A reader passed along a really interesting receipt, with grave concern. He wanted to know when the AAdvantage Dining program started charging extra to earn miles? And how many restaurants show you a tipping recommendation based on the post-tax amount on the version you sign, and then give you a receipt to keep that shows a recommendation based on pre-tax, to hide that they were trying to boost your tip?

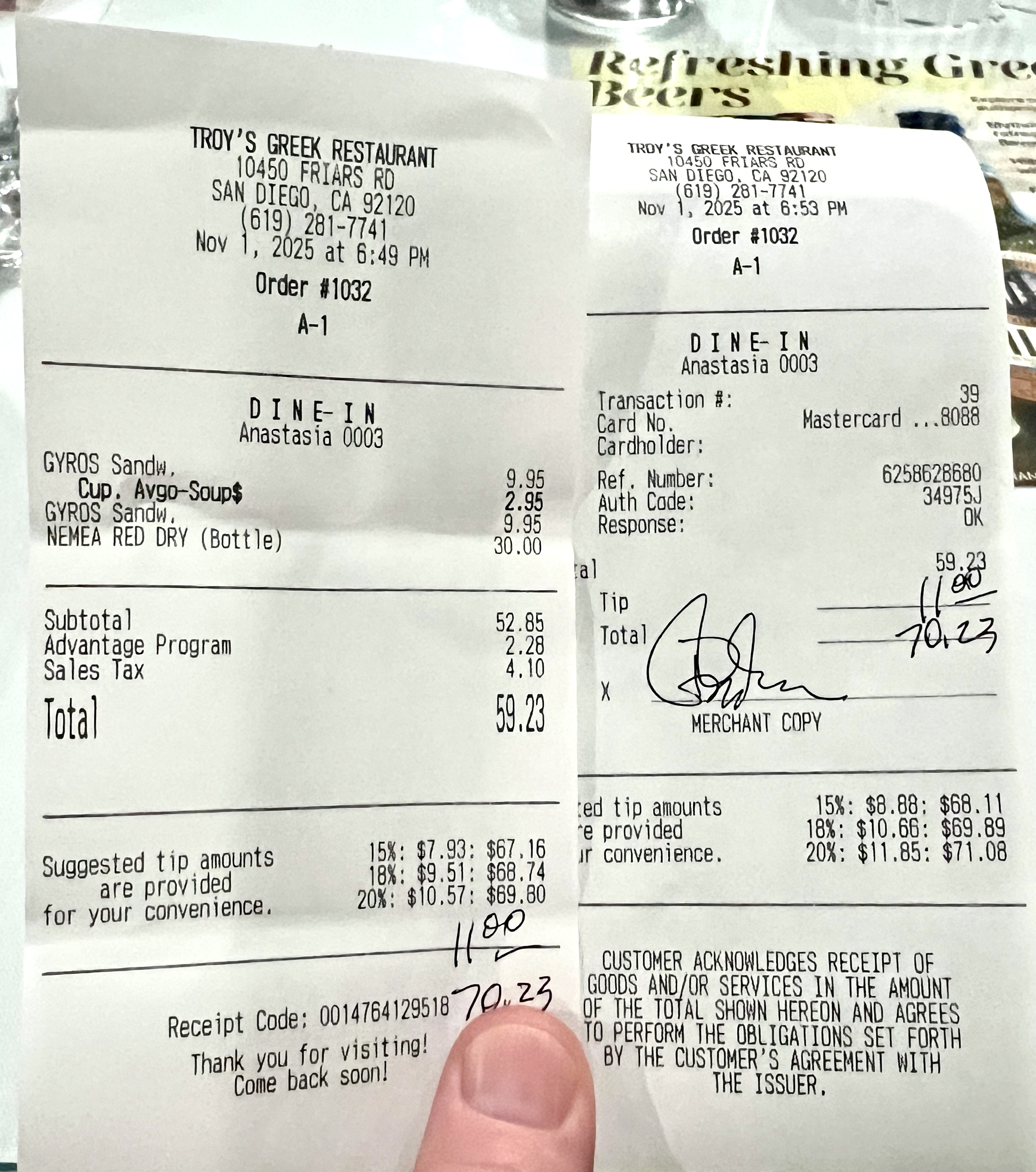

Here’s the receipt, and it sent me down a bit of a rabbit hole to figure out that this isn’t what’s happening at all.

It’s understandable that the customer would think a surcharge for the “Advantage Program” was for earning miles at the restaurant through AAdvantage Dining, but the restaurant actually has no way of knowing which customers are signed up with a Rewards Network dining program, let alone which one (AAdvantage Dining, MileagePlus Dining, etc.).

Instead, it’s just coincidental naming. The Advantage Program is the option in the restaurants Point of Sale system, Shift4 that allows them to surcharge the meal for credit card payments.

- It’s an advantage to the restaurant, not to the guest.

- And they make what I’d consider a rather sketchy claim that it’s an option, not a surcharge to circumvent Visa’s 3% surcharge limit.

The idea is that a customer ‘can ask to have the fee removed’ and therefore isn’t a surcharge, but the restaurant doesn’t tell you this (and it isn’t clear if they’d honor the request) – but it’s in the software documentation.

If a customer wants the “Supplemental Fee” removed, you (or server) can select the Remove Fee function button in the Settlement screen prior to adding any payment, refer to How to Apply Cash Price, Remove Fee or other function buttons in RM.

Note: This must be done for all debit cards.

In fact they assume it’s so rare that the fee would ever be removed that they don’t worry about the fact that doing so will ruin their reconciliation reports.

Important: Removing the supplemental fee would result in the estimated bank deposit being lower than is shown in the Session Summary and other reports.

I’ve found plenty of complaints about this on social media.

Now, this restaurant is in California. Under Senate Bill 478 (“Honest‑Pricing/Hidden Fees Law”) that went into effect July 1, 2024, businesses must list the full price the consumer will pay (excluding only taxes) when advertising goods or services and adding a mandatory surcharge at checkout (not included in the advertised price) is prohibited for most goods.

There’s a special exemption for restaurants, bars and food vendors. They can have “mandatory fees” (service fees, surcharges) only if those fees are “clearly and conspicuously displayed wherever prices are shown” (menus, websites, etc).

- If the fee is mandatory, then the restaurant must have included that fee in the price displayed up front (or at least clearly show it before taking an order).

- If the fee is avoidable by paying cash then it’s a cash discount (‘dual pricing model’) that’s more compliant. And if the fee is truly optional it wouldn’t run afoul of the law.

Meanwhile, the “customer copy” shows suggested tips of 15/18/20% on the pre‑tax subtotal ($52.85). Point of Sale systems commonly let the restaurant choose whether suggestions are based on subtotal or total (including tax).

The “merchant copy” here shows suggested tips of 15/18/20% of the grand total ($59.23). That is likely the default configuration. This mismatch is almost certainly a configuration problem, rather than a scheme to hide the basis on which the customer likely tipped.

However it is frustrating that the merchant figured out how to configure the surcharge, but couldn’t figure out how to configure the receipt properly.

Bottom-line: the restaurant’s “Advantage Program” is not “AAdvantage Dining” even though the eating out there earns AAdvantage miles. And restaurants now commonly default to suggesting tips on the total including tax, though that certainly didn’t used to be the standard basis on which to calcuate tips.

The good ole days are over; many of these gimmicks are becoming scams. Sure, maybe if you’re paying with ‘other peoples’ money’ you’ll feel fine with overspending on meals or hotels or flights or everything, because you get your kickback, but after a while it’s just not worth it anymore. Like, ‘lookie, 51x rove or whatever, but pay double.’ Friends, these corporate pseudo-currencies and completely unregulated schemes are feeling more like crypto scams than like ‘a fun hobby’ more and more. Beware.

Gas stations in CA have cash price and cash price posted.

These places that rely on cash are the ones getting robbed. You never hear that the Marriott was robbed because they have no cash

Gas stations in CA have cash price and cash price posted.

These places that rely on cash are the ones getting robbed. You never hear that the Marriott was robbed because they have no cash.

Of course it can’t officially be a surcharge program because some states have laws against surcharges. Of course there’s almost never a problem giving a cash discount, which itself is not a surcharge. That’s what the Advantage Program claims to be, even though it is clearly being presented on the bill as a surcharge and not “cash v non-cash pricing”. Tomato, to-mah-to.

This is the reverse side of the coin from the prior article. None of this is about the 0.1% interchange fees. It’s all about restaurants and other merchants simply passing along the entirety of the interchange + middleman’s fee to the consumer. [Insert comment about how tariffs work the same way here.]

The not-so-secret secret is that cash transactions and cash back rewards, for most people, is better! For those of us who have some means and are just looking to “play a game” by earning points for “free” business class travel, one can have all of the social media “my cpp is bigger than your cpp” posts they’d like, but the cost of actually acquiring the points is half the battle. For those who actually rely on credit cards as a means of financing their lives, not only is the cost of doing so potentially now 3-4% higher, but those increased balances of course are being charged outrageous interest rates that fall just below this week’s definition of usury.

In all of this, rest assured that the banks always win. Signed, proud VIP member of the AAdvantage Dining Program that enjoys earning 5x points/LPs at participating restaurants!

@gary i have a senior contact in the f&b pos industry – email me if you want to connect with this person

my local thai takeout autodefaults a 15% gratuity

when you change it to 0% and tab through to confirm payment it resets back to 15% the first time, but stays at 0% the 2nd time

if you have to enter a card number or change any information, cell, email, any of the card information, you have to go through the double set-to-0% bs every time

these are FEATURES developed by the pos industry – not bugs – not config errors – it’s done on purpose

i tolerate this because the place is close by and the food quality is high, they get the order right every time, and the staff doesn’t short or steal part of the order (which is a frequent problem nowadays)

If Troy’s Greek Restaurant in San Diego renamed their “Advantage Program” surcharge to “DISadvantage Program” surcharge, it would demonstrate their commitment and dedication to Truth-in-Advertising practices.

@1990 – Your pathetic, brain dead rant fails to grasp a single point of the article you claim to be criticizing, rendering it nothing but a hilarious, impotent visually screaming exercise in intellectual fraud. You misread “Advantage Program Fee” as some grand miles conspiracy, proving you can’t parse basic business language, and then devolve into mindless “crypto scam” hoaxes and inarticulate nonsense about “pseudo-currencies” and gibberish like “51x rove.” It’s a brilliantly childish performance of someone who’s too angry and confused to actually pay attention, right up to your laughable, “Beware”-Style savior complex. You stumbled into a grown-up conversation with subway-level reasoning and couldn’t even follow the simple 1-2-3 of the piece, letting out a primal scream of impotent rage while the adults talk about actual, real-world business practices. You are an incompetent, distracted spectacle of a failure.

@Mike Hunt — So, where are you on the David Frum spectrum: “If conservatives become convinced that they cannot win democratically, they will not abandon conservatism. They will reject democracy.” You one of those ‘reject democracy’ types?

@1990 – I am a reject you type. Go away.

@Mike Hunt — So, you going with Balkanization? Not a good idea, but, wouldn’t surprise me if you guys pushed for it…

@Mike H, thank you.

No doubt 1990 will feel obliged to respond.

@Pilot93434 — You sure you and One Trippe aren’t the same fellow?

Places that that try to pull this with me see the tip reduced by a like amount.

I have been tipping on the full amount of the check for over 45 years.

@Mike Hunt. I’ve found my pleasure at this and other websites increased dramatically when I stopped reading posts from a poster who never really reads posts and simply reacts with canned stupidity. The great benefit is I haven’t seen the word oligarchy in weeks.

“We live in a time where intelligent people are silenced so that stupid people won’t be offended”

I’m talking to you 1990 (and I don’t give a damn whether you are offended, because you are hysterically wrong 98.6% of the time).

There is no such thing as a free lunch. Period.

The fee is either hidden or it’s on the receipt, but it’s still a fee someone has to pay.

It’s a shame that Visa/Mastercard won’t yank their MCC over this. Killing a few restaurants to encourage others not to play these games would be nice.

I prefer when the fee is included in the item price on the menu (like the costs of handling cash are).

Gary, do you have AI turned on in your reply box? I was typing and then navigated away from the box for a bit. When I came back, my text was changed and ‘stylized’ & ’embellished’ more. Totally creepy. Not going to reply anymore.

@Gary said:

“And restaurants now commonly default to suggesting tips on the total including tax, though that certainly didn’t used to be the standard basis on which to calcuate tips.”

And it still ISN’T the basis to calculate a tip on sales tax nor is it the standard to calculate a tip on the credit card surcharge or any other BS fees that restaurants put on a bill.

The gold standard for deciding when to tip is whether or not one receives a PERSONAL service such as those provided by EXPERIENCED wait staff, one’s barber, building doorman, etc.; in simple terms, did someone “take care” of you?

And as for the credit card surcharges that, for the most part, are still confined to restaurants, let’s call them what they are: a money-grab, pure and simple. By imposing a credit card surcharge, it’s obvious that those restaurant owners who do so are clearly out-of-touch with the times since damn near everyone except for a Luddite uses credit cards, if not for the points and miles then for sheer convenience and credit card fees are a cost of doing business just like electricity and lettuce for the salads.

I just returned from a trip where I needed to eat out for the duration and one of the restaurants had a very clever way of hiding the CC fee by presenting two totals: one for cash and one for payment by credit card. That was the last straw for me; from now on, in the types of restaurants that typically impose a CC fee (Tex-Mex and Indian for me), I simply reduce the tip by 4%, since some impose a higher surcharge for Amex cards and one restaurant didn’t show it on the bill I was given at the table and I only became aware of it when I received the receipt AFTER paying.

No more BS: no more searching for CC surcharge disclosures on the menu, on a small sign with tiny print seven feet up on the restaurant door, no more asking the wait staff, etc. Reduce the tip and show my math on the receipt so that the wait staff knows why their tip was reduced. Maybe that will put an end to this crap.

Restaurants need to correctly price their offerings to include ALL of their costs of doing business just like Amazon, Lowe’s, United Airlines, etc. and quit trying to trick their customers into paying more at checkout.

And a tip for the Android users out there: I’ve been using an app called ClevCalc by Cleveni Inc. It’s got 100M+ downloads on the Play Store and it makes short work of restaurant checks and makes sure one gets the arithmetic right. I have no connection to the developer, just a very satisfied user.