A new white paper Speed of Data: The New Airline AI Arms Race looks at how Delta Air Lines is using AI in pricing, and how other airlines are likely to respond.

Delta Air Lines has courted controversy by using AI to price its tickets – 1% of fares back in the fall, 3% of fares at the time of its earnings call in July, and with a plan to hit 20% by year-end.

But they say they’re completely misunderstood. They aren’t doing ‘personalized pricing’ which is scary, they’re just automating. So what are they actually doing, and why is this so confusing?

Here’s What Delta Is Doing Today

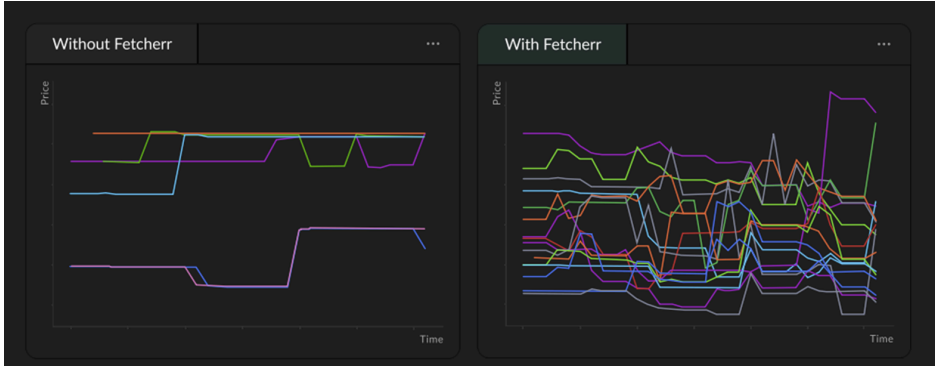

Delta partners with tech firm Fetcherr to link a transformer‑based model directly into fare filing and price setting so prices update near-continuously. Fetcherr says this delivers a 10% increase in revenue. Delta calls the tech a “super analyst.”

Fetcherr’s tech predicts the next number (price) instead of the next word. A GPT‑style transformer ingests inventory, historical fares, competitor prices, events, weather, and all the information that should influence decisions to generate an optimal price and push it live in seconds. That’s “top analyst‑quality decisions at machine speed.”

Airlines have had sophisticated models for years, but humans gated the last mile. What Delta and Fetcherr are currently doing is removing the human bottleneck, so frequency of repricing becomes the competitive edge.

Why The Backlash?

The paper claims that this tech has been conflated with personalized “dynamic pricing,” but that the model does not use customer‑specific data – it’s classic RM data, just faster. That’s no doubt true today.

So when Delta was asked by Senators to address their plan to use information about individual customers to figure out how much they’ll pay, Delta responded that they aren’t doing this at all. They’re really just using computers to help their analysts become more efficient.

Where could we all have gotten the idea that Delta “will have a price that’s available on that flight, on that time to you, the individual”? From Delta’s President. Glen Hauenstein shared at their November 2024 Investor Day that they aren’t there yet but what they are working towards is offering specific prices on specific flights to specific customers. This is called “offer management.” (Emphasis mine.)

[T]his is again a full reengineering of how we price and how we will be pricing in the future.

And if you think about it today, there are two disciplines. There is pricing, which sets the price points and then there’s revenue management, which controls access into the inventory of those price points.

And over time, we think this is going to get melded together, that it’s going to be really just offer management. That we will have a price that’s available on that flight, on that time to you, the individual. Not a machine that’s doing an accept reject and a static price grid.

There’s a fear that someone might have to travel to a funeral, or pay any price to visit a dying loved one, and Delta will know that. The thing that constrains their ability to charge a premium, though, even if they did know a given customer’s actual demand is competition. That’s what makes competition so important, and why governments should stop blocking competition and subsidizing incumbent carriers.

Nonetheless, Delta isn’t doing this today, so Delta prefers to speak publicly about what they are currently doing – while telling investors that they are going to do something much more in order to convince them they will earn more in the future and thus warrant a higher stock price.

Where Is AI Pricing Going?

Delta is very clear that they see the future as using AI to target individualized prices at specific consumers. But they aren’t there yet.

We’re going to see a short‑term arms race in the industry. Other airlines have to deploy comparable automation or accept a pricing‑speed disadvantage. The hardest part of this is data plumbing. Delta has already spent about a decade unifying data. And other airlines are likely far behind. That gives Delta a temporal advantage.

Several airlines use Fetcherr including Azul, Virgin Atlantic (49% owned by Delta), Westjet (15% owned by Delta) and Viva Aerobus. Azul was actually first to acknowledge it publicly in 2022.

Fetcherr isn’t the only one in this space. JetBlue partnerd with FLYR. Virgin Atlantic did, too and reported a 10% increase in seat fees priced dynamically. flydubai is using PROS and Lufthansa announced a partnership with them as well.

Ultimately we’re going to see a lot of incremental progress before we get to anything like the kind of ‘offer management’ that Glen Hauenstein talks about. First they’re going to have to address system underperformance on off‑peak days (discounting too much), potential “flash‑crash”‑style price spirals when algorithms react to each other, and what kind of human supervision is required and even possible when fully turning decisionmaking over to the machine.

The Tool Will Decide When To Offer The Lowest Prices – Not Which Individuals To Gouge The Most

What’s mostly being misunderstood is that AI is likely to lead to greater confidence offering lower prices to specific customers, rather than raising prices on individuals (who at least currently can buy tickets without logging in at Delta.com, but at Expedia, or buy from another airline).

The way airlines generate a lot of their incremental revenue isn’t just figuring out whom they can charge more to, it’s to figure out how to charge less to new customers without offering those same low prices to current customers who are buying tickets anyway at higher prices.

- Airlines want to charge high fares to price-insensitive business travelers

- And they want to charge low fares to attract price-sensitive leisure travelers, to the extent they have empty seats to fill (since those fares are almost all incremental profit)

- But they don’t want the low fare offered to a leisure traveler to be available to that business customer who would have bought at a higher price.

Personalized pricing has been an airline goal for the past decade and a half, and one of the ideas behind ‘new distribution capability’ (“NDC”). But the trick is simply to figure out whom to offer the lowest fares to! And AI can help them offer more low fares to more people without cannibalizing high fare revenue (as well as avoid offering those low fares and selling too many seats that customers will buy later at higher prices).

Airlines long used Saturday stays and 14- or 21- day advance purchase requirements to segment business travelers (who buy last minute and don’t stay away the weekend as much). This is now accomplished with basic economy (meant to offer low fares to price-sensitive leisure travelers) and even offering the lowest fares only when more than one passenger is on a reservation (because business travelers usually book solo). AI can move towards less blunt instruments to accomplish this goal.

I’ve been trying to understand why American Airlines CEO Robert Isom blasted Delta for a “breach of trust” during his airline’s earnings call. Maybe it was just ‘sure we underperform financially but at least we do it ethically’ or maybe he wanted the story to be something other than his airline’s performance. But it also may be offering an early excuse for why they’ll lag Delta in rolling out continuous pricing – using ethics as a substitute for technical capability.

But make no mistake, this is spreading – even to American. American’s Vice Chair and Chief Strategy Officer Steve Johnson mentioned upside from “the opportuntiies to deploy AI in revenue management” at the Morgan Stanley Laguna Conference on Thursday.

How much does AI price the ticket for Ed’s BFF? Or does she ride for free?

Using AI to determine the price to charge EVERYONE minute by minute: Perfectly OK with me.

Using AI to determine different prices for different people at the same time: Evil.

@ Gary — What is Delta doing? Lying like they usually do.

I bet Tim would be willing to pay $1,000 for a Saturday noon flight ATL-BNA in Delta Main

Let’s do a beta test

Good article, Gary, especially the homework on what Delta’s President Glen Hauenstein shared at their November 2024 Investor Day: “That they aren’t there yet but what they are working towards is offering specific prices on specific flights to specific customers”. Some could call that “offer management”, I would call it grossly illegal.

since it is already almost 1.30 pm in ATL on at least this Saturday, you would be wrong, J

I’m glad Gary wrote this article. I’d far rather read this type of stuff than the anecdotal bad passenger stories.

Hauenstein is a smart man but I bet he tried to make something sound customer friendly and said the wrong thing. Most companies have PR teams specifically because execs usually aren’t the best public speakers.

UA’s PR dept. wouldn’t say the things that UA execs say but it is clearly a couple loud-mouthed execs there that grab the attention and that is what those execs want.

How does this affect my seat price on Delta if I’m using Google Flights without signing in? Would that be the workaround if Delta’s site tries charging me more for the same seat?

@Ken If you are using google flights, clearing our browser history and not logging in, you have done the best you can to avoid AI customizing to you. Some people have discovered that if you VPN to travel sites from other countries (like India) you can find lower hotel and car rental rates. May want to try that for your air travel as well.

Optimizing pricing such that they are charging the maximum a customer is willing to pay is obviously not good for the consumer. Of course the wildcard is competitive response, it’s not so easy. AI is not god, it’s just an algorithm, and doesn’t always get everything right. I find people who are the least mathematically inclined are the ones most believing and fearful of AI. In reality, it’s entirely possible that they think they go down a profit maximizing route and end up driving away customers. But I’m sure nerfing credit card benefits and adding a new more expensive top tier card will fix everything.

Delta is getting more efficient at raping their customers.

I don’t like this anymore than the next person but it’s just the tip of the iceberg. There’s no turning back. You can’t stuff the turd back in the dog.

@TexasTJ – I do not think it is currently ‘grossly illegal’ remember that state regulation of airline pricing is preempted by the Airline Deregulation Act.

I’m positive DL’s current statements are lies. They’re pricing the tickets individually, and they do it all the time. My reasons:

– they mostly refuse to quote multiple-day prices (“my dates are flexible”) if I don’t login into delta.com; show them fine after I log in.

– recently, I observed (and saved screenshots to prove) DL jacking up prices, from $479/pp to $718/pp for a 40 min (ATL-GPT) flight. They then lowered them to still ridiculous, but more reasonable $649, then $479. The $718 price was listed 5 or 6 days before the outbound flight, with 35 available seats.

– I currently have 3 future bookings, to various destinations. Every time I check them, about once a week, they’re priced HIGHER then when I made them. And I keep reading about airline prices decreasing. For whom?

My prediction is that there will be a giant grassroots effort to thwart individual pricing, and there will be no need to outlaw it. Smart people will gather data, collaborate, and reverse engineer (or maybe even manipulate) the AI pricing engines as fast as they can adjust. Many will do it just for fun, while some may even profit off of it, e.g.: “pay $10 and I will show you how to save $100 on your flight”. Looking forward to it!

“How does this affect my seat price on Delta if I’m using Google Flights without signing in?” Gee, the article you skimmed over (apparently) suggests it makes no difference.

Would any airline be profitable if their only revenue was airfare? Therefore, it’s hard to look at historical low inflation-adjusted airfares and use the term “gouge.”

Time to re-regulate the airlines. Customer service has gone to sh#t and maintenance has suffered.

Booking Business class to Madrid last month, we saw prices go up and down every time we looked. With my girlfriend on one end of the couch and me on the other, we saw UA prices jump from $4700 to $7500, then to $6500. While she was looking at the $6500 price on Expedia, I again saw the $4700 one on the UA site. She quickly logged back in and grabbed us two seats.

Recently saw Delta D1 flights JFK to CAT for over $23,000. Yes, $23,000!!!!

@ Alex — I like the way you think!

Delta’s plan to extract the maximum revenue from each customer: I have two Eponymous Laws that might apply:

(1) Howe’s Law: “Every man has a scheme that will not work.” AI will have a new scheme that will not work over and over again.

(2) Zymurgy’s First Law of Evolving Systems Dynamics: “Once you open a can of worms, the only way to recan them is to use a larger can.” Right. So when AI (“can”) fails, they will build a more powerful model (“larger can”). And so forth.

Besides, eventually, Captain Kirk (read travel bloggers) outsmart the AI every time.

Ok, it is Saturday, I will come up with better arguments next time.

But, @Tim Dunn, anecdotes are all we have anymore! Data? *yawn* And, still managed to throw shade on United…

@Parker — I set my VPN to Vietnam; always fun to see a $100 flight cost a few million Dong.

@Gene — Show us on the doll where Delta (and Marriott) hurt you… *wink*

@Alan — No, no… it’s consensual.

@David gets it.. “just the tip”

@Alex — Ah, so, scamming off the scam. Niiiice. A tale as old as time.

@WileyDog — What is CAT? I thought LIS was the airport code for there. Unless you were doing a play on words, since you’re Wiley…Dog … wanting CAT.. did I get it?

@Captain Freedom — Who’s Ed’s BFF?

@Tim unusually lame retort even for you. As an fyi there are 52 Saturdays in a year.

@1990

Dyslexic. I am. CTA, Catania Sicily.

You gotta love the Brave New World of ticket pricing.

Maybe they will just add 20% (consider it a service fee such as restaurants are doing) on top of the price at checkout and say it was AI that repriced it. Bait and switch. Having a live one on the hook. I have had the price change to higher from one search to another search on the same airline site. I have also changed my dates and times to get one of the tickets at the original, lower pricing. The interesting thing is that once a price goes up it seems to get stuck at the higher price for a long time (days or weeks or even months.) Maybe a cookie thing. If AI is really changing prices to meet market changes, the price should change almost every time you make a separate inquiry, sometimes up and sometimes down. If the price just gradually or abruptly goes up, it may be gauging how desperate a potential passenger is for a ticket.

People are confusing custom pricing based on your personal views (via browser cookies or IP/MAC tracking) vs a dynamic market price based on holistic data. It is easy to confuse, because when a single individual is looking for flights for a concert, game, or holiday, it’s highly likely multiple people are too. But the individual will think that, due to their constant search on a similar set of dates, that the price went up from their own search. However, it’s more the RM model is detecting or predicting greater demand.

AI is just doing what an analyst would do on a cadenced cycle; but now it’s going to be much more frequent, potentially even real time.

There is nothing wrong with telling AI that its role is to be an experienced airline pricing analyst and to mine historical data to suggest fares and timing. Think holiday fares between city pairs. But if the model is trained on passenger traits or circumstances, things go off the rails. And that’s being optimistic. In many countries, mining personal data for any reason — much less to create “custom fares” — may get a company into trouble.

@WileyDog — Oh! Nice. I mean, Sicily, not France. Bah!

If a fare was good for only a billionth of a second before going on to the next fare, it would probably be only locked in by a single customer. It would be hard to distinguish what happened as different from individual pricing bases on an algorithm on how much can be extracted from each individual customer. A digital record could be generated showing that the high priced ticket was only available for a certain number of nanoseconds and the customer locked in during those nanoseconds. Too bad, so sad, sang loudly all of the way to the bank.