I find a ton of value in Bilt Rewards. I think they have the most valuable points (the most and best transfer partners, the biggest transfer bonuses, points that can still be used through their quite good travel portal at 1.25 cents apiece). They have great partners and great benefits for my Platinum status, like Air France KLM Gold status (free checked bags and exit row seats on Delta) and a free Blade helicopter transfer each year.

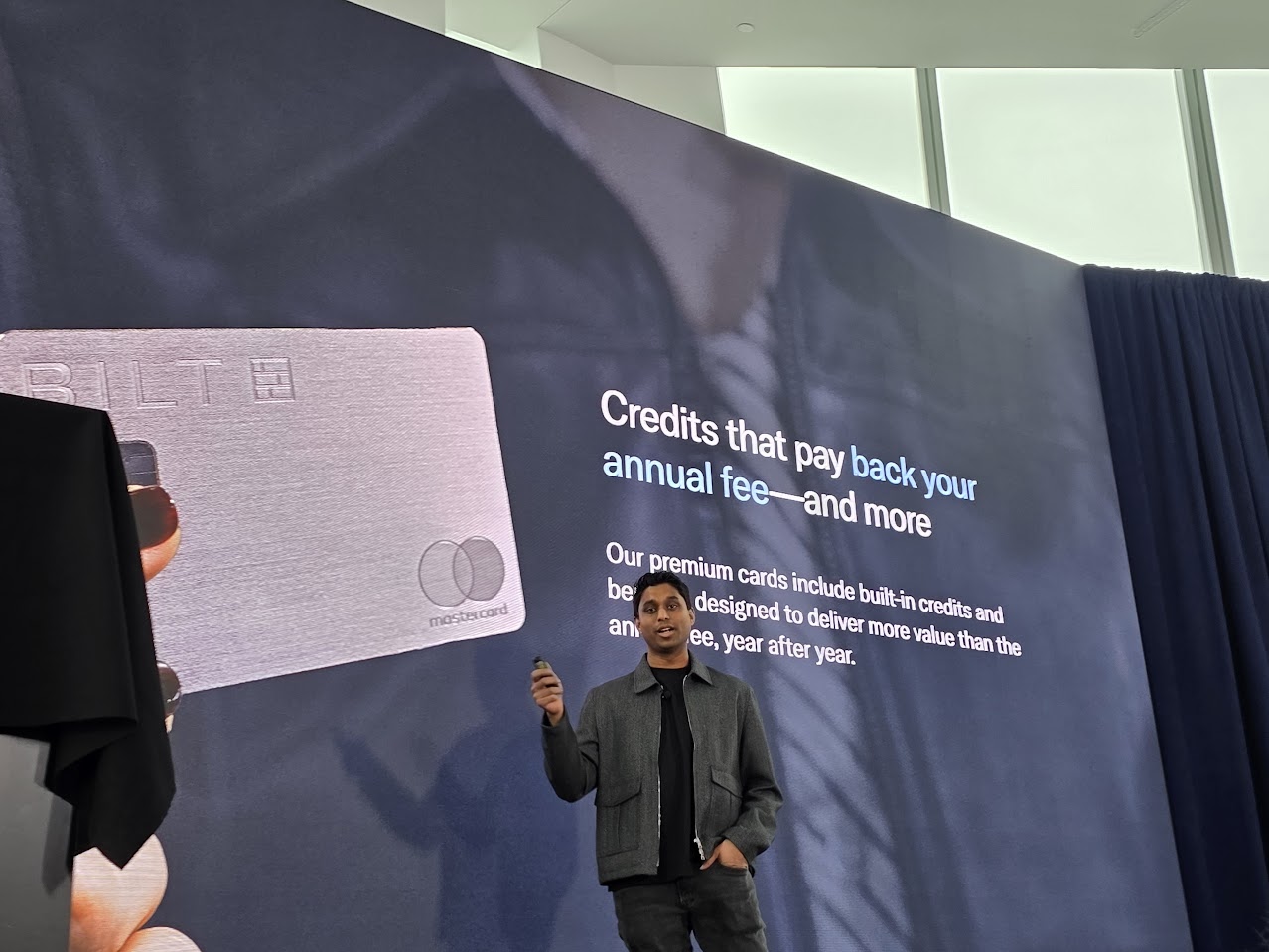

And I find a lot of value in their new credit cards. I have my Palladium card in hand, and I can’t wait for it to be my everyday spending card since I’ll earn 3 points per dollar or more on most of my spending.

But the roll-out of their new cards was rocky. I think they’re past a lot of the frustration, and they report that 83% of ‘active’ cardmembers applied to convert to one of the new cards during the latter half of January.

However, four things led to a lot of confusion and consternation about what they’d done.

- The products are complicated. They can be simple, just spend on the cards and get great rewards. But they introduced complexity that lets you pick how you earn and the kind of value you want from the card, different ‘earning styles’ for rent and mortgage payments and Bilt Cash that can be spent on things like faster points-earning, real money with their partners like Walgreens, Lyft, and GoPuff or on their travel portal (but with rules and limits for each).

This is in many ways better than what Amex and Chase do because it means they don’t spend on every benefit for every cardholder – which lets them deliver more of the things each cardmember wants. And it’s better for those who really work the system! But complexity also scares people.

- The full details of the product weren’t available. If they could have waited a week to do the launch things would have gone a lot more smoothly, but details on Bilt Cash – and therefore on how a lot of benefits and earning with the cards – simply weren’t available yet. Those came later, but meant there were a lot of unanswered questions and that led to skepticism.

- They wanted to market the new cards as being more similar to the old one than they should have. Since they wanted to make it cleanly ‘earning points on rent but also now mortgage’ and they introduced the idea of using Bilt cash to cover the cost of earning points it sounded like you would pay a fee for paying rent or mortgage but could ‘buy down the fee’. They didn’t clearly explain the mechanism for making housing payments and earning points. You aren’t charging the card for your rent or mortgage. They withdraw that from your bank account and make the payment and that makes you eligible to earn points in exchange for Bilt Cash up to the amount of housing payments you’ve made. Letting people assume it was closer to the ‘old way’ generated tremendous confusion.

- They were taking away free money from people who only used the old card to earn points on rent. A lot of complaints came from people who only used the card to earn on rent. They may have met the ‘5 transactions a month’ requirement to earn points on the card by breaking up a single tank of gas into 5 fills at the pump, bought 5 $1 Amazon gift cards, or… went to a minimart and purchased 5 individual bananas.

Those people lost value, and to them it didn’t matter what the new cards were. The new ones were – by definition, for them – worse. I didn’t want to spend regularly on the old card – it was like a Sapphire Preferred but with earning on rent, and I could do better for most of my spend. And I do want to spend on Palladium because it earns better points faster than I can get elsewhere. But the people for whom it no longer works were apoplectic.

And oh my, Bilt is in Money Stuff (the greatest daily read on the internet): “Five Bananas Won’t Pay The Rent.” He begins, about how lucrative the original Bilt card was, offering points for paying rent as long as you made 5 transactions a month: “A helpful rule of thumb is: “You always find product market fit when your product is giving away money.”

Everyone knew that if customers used their Bilt cards only to pay rent, Bilt and its card partner would get fleeced. So you only got rewards if you used your Bilt card for rent and also a reasonable amount of other stuff. But “a reasonable amount of other stuff” is a fuzzy concept, and for a while Bilt defined it as five monthly credit-card transactions. This requirement became known as “five bananas,” and buying five bananas is not going to cover the bank’s costs.

So Bilt pivoted, and people got mad, because (1) they had been getting free money and (2) now they weren’t

Levine admits he tells some stylized stories, but I do not in fact think this is accurate.

Bilt wanted to create an electronic system for paying rent, but landlords didn’t want that system unless it had customers. So it gave away free money to get customers, and now landlords use its electronic system for paying rent, so it can stop giving away free money.

In some sense I’d argue it’s the other way around – likely fewer than 15% of Bilt members had the credit card (Bloomberg reports the cardholder number at over 1 million). They join Bilt to pay their rent in buildings that use Bilt software, and then they’re marketed the credit card (among other things). Indeed, some of these large apartment owners were early investors in Bilt.

Having a cardmember base was part of generating their early member base. And launching any program from scratch without a separate base of customers (like people who buy coffee, e.g. Starbucks, or people who fly an airline or stay in a hotel) is tough – you need customers to be attractive to partners, but you need partners to be attractive to customers. So you have to sell a vision, and convince both sides to take a leap of faith. And to some extent that does require overindexing on value for both, the ‘light VC money on fire’ idea that was once so popular.

But Bilt struck a deal with Wells Fargo that allowed them to charge rent to cards without paying standard interchange, and still getting paid for their points by Wells Fargo. That was great for customers earning points on rent, and it was great for Bilt delivering value to cardmembers in a way that had never been done before.

It was actually going to be great for Wells Fargo, too! The traditional story that Wells somehow got fooled into thinking customers were going to spend a lot more on their cards than they did, and were going to revolve and pay a lot more interest than they did (but people normally plan for and pay off their rent charges), and made a bad deal doesn’t actually hold together.

- Wells Fargo was getting into the cobrand business, and they were new at this. They needed early cobrand deals to gain credibility in the space, so they could go after big accounts like airlines and major hotels. They’re one of the few banks big enough to actually compete for United with Chase or Delta with American Express – and that was the plan.

- So you go and overpay for early deals like Bilt, Choice Privileges (the card’s earning is poor, Choice takes so much out of the deal there’s nothing left for customers) and Expedia. And that makes sense if it’s an investment in doing bigger deals later that will make money.

- Plus, if you’re Wells Fargo with all kinds of consumer reputational baggage, you get those early wins with a big checkbooks. And Wells Fargo was getting desirable young urban professionals as customers – high income, upwardly mobile. Plus, Wells was an early investor in Bilt and has seen a tremendous return on that – perhaps 20x.

- But once the bank pivoted strategy and changed their mind about emphasizing cobrands, they started to care more about the economics of the Bilt deal on its own. And they were subsidizing a lot of banana-eaters. So it’s been reported that they threatened big annual fees on the cards and this got a negotiated early end to the deal.

The co-brand card with Wells Fargo was an important early piece for Bilt. They had a vision of rewarding rent, but really what they had was a vision for reaching a valuable customer that nobody else had managed to reach but that everyone wanted. The credit card provided the first big way to monetize those customers and helped fund the enterprise.

Now they have a whole ecosystem, that begins with affluent customers with disposable income, and they reach those customers where they live. They promote partner offers (Lyft, Walgreens, GoPuff, restaurants, travel, and the like) to those customers. Some of those are very good offers, to bring the business of very good customers to brands. They’ve built a coalition loyalty program that no one has been successful at in the United States, and they did it from scratch in just a few years.

Their Chairman is the former Chairman of American Express by the way – who tried to do this and failed with Plenti. So they have a lot of wisdom in what didn’t work in the business, and navigating credit cards too.

To bring this full circle to Levine’s take saying that giving customers something that costs you more to make than you’re selling it for – hoping to get to scale – doesn’t work sometimes (Moviepass) but does work other times (Uber), the way it usually works is you light VC money on fire and then you raise prices later.

Uber has gotten quite bad. They’ve squeezed drivers with lower pay, they charge riders more, and they no longer enforce quality standards much either.

But Bilt has managed to build a customer base that’s value, a partnership ecosystem that’s valuable, and a set of cards that’s valuable just in a different way than before. It’s one that works a lot better for me than the old one.

The no annual fee card is surely a better points card than any other no annual fee product on the market. But it doesn’t work well for the people using it… exactly the way the old one was designed. And Bilt now is a lot more than just a credit card.

“I find a ton of value in Bilt Rewards.” Yes, as did anyone who actively partook in 1.0, but those days ending. Please, anyone, if you can convince Wells Fargo to keep losing $10 million/month so we can keep milking 1 point per dollar on rent without fees, gladly, bring back our sugar-daddy.

That said, yes, many of us (maximizers) are still willing to churn-n-burn the SUB on Palladium, but, with great skepticism. If they pull AS/WOH/UA from transfers; Rakuten is basically nerf’d in May; if the Alaska cards 3x ends abruptly… bad signs.

Excellent analogies on Uber, Gary, especially the “light VC money on fire and then you raise prices later.” Ankur’s goons on other blogs are so quick to try to discredit any naysayers, and also, like Gary, point to the former Amex CEO as being on their board, as if that guarantees longevity. It doesn’t. If it did, why isn’t issuer Amex? Amex must’ve been like… ‘new phone, who dis?’

Oh, and Gary, DoC has been posting about folks using link for 5x, but it not attaching… classic TPG/BILT bait-n-switch right there. They really should just do 5x up to whatever for everyone as a consolation, regardless of using that link or not.

This new ad program where you send me FIFTEEN GD TIMES to a Hyundai ad before I can read the entire post SUCKS. Christ. FIX IT.

The problem with your explanation of the role of Wells Fargo is that Wells is currently sitting watching all those valuable Bilt 1.0 customers leave it for Bilt 2.0. It has not come out with a competing offering. Rather than being a sophisticated, knowing fellow traveller they are just a bonehead banker unable to contrive a compelling loyalty program.

Insane levels of shilling, would love to see what the kickback from bilt is here

I didn’t convert to Bilt 2.0 and I don’t even use the cards/program for rent payments. I liked a 3x no AF dining card. They got rid of that. That isn’t competitive to other no AF 3x dining cards out there. I don’t get what they are doing. Sure the point system is better but not that much better.

Such a bad roll out. So hard to trust after that. And yet… the math is very compelling.

The adjustment they made after launch was excellent – not the housing only option but the $50 in Bilt cash per 25k points earned not $25k cash spent. Changes the cpp very positively.

My personal math gets me above 3.5cpp with the accelerator while requiring less overall spend to unlock the housing points because of the increased B$ earnings.

Encourage everyone to rerun the math.

@Jack, what other no AF card gives you 3x in transferrable points for dining without holding another AF card from that bank? I don’t see how Bilt is uncompetitive when they give you this option for a $95 fee, the same fee as the cards you would need to hold to unlock points transfers on other no AF cards.