I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

American Express Platinum Card® has gotten much better. There’s an initial bonus offer as high as 175,000 Membership Rewards points after $12,000 spend in your first 6 months of cardmembership. (“Welcome offers vary and you may not be eligible for an offer.”) (Initial bonus offers vary and you may not be eligible for an offer – the actual offer is confirmed prior to finalization of application so there’s no credit score impact unless you’re approved and choose to accept the card).

The American Express Platinum Card® has an $895 annual fee (see rates and fees). They tout $3,500 in benefits – in fact, over $2,900 in credits are available. The initial bonus offer, combined with elite status offered by the card and lounge access, make this a no brainer to get.

I’ve had it in my wallet for years. It was sort of marginal lately, but the refresh makes this super easy to keep and get real value from. It’s not a card I use for my spending outside of airfare. It’s a tool for better travel travel experience with Hilton and Marriott Gold status, car rental status and access to Centurion Lounges and 10 complimentary Delta Sky Club visits when flying on an eligible Delta flight.

Delta Sky Club LAX

Delta Sky Club Austin

Centurion Lounge New York JFK

I personally find great use for these credits, though there are others:

- $320 Uber: $200 Uber Cash + $120 Uber One Credit, up to $15 in Uber Cash each month plus a bonus up to $20 in December (add your American Express Platinum Card® to your Uber account and use it on rides and delivery orders in the U.S to use the credit, and paying for an auto-renewing Uber One membership covers the cost of membership in statement credits).

- $300 Digital Entertainment Credit: Experience the latest shows, news and recipes. Get up to $25 in statement credits each month when you use your Platinum Card® for eligible purchases on Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $600 Hotel Credit: up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts or The Hotel Collection bookings (the latter requires a minimum two-night stay).

- $400 Resy Credit: Pay with the American Express Platinum Card® at U.S. restaurants which use the Resy platform (or make other eligible purchases through Resy) and get up to $100 in statement credits each quarter. The card also offers special access to reservations on select nights at participating ‘in demand’ Resy restaurants. (Enrollment required.)

- Up to $209 CLEAR Plus Credit: Sometimes it gets you through security faster than PreCheck, not always. I travel enough that I want all options on the table, especially when lines are long and I don’t show up to the airport super early. I don’t like queueing. This credit covers the cost of membership.

- $200 Airline Fee Credit: You choose one qualifying airline and receive up to $200 in statement credits each calendar year for incidental fees like checked bags that are charged by that airline to the card. The past several years I’ve had luck buying under-$100 Southwest Airlines tickets with my credit (I register Southwest as my airline of choice) but I assume at some point this will no longer work, since it isn’t supposed to.

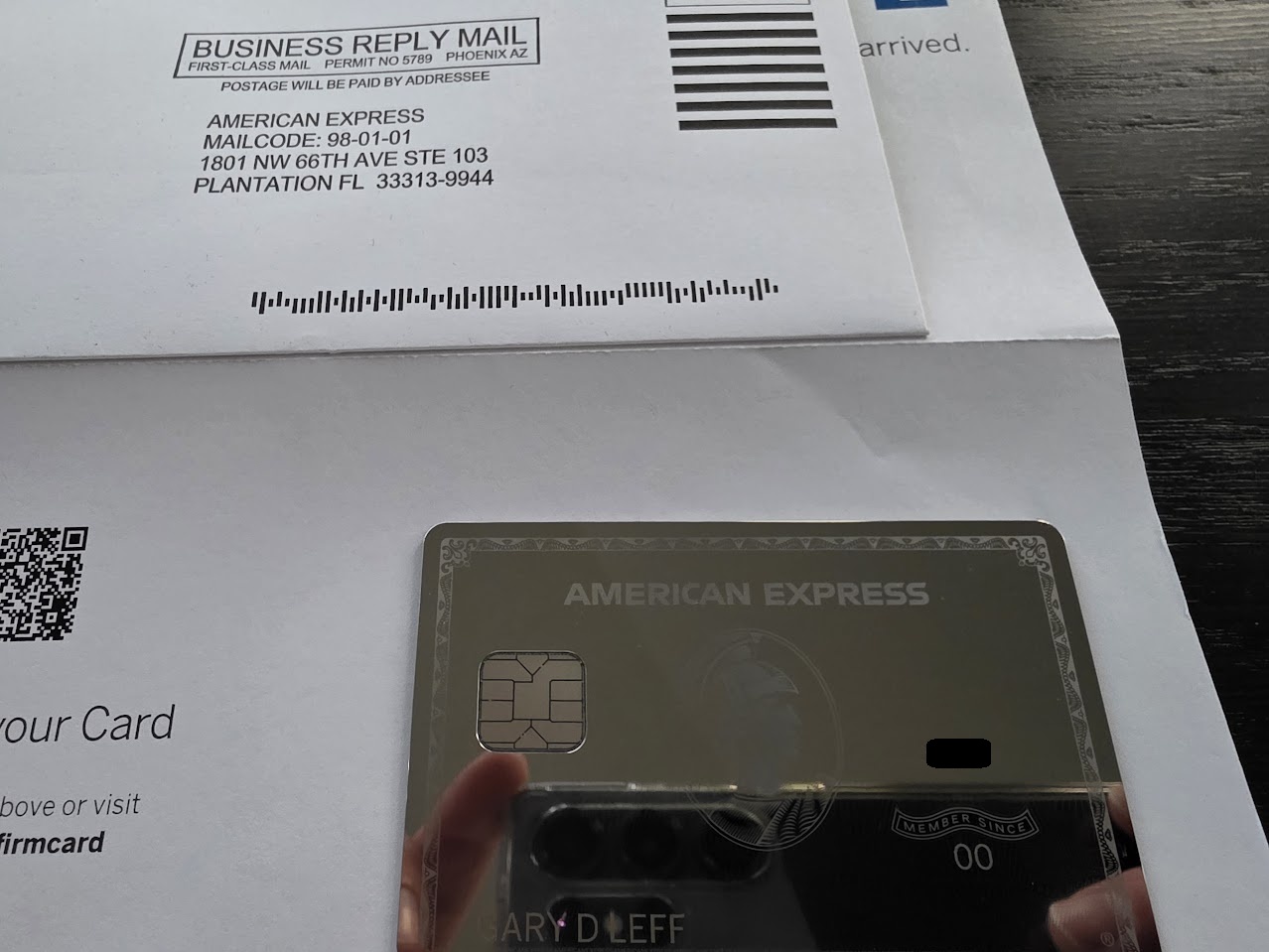

But is it weird that – with all of this – I was excited to get my card replaced with the new mirror design? They said it wouldn’t arrive until October 3. It showed up September 24.

The card really is a mirror:

It’s a nice, clean design as well. I like it.

I don’t like to admit that I was excited over a credit card’s aesthetics, but we might as well find joy in creativity and design. I hadn’t really liked the artistic designs Amex has offered in recent years. This one is somehow different.

Platinum Card® from American Express

For rates and fees of Platinum Card® from American Express, click here.

Gary, did you have to request a new card or was this sent to you automatically?

@kimmiea – I requested it https://viewfromthewing.com/amex-platinum-mirror-card-just-dropped-how-to-get-yours-before-everyone-else-does/

How is it with fingerprints? The shiny happy people song comes to mind.

I like the Kehinde Wiley card! Flower power.

Did you know that the new MIRRORED Platinum American Express card could be a lifesaver in the event of an aircraft crash in the wilderness? It’s a travel essential you won’t want to leave home without. Inspired by Gary Leff’s article on VFTW, I decided to order this innovative AMEX card design. Since the mirrored Platinum American Express card lacks a sighting hole, here’s a guide on how to use it for signaling help after a crash:

1. Form a “V” shape using the index and middle fingers of one hand.

2. Extend that arm to frame your target (such as a helicopter or a distant ship) within the notch of the V.

3. With your other hand, hold up the mirror.

4. Adjust the mirror until you catch the sun’s reflection on your V-shaped fingers.

5. Keep the light focused on your fingers and flash it three times toward your target, repeating as needed.

I am writing this reply from the sky on my American Airlines DFW to DTW flight. Your new mirrored Platinum American Express card could prove invaluable and save your life in a critical situation!

Wow looks nice, enjoy! And thank you for your valuable PSA @Ken A, as always — very resourceful.

I envy you. mines like stained or graffiti, embarrassing to present

@Peter — Nice REM reference!

@Ken A — So… you purchased AA WiFi? Oof… shoulda flown Delta…

@ Gary — It has been widely reported that UberOne is nothing but a scam. Uber simply raises the price of your ride and then subtracts back the “discount”. This scam does not save you any money. Knowing uber, it probably costs you MORE.

Reagarding the silly “mirror” card, I guess it is great for narcissistic cocaine addicts, like Don Jr, but otherwise, why not get the plastic version of the card? Why carry around the excessively heavy/thick metal card at all?

@1990- one of the lyrics is “gold and silver shine” but sadly no mention of Platinum…

@1990 @Peter — That whole album went platinum though so it all works out!

Probably one of the few who bothered to order one. That’s why.

What nonsense.

@Peter @L737 — “…and I feel fine.”

@L737 – now we’re talking! Wikipedia said it went quadruple platinum – just like @1990!

For those of us who don’t want to weigh our pocket down with a mirror that doubles as a credit card, Amex will send out a plastic card replacement if you ask

I’m pleased to report that each of the new Q3 Resy and Lululemon credits are posting (on all four cards)… booked 1 of 4 FHR stays for the new $300 credit; it should post eventually, too.

@1990: You wrote, “So… you opted for AA WiFi? Oof… perhaps you should have flown Delta…” Fortunately, I received 20 complimentary minutes of Viasat internet after watching a sponsored ad. I can’t help but wonder if the absence of free broadband internet on American Airlines is why many premium passengers are choosing to fly with Delta Air Lines instead of with American Airlines.

@1990 – LFG!

@Ken A – Using your precious internet time on VFTW? I salute you, sir.

@Ken A — I’m assuming this was AA2508 (6:49-10:28PM, 2:39 duration on an a321), or AA1355 (2:47-6:21, 2:34 duration on a 738), each of which experienced about 2 hours of flight time above 10,000 feet with WiFi active, if working properly.

My questions:

Was watching the advertisement(s) worth accessing ‘free’ WiFi for 1/6th of the eligible time of the flight?

Do you wish you had T-Mobile so that you could have received ‘free’ WiFi for the entire flight without watching the ads?

Do you wish you’d paid $10 for the WiFi for the entire flight, or $49.99/mo, or $499 annually, for those services?

Are you excited that as an AAdvantage member, starting January 2026, supposedly, WiFi will be ‘free’ on AA?

I hope my format and inquisitiveness matches your typical style, and that it is appreciated and/or mocked. 1990, out!

@ 1990 – T-Mobile is best!!

@Gene — Apparently, they actually are, at least for ‘free’ in-flight WiFi on a variety of airlines.

Just looked it up: “As part of In-Flight Connection, eligible customers get free connectivity with streaming, where available, all flight long on nearly 100% of domestic flights on partner airlines: Alaska, American, Delta and United. We partner with Intelsat, Viasat, Thales and Panasonic to give free in-flight Wi-Fi on Alaska Airlines, United Airlines, American Airlines, and select Delta Air Lines flights. T-Mobile is also a proud partner of Delta, giving SkyMiles Members fast, free in-flight Wi-Fi on Delta and on us on most Viasat flights within the U.S.”

That is super generous. Or, more so, why is Verizon and AT&T so stingy? Hmm.

Thanks for sharing! Mine is scheduled to arrive in a couple days and I’m SO excited. I agree with you that other designs didn’t feel very classy or appealing so ive always just carried the regular card. I love the classic simplicity of the mirror design! Cheers

@ 1990 — Their are FAR more T-Mobile benefits that in-air wifi. You should research them. T-Mobile is hands-down the best of the big US cell phone companies. They also offer military and over 55 price reductions on their plans.

@Gene – Agreed. If I wasn’t grandfathered into a really cheap VZ plan I’d be with TMobile. I always get envious when I see the TMobile Tuesday deals on DoC (which @1990 got me to start checking regularly, if only there was a referral bonus)

@L737 — Aww. No referrals needed. I’d share good ideas for the ‘love of the game.’ Keep churning. Don’t hoard points. Earn ‘em and burn ‘em. (Zoidberg ‘woop woop woop…’)

@Gene–You bring up an interesting point about Uber One. It’s almost impossible to know if it really saves you any money. I just joined after Amex announced the Uber One credit. One supposed benefit was that they assign you to higher rated drivers. I recently ordered food via Uber Eats and the driver brought me someone else’s order. It clearly had another person’s name on it. Regardless, I was charged, my Amex Uber Cash was deducted, and I have had no response from Uber about refunding the charge or returning the Uber Cash–and I received no food! The biggest problem I have with Uber and Uber One us that there is no service whatsoever in the case of a problem. I may end up dropping the Uber One “benefit.”

Gary–I agree that going gaga over how a credit card looks is a little silly but I did it once myself. In my case, it was the limited edition Delta Reserve card with a 747 design–and made from metal salvaged from an actual 747. It was incredibly cool. I would just point out that your photos of your new mirrored card don’t show it off well. It did look good in Amex’s promos, though.

@Gene RE: the Uber One scam

When Amex started the $15/month Uber credit, I regularly say the price of Uber almost exactly $15 more than a LYFT.

@Steve from Seattle — Thank you for bringing that up! I got the ‘black card’ one from N667US for my Delta Reserve card; it’s special to me because I flew on the 744 between ATL-NRT in 2013. Did you get one of the black or one of the ‘white glossy finish’ background cards (N662US, N670US)?

I do get the digital credit. I did order two golf hats from LuLuLemon for, basically, free – like I really needed two more hats! And the only time I use the card is to pay for airfare. Mirror or not, I use my wife’s Gold card a whole lot more. I’m in my late 70’s and since I graduated dental school, I’ve gone from the following: Green-Gold-Platinum-Centurion-Platinum. Back in the day, there was no competition, now there is lots. Problem is all of them are taking away the sweet spots while the feels continue to escalate. It’s a quandary!

@gene no one likes you. And you have never won a spelling bee, which likely led to the bitterness.

@1990: Here are some answers to your questions. Yesterday, I embarked on a one-day trip from Detroit to Charlotte, then to Dallas, and back to both Charlotte and Detroit. The 6:00 AM flight, AA387 from DTW to CLT, was excellent. Upon arrival at CLT, I took the opportunity to visit the Provisions by Admirals Club located in Terminal A, near Gate A1. While I was there, the fire alarms were sounding and flashing for about 20 minutes across terminal A. When I inquired with the gate agents about whether an evacuation was necessary, they advised me they disregard the fire alarms. The Provisions by Admirals Club by gate A1 in terminal A offered a delightful to-go breakfast salad with salmon. Additionally, guests could choose from a yogurt berry parfait with granola, fruit salad, a garden salad with ranch dressing, or a Mediterranean salad. Then I flew from CLT to DFW on AA2747.

I was advised my return on AA1212 had a late crew so I would miss the connecting flight from CLT to DTW on AA419. No problem. I booked the non-stop flight 1355 from DFW to DTW, arrived four hours earlier and received a mileage refund for the reduced mileage for a non-stop flight. You should know the WiFi is operational gate to gate when using Viasat connectivity. Your flight does not need to be above 10,000 feet.

To answer your questions:

1. Was it worthwhile to watch the advertisement(s) in exchange for accessing ‘free’ WiFi for only 1/6th of the eligible flight time? The ad I viewed promoted visiting a city in Texas in exchange for 20 minutes of complimentary internet access.

2. Do you wish you had T-Mobile to enjoy ‘free’ WiFi for the entire flight without having to view any ads? While T-Mobile would be convenient, I find T-Mobile to be deprioritized in certain areas like Barrow, Alaska above the Arctic Circle. As a first responder, I rely on Verizon becuase I don’t want to get deprioritized during an earthquake, hurricane or blizzard.

3. In hindsight, do you wish you had paid $10 for WiFi for the entire flight, or considered the $49.99 monthly plan or the $499 annual subscription? I believe paying anything for slow internet is unreasonable.

4. Are you looking forward to the prospect of free WiFi on American Airlines, supposedly starting in January 2026, as an AAdvantage member? When flying with American Airlines, I keep my expectations low to avoid future disappointment and regret. I look forward to American Airlines delivering on all their promises like free WiFi.

@1990–I think my 747 Delta Reserve card was black but I couldn’t tell you the tail number the metal came from. I no longer have that account so haven’t looked at the card in a while and couldn’t find what I did with it when looking just now. (No, I didn’t throw it out!)

I never flew on a DL 747 but my first trip on one was memorable. It was on UA, from SEA to ORD, and I remember the bar on the main deck in economy class. Ah, how times have changed.

@Ken A — Thank you. You always deliver. Without fail.

Was that a mileage run? Quite a unique routing.

I’m glad you got to checkout the new stuff at CLT. You likely recall how it’s been a topic of discussion on here, including the aging Admirals Clubs, new ‘provisions’ stand, as you mentioned, that Priority Pass location that tries to pitch paid reservations, and a new Delta SkyClub, supposedly. Were others packing items to-go, like, clearing the shelves, or was it overseen by a dedicated agent to prevent such ‘looting’?

Glad AA1355 worked out for you! Seems like a winner under those circumstances.

And, as to WiFi, that’s good to know, gate to gate, over 2.5 hours of WiFi. Woohoo!

After watching that ad, did it make you actually want to visit the city in question? I’m gonna pretend it was… El Paso, no… Lubbock?? Psh, them oil rigs!

As to mobile carriers, yeah, I’m loyal to Verizon as well, mostly because it gets coverage while underground in the subways.

Right on about high-speed WiFi; if we’re paying, it better be ‘excellent,’ yet rarely is it. Ironically, I’ve had better connectivity over the Atlantic Ocean on jetBlue transatlantic a321 with complimentary service than some of these regional jets with paid service.

Finally, I, too, like to keep expectations low, and likewise hope they do deliver on that particular promise. Won’t hold my breath though.

@Gene — I still like you, so @Yo Daddy is clearly wrong. Bah!

@Steve from Seattle — It’s an incredible aircraft, fortunately a few still flying around, mostly foreign carriers like Korean and Lufthansa. Getting to sit upstairs or ‘in the nose’ is quite the experience.

@Gary Leff — My new ‘mirror’ Platinum arrived today! I credit you with my receiving it early, because I requested it the first day (Sep 18) thanks to your reminder.

It is a beautiful card. Reminds me a little of Mad Max, Immorten Joe to his War Boys, “You will ride eternal, shiny and chrome!”

“Witness me…” use this card, again and again, in Q4 as I reap these new Resy and Lululemon credits. *sprays chrome*

@1990 – Woot woot, congrats and enjoy! Certainly not “mediocre”

Personally I liked the post-Bonvoy SOG Amex Sjöman card design, as well as the Wiley Plat. The vanilla Plat is too pretentious, so it’s nice to have some flowers to make it plausibly ironic

I just got mine, and I hate it. I know I’m in the minority here, but it looks way too showy. Feels tacky rather than upscale in a classy way. Kind of like Emirates plane interiors. And it collects smudges like none other.

I ordered a bunch of mirror Amex Platinum cards yesterday and it’s now saying it will take up to close to the ides of October for them to arrive.

Since when have you been adding the middle name/middle initial D to your credit cards, and any reason you choose to get it that way?

@GUWonder — Better than the Ides of March… Et tu, Brute?

Greetings 1990. Caesars aren’t for me, what can I say other than that until I am listed as an enemy of the state for being an anti-fascist. 😀

What is with the delay in comments being posted in the comments section of this board? Are some of us added to a “watch list” that requires review prior to our comments showing up on the site even when avoiding the use of blacklisted words in the body of the comments?

I recall some FlyerTalk moderators hoping that would happen to me on this site.

THANKS once again for great tips, in this case, the AMEX mirror card!

#GUWonder – I think it is a caching issue, the comments are not being newly moderated

@ O.K. Thank you. It probably feels tacky because it is. I sincerely doubt that Warren Buffet and his contemporaries carry it in order to feel good about themselves.

The disco ball of credit cards…

Excellent repost, Gary. I’ll say, mine has remained ‘shiny and chrome.’ (“Witness me!”)

Wonderfully decadent. I’ve been very much enjoying whipping mine out. (The card, mind you)

@GUWonder — Apologies for my delay. No Kings, and no arrests (in NYC, at least). ‘7 million of us rose up at more than 2,700 events in all 50 states, DC, and cities worldwide to say: America has no kings, and the power belongs to the people.’

@L737 — “You must have very big (card)… Wow! (Card) so big! Soo big (card)! …This-a man has veh-ry big (card)! …Thank you for stopping by, with your gargantuan (card).”

I used to think the mirror car was silly. Then I realized it is perfect, not only for the typical AMEX Platty cardmember, but for our society at large. Where we as a society have refined our own self obsessions to the point that most of us are guilty of carrying at least some amount of weapons grade reflexive narcissism. Where those who wish to rob us blind would rather we spend our free time obsessing over our own image for an indifferent audience focusing on their own images, meticulously building a profile that will only be considered when a company or person wishes to extract maximum revenue from us.

@1990 — SP throwback! Niiice.

@L737 — One of the best episodes….”He assured me that I have a very large (card)… he said it was mammoth… dinosauric… and absolutely dwarfed his (card)… which he assured me was nearly microscopic in size… my card, he said, was one most likely one of the biggest in the planet.”

I just threw up in my mouth.

@Gene — Because of Amex, or my antics? Both??

Because of

@ 1990 — AMEX! I finally decided to whip out Excel and make a credits spreadsheet. So much noise that I must crunch my own mumbers.

I’ve been with AMEX since 1973. Went the route from Green up to Centurion but not back to Platinum. And I was shocked/disappointed that there was no recognition of my 50th anniversary – right? But I called a week ago and the agent said, “Wow! 52 years! Thanks.” Told her she was the first one to acknowledge it.

I keep it for the 5x on air ticket purchases and I get the $15 for Uber rides. The new Resy $400 seems very worthwhile to me and is probably the reason I will stay despite the fee increase.

A repost and it is still pathetic that one ties their self esteem to a shiny CREDIT card. And what “We’re all looking in mirrors all the time” says.

@Gary — You should change the title to “I Am Loving #My Precious# New Amex Platinum Mirror Card”

I upgraded an Amex Gold card (it was coming up on renewal, and I was set on canceling it but took advantage of an upgrade offer) to the Platinum card and, of course, opted for the mirrored version. It’s nice to admire, but let’s not get caught calling it “My Precious,” lol.