I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Sapphire Reserve for BusinessSM (See rates and fees)

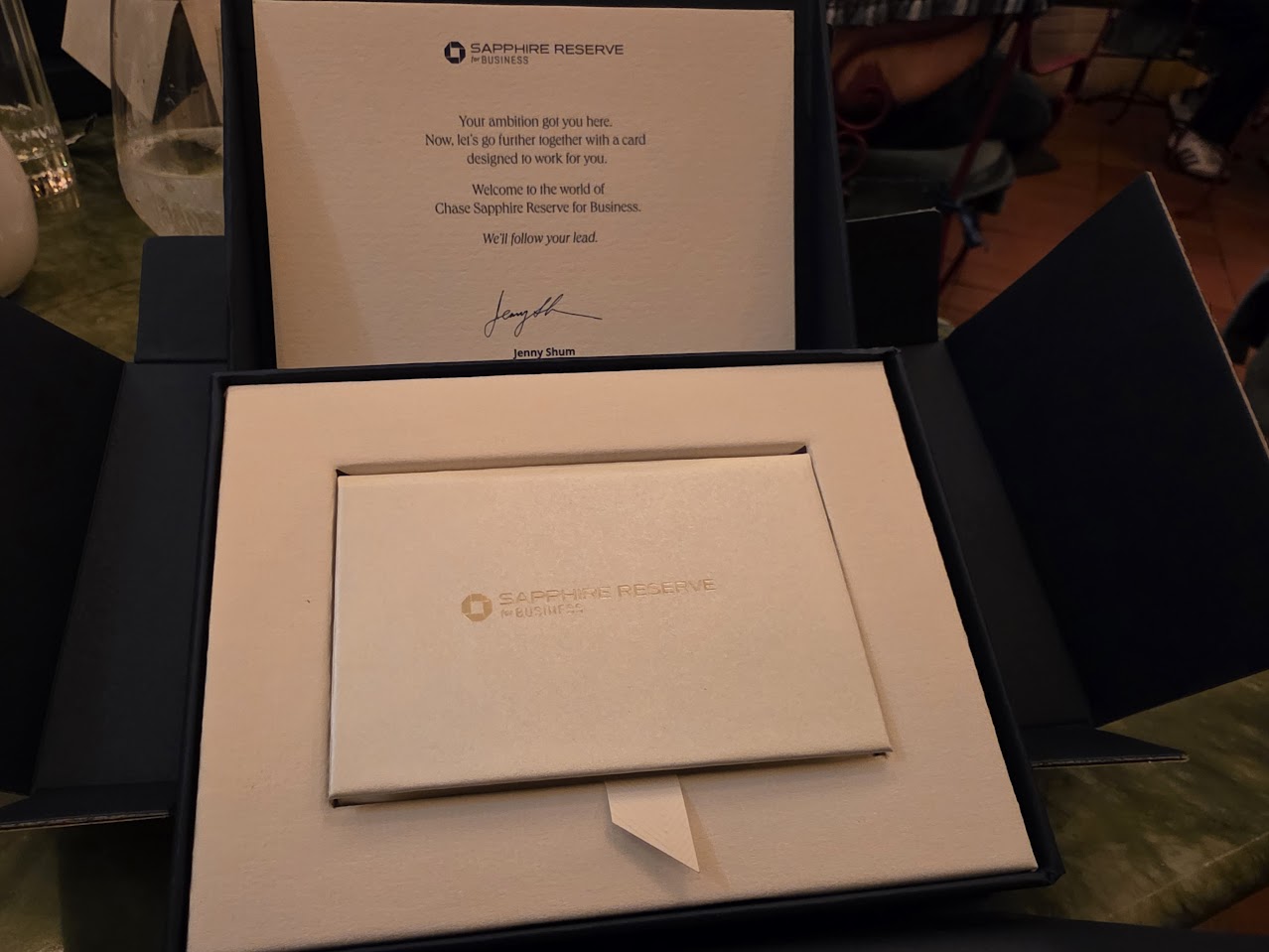

Chase relaunched their Sapphire Reserve Card with a new value proposition. They’re also doing something else notable with the franchise: introduced the Sapphire Reserve Business Card. And they did it with the biggest bonus Chase has offered for any travel card: earn 200,000 bonus points after you spend $30,000 on purchases in your first 6 months from account opening and with more than $2,500 in annual value

The card largely mirrors the consumer version, but there are a few key differences.

- higher spend requirements for extra benefits (like IHG Diamond and Southwest A-List status)

- different credits, more geared towards businesses

- no annual fee authorized user cards (while the consumer card sees the fee for those increase), but business card authorized users don’t get lounge access

Here are the key elements of the product.

- Earning: 8× Chase Travel, 4× direct air/hotel bookings, 3× social/search ads, 5× points on Lyft rides, 1× points on all other spend

- Redemption: Transfer to travel partners, redeem at 1 cent in the Chase travel portal or up to 2 cents per point with Points Boost

- Credits: $300 travel credit, $500 The Edit hotel credit (2× $250 windows per year; two-night minimum stay), $400 ZipRecruiter hiring credit (2× $200 windows), $200 Google Workspace, $100 Giftcards.com (2x$50 windows), $300 DoorDash ($25/mo if maxing out food delivery and grocery), $120 Lyft ($10/mo), $120 Global Entry / TSA PreCheck / NEXUS every 4 years

- Benefits: IHG Platinum status, access to Chase lounges and Priority Pass for the primary cardholder with two guests

- Additional benefits with $120,000 annual spend: IHG Diamond, Southwest A-List, Southwest $500 credit, $500 Shops at Chase offering products from brands like Baccarat, Dyson, and TUMI.

- Annual Fee: $795, employee cards $0 but those do not receive lounge access

Existing Ink cardmembers can apply for a Chase Sapphire Reserve Business Card. However, it is not possible to product change from Ink Business Preferred to Sapphire Reserve Business.

I am seriously considering giving this a short. The up front bonus offer is huge, though on a ‘per dollar spent’ basis it isn’t so outsized. Still, I’m in a position to generate the spend and I’d love to have the additional Chase points. My current Ultimate Rewards balance isn’t much over a million, so I could use the points (I’m redeem for four these days).

Between the travel credit, The Edit credit, and gift card credit I can make the math work on the annual fee, too.

Do you know if you can transfer the business card points to your personal Reserve card ?

That is a tasty signup bonus. Any idea about 5/24?

It’s a good sign-up bonus. If you can pull off an approval, like, escape ‘pop-up jail’ equivalent, avoid the 5/24 block, and have a ‘business’ (like Gary often says about his wife on here, and I’m sure, it’s ‘legitimate’ *wink*), then why not. Go for it. Get that 200K. Use the silly coupon credits. And 12 months later, attempt retention offers; otherwise, close it. I’d say you’re ‘ahead’ after all that. I think there’s more going on here than the personal card updates. You know what, let’s all start new ‘small’ businesses and milk this!

Tempting for the SUB. But otherwise not. a keeper

@Christian – we need more data points, I’ve assumed it probably applies but for new offers on Chase’s own cards especially business cards sometimes it doesn’t!

@Mark O – yes you can

@Gary Leff — Yes *we can! Bah…

One question I have: If I applied for this now, and got the bonus before October, would the 1.5 redemption rate with the personal Chase Reserve still apply? Or are these the same kind of point we’ll be getting after October?

I plan on keeping my CSR so I can switch between the 2 programs

sorry for the late question

But if you signed up for the chase sapphire preferred three months ago

but want the 200k points for a legit business card

can you still sign up for it and get the 200k points?

@ 1990 — Yes, not a keeper. Not many cards are. Even the SUB is a bit weak given the $30,0000 spending requirement. That spending could instead be used to earn roughly 7 SUBs totalling about 500,000 miles/points.

As a small business owner that has a lot of travel and online engagement I see very little of value in this card. Such a shame.

Is 5/24 still a deal killer under the new Chase approvals guidelines

The headline threw me off. I though Chase was dropping the 200K offer from the headline. I’m working on hitting my spend on the card. I was approved at 5/24 so I’m pleased with my acquisition although the bonus categories are extremely non-compelling for me so it’s quite dubious whether I’ll keep the card. What Chase absolutely should do is what the business Amex gold card does and instead of forcing specific categories (along with coupons that are worthless to my business) they should offer bonus categories for the 2 top uses out of a series of 6 or 8 categories. That would actually act as an enticement to use the card, and therefore keep the card.

Sharpen your pencils people and figure out how you can work backwards to rationalize why this is a good deal despite the fact that it contemplates you handing over $795 every single year to Chase (assuming they don’t raise the annual fee). Hold it for 5 years and you’ll be giving Chase $3,975 that you would otherwise have to spend on whatever you want, how and where you want.

The 5/24 was not an issue…..

@Mak – Some people won’t have to contort their numbers to make this come out a winner, such as people who use the Chase lounges a lot, people who for some reason use the Chase travel portal frequently, those who pay for a lot of social media, etc. Given the current benefits structure I’ll probably see somewhere between $400 and $500 a year in value. If I don’t get some good usage for Chase lounge access then unless Chase alters the earning structure so I break even I don’t see renewing as a likely option. I want to like and keep the card and I don’t need to make money from it but I’m unwilling to lose money on an ongoing basis just to hang on to it.

Did it to get SUB only. thats it. The Edit hotels seem so expensive its like they give you $150 off a $1000a night room. no thanks

Question – can we switch one of ink cards to CSR Business?