Southwest Airlines now has a points-earning debit card and while you should prefer their credit card if you can get one for your actual spending, this has a strong role to play for Southwest customers looking to earn companion pass and fills an important hole in today’s frequent flyer programs.

Here’s the value proposition:

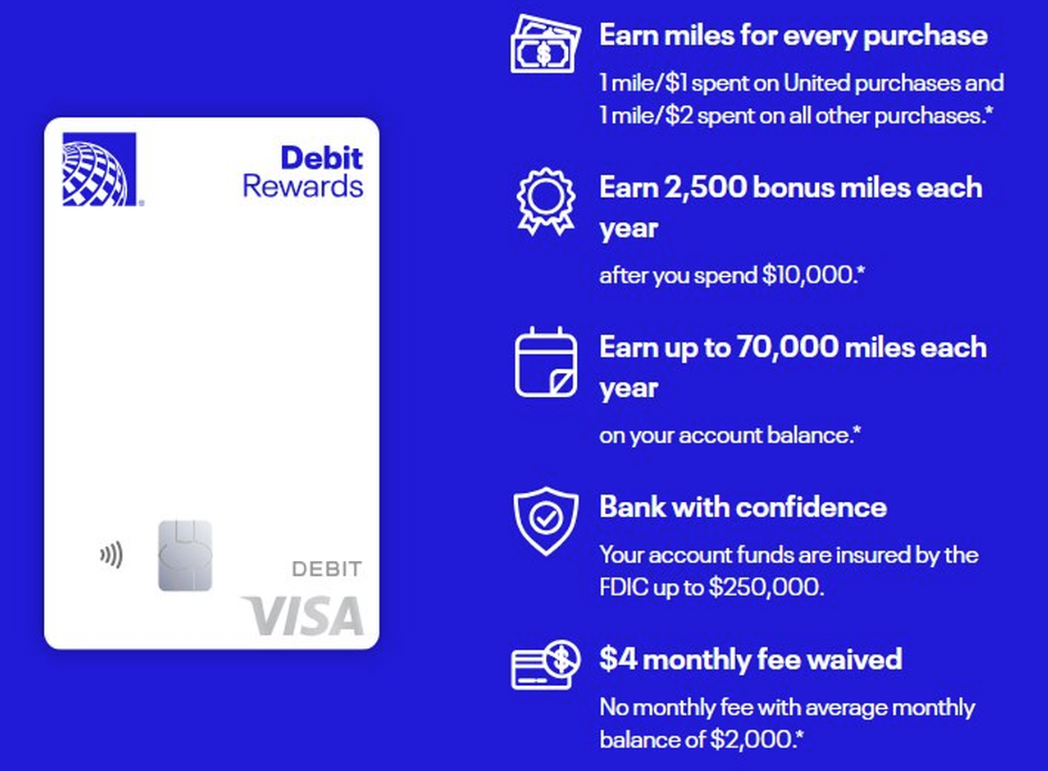

- Initial bonus: 2,500 points after spending $100 and having two recurring deposits within the first 90 days

- Earning: 1x on Southwest purchases, dining, utilities and subscriptions; 0.5x on other eligible spending

- Annual spend bonus: your cumulative card spend gives you bonus points at the end of the year.

- $5,000: 2,500 points

- $10,000: 5,000 points

- $15,000: 7,500 points

- $5,000: 2,500 points

- Benefits: annual 20% off discount code awarded each January; $35 statement credit every calendar year on Southwest purchases (excluding inflight purchases and upgraded boarding)

- Automatic bonus towards Companion Pass: 7,500 bonus Companion Pass qualifying points every calendar year awarded in January (or within 30 days of account opening for your first year). These are not redeemable points.

- Monthly fee: $6.99, waived with $2,500 minimum monthly balance

All points earned on the card count towards Companion Pass. So for your first year, pick up th initial bonus and the annual companion pass bonus and that’s 10,000 points towards Companion Pass. And that’s in addition to Companion Pass credit you earn from having a Southwest Airlines credit card. So it’s a new way to make progress on free companion travel whenever you fly, whether on revenue or award tickets.

But beyond the specifics of the product, what’s important here is that the dam is breaking loose on debit card rewards. We’re going to see more mileage-earning debit cards. Those used to be a standard, but the Durbin Amendment to Dodd-Frank financial reform banned earning a profit on debit cards. Debit card interchange was crammed down, so it no longer made sense to incentivize debit transactions. (And many people lost access to the banking system, becaue debit card subsidized free checking accounts.)

The Durbin amendment contained some carve-outs and exceptions, most importantly small banks with less than $10 billion in assets are exempt from debit interchange caps.

I mused at some airline co-brand conferences years ago that carriers should be doing driving to use these exemptions, partnering with Durbin-exempt banks on mileage-earning debit cards. But it was ‘hard’ and they had other priorities.

- Airline portfolios are large. Partner with one small bank, and they quickly could become a large bank (and no longer Durbin exempt). If this succeeds, it implodes.

- Small banks aren’t set up to sign up customers nationwide. They mostly did in-brand account opening, and even where accounts could be opened online their processes didn’t scale.

Now, though, you have fintechs that streamline the account-opening process and that can work with a portfolio of small banks so that each stays under the $10 billion in assets cap to do this. These deals are being put together for the first time by Marketgate Advisors, led by two ex-Chase, Barclays and Wells Fargo card executives Dan Dougherty and Scott Harris. And it’s built with Galileo Financial Technologies.

Airlines aren’t going to make money on this the way that they do credit cards. Even Durbin-exempt debit card interchange is far lower than credit card interchange. But the payments volume is large. Average purchase sizes on debit are lower, but the number of debit transactions exceeds the number of credit transactions.

I don’t generally like debit, because the money leaves your account right away and if there’s fraudulent charges you need to get the money back rather than just freezing the transaction and not having to pay until the investigation concludes (and then only if it goes against you).

However there are real roles for debit for the consumer:

- Many people can’t get credit or don’t want to transact on credit. Dave Ramsey is popular!

- Not all transactions make sense on credit. You might earn an account-opening bonus with tax payments, but may not want to pay around 1.9% to earn card rewards paying taxes – while debit fees for tax payments are de minimis.

- You can make numerous purchases, like money orders, using debit cards that you often cannot with credit cards.

- Plus there are benefits to just having the account, without transacting much!

For the airline, this may create a new pool of customers that could be converted to card. The programs are so mature there may not, today, be many cardmembers left to acquire. They’re making people sign up for their loyalty program to get free wifi onboard, to them try to convert these new customers into cardholders. Delta has its Starbucks and Uber and soon DraftKings deals to try to find new people to pitch cards to.

This puts plastic in the wallets of more customers, and an opportunity to shift their behavior – once they are more engaged with rewards, they can potentially be moved to richer rewards. And for younger consumers who just aren’t credit-ready yet this helps keep them within the ecosystem as they mature.

United’s card leaked. Southwest is out. Wyndham is doing this.

And we’re going to see others – because as soon as this became public, executives at other airlines and hotel chains started yelling at their cobrand teams “how did they do this? why haven’t we done it?” and they’re almost certainly scurrying to launch their own products if only to not get behind (and to protect their jobs).

Chasing the poors is no way to run an airline.

Lame-y Mc-LameFace.

Boo-urns! I’m saying, Boo-urns!

You can’t make a mortgage or college payment with a credit card. You can with debit. It’s going to see much broader adoption than you think.

I miss my Delta Suntrust card!!

Didnt these all get banned years ago from some congressional act?