On Tuesday I wrote about the offer for the Barclays Aviator Red AAdvantage card of 70,000 miles after first purchase.

- Citibank is gaining exclusivity with American AAdvantage cards, so this card (and opportunities for AAdvantage cards with Barclays generally) will go away.

- Unconfirmed reports that last day to apply is September 30, though Citi exclusivity starts next year.

The application link with 70,000 miles has already been pulled. The standard public offer is 50,000 miles. There may be better offers out there, e.g. first year annual fee waived.

I applied for the card as I wrote about it, and I was approved. I did not actually expect to be approved.

Barclays was the pre-merger issuer of US Airways credit cards. They picked up the co-brand from Bank of America when they funded America West acquiring the carrier out of bankruptcy, and later purchased the BofA back book.

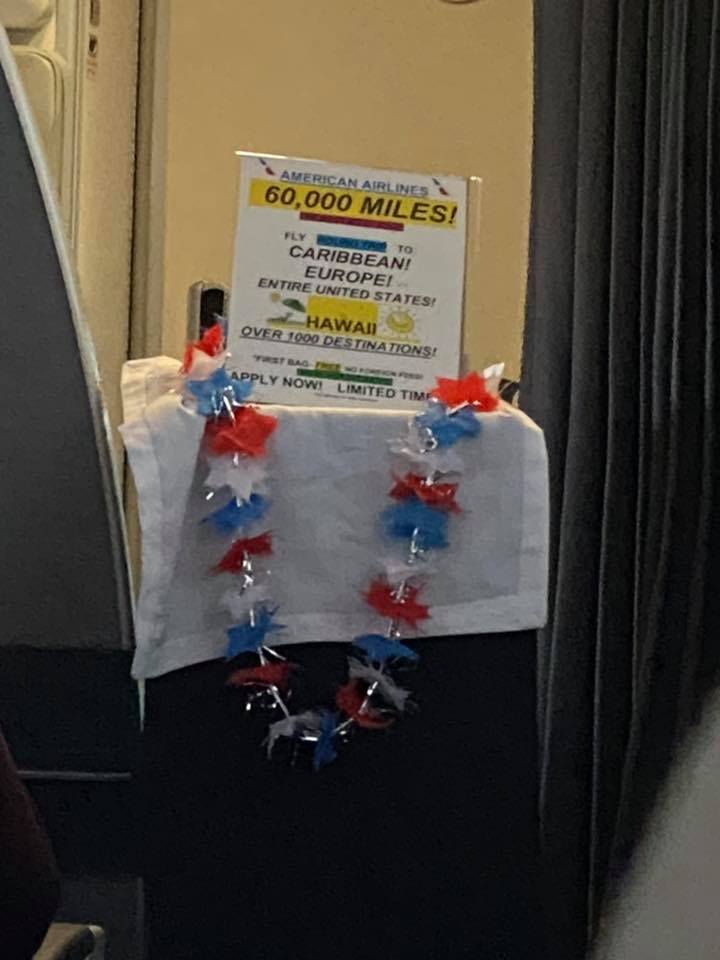

Under the 2016 co-brand deal Citibank and Barclays shared the portfolio. Citi wouldn’t pay up at the time for exclusivity (and Thank You Rewards points transfers). So Barclays kept onboard acquisition and in-airport advertising, but not within 100 feet of an American Airlines lounge. That was mostly about keeping the profitable historic portfolio they’d built up.

I’ve had the Aviator Red card before, and I have the Aviator Silver (converted from an Aviator Red). I also recently cancelled my Barclays Hawaiian Airlines cards. Barclays can be finicky so honestly I wasn’t expecting to be approved. It wasn’t an instant approval. It took 48 hours of ‘under consideration’ and I received both a text and an email.

The US Airways card was the very first points-earning card I’d ever gotten, almost 29 years ago. I cancelled it almost immediately after getting it, deciding I didn’t want to pay an annual fee. Then i realized I was traveling enough for work – with reimbursable business expenses – that the math worked out and I should really be earning something.

US Airways was the airline I flew the most, living in Northern Virginia and flying out of National airport, so I applied again. It had only been a couple of months since I’d gotten the card and then cancelled in the first place. They gave me the bonus again. I was not expecting that! But it really juiced me to pay attention and take advantage of points opportunities.

Seeing the legacy US Airways products fade into the sunset feels like the end of an era for me. But the only reason for someone not to apply for this card right now, really, is concern over too many or too many new accounts (Chase 5/24, or going to get a mortgage). We’re close to what’s likely the last opportunity to get this card ever.

Gary, my questions would be, is it worth it to convert to the Silver card before the changeover? My P2 and I have 4 red cards between us, and the Silver card really doesn’t seem like it’s worth the extra $100 a year in our case, as I would typically put AA spend on my Citi AA card.

If you’re eligible (cannot have had it in the past 24 months) and under 6/24, or can get approved anyway, why not pay $99 and get 70,000 AA points after spending a dollar. Worth it, even if it’s just one last time.

I got the Barclay AA card with a 50K bonus and $99 annual fee last year. I converted it to a no-fee card starting in year 2.

Although I am ineligible to receive the 50K bonus again before the offer window closes, Barclay keeps sending me emails offering to upgrade my no-fee card to the card I used to have, with a $99 annual fee. Of course, the 50K bonus is excluded from the offer. Barclay should know better.

@Al Barta — Yeah, Barclays, Capital One, nearly all issuers will market you (and all of us), even if we are not eligible. It’s odd. Like save the expense of printing and mailing me; in the aggregate, I can’t imagine it isn’t wildly expensive for them to keep doing that.

P2 applied but was denied. Reason cited was it appears that you’ve had this card before, which she had Three times over the years, most recent one canceled in February when the annual fee posted. Oh well. It was worth a shot.

What I don’t like about AA (and US Airways) is that when the card issuer changes, they force everyone to change (from Bank of America to Barclays) That sucked. Lots of wasted time updating accounts with other vendors/companies (i.e. Netflix, Google, Apple, etc.). I have two Barclays/AA credit card accounts. I actually like them (I am EP, and roll about $500k in expenses a year through my business), and they answer the phone immediately. I hate, hate, hate HATE changing the account numbers, especially when I have more than 30+ internet services supporting my businesses and when they break… it sucks.

I got it a year ago to get the 70 K bonus. TransUnion Bankcard-enhanced FICO 8 was over 800. Utilization rates under 10%. No inquiries. No recently opened accounts. Came back as an automatic decline. I have two other Barclays cards for over 10 years in good standing.

I called their reconsideration line and the rep said the decline was due to a 2002 delinquency on an iTunes rewards card of theirs. I asked why I was automatically approved for other accounts in the past and the rep clearly had no idea. I was just nice and friendly with the rep and she ended up overriding the decline and approved me.

But beyond the 70 K bonus, the card offered me very little I didn’t already have with Citi. Which is why I didn’t keep it for the second year and pay another $99.

The elimination/disappearance of anything associated with USAir is way overdue. It got really old being subjected to the ridiculous “hawking” of it inflight with P/A’s. Good riddance!!

Gary,

The Barclays link is not working. I tried two times already.

Just applied and was approved in about 15 seconds so they’re still taking new applications. 50k SUB, no AF for first year, only 1 purchase needed (and bill paid) then you get bonus. Will cancel this card before the end of the year so I can apply for the Citi AA card next January after my moratorium from my previous card is over (just in case I get some blowback from having an open Citi AA card). Put me over 5/24 but not planning on a new Chase card anytime soon. Easy 50k AAdvantage miles.

If the Barkleys card no longer will issue AA rewards I would then no longer want that card. Problem is there is a hefty fee applied on that card annually, and to drop the card dings the credit score. Are they doing away with the card or is it the same card minus the rewards. I called Barkleys and she said she knew nothing. this is hard to believe since it is easily found. Is Citi taking the card and reissuing something or am I stuck with a ding on my credit?