American Airlines will go from 2 different banks issuing their credit cards in the U.S. to just one in 2026. The new deal goes exclusive with Citibank. Barclays is no longer accepting new applications for its AAdvantage cards. Those were the ones that flight attendants made announcements about inflight.

So Citi’s card is now the one being announced and I find it especially interesting the offer that’s being promoted.

- 80,000 miles after $1,000 in spend within 3 months

- The recent public 80,000 mile offer just ended, and it required $3,500 in spend.

So Citi’s strategy does seem to be to offer something onboard that they aren’t publicly promoting in other channels, and it isn’t just an elevated offer but one with lower spend required.

R.I.P. Barclays AAdvantage Aviator Red

That almost makes me not mind the announcements? Kevin Williamson observed that there was a certain “Clockwork Orange sensation [to] being literally strapped into a seat while someone screams corporate banalities at you on a loudspeaker fifteen inches from your head” and suggested,

It is a “limited-time” offer in the sense that the sun eventually will run out of gas and become a dying star, first engulfing the Earth in fire and then leaving the wreck of the solar system a sterile plane of interstellar cold and utter silence, which will be interrupted only by some addled flight attendant screeching about the limited-time…card offer.

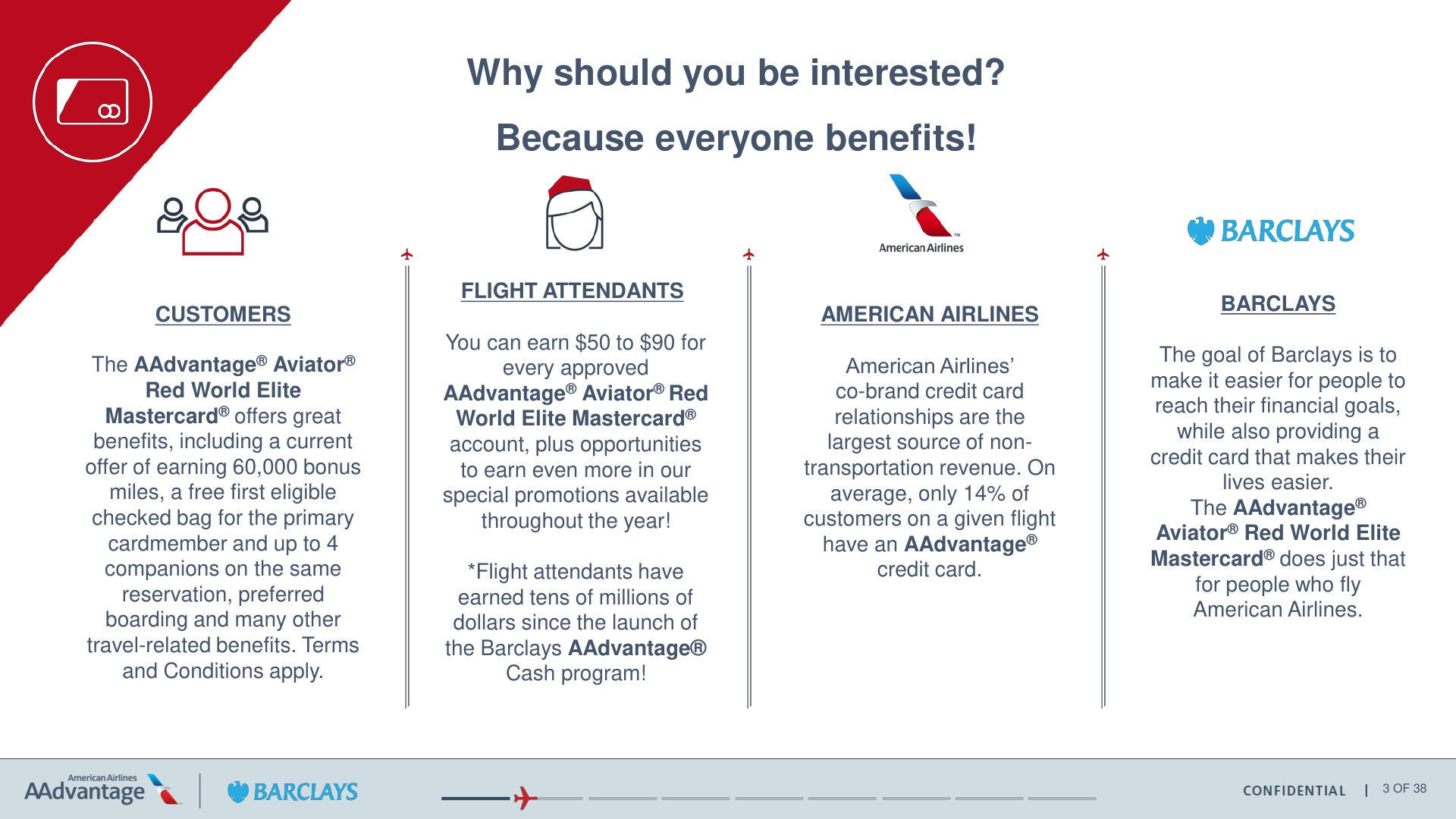

The announcement is often a wake up call at 6 a.m after a redeye flight, or the first thing you’d hear once airborne on a 5 a.m. departure. Yet only about 14% of passengers on a given flight have an AAdvantage credit card. That’s a huge opportunity to grow the card portfolio. The people most likely to be interested in the American Airlines credit card are those already flying American Airlines.

One good reason, by the way, for airline seat back entertainment is that the entertainment can be paused during flight attendant announcements. When people are using their own devices, they’re free to ignore card pitches. American Airlines should work with Citi to sponsor a return of the seatback screens.

I’ve even argued that American should increase the size of its lavatories and plaster them with credit card ads. That way a revenue stream would attach to the lavatory space, and American would no longer need to view the fact they have to provide lavs as deadweight loss.

These announcements are critical to American Airlines. During early Covid, service was limited and flight attendants weren’t supposed to make contact with customers, except to hand them credit card applications.

There were literally almost no passengers on planes and flight attendants were still making these announcements, and had applications to pass out to passengers back when we still thought Covid-19 spread via fomites.

- Even though it was American Airlines flight attendants pitching the card to American Airlines passengers on American Airlines planes, Barclays had a minimum quote for acquiring new customers.

- When Barclays failed to meet that quota, they owed a penalty payment to American. This was being paid out even before the pandemic.

- But if American suspended card pitches inflight, Barclays wouldn’t have to make payments to the airline for failing to grow the card portfolio.

The goal that American and Citi have is better integration of the card program, so they can work together to increase its value the way that Delta and American Express have. American’s program had the largest charge volume seven years ago. Now it’s in third place. They aim to change that. So expect to hear more announcements – but also better offers.

Information about the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® offer featured in this post is neither provided nor reviewed by its issuer.

Bottom line: 80,000 miles in return for $1,000 spend is a pretty good deal. Now that the in flight offer is coming from Citi, folks who only have the Barclay card can load up on the extra miles.

@David P — Not compared to $1 for 70K with the Barclays Aviator, but, if it’s all we got now, that’s that…

If you have the Former Barclays card, are you still eligible for the on-board offer?

I am sure that the ad(s) that you will have to watch to get the free wifi coming in 2026 will strongly suggest that a Citi AA card is a good deal.

Here’s an idea: if you have the AA Executive card, you don’t have to watch an ad to get on the wifi. That alone would drive sign ups and retention!

Are the in flight offers exempt from the normal citu bonus restrictions? Or if you hsve a citi aa card can you get the bonus again?

@Peter — Oh man… they’d better live up to that free WIFI promise… it’s one of the areas that Delta and jetBlue excel, while AA and UA have been lagging. Step. It. Up. Fellas.

@Travel Hacktivist — Pal, the Barclays and Citi products were always separate. You should be good to go on Citi, if you want it (they do have a 48-month rule, usually, if you had Citi before, but if you had Barclays before, you’re good to go, bud.)

Put your #SS on this piece of paper with all your details and I’ll give you some candy.

It sounds like you believe you’re the only person on the planet who’ should be allowed to hawk credit cards. Isn’t this critique a bit of a double standard?

Too bad Citi, in their latest incarnation, loves to reject applicants for “too much unused credit” and “too many recently opened accounts” for anyone with more than 4-6 new cards in the past 2 years. They’re worse than Chase 5/24 and their website and customer service are terrible. So, this sucks for churners.

@DesertGhost — Yeah, ‘hawk’-ing them ain’t enough… ya need that ‘hawk-tuah,’ if you wanna get us to use your link…

Wondering if my Barclay card will still give me free bags on international if it’s no longer going to be affiliated with AA.

Barclays AAdvantage cards are expected to transition to Citi

@Gary Leff — But, but… I thought we were ‘anti-trans’ these days? (bad joke, I know…)

I applied and was approved with the 6-digit promo code 000000.

@WFB — How nice that you took… AAdvantage of that offer… *slaps knee*

What are those 80 k miles can buy in ticket purchases?

Bad news is the 80K miles are on AA, good news is you can use them on One World partners and avoid AA. I’ve had the Barclay’s card twice and cancelled them over bad service. I would walk before I’d use another Barclay’s card. I’ll get the Citi card app on the next flight for the wife and I.