Bilt Palladium Card (See rates and fees)

We’re two weeks away from Bilt‘s new cards going live, though you can apply for them now. I applied on announcement day last week for the Bilt Palladium Card, because – though there are a lot of features and options that make the choices feel overwhelming – when you strip it down this is at least a card that can earn 3 points per dollar on all of your spending, up to $25,000, and that earns the most valuable points.

It’s actually better than this, but if you ignore almost everything else that becomes pretty much a worst-case with it.

Basics Of The Bilt Palladium Card

Here are the general features of the card:

- $495 annual fee

- Earn up to 1X points on rent and mortgage payments, 2X points + 4% back in Bilt Cash on everyday purchases

- Initial bonus offer of 50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash.

- Benefits include a $400 Bilt Travel Hotel credit (applied twice a year, as $200 statement credits, for qualifying Bilt Travel Portal hotel bookings of 2 nights or more) and $200 Bilt Cash (awarded annually, and note that at the end of each calendar year, any Bilt Cash balance over $100 will expire), along with a Priority Pass that covers the cardmember and up to two guests (see guide to benefits).

Bilt Cash lets you buy points up to the amount of your housing payments, accelerate your points earning on the card, and redeem for credits like free Blade helicopter flights and car service rides as well as food and other home delivery and myriad other things.

I like it for the faster points-earning, like redeeming so that you earn points for paying rent and mortgage (effectively earn a bonus of 1.3 points per dollar spent, in addition to the standard 2 points per dollar earned on the card) and once you’ve exhausted that, accelerating your points-earning so that you earn an extra point per dollar (redeeming the benefit in $5,000 spend increments up to 5,000 points, up to 5 times per year).

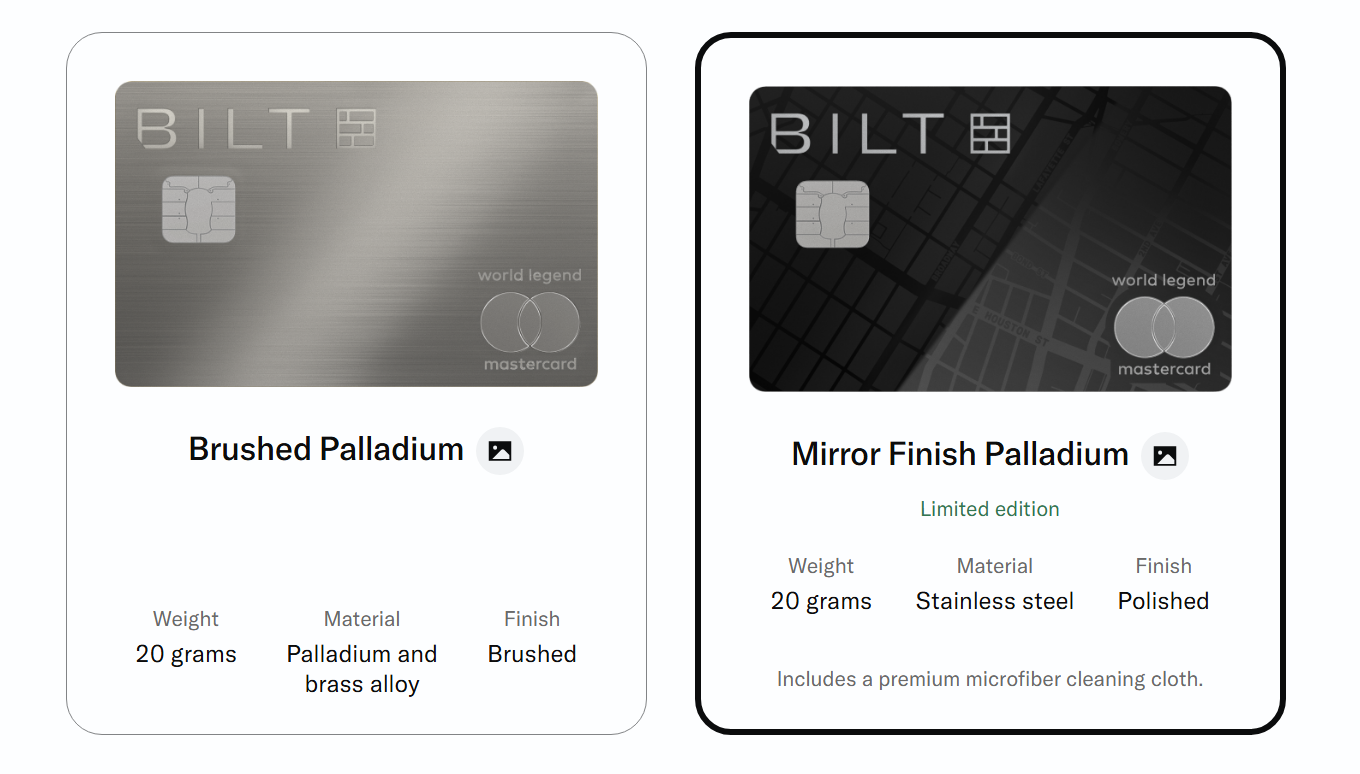

There’s a ‘mirror’ version of the Palladium card which you can select when approved for the card, and they even say they’ll be sending a Bilt smudge cloth for it. That’s a lesson learned with Amex’s mirror card, I guess, that you need a microfiber cloth to keep it clean!

Elite Status Comes With The Card

The value of the card’s initial bonus far more than covers the annual fee. The benefits of the card cover the annual fee in subsequent years and are gravy in year one. But under-discussed is that you’re also going to get Gold status when you achieve the initial bonus on the card, and that the card can help you quickly earn Platinum.

Gold gets you bigger points transfer bonuses, access to points accelerator redemptions on the card, a commitment of continued 1:1 points transfer from Rakuten’s online shopping portal, access to Bilt’s Home Away From Home travel program (akin to Amex Fine Hotels & Resorts) and early access to Bilt experiences.

Platinum status is earned either achieving 200,000 points earned with Bilt Rewards in a calendar year, or $50,000 spend on a Bilt co-brand card.

Earning Over 400,000 Miles In One Year With This Card

Say you spend $2,771 per month on housing (rent or mortgage), and put $4,167 in monthly spending on the card. And you redeem your Bilt Cash to earn points on housing and towards points accelerator. In your first year you might earn:

- 33,252 from housing

- 25,000 from points accelerator

- 100,008 from base 2x earning

- 50,000 points from the initial bonus

- Platinum status in Bilt Rewards

That’s 208,260 points (the initial bonus, plus 3.2 points per dollar spent). Plus, your $50,000 spend on the card earns Platinum status. Bilt Platinum gets Air France KLM Flying Blue Gold status (which means priority check-in and boarding, free checked bags, and free exit row seats on Delta, too, plus lounge access on international trips) and an annual free Blade helicopter transfer.

It also gets their biggest transfer bonuses. So your points are worth even more. For instance, with a 100% bonus – which they’ve run quite often to many transfer partners – your $4,167 a month spending can turn into 416,000 airline miles in a year leveraging one of their 100% transfer offers.

These Are The Most Valuable Points

Bilt’s points are transferable points, that can also be used in Bilt’s travel portal at 1.25 cents apiece (often for direct bookings on hotels and air). They have more transfer partners than Chase, American Express, Capital One or Citi. And they have some of the best partners,too, like Hyatt, Aeroplan, and Alaska Airlines.

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus, Avianca LifeMiles, TAP Air Portugal Miles&Go

- oneworld: Cathay Pacific Asia Miles, Alaska Airlines Mileage Plan, Iberia Plus, British Airways Club, Japan Airlines Mileage Bank, Qatar Airways Privilege Club

- SkyTeam: Air France KLM Flying Blue, Virgin Atlantic Flying Club

- Non-alliance: Emirates Skywards, Southwest Airlines, Aer Lingus Aer Club, Etihad Guest, Spirit Airlines Free Spirit

- Hotels: World Of Hyatt, IHG One Rewards, Marriott Bonvoy, Hilton Honors, Accor ALL – Accor Live Limitless

I put my unbonused spend now on Capital One’s Venture X, earning just two points per dollar, and those points aren’t as valuable (the transfer partners, while good, aren’t as good as these and the value spending on travel purchases directly is just one cent per point).

What I Don’t Like About Bilt’s Cards

My application for the card was rocky. As an existing cardmember, there wasn’t supposed to be a hard pull of my credit but there was a system issue on launch day and there was one. I’m told that’s being removed. They were also supposed to provide existing Bilt cardmembers the same credit line as on their Wells Fargo card. My credit line was cut in half, from $50,000 (!) to $25,000.

I also do not like that the terms of the card exclude points-earning on tax payments. We’ll see if that actually happens in practice. And I don’t like that ‘Bilt Cash’ expires December 31 of each year, with just $100 eligible for rollover to the next year.

I feel like that’s a disincentive to spend on the card heavily in November and December and the holidays is when a lot of consumer spending happens! In my view they will almost certainly have to adjust this, for instance carrying more over or pushing out expiration to March.

And with all of the options and customization built into this program, which I think is great (while some complain it’s confusing), I wish I could customize rejecting the card’s Priority Pass in favor of something else (more Bilt Cash!). I have too many cards offer Priority Pass already.

So I think there’s still room for improvement in the product, and the communications during the rollout was clumsy. But as we get further away from announcement day, and dive into the actual product, the value on offer here is really great I think and I plan to spend heavily on this card.

Gary… you’re relying on $4K+ non-rent spend, and a 100% bonus via their top status… that’s a tall order for most folks, and it doesn’t speak to the opportunity cost of forgoing all other SUBs.

Continues to be not uncompelling…

I think the slightly cleaner example is perhaps $40k of annual housing spend ($3.33k/mo). Because if you factor in the $200 of Bilt Cash that you get on an annual basis (no reason why not), then it requires exactly $25k of spend for the housing points. Then another $25k of spend on the accelerators and the $300 SUB can jumpstart that and you’ll make up the B$ on the back end. $50k total spend not only gets you the Bilt Platinum status (as you note) it also gets you an extra $100 of B$ ($50 for each $25k spent). So between that extra $100 B$ and the SUB $300 B$ you’ll still have $400 of Bilt Cash sloshing around even after using the annual $200 – you can roll over $100 of that and use the $300 4x to buy up transfer bonuses even further (can get you to the Platinum level bonus even though you’ll only have Gold year 1). Should be 215k points (50×2, 40 housing, 25 accelerator, 50 SUB). And if you take advantage of a 100% offer, 430k airline miles, although I’d put that in the bucket of “may well happen but can’t count on it and you still may prefer flexibility until you have an award ticket you want to buy”.

I think you did a very good job outlining the negatives. Only other thing I would add is I wish like C1VX they had a $0 authorized user card. Annoying to have to pay $100 for yet another PP that no one wants. But even at $595 AF you’re still getting 65k more points than you would on a 2x card, and if you value Bilt points at 2cpp, it’s an extra $1300 in value versus a 2x card (65k x 2) or $705 after accounting for $595 AF. And that’s before the potential for a 100% bonus on your Bilt Points.

Bilt needs to sell Bilt Cash to the masses so that this can work for the rest of us – folks will find a 4% return attractive even if it is for a coupon book. And… look, I had to build my own spreadsheet to figure this out for myself. Most people are not going to do that. Not sure what to say other than I hope Bilt can recover from the “it’s too complicated” launch and market this better, because I agree that once you get past the frustration with the roll out, the inherent risk, and the nonsensical end of year treatment of Bilt Cash, there really is value to be had here.

Final note is I’m still noodling on how best to combine FB Gold status from Bilt Platinum with the new AF card. Feels like there’s a real pathway to FB Platinum status as long as all the XP from that card hit after you match to FB Gold status. Between the 100XP welcome bonus and 160XP annual on $25k spend, only need another 40XP to get from Gold to Platinum…

I have 10+ credit cards and am a savvy points user. Bilt officially sucks now. Most ordinary folks aren’t spending $4k+ on a credit card. And even if they are, they likely already have other cards that meet their needs. At some point, coupon book fatigue becomes real. Making sure I used the card 5x/month was already annoying but certainly doable; I just charged it every time I went out for boba. But now I have to perfectly track how much money I spend on the card or end up coming out behind. This just isn’t worth it. I’ll get the top tier card for the SUB and then cancel after a year.

With all due respect: look up whether the travel bloggers you’re reading have a vested interest in the companies they’re advertising for.

FWIW, I respect Gary and the work he does to make flying cheaper for all.

I confess I’m struggling making sense of Bilt 2.0 and need smarter people to help me understand which of the cards, if any, would make sense in my situation.

I pay for rent and utilities through a single transaction averaging $3,400. If I’m understanding correctly, I would need to spend at least $2,550 to get maximum value from the Bilt cash.

Questions:

1. I hate that I now have to juggle two currencies, points and cash. If my rent is processed via ACH, why do I need to accumulate enough Bilt cash to pay a transaction fee on the rent? Or is that a misunderstanding on my part?

2. I carry the Platinum, Reserve and most of the cards across the Amex and Chase ecosystems. I just picked up the Strata Elite, though I am not sure yet how long I will spend in that ecosystem beyond the first year. I know Bilt has a wide range of transfer partners, but I am highly distrustful of the longevity of this Bilt arrangement. I feel reasonably sure I could spend up to $2,550 in non-rent spending, but don’t want to be penalized if I miss the mark on any given month. What’s the most compelling reason for why I should basically be making the Bilt card my center of spending when compared to the Chase and Amex alternatives? Most of my travel is domestic. I tend to transfer most to Southwest, Marriott, Hilton, and now with Citi, American.

3. All that said, if the Bilt makes sense to carry, which card makes the most sense from their three options?

Thank you kindly for breaking it down for my slower brain.