at DFW Is 60% mainline. DL simply carries far more passengers through ATL and does it more cost efficiently than any other US airline.

@Tim Dunn – I was talking Departures, not Seats.

Yes, a lot of business decisions look badly in the rear view mirror.

Still, retiring the 767s and A330s made sense in 2020. Traffic, particularly international traffic, recovered very slowly after September 11, 2001 and the market crash of 2008. No one knew in 2020 how soon international travel would resume, let alone the date when travelers would not need proof of vaccination and/or a negative Covid test to enter a country.

For all of the people who are making up for lost trips in 2020-22, I know hypochondriacs who have sworn off all travel but their own cars, because they don’t want to spend hours on a germy plane, train, bus, or rental car.

@L737 — Bah! Yeah, I try to stay original on here. I try to ‘Stay Human’ as Michael Franti sings.

@Gene — You’re absolutely correct. Delta Diamond has outsized value, $700 credit to Amex DL Reserve and GUCs for Choice Benefits alone made my year. Unlike American’s system wide upgrades or United’s PlusPoints, with DL, I can reliably confirm DL’s RUCs and GUCs online without making calls or dying on the Waitlist, usually. That’s actually rewarding. Less games. Less bait and switch. Reduced my business with AA last year from EP to PP, and feeling fine, still with OW Emerald anyway. There is a better way!

And what bean counter formula was used to arrive at the $200 million hit due to flt. 5342? That is just a non-scientific, wild ass guess on their part.

@Steve — “non-scientific, wild ass guess” …welcome to the anti-intellectual era of 2025. Bah!

For those doubting 200 million for 5342

Seems median settlement is somewhere in the area of $3 Million per pax.

64 Pax x 3 = 192 Million

4 Crew ?

Plus legal fees, funeral costs, cost of replacement aircraft

I think the $200 million is a ballpark estimate of how much revenue was lost after the flight 5342 tragedy due to cancellations and passengers taking other airlines instead due to it. This estimate would consider projections and revenues as well as past performance of the algorithms used. The fight about who gets to pay the families of the victims and how much has barely started. I think that the military will shoulder most of the blame and have to pay out the most.