I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Since I’ve shared that I believe Citi Strata EliteSM Card (See rates and fees.) is a pretty awesome play to apply for and get started using benefits with during the first year that you have it, I thought that I should share my own approval experience with the card.

- When I share opportunities here, I try to explain whom they are good for – and whether it’s something I would do myself.

- So I want to be transparent, and also share my thinking because that can be helpful as you decide what strategies work best for you.

Citi’s new premium card is pretty incredible in the first year, not just because of the strong initial bonus but also because of credits that are timed to calendar year rather than cardmember year. (Calendar year credits can be claimed twice in cardmember year one.)

Honestly, I feel like this was a strategic error on Citi’s part. They’ve constructed a card that is a no-brainer to get. There’s just so much value to the customer up front. I’m not sure if it’ll be a keeper long-term or a card that’s best for your everyday spend (although it is very good).

My take: apply for this card, reap the maximum benefits in year one, and then consider whether it’s right for you in the long-term.

My Approval Experience With Citi Strata Elite

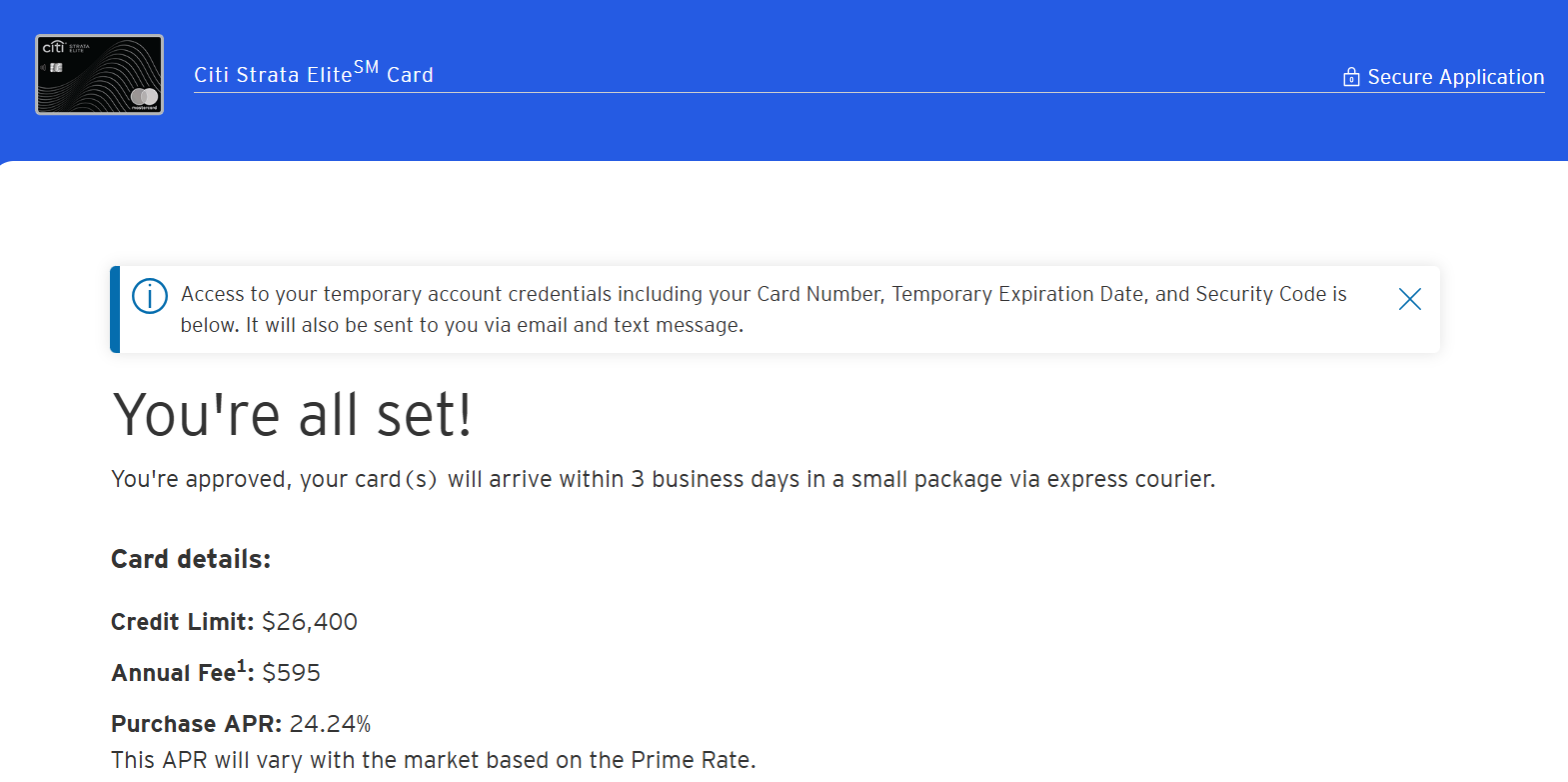

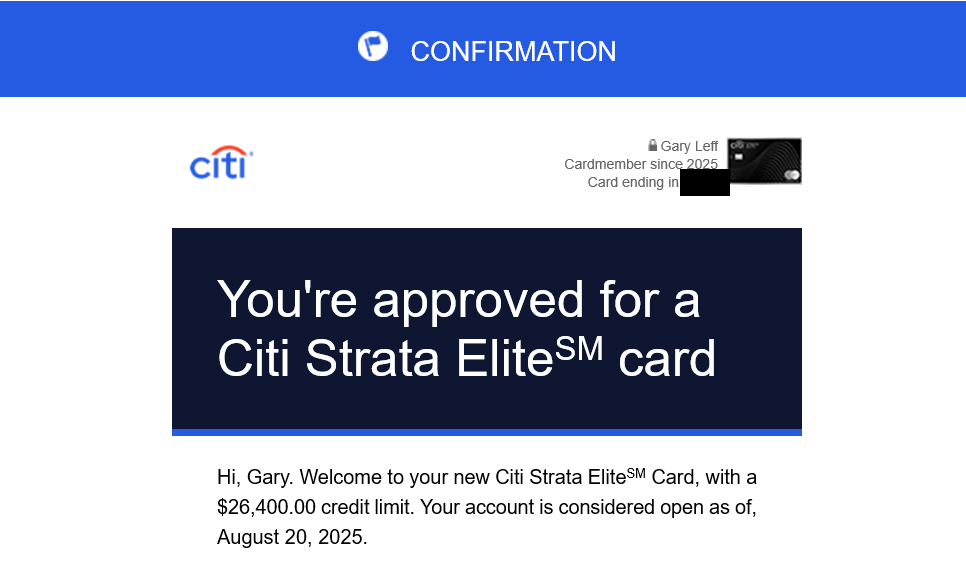

I received instant approval for the Citi Strata EliteSM Card – as soon as I hit apply.

That surprised me, since Citi already extends me quite a lot of credit and since Chase had just rejected me for their Sapphire Reserve for BusinessSM (See rates and fees) – I really wanted that card and offer, so I called for reconsideration and got it. I expected at a minimum to have to follow a similar path here.

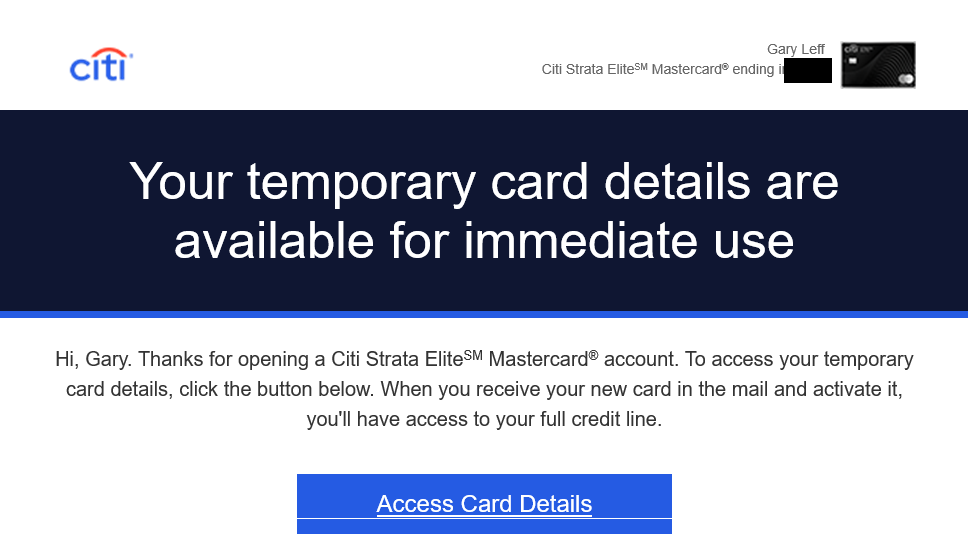

I immediately received an email about the approval, and also with a link to clink for a temporary account number to use before the card arrives. (This was also shown on the approval page online.) Only about 10% of the credit line was available for immediate use.

I received another immediate email as well – since the application also asks for an American Airlines AAdvantage number if known I immediately received notification that the airline lounge passes had been deposited into my account.

These passes are not part of the value equation for me, since I am already an Admirals Club member via the Citi AAdvantage Executive card (and the passes can’t be gifted).

That’s actually really good integration and better than I would have expected. American and Citi really worked on this. Making the passes available for immediate use is a great cardmember experience.

Benefits Of The Citi Strata Elite Card

The card offers plenty of points, and they’re very valuable points – recently made even more valuable.

- Earn 80,000 bonus points after spending $4,000 in the first 3 months of account opening. Current Strata Premier and Prestige customers are not excluded. Points transfer to a variety of airline and hotel programs, now even including American AAdvantage. And this card earns AAdvantage miles faster than the American Airlines cards to (even unbonused spend with this card earns 1.5x, versus just 1 mile per dollar with American Airlines cobrands).

Points can be transferred to:

- oneworld: American Airlines AAdvantage, Cathay Pacific Asia Miles, Malaysia Airlines Enrich, Qantas Frequent Flyer, Qatar Airways Privilege Club

- Star Alliance: Avianca LifeMiles, EVA Air Infinity MileageLands, Singapore Airlines KrisFlyer, Thai Airways Royal Orchid Plus, Turkish Airlines Miles & Smiles

- SkyTeam: Aeromexico Club Premier, Air France KLM Flying Blue, Virgin Atlantic Flying Club

- Non-alliance: Emirates Skywards, Etihad Guest, JetBlue TrueBlue

- Hotels: Leading Hotels of the World Leaders Club, Accor ALL – Accor Live Limitless, Choice Hotels Choice Privileges, Preferred Hotels I Prefer, Wyndham Hotels Wyndham Rewards

- Credits include a $300 hotel benefit for 2+ night stays booked through Citi Travel; the $200 Splurge credit (take it for American Airlines travel!), and $100 in Blacklane credits twice each year.

American Airlines Boeing 787-9

American Airlines Boeing 787-9P Flagship Preferred Suite

If the 80,000 points are worth roughly $1,200 and the credits another easy $1,200 that’s $2,400 during the first year – not even including benefits like Priority Pass (which includes two guests) plus Priority Pass for authorized cardmembers as well; protections like Trip Cancellation and Trip Interruption coverage, Trip Delay coverage, and Lost or Damaged Luggage; and four American Airlines Admirals Club passes each year.

The card earns:

- 12 points per dollar spent on Hotels, Car Rentals, and Attractions booked on cititravel.com

- 6 points per dollar spent on Air Travel booked on cititravel.com

- 6 points per dollar spent at Restaurants on “Citi Nights” purchases, Friday and Saturday from 6 PM – 6 AM Eastern

- 3 points per dollar spent at Restaurants any other time

- 1.5 points per dollar spent on All Other Purchases

6x weekend dining during the time windows is pretty lucrative, but excludes my business reimburseable meals that are often with groups.

1.5x on all unbonused spend is great – far better than what you’ll get from most cards, and better than what you’ll get from American AAdvantage cards. It’s just not the best you can do – unbonused spend is better off on a Citi Double Cash card (2x on all spend) pooled with points from a transferable Citi product like this one.

AA passes this year only good for 4 months. I got 50k typ in compensation.

Thanks for the update, Gary ! Curious how you feel about that 6X Air Travel Points only when booked through cititravel.com ? I’ve noticed recently that when I call the AA Platinum Desk because of any sort of delay (Weather/Maintenance/Crew), the recording says that if you booked your travel through a 3rd party that you should hang up and call them. If you have a high enough status to still work through AA that’s great, but on that basis alone I wouldn’t take this card, as that bonus would effectively be useless under those conditions.

@TexasTJ – I don’t plan to book air through them, I need to work through whether to continue earning 5x with amex plat on book direct or 8x chase ultimate rewards through their portal once new benefits kick in for me.

I’m glad you see value in it for yourself but for me it’s really lacking in value beyond the first year and even the credits are pretty meh. If I could pass on the AAdmirals Club to someone else that would raise the value somewhat.

@Christian — Bingo. And if you’re going for it, do the ‘triple dip,’ December 2025-January 2026, maximum credits, sign-up bonus, transfer all points to AA, ditch. Rinse and repeat. Churn baby, churn!

@ Gary — To suumarize, you pay $595 AF for $400 AA credits in Year1 and only $200 thereafter? This “floored” you? Really? This is a card to get for the SUB, place in sock drawer and close upon renewal. Hotels credits that don’t come with elite benefits or elite credit are fairly uuseless. Lounge passes are useless. 6x dining? Maybe some card issuer could give 6x for GLP-1 scripts instead?