I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Now that October is here, it’s time to execute on the best deal in travel.

Southwest® Rapid Rewards® Performance Business Credit Card (See rates and fees)

Southwest is dangling its Performance Business card with a massive 120,000 Rapid Rewards points after $10,000 spend in the first 3 months. At $299 annual fee, this is an unusually rich welcome bonus that — if you play the timing right — can deliver almost two full years of Companion Pass.

Note also the accelerator categories of 4x on Southwest, 3x on Rapid Rewards partners hotel and car partners through end of 2025, plus 2x on gas, dining, rideshare

Keys to the Companion Pass:

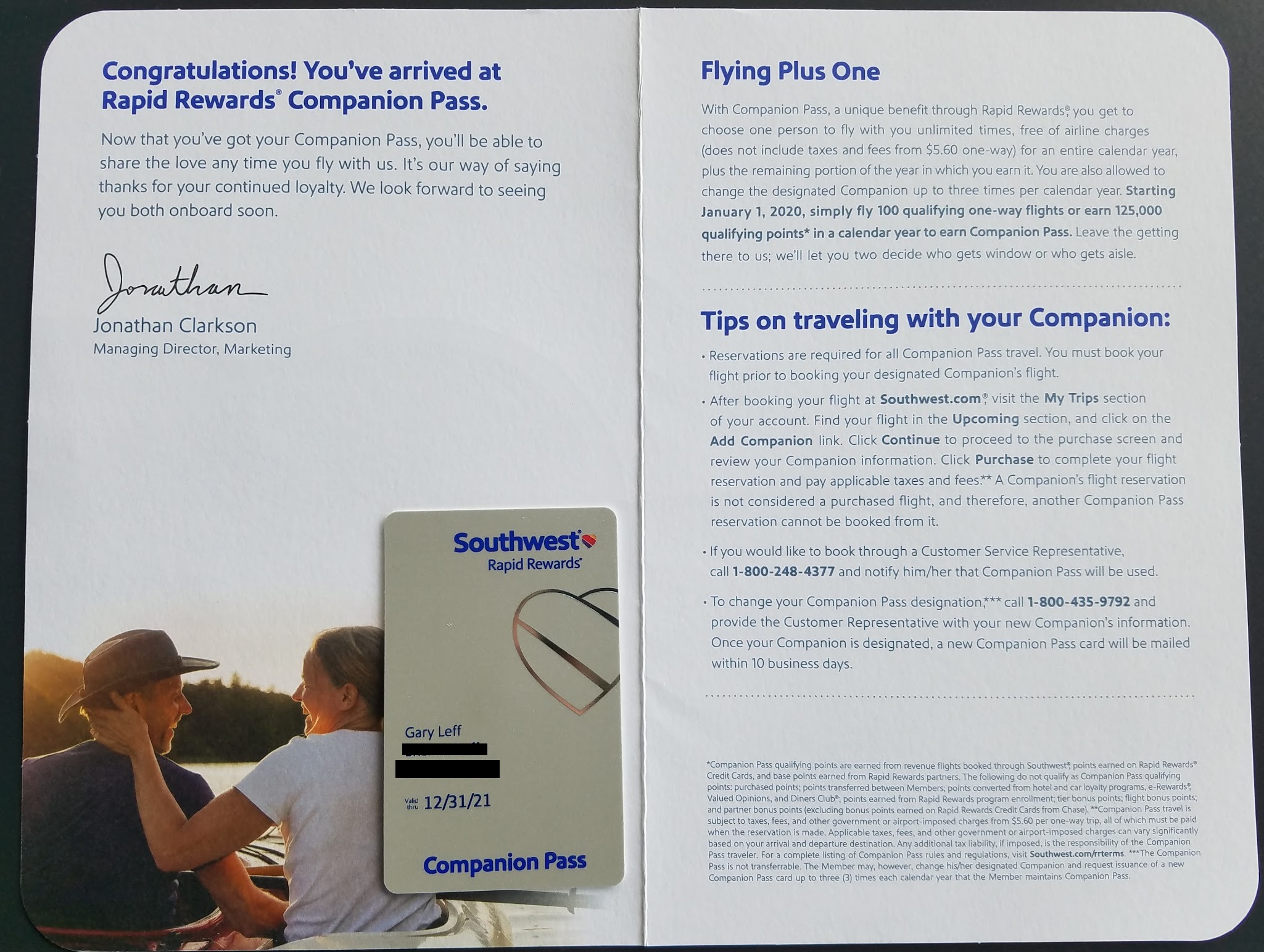

- Earn 135,000 qualifying Rapid Rewards points in a calendar year, and you get Companion Pass for the rest of that year plus the following year. That lets someone fly with you for just taxes whether you’re paying cash for a ticket or redeeming points.

This is the single best deal in domestic air travel if you fly Southwest with a partner even a few times a year.

- Holding a Southwest credit card gives you a 10,000-point head start each year, so effectively you need 125,000 more.

- Apply in October. I’m surprised they’re making it available at the end of the calendar year because of this quirk. You’ll need $10,000 spend, making sure it doesn’t hit until a statement that closes in 2026.

- That way you it Companion Pass at the start of 2026, so it lasts for the rest of that year and the full next year (so, through December 31, 2027).

I’m a former Companion Pass holder myself and need to find my way back in. Southwest is still about 40% of the seats out of my home airport in Austin.

You can’t have had this card’s bonus in the past 24 months. Chase also applies its 5/24 rule, so you need to have fewer than 5 new cards in the past 24 months that appear on your credit report.

Anyone who will fly Southwest at least a few times a year with a companion should jump on this, if they’re in a position to handle the required spend. Even modest use can justify the $299 fee once you factor in free checked bags as well. This is the easiest path in years to a full Companion Pass.

Gary, do you have inside information that Southwest will not increase the 135k point threshold for earning the Companion Pass in 2026? They have done it before, once even with no notice. Your article needs to at least mention the risk.

I don’t have high confidence that the Companion Pass earning and/or usage rules will not change starting January 1. This is the new Southwest after all. Anything to boost the balance sheet now, damn the long term consequences.

@nsx at FlyerTalk — You’re onto something because I would’ve thought SW would have already increased the requirements by now, especially with all the recent changes pushed by Elliott (mis)Management.

It’s not just the free checked bags but the $299 covers assigned seat fees as well (in the sense that you can get assigned seats at time of ticket purchase, even when using points for BE fares).