The much-anticipated refresh of American Express Platinum and Business Platinum cards is out, and the news is a lot better than expected. I was something of a begrudging cardmember recently. These changes make me an enthusiastic one, because I’m going to be getting a lot more value than before for what I pay to American Express. I’m downright excited to start using new benefits, which are all available right away.

Premium Rewards Card Competition Has Become Intense – And Expensive

American Express Platinum has been the granddaddy of mass market premium cards for decades. And Amreican Express has been the leader in bundling partner offers to deliver value to cardmembers in exchange for ever-increasing annual fees. But the field has gotten crowded – first with the introduction of Sapphire Reserve, and now with its refresh as well as new entrants from other banks into the space.

In June, Chase Sapphire Reserve relaunched at a $795 annual fee with a lot of new cardmember credits and a new value proposition to try to turn around the economics of the card. The refresh is intended to reduce earning, reduce redemption expense, and raise fee revenue – while delivering enough new value through merchant-funded offers that consumers stick with the product.

And many of those offers are from within Chase’s own ecosystem. They’re driving business to their own travel portal (8x earning, even on airfare) and no longer subsidizing competitors (like Expedia and Airbnb, removing 3x earn on ‘all travel’).

On the day that Chase launched its refreshed Sapphire Reserve, American Express issued a press release saying that they’d be refreshing Platinum, too. They were able to steal a little bit of Chase’s thunder, and launched speculation of just how expensive Platinum would become and whether they’d be able to deliver big enough benefits to keep cardmembers engaged.

We’ve had three months to wonder and wait, and the details are now out. I am not a fan of the ‘coupon book’ model where cardmembers pay an ever-increasing annual fee and get credits and discounts in return – where the reality is that a valuable customer demographic is being sold to brands in exchange for discounts, and we’re paying for the card to sell our eyebals.

Capital One’s Venture X doesn’t really use this model at all. It prices at a lower ($395) annual fee. I like their lounges a lot, but there are far fewer of them. To me, net of the $300 credit for bookings through their travel portal (including airline tickets) and the 10,000 bonus points at card renewal, I internalize tha the card doesn’t really ‘cost’ me to keep it. And I use it for 2x earn on all spending.

In the meantime since the Sapphire Reserve refresh and the promise that one was coming for Platinum, Citi has introduced its $595 annual fee Strata Elite card – with American Airlines AAdvantage transfers, minimum 1.5x points earning on all spend, and 6x on weekend dining. They don’t have their own lounges, but they too have enough credits to cover the card’s cost.

Nonetheless, American Express has added a tremendous amount of value here. And the results are a lot better than I expected.

The Refresh

Both the consumer and business Platinum cards are going up from $695 per year to an $895 annual fee.

Existing cardmembers will not see the higher annual fee until their next renewal date or after December 2, 2025 for Business Platinum and January 2, 2026 for Consumer Platinum. That means if your consumer Platinum card renews in November 2025, you won’t see the $895 annual fee until November 2026. But you get all the new benefits right away.

There’s also a new card design option now available. Both new and existing consumer and business Platinum cardmembers can choose a limited edition mirror card design.

Here’s video of the new mirror design:

Nothing is being taken away with this refresh announcement. There have been benefit changes recently, for instance restrictions on the Business Platinum redemption rebate for premium cabin airfare. But today’s announcement is strictly about the fee and new or increased benefits rather than restructuring or eliminating any.

Consumer Platinum Changes

With this $200 increase in annual fee (that won’t hit existing cardmembers right away), customers receive:

- $600 hotel credit. There’s been a $200 hotel credit, valid on Fine Hotels & Resorts stays or minimum 2-night Hotel Collection stays. That shifts to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts or The Hotel Collection bookings through Amex Travel using the card. The portfolio has expanded significantly and now covers over 3,100 properties. This is $400 additional value per year.

- $400 Resy Dining Credit. Up to $100 in statement credits each quarter when using a Platinum card to make purchases at more than 10,000 U.S. Resy restaurants. (Enrollment required.) This is a new $400 benefit and you don’t need to even make a reservation through Resy to use it – the statement credit works at any restaurant that uses the Resy platform (which American Express acquired in 2019).

- $300 Digital Entertainment Credit, a $60 increase from the current $240 [$25 per month instead of $20 per month] and they’ve added Paramount+, YouTube Premium and YouTube TV to eligible merchants on top of Disney+, Disney+ bundle, ESPN+, Hulu, The New York Times, Peacock, The Wall Street Journal. (Enrollment required.) This is $60 in new value.

- $300 lululemon Credit. Up to $75 each quarter in statement credits for lululemon store or lululemon.com purchases on the card in the U.S. (Enrollment required.) This is $300 in new value.

- $120 Uber One Membership Credit. On top of the existing $200 annual Uber benefit (and Uber VIP) cardmembers can receive up to $120 in statement credits each calendar year for auto-renewing Uber One subscription. That’s $120 in new value.

- $200 Oura Credit Up to $200 back each calendar year in statement credits for Platinum card purchases of an Oura Ring through Ouraring.com. (Enrollment required.) That’s $120 in new value I’m probably not going to use but maybe you will. Maybe you’ll buy and resell yours.

- New Hotel Elite Status. Leading Hotels of the World Sterling status which comes with one-category room upgrade priority; continental breakfast; early and late check-out if available and Sixt Platinum status. You get 5 pre-arrival one-category room upgrades each year for use on revenue stays. These “are not guaranteed.” Some interesting properties are included. (Enrollment required.)

Not everyone will use all of these benefits, but together that’s a lot of new value… $1,680 in new or increased statement credits against the $200 increase in annual fee.

The card continues to provide:

- $200 Uber Cash ($15 monthly, plus $20 bonus in December)

- $200 Airline Fee Credit for incidental fee purchases at one selected Airline

- $100 Saks Fifth Avenue Credit ($50 semi-annually)

- $300 Equinox Credit

- $155 Walmart+ Membership ($12.95 monthly)

- $209 CLEAR Plus Credit

And it continues to earn 5x on flight purchases direct through airlines.

Business Platinum Changes

In addition to the $200 increase in annual fee for the card, additional cards with benefits will go from $350 to $400 per card. There are no new benefits for these additional cardmembers – but those come with Centurion lounge access; 10 complimentary Delta Sky Club visits when flying Delta (non-basic economy); Marriott Gold status; Hilton Gold status; among other benefits.

New and increased benefits:

- New accelerated points-earn category. 2x on eligible purchases in key business categories, as well as on eligible purchases of $5,000 or more. (The card continues to earn 5X points on flights and prepaid hotels booked through AmexTravel.com.)

- $600 Hotel Credit. The card finally matches consumer Platinum here with $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts or The Hotel Collection bookings through Amex Travel using the card. The portfolio has expanded significantly and now covers over 3,100 properties. This is $400 additional value per year.

- New Hotel Elite Status. Leading Hotels of the World Sterling status which comes with one-category room upgrade priority; continental breakfast; early and late check-out if available and Sixt Platinum status. You get 5 pre-arrival one-category room upgrades each year for use on revenue stays. These “are not guaranteed.” Some interesting properties are included. (Enrollment required.)

- $1,150 Dell Credit. They’re calling this ‘enhanced’ but it appears to me to be identical to the current (recently changed) offer of up to $150 in statement credits on U.S. purchases made directly at Dell and an additional up to $1,000 statement credit after spending $5,000 or more at Dell (Enrollment required). Personally I preferred the $200 credit twice annually the card used to feature.

- $250 Adobe Credit. They’re calling this ‘enhanced’ as well, but it also appears to be identical to the current offer of a $250 statement credit on after spending $600 or more on U.S. purchases made directly at Adobe per calendar year (Enrollment required).

- $1,200 Flight Credit after spending $250,000 on eligible purchases in a calendar year for use in the next calendar year on flights booked on AmexTravel.com.

- $2,400 American Express One AP Statement Credit after spending $250,000 on eligible purchases in a calendar year for use in the next calendar year on monthly fees for Amex’s digital accounts payable product for automating supplier payments.

In reality on the business card you’re getting $600 in hotel credits, more 2x on spend, and significant credits for hitting $250,000 in annual card spend. That’s not the increase in value we see on the consumer side but (1) the card was probably already richer than the consumer card to begin with, and (2) it’s still worth more than the annual fee increase.

They’re bundling recent changes (Adobe, Dell) with this announcement. That makes it seem bigger, though I personally viewed the Dell change as a downgrade. They’re also bundling the devalation of the 35% rebate spending points on premium cabin airfare as a positive change.

Cardmembers get 35% points back using Pay with Points for flights booked through Amex Travel with one of nine selected qualifying airlines, up to 1,000,000 points back per calendar year. You used to be able to book with any airline in premium cabins and not just your selected airline. That means you can no longer redeem with the 35% rebate for travel on non-U.S. carriers. No more British Airways, Air France, Singapore Airlines, or Qatar Airways.

The card continues to offer lounge access, similar to the consumer card, and has a $360 Indeed Credit (up to $90 quarterly); $120 Wireless Credit (up to $10 monthly); $200 Hilton Credit (up to $50 quarterly); $209 CLEAR Credit; and $200 Airline Fee Credit at one selected airline.

No Hidden Gotchas

I asked about any rules changes to the hotel credit that’s going from $200 per year to $300 twice a year – that is, can it still be used on a single one-night Fine Hotels & Resorts stay / 2+ night Hotel Collection stay? And what if you’ve already used your $200 credit from the old benefit for this year?

American Express confirmed that the only change is that “the $600 is to be used $300 semiannually (Jan – Jun/Jul – Dec)” and that “if you already used the $200 credit for this year, you will now also have access to the $300 credit for the remainder of the year” to use on “a new booking.” It doesn’t matter if you used your $200 benefit in the first or second half of the year. So hopefully you already did that, and now also get this $300!

By the way I’ve used my Amex hotel credits most recently at Kempinski Cancun and at Viceroy DC.

For the Resy credit, all you need to do is “enroll in the benefit and eat at any of the 10,000 US Resy restaurants and you get a credit – 4 x’s a year, $100 a pop. You do not need to make a reservation to get the credit.”

All of the new benefits “are live for new and existing” cardmembers as of today. There’s no wait to use these benefits, even if your increased annual fee won’t kick in for over a year. That’s a lot more generous – consider that Chase didn’t make many of its new benefits available to existing Sapphire Reserve cardmembers for about four months.

This all sounded a bit too good so I wondered what they might not be telling us? Yet they confirmed “no changes to existing benefits” outside of what’s detailed here, no matter how small.

My American Express Consumer Platinum Card Is Worth Keeping

I was on the bubble over whether to keep my Platinum card. I got the math to pencil, but it was work to keep track of and I wasn’t sure why I was doing that.

I managed to use the $200 airline fee credit (on Southwest); I’d use my twice-yearly $50 Saks credit (but with free shipping now requiring bigger orders and my favorite items gone, it’s become tough); I use the $240 Digital Entertainment Credit for New York Times and Disney+; I’d pay for CLEAR anyway to have the option to use their security lines when shorter; and I spend on Uber anyway so the $200 credit is real money there; and the $200 Fine Hotels & Resorts credit is something I could use on reimbursable business stay.

Put another way, I’m getting use out of the credits to ‘pay for’ the card and then it delivers me Hilton Gold status for my occasional Hilton stays (I’m a Marriott lifetime Platinum so Marriott Gold is no use) and Centurion lounge access – which I haven’t valued as much as I used to as I watched the lounges get more and more crowded and the food quality decline over the years.

I have to say that this refresh makes the value proposition a lot clearer – and more clearly worth the effort. The annual fee has gone up by $200, but:

- the Fine Hotels & Resorts credit alone has gone up by $400.

- $400 in Resy dining credit is something I’ll easily use (and is much easier to use than Chase’s dining credit)

- Uber One membership will be real savings ($120)

- my wife will use the $300 in lululemon credits

- and the Digital Entertainmnet credit going up by $60 is real money for us (and the addition of YouTube TV is great since that’s what we use at home now).

That’s legitimate $1,280 in additional value we’ll get for our $200 plus a bit of extra brainspace and I consider that a pretty big win personally.. even if I don’t value the Oura credit.

These Cards Are Worth Getting

American Express is touting “over $3,500 in benefits” against an $895 fee for the card. The truth is that how much each cardmember will get out of the benefits will vary, and it does take some effort to track and make full use out of these – though they are making it easier.

I like the Platinum card for access to Centurion lounges, even though those are more crowded than they used to be (and I’ve complained about the food, I haven’t yet tried their new menus which are now live across the lounges).

I’m also looking forward to the expansion of the lounge network, which is already the largest among card issuers, and the introduction of Sidecar, their new dining-focused space (presumably inspired by Capial One Landing) which will debut in Las Vegas “in early 2026.”

I like having access to Delta lounges (when flying Delta non-basic economy). I have plenty of Priority Pass cards already.

Hilton Gold is a nice throw-in for me. Some of you will value Marriott Gold for the 2 p.m. guaranteed late check-out at non-resort/conference hotels. And it’s been my go-to card for airfare to earn 5x for quite some time (though Chase’s 8x for travel portal air purchases is tempting).

I’ve used the mental math on credits to justify the card’s fee, making those lounge visits more or less a throw-in on cost. And I was getting my money’s worth! I just always wondered if it was worth the effort. These updates on the consumer card make it clearly worth keeping. If it was worth $695 to me before, $895 now is a no-brainer.

And I think the math works out really nicely on both cards now. There are big initial bonus offers for these cards, so they’re a no-brainer in the first year. Then you have a year to think about whether to keep them. And I know I’m not cutting mine loose.

The Benefits Are Getting Easier To Use

In American Express’s last earnings call, their CEO described at the model used to be benefits that could be hard to use but that they’re now trying to make benefits easier to use. They’re not looking for breakage, and want customers to use the benefits that are helpful to them.

I love that the Resy credit, for instance, just requires paying with the card at one of over 10,000 participating restaurants. That’s easy. And they’ve grown their Fine Hotels & Resorts and Hotel Collection to over 3,100 properties where the new $300 semi-annual benefit can be used.

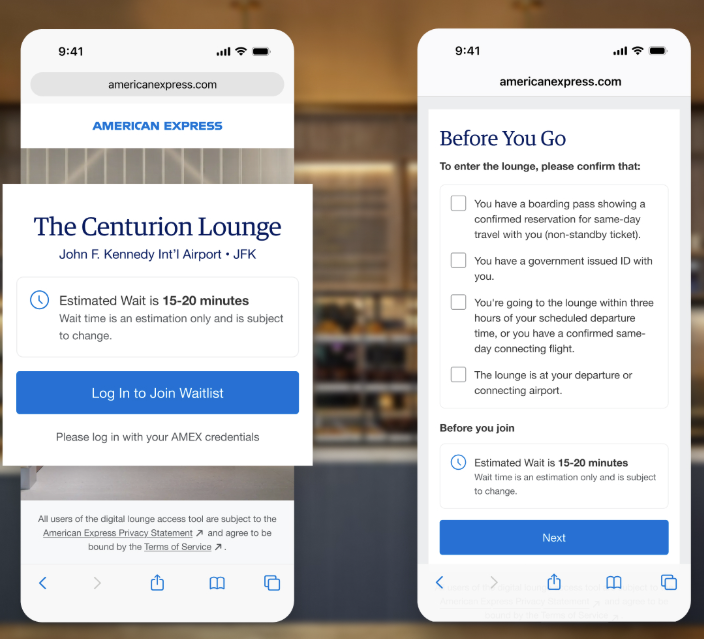

American Express also has rolled out enrollment and benefit tracking inside of their app. That makes it much easier to find and use the benefits. I don’t have to remember anymore, did I max out the restaurant benefit this quarter yet or did I use my $300 hotel credit yet (it can be confusing since the use-by date is when you make the prepaid booking, not necessarily the date of the stay).

The app already lets you add yourself to Centurion lounge wait lists (that’s why I downloaded it in the first place). Now they’ve followed Capital One with estimated wait times in the app as well.

I Hate To Admit It, But Amex Really Delivered

I wanted to criticize the American Express Platinum suite refresh, because $895 is a lot of money and because I’ve tired of all these offers to juggle, and the treadmill you’ve got to be on, in order for the product to make sense.

But I have to admit I am impressed by the generosity of their approach. I know I will use the hotel credits and Resy credits. And I appreciate an intention to make these benefits easier to use through the app, rather than hoping none of the benefits get used to contain cost.

American Express generates fee revenue, keeps customers inside their ecosystem with some of these offers, and delivers enough value that I think it’s all worthwhile. So I really can’t complain too much about that.

The business platinum never had a hotel credit.

Alas, the hotel credit can’t be used in one shot, and the Hilton credit has to be divided over 4 quarters. Otherwise, it would be much more valuable.

I’ve had the business card in the past, so we’ll see if it’s a NLL offer for the new one. I’d get it again for the signup bonus but not otherwise.

I was cautiously optimistic about this product launch and I could not be more pleased. Great job by Amex. Heads should roll at Chase.

I was cautiously optimistic about this card refresh and I could not be more pleased (other than my renewal date being in February, but what can you do). Yes the fee is higher but inflation is real. Amex should be congratulated for offering easy to use benefits that are simple to understand. Heads should roll at Chase.

Gary. I think you overvalue the benefits tremendously. Take the hotel credit for example.1.prices of hotels often much cheaper on other portals than the Amex portal. And if you book directly in the hotel portal, you will get the loyalty. Beni’s+ points 2. You’re limited to super expensive hotels, which many of us don’t book . So the saving is imaginary..

The Lululemon credit only useful for those who buy and buy directly from the retailer. . Etc. overall, I think it’s hard to justify the value.

You’re really going for that first prize bicycle for selling the most coupon books, Gary. Plats and CSR are a pathetic joke now. Because all successful people I know just love tracking 30 different monthly, quarterly or biannual coupons. Lululemon, what a dumpster fire this will be. Does the world really need more fat Karens and gen Y soi boys in yoga pants?

The only way to win this game is to not play. The best ROI on spend is ~$100 AF or less SUBs. And you’ll feel much better not having to worry about this stupid crap too.

Please let me out of pop-up jail so I can get the card. Hopefully rules are relaxed for the refreshed card.

A “luxury card.” So luxurious to have to keep track of all of this stuff so that you can justify giving Amex $900 for your fancy mirror finish card. This has to be one of the greatest accomplishments in the history of marketing, worthy of a Mad Men episode, to have convinced people that they are engaging in luxury behavior by tracking their Uber and Saks spending. The real luxury is to get a cheapo card and spend your money when and how you want, instead of how Amex says I must. There is no underestimating the sensibilities of “luxury card” consumers. Watching from the sidelines to see just how far Amex can take this and what happens first: 1) people rationally give up the card and prefer keeping $900 in their pocket every year; or 2) the demographics and credit profile of “Luxury Card” holders declines to the point where the only people silly enough to engage in this self-deception are mostly the sort of people who can’t or don’t pay their credit card bills reliably and the whole charade that this is a card for wealthy people with excellent credit collapses.

@Mak – to each their own. Personally this fits my lifestyle very well (as do the changes to my CSR). Sure if you don’t get value don’t have the card. However I’m retired, affluent and go on 2-3 international trips a year (plus 8-10 domestic ones). I like to stay in 4-5 star hotels (and am lifetime on most programs so not chasing status) so I value the FHR and Edit (CSR) credits highly. The Resy credit is an easy $400. I use the one in my Gold card and look forward to this.

All about your lifestyle. I spend $2500-$3000 a year in AFs across the 15 or so credit cards I have and get value from each of them. Yes it takes a spreadsheet to keep up with everything but, again, I’m retired with plenty of time so no big deal.

Overall IMHO great move by Amex and clearly the additional benefits are worth more than the $200 incremental AF

It’s an extra $200… I thought they’d go for $995 (make it a thousand.) @Gene 4x is gonna bite. Extra FHR, Resy, Lululemon credits… yeah, tedious (@Mantis, how’s Asia?), but I’ll use ‘em. @PENILE, is that really the best you got?

TPG is reporting that the airline credit is “broader,” and more aligned with the CSR’s travel credit. Thoughts?

@Mantis – disagree but always happy to consider Wargames references.

$400 at Resy restaurants. There are over 10,000 of those, I’m constantly going to one in NYC. Versus the obscure list of literally tens (not tens of thousands, just tens) of OpenTable exclusive restaurants with CSR.

$600 at FHR and they can be used for one night stays. Versus $500 Edit for two night stays. And more engagement from hotels with FHR program overall.

Didn’t take anything away either.

Sure there are more coupons but for those of us used to using coupons on this card, these are actually usable and deliver more value!

This one is a big keeper. CSR is now very replaceable. C1 for lounges (will have equivalent lounge locations to CSR in NYC). Citi for daily spend (Strata Premier, Strata Regular and DoubleCash for $95, or $0 if you also use the Premier hotel credit). This is clearly the new 1-2-3 combo and CSR is now relegated to the dust bin.

Folks, does this mean that if we already used and received the old annual $200 FHR credit, that now we get another $300 FHR credit for now through December? Oh lala… me like-y.

@Your Two Cents — It always was ‘broader’ if you merely used it for United’s Travel Bank each year.

@1990

It’s awesome. Western karens have zero power, nobody cares about their perceived grievances. You can actually speak more freely and have civil conversations without fear of being murdered for your beliefs, so there’s that. Oh wait no, it sucks, it’s horrible. Stay away.

@Your Two Cents – Actually they list that under “What’s missing?”

The airline fee credit has not changed.

@1990 – anything $900+ is $1,000, so $895 feels less, they weren’t ready to break the thousand barrier

@Mantis “You’re really going for that first prize bicycle for selling the most coupon books” .. except you don’t see my links in this post, do you? #apologyaccepted

@Gary Leff, @Mantis, and everyone… this is all really exciting… I mean, I feel like Ryan Gosling’s character, Jared Vennett, in the 2010 film, The Big Short: “Oh, I’m jacked. I’m JACKED! I’M JACKED TO THE *TITS*!”

@Peter

Come on, don’t compare to the edit, the most non benefit ever. $250 off (or whatever , I can’t keep up) $1000+ at properties that you’d probably otherwise never stay at. That’s the definition of a scam. I value that benefit at $1. So if you’re setting the bar that low, congrats, it’s a win.

Still, nobody needs a credit card to prepay for hotels they have no idea they will stay at over the year. Obviously there is massive breakage, even from ppl that fully intend to use the credits. It’s the easiest benefit to use for those who travel, but still I don’t want to prepay nearly $1k for it. All the other credits are useless except under specific circumstances, or if you value your time and energy at $0.

@Peter gets it; many others will debate preferences between this and other cards. For the most part, we still believe and support the general ‘system’ of cards and awards. This is the way.

Whereas, some folks, like @Mantis, appear to be a nihilists (‘nobody needs a credit card’ …psh, you’re at VFTW, buddy, read the room); they’d be happy to see it all get torn down, and think they’d enjoy watching it burn. This is not the way.

Exciting day! (Dare I say, “dreadfully exciting”, @1990) Not that it may have mattered as these negotiations take a long time, but it’s always nice to have the opportunity to go after you see what your competition does.

I wonder if they’ll announce a SUB that kicks in after the af hike to incentivize people to wait.

@Gary @1990 — On the other hand, does the $1000 barrier make it feel more premium as an incentive for people to apply? Probably doesn’t outweigh the people that think what you said but interesting food for thought.

@Peter — That seems like a good system! Thanks for sharing.

Exciting day! (Dare I say “dreadfully exciting”, @1990). Not that it would have mattered as these negotiators take a long time, but it’s always nice to go after you see what your competition does.

I wonder if they’ll announce a SUB that kicks in after the af hike to try and incentivize waiting.

@Gary @1990 — on the other hand, would breaking the $1000 barrier feel more premium and make people want to apply more? Probably doesn’t outweigh what you said but interesting food for thought.

@Peter — That’s a cool system you came up with!

@Gary Leff — I think there’s a delay issue with posting comments recently. Not sure what’s up. Until that’s resolved, expect a lot of duplicates on here…

@L737 — S13E3, does Fry seem more ‘mopey’ to you this season? At least there were even more returning characters… Scruffy (and the bucket) ‘eee-yup’

@Gary, I enrolled in the $400 Resy credit. Do you know (or assume) there’s 12 more days in this quarter for $100 and then another $100 starting in October?

@1990 — That’s what happens after you get married am I right (I kid, I kid – lots of P1/P2 benefits, among other things!)

@George — It seems so. Time to eat, son!

@Gary

“except you don’t see my links in this post, do you?” #apologyaccepted

Ok fair enough, I apologize, I was wrong…but obviously just teasing you. I still disagree on your assessment, but back when I went to business school in the mid 2000s, one lesson I learned is that reasonable people can disagree. I hope that’s still true.

The original American Express Platinum Card came out around 1985. It had an annual fee of $200. At that time, many ordinary Visa and MasterCard (Master Charge) had a small annual fee. The original platinum card came with an Amex magazine called “Destinations”, lounge access for major airlines (which had minimal food).

@Mantis — Becoming less of a thing; really depends on who’s in-power. Kinda like how the CCP rules with an iron fist in the mainland; unfortunately, we’re adopting one-party style totalitarian tendencies in the USA, too. That’s a horrible direction. Hope we revert back to sanity, soon. We absolutely should be able to disagree civilly without threats of violence or attempts to ‘cancel’ other’s livelihoods… yet, gonna be a lot of disingenuous ‘but, but’ about all this, no doubt. So much for ‘free speech’ eh?

I find the $300 lululemon credit interesting. At a minimum, this is much better than the $50 Saks credit, which is… still there! From a cursory look at the website (which I just visited for the first time), there is also plenty of non-yoga pants stuff on there – at a minimum this is a free men’s polo shirt every 3 months.

But it gets better, because lululemon is constantly at 10x on Rakuten. Just pick a day in the 3 month quarterly window where it’s at 10x. With a small amount of effort, no reason one cannot earn 3,000 MR points every year for doing very little. Or use AA’s eshopping portal – it’s sometimes as high as 6-8x looking at past history (most commonly at 2-4x but you only need that one day every 3 months, right?). If it’s at 6x for instance that’s 1,800 AA miles and LPs per year (more LPs if you are in the 20-30% bonus).

Not getting or keeping the platinum card for this, but end of the day, easy enough credit to use even if you don’t wear “yoga pants”. Buy some gifts for people, put your polo shirts on e-bay, whatever, this one takes some attention-span but really does not seem that hard.

Most of this stuff is utterly useless for frequent international travelers. Uber credits: US only. Resy credits: US only. Streaming credit: content is geo-restricted. FHR credit: basically a Bed, Bath & Beyond coupon (a “discount” on inflated prices).

The one area where the Plat still shines is the 5x points for direct airline bookings. That can add up quickly with J/F bookings. Otherwise, a free C1 Savor card easily beats the Resy credit (cash back on all food-related purchases worldwide), while any number of platforms beat FHR.

@Rob- Amex, Chase and C1 are in the airport lounge business and have made certain offerings to US based customers. Frequent travelers, especially frequent domestic US travelers that do not get lounge access with a domestic first class ticket, like to go to their lounges. If you would like to regularly access their lounges, they have “premium cards” which charge a lounge fee of $895, $795 and $395, respectively. They also provide credits to offset the lounge fee which one can take advantage of, or not take advantage of. The value of those credits can exceed the value of the lounge fee, but your mileage may vary. I suspect many on this site enjoy having access to these lounges and are hopeful that they can offset the lounge fee by using many of the credits that are offered.

If you have no interest in their “premium” lounges (perhaps you are mostly outside of the US, regularly fly in J and therefore get lounge access, or maybe you don’t care about lounges at all) and would like to earn points, I agree there are many better ways of doing so other than paying for the Amex Plat, the Chase Reserve and/or the C1 Venture X.

You can get the WF Autograph Journey and earn 4x points on airfare instead of 5x with Amex Plat, for instance, although WF transfer partners are limited. For folks who are primarily in the US, I would suggest the combo of the Citi Strata Premier ($95 but if you use their $100 hotel credit, $0), Citi Strata Regular ($0) and Citi DoubleCash ($0). The Premier unlocks the 1:1 ratio of TY transfer partners, including transfers to AA, and the “trifecta” of those three cards together have the most bonus categories.

I also agree that the C1 Savor provides excellent value along with no foreign transaction fees, is an excellent option for those who spend more time outside of the US, and anyone that has the C1VX would be silly to not also pick up a $0 Savor card and enjoy its 3x points on dining worldwide. But in addition to the Savor you need a $395 VX or a $0 V1 as well in order to unlock transfer partners. While C1 has good international transfer partners, C1 does not have a US airline 1:1 transfer partner (there is a non-1:1 transfer to JetBlue) and does not have the best hotel transfer partners. That may or may not matter depending on your travel patterns.

That said, the C1 Savor 3x dining points does not “beat” the $400 Resy credit. Likewise, the $325 Amex Gold does not “beat” the $0 Savor card because it provides 4x points worldwide versus 3x with the Savor. Apples and oranges.

As an aside, I suppose that Citi also thinks it is in the airport lounge business because you get 4 admirals club passes each year which can be used when flying AA/oneworld (yes, as Gary notes and reminds, you can get 8 passes in the first 12 months of having the card). That, of course, is not remotely the same thing as having access to a bank branded lounge irrespective of which airline you are flying. And 4 club passes basically mean that if you are flying as a family, you can access the club on one roundtrip vacation both ways (2 passes for the outbound for the 2 adults+kids, 2 passes on the return for the 2 adults+kids). So it’s not much of a lounge offering from Citi, although their points offering is potentially very good.

Finally, I’m not going to comment on priority pass here, which many premium credit cards offer. You may get value out of priority pass domestically, but again, your mileage may vary. Nor will I comment on cards that offer lounge access primarily for one airline (AA Executive, Delta Reserve, United Club, Atmos Summit (although that’s only 8 passes), etc.) as those have separate use cases.

Good luck out there!