I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

There’s a lot of confusion over what it means for a credit card to be ‘best’. And many of the fights and arguments are really two groups talking past each other, because they value different things without realizing it.

Basically, credit cards

- Do different things, and different people value different elements, well… differently.

- Have benefits that are better for some customer profiles than others.

So what we have to think about is what is this card actually good at and when comparing cards, is each one good at something else? And how do we compare those? And then, who is this card actually good for?

Obviously a credit card reduces transaction friction. We use it to buy something. And it bundles financing, both for those who do not pay their card off in full each month (at a high APR, but lower than some other forms of financing) and for those who do (since you have a few weeks from the end of your billing cycle to pay, you may get six weeks of free financing or float on purchases).

Beyond those basic functions, though, a rewards card generally gives you three things:

- Up front bonus. Card companies want to acquire customers and they know to do that they need to make the product focal. They can impress you with a big up front bonus. Plus, consumers don’t trust brands. They need to show you up front value – give you rewards quickly – to demonstrate you’ve made a good choice getting the card. And that’s why we have these big bonuses, to get you to apply and get you using the card and get you a reward quickly to prove you made a good choice and should keep using it.

There are cards with huge bonuses, and some with small ones. And if a card has a big one, that may be a great reason to get it! Try out the card after that! But the bonus itself is not a reason to keep the card after your first year, and it’s not a reason to put your spending on the card.

- Benefits. You might get free checked bags or lounge access or great travel coverages (trip or bag delay, primary collision coverage for your rental card). You might get a companion ticket or free hotel nights each year. Those are great reasons to keep a card. But – except to the extent earning them is tied to annual spend levels – they aren’t reasons to put much of your spending on the card.

- Rewards for your spending. Where you want to put your spend should be the card that gives you the most valuable rewards for that spending.

Some cards are great for certain categories of spending, like 5x on airfare, 4x on hotel or 3x on daycare. You’ll want to put that category spend on the card but not other spending.

Other cards are great for general spending, for instance you’ll earn 2x on all spending regardless of category and it becomes your ‘catch all’ for spending that isn’t more rewarded in a category on another card, that isn’t being used to earn a bonus, and that isn’t necessary to earn an annual card benefit you value heavily.

Often this means you want more than one card for your spending, for instance the card that is most rewarding for the type of spend you do the most and then the catchall for the rest so that you’re never earning just one point per dollar (if a no annual fee 2% cash back card is the ‘opportunity cost’ of your spending, you wouldn’t choose to earn just one point per dollar if you wouldn’t buy that point for two cents).

So when someone recommends the $595 annual fee Citi Strata EliteSM Card (See rates and fees.) and someone else says they don’t like the card they’re probably both honestly looking at the same set of facts – and valuing different things.

I’d bet the recommendation for the card is about that incredible first year value – a function of both:

- the limited-time initial bonus offer to earn 100,000 bonus Points after spending $6,000 in the first 3 months of account opening, and

- the annual $300 hotel benefit (discount on 2+ night stay booked through cititravel.com) which is available each calendar year; the $200 splurge credit (statement credit from merchants you can opt into like American Airlines and Best Buy) which is available on a calendar year benefit; and the $100 Blacklane statement credit available semi-annually.

A cardholder getting the product now could take advantage of each of those three benefits for $600, and do so again in the first half of 2026 for another $600. That’s $1,200 plus the value of 100,000 points – approaching $3,000 in first year value which is incredible.

But Citibank doesn’t have its own lounge network, offering just Priority Pass and 4 American Airlines Admirals Club passes each calendar year. So they aren’t really competing in the lounge space with American Express, Chase, or Capital One.

American Airlines Admirals Club Philadelphia A West

American Airlines Admirals Club Philadelphia A West

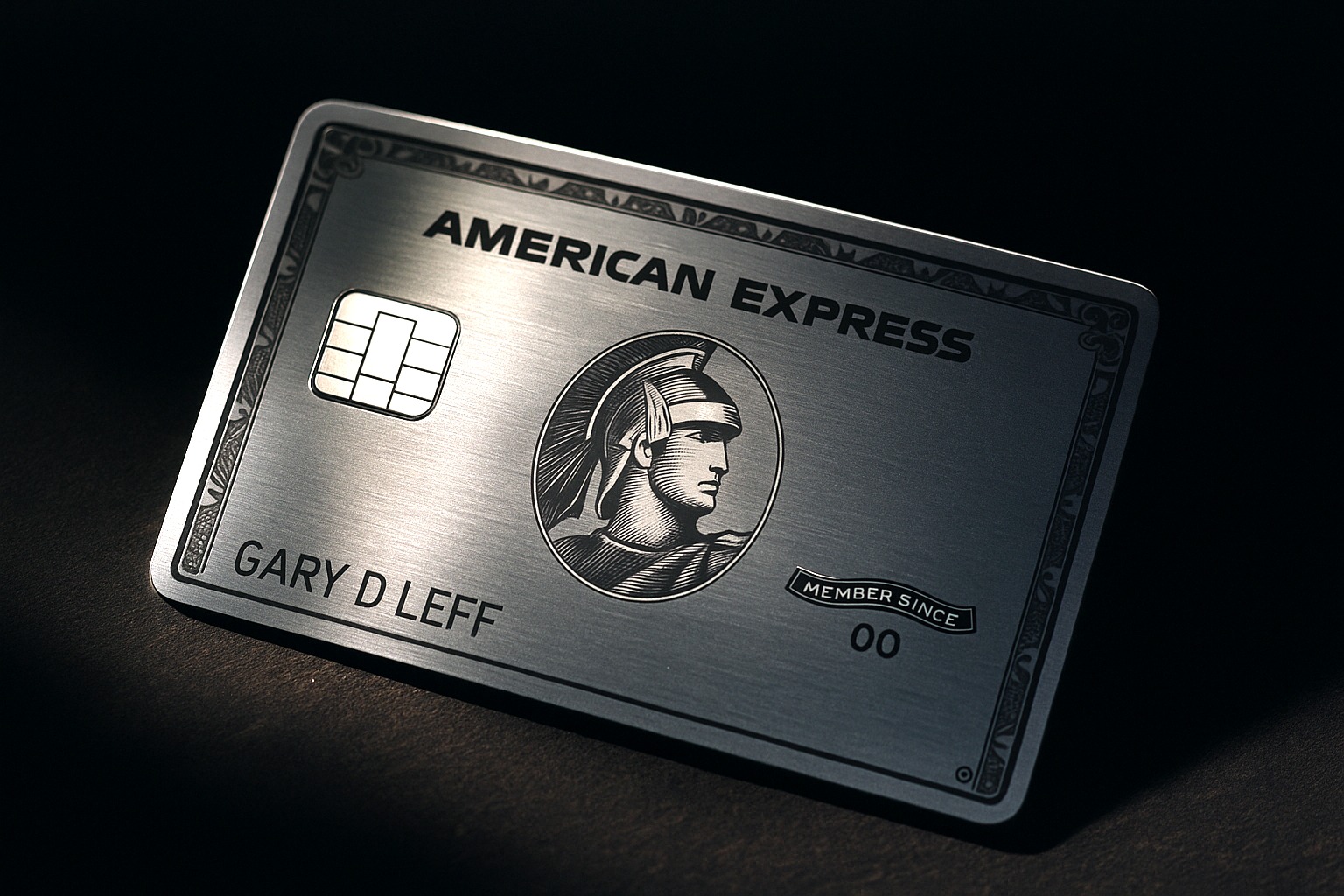

Many would say ‘but this card doesn’t compare to the American Express Platinum Card® (see rates and fees). Amex has its own lounge network, more credits, and I like Fine Hotels & Resorts more than Citi’s hotel booking platform. But Amex Platinum isn’t a card for most of your spending, either! In fact I try to only put airfare spend on the card, and as little else as possible.

Platinum is great in the benefits category. It’s great for its up front bonus offer of as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

Similarly, many argue that the Amex product is better than Chase Sapphire Reserve® (See rates and fees). I think it has better benefits – although it depends on which card’s lounges you’ll likely frequent. Chase, too, competes with a strong up front bonus to earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening. But it’s actually a good card for spending.

- 8x points on all purchases through Chase TravelSM, including The EditSM – great for hotels because you still earn hotel loyalty points and stay credit. And including airline tickets, cruises and short-term rentals booked on the platform.

- 4x points on flights and hotels booked direct.

- 3x points on dining worldwide

Chase Sapphire Lounge LGA

Chase Sapphire Lounge LGA

Sapphire Reserve beats the other two, I think, on actual spending though you still want to pair it with another card for your unbonused spend categories (just as you’d pair the Citi card with Double Cash, or the Amex card with Blue Business Plus).

Each one is good at different things just like Capital One’s Venture X is good for being the lowest cost of the bunch, with its own lounge network (smallest network, best food), and being good for actual, unbonused spend earning transferrable 2x points all purchases.

Capital One Landing DCA

Capital One Landing DCA

Capital One Lounge JFK

It is always important to think clearly about what purpose a card would serve in your wallet. And when comparing cards, ask if each one is valuable for the same thing?

I have all of these. They each serve a different role. I don’t recommend that everyone get all of them, let alone keep all of them. I think your long-term keeper for benefits aligns with (1) whose lounge network you’ll use in your travels and (2) whose credits cover spend you would naturally do anyway.

Each one, of course, is tremendous during that first year when you factor both the initial bonus and the credits. Then you have to ask, is it the card you’d keep (and keep paying on) for the benefits? And is it a card you’d actually use for your spending?

For rates and fees of the American Express Platinum Card®, click here.

I like an all-the-above approach. Call it the ‘Pokemon rule’: ‘Gotta catch ‘em all.’ If they’ll approve you, and you can get a good sign-up bonus, and you can pay on-time, and use the credits, etc., it’s still a great ‘hobby’ for most of us.

I don’t understand why the CSR is a good card for spending at all. In fact, I think the CSR is now almost useless for spending.

Can get 3x dining on so many cards, including the $0 fee Freedom Unlimited (can always pair with a $95 CSP for transfer purposes).

Amex has CSR beat with 5x direct airfare – and airfare is the one thing that you mostly want to book direct.

Hotels – 4x direct is nice, but I personally care much less about booking hotels direct (unless you are traveling somewhere obscure, generally lots of hotels to stay at in most places! Very different than missing a flight.) Sure there are some instances where it is useful to book direct. But you can get some great deals on the travel portals (including my favorite, AA Hotels paired with an AA Executive card, although Agoda, Rove and others all need to be checked as well now), so why limit yourself to 4x points?

And Chase Travel is simply lacking in the hotel department! The Edit is a complete joke, especially as compared with FHR (or even The Hotel Collection). I actually tried three different times this past week to see if The Edit would be even remotely competitive with stays I was booking for next year, and on all three occasions, the Edit’s pricing was either a) dramatically inflated as compared with FHR / direct / other portals or b) listed as “sold out” when there was availability on FHR / direct / other portals. Three different sets of dates and cities, all useless. Booked one with FHR, two with AA Hotels, although almost booked one of the AA Hotels ones with Rove – was arguable either way).

And 8x on hotel portal spend is not really that competitive anymore! Can get the Strata Elite and it’s 12x on hotels. But Agoda is often around 10x on Rakuten (today it’s 9x), generally has better deals than Chase Travel, and you can stack Agoda with whatever card you want for even more points (DoubleCash, Citi Strata Premier come to mind). Can transfer Rakuten points to Amex or Bilt (and confirmed you can do Bilt at 1:1 through 5/15/26 regardless of Bilt status).

Bottom line – Amex Platinum is a must have for any frequent traveler – dare I say the price is now right compared with the perks you get. The CSR used to be a no-brainer #2 card to the Amex – why not use it for everyday spend with 3x all travel and dining – it was designed to be the card that you took out of your wallet. Now it’s a Frankenstein’s monster – a niche card with incredibly hard to use credits (and if you think the Edit is inflated, that’s nothing compared to opentable credits that can only be used at tens of restaurants around the country) and bonus categories that are simply “meh” unless you have a ton of direct hotel spend. (And if you do, you are probably loyal to one brand, and probably have that hotel’s credit card that you’d put the spend on anyway).

If anything, CSR is probably best for 8x airfare portal spend, but… in general… who wants to book their airfare through a portal? It’s a risk! Even your article the other day noted that you could book airfare through Bilt and it would count as booking direct – so book with a Platinum through Bilt and it’s 6x (5x MR; 1x Bilt)! Or plenty of airlines are 1x on Rakuten as well (used Rakuten with the Plat on airfare booking yesterday). So you’re going to go with 8x points on airfare instead of 6x points and take the risk in the event of IRROPS etc.? Sometimes if the price is right the risk may be “worth it” but in most cases?

Can I personally break even on the CSR? Yes. Do I like the Chase lounges? Yes. Will I keep it? Maybe, maybe not, and you better believe I’ll be exploring retention offers. But as someone who routinely put a ton of spend on the CSR / F.Un. over the past number of years, not sure why I would do so anymore – plenty of other good options out there with Citi, C1, etc. And I don’t think the incentives to spend $75k on the CSR align with what the marketplace perceives as premium benefits (the lean into Southwest / Holiday Inn Express is baffling to say the least, even if those were the deals on the table that were available – just poor associations for a premium product).

Final note – I find it frustrating that if you transfer points with Chase (I just transferred some to take advantage of the Virgin 40% bonus) they use your 1.5c points first, even if you have enough “new non-1.5 cent” points. Just something to be aware of.

@ 1990 — Don’t forget the step where you close the card on 1st anniversary.

@Peter — Speaking of transfers with Chase, I presume due to that recent Clowdflare outage, I had a UR–>UA transfers cancel on me yesterday. Finally, started working again today.