I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I’ve been looking forward not just to earning a big initial bonus, but to making the most out of all of the credits that come with the Citi Strata EliteSM Card (See rates and fees.)

I only wish I’d waited until right now to apply, because the limited time launch offer for the card has actually been improved upon. Usually launch offers are the best offers – they don’t get better so I was not expecting to see ‘100,000 points after $6,000 spend within 3 months’ come as the follow up to the card’s first limited-time bonus.

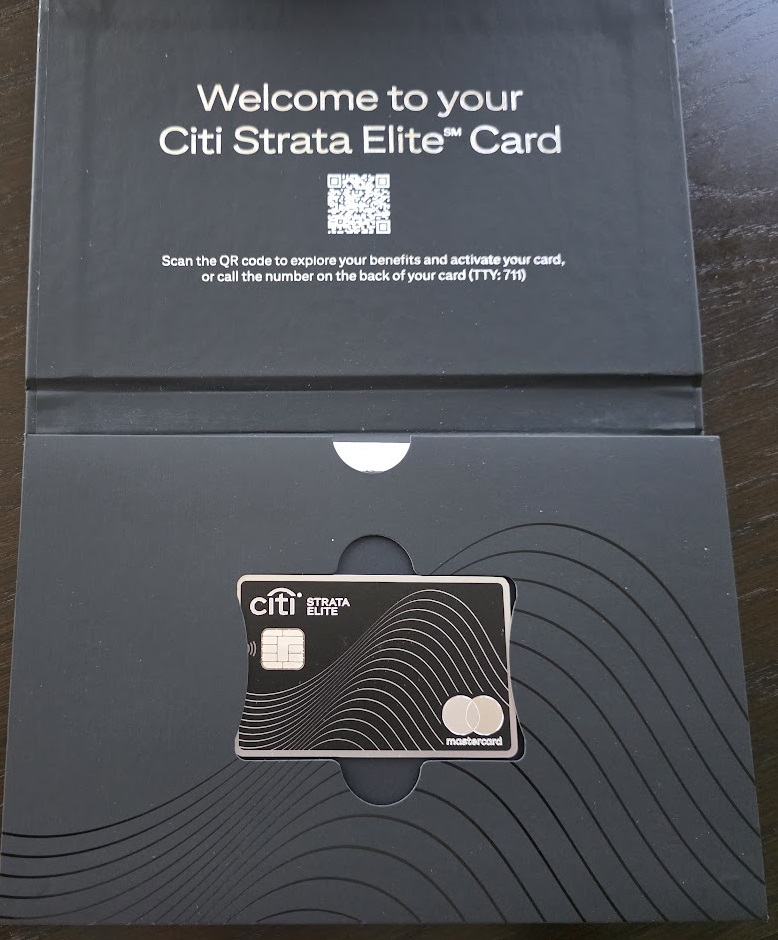

Still, I got my card when the offer was just 80,000 points and I was super happy with that – and pretty impressed by the packaging.

Obviously it’s not the box that’s the appeal of the card. But they want to make clear that this is a premium product, and it makes an impression.

The first thing I’m actually interested in right now is the 100,000 bonus points after spending $6,000 in the first 3 months of account opening. Current Strata Premier and Prestige customers are not excluded.

American Airlines Boeing 787-9

If the 100,000 points are worth roughly $1,500 and the credits another easy $1,200 that’s $2,700 during the first cardmember year – not even including benefits like Priority Pass (which includes two guests) plus Priority Pass for authorized cardmembers as well; protections like Trip Cancellation and Trip Interruption coverage, Trip Delay coverage, and Lost or Damaged Luggage; and four American Airlines Admirals Club passes each year.

For the card’s Splurge credit I’ll just buy an American Airlines ticket. I do that anyway. And the $300 hotel credit is easy to use – I just won’t use it when I want to apply elite benefits (since it’s a travel portal booking). And points can be transferred to:

- oneworld: American Airlines AAdvantage, Cathay Pacific Asia Miles, Malaysia Airlines Enrich, Qantas Frequent Flyer, Qatar Airways Privilege Club

- Star Alliance: Avianca LifeMiles, EVA Air Infinity MileageLands, Singapore Airlines KrisFlyer, Thai Airways Royal Orchid Plus, Turkish Airlines Miles & Smiles

- SkyTeam: Aeromexico Club Premier, Air France KLM Flying Blue, Virgin Atlantic Flying Club

- Non-alliance: Emirates Skywards, Etihad Guest, JetBlue TrueBlue

- Hotels: Leading Hotels of the World Leaders Club, Accor ALL – Accor Live Limitless, Choice Hotels Choice Privileges, Preferred Hotels I Prefer, Wyndham Hotels Wyndham Rewards

American Airlines Boeing 787-9P Flagship Preferred Suite

Citi Strata EliteSM Card is an easy win for me with the up front bonus offer, even with the $595 annual fee, especially given the card benefits in this first year.

Oh, the irony… Gary telling his readers to GET THIS NEW CARD NOW… when it was just the 80K offer. We’ve all been burned one time or another, sir. Wear it as a badge of honor (or a dunce cap). *salute*

Are the Admiral’s Club passes transferrable to other people or must they be used by the cardholder?

Compelling SUB, Year 1 value and Kristen Bell commercial! Support the site and sign up today!

(Ditch this after year 1 for Strata Premier / Strata Regular / DoubleCash.)

Can I use the Admiral’s Club passes at partner lounges? In other words can I use them to get into a Cathay lounge in Hong Kong or a Qatar lounge in Doha, both of which I believe are accessible by full Admiral’s Club Members (but maybe that understanding is wrong)? Or are they only good at AA run Admiral’s Clubs, which would limit their attraction to me.

@Peter gets it.

@Mak — I wish, but no. Admirals Club passes only used at AA-run Admirals Clubs.