Alaska’s strategy is to award high revenue customers, and their most frequent customers, with more miles.

That’s because — as the title of one of their slides at this week’s Investor Day made clear — Industry transition to a revenue-based loyalty prorgram provides opportunity in the near term for Alaska.

(Alaska was believed to be considering a revenue-based program themselves a couple of years ago.)

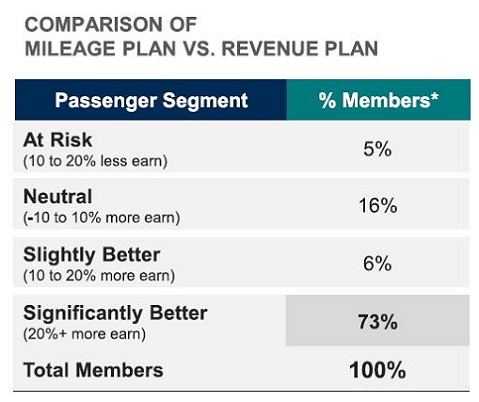

Alaska has looked at the numbers, and shared them in a chart, to explain why customers are much better off with a traditional mileage program than a revenue-based one.

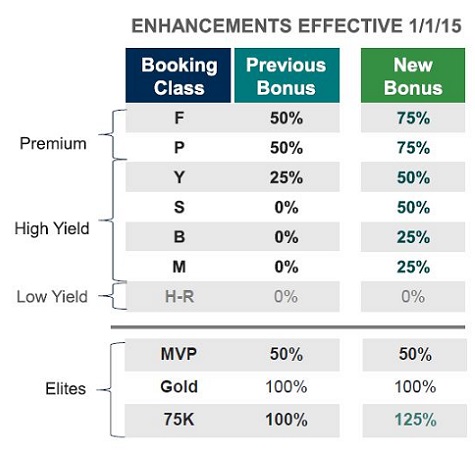

Here’s what’s changing with Alaska Airlines Mileage Plan earning (for Alaska flights):

They’ve run the numbers and compared winners and losers under their system versus a revenue-based one like United’s and like Delta’s.

Interestingly, United has historically been Alaska’s major competitor along the West Coast (remember, they partner with every full service airline but United, more or less) and Delta has been their major competitor – directly in Seattle – most recently.

The simple fact that break-even for revenue-based earning at Delta (and at United) is set at 20 cents per mile, but both airlines’ average revenue per seat mile is substantially lower than that, suggests fewer miles will be earned under the new system. (And the highest priced tickets don’t benefit proportionally because mileage earning the capped.)

So what do Alaska’s numbers look like?

- Alaska believes only 5% of flyers would earn more miles under a revenue-based program.

- 79% of flyers do better under their mileage-based system. In other words, 79% would do worse with revenue-based.

Now, they’ve run the numbers on their customer base. So their numbers probably aren’t off by a lot.

And each airline’s numbers are different (which is why it’s so strange that United directly ape’s Delta’s mileage-aerning rates and minimum revenue requirements for elite status).

But Alaska’s numbers publicly make the case pretty strongly that flyers are worse off with revenue-bsaed earning than mileage-based earning.

That doesn’t mean revenue-based is worse for an airline. I’ve argued that revenue-based programs are precisely about spending less on marketing to fill seats when seats are mostly full. Being less rewarding for travelers, for Delta, appears to be a feature not a bug.

Nonetheless, this is pretty strongly persuasive that revenue-based programs aren’t ‘rewarding the right customers’ and better for customers as a whole or for most customers.

(HT: Joe B.)

- You can join the 40,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

But…

Alaska has a really small base of international fliers. So the At Risk / Neutral of them will be much lower than for a global network carrier (look at less than 10% of their mileage redemption with global carriers).

For Delta / UA that segment is probably closer to 30-40% of the flyer base that makes out better. And they may constitute 70% of the revenue.

In other words using Alaska’s member base for comparison just doesn’t have much application to UA/DL.

Revenue-based redemption is better for people who do not have the time or desire to figure out how to play the loyalty program game.

Revenue-based earning is better for people who don’t pay any attention to loyalty programs and don’t fly often. In other words, revenue-based earning gives more rewards to people who don’t care about the program and less rewards to the people who do respond to incentives. That’s nonsense unless the other benefits to the airline are overwhelming, which apparently they are.

NSX – the problem is, without excess capacity in the system (read: CHOICE) you don’t really need to incent most of the revenue base. Most people will choose around nonstop options, schedule, and maybe, *maybe* hard product. I’m reading a little between the lines, but based on what I’ve heard unofficially from some carriers, they think they could axe mileage earning to a fraction of what it is now and not see a meaningful shift in behavior because of how important nonstop and schedule is. I personally disagree, but its the ones with the data passing this along.

I’m very excited about switching to United (although not about the product) because I only fly transpac in J.

If an airline really wants to save money they could just eliminate the mileage plans.

Airlines know this. It is obvious. And ranting about it constantly won’t change anything. Bottom line is that elites are not worth the cost to airlines. The trend is going more and more to cattle car economy all over the plane. Few fat cats sitting in first class are actually paying for those seats. Mostly upgrades. Why award them when can make profit. No alternatives if all airlines mimick each other. Heck bloggers demonstrate the absurdity of providing first class award seats. The trend will hurt award booking services. I guess that is the reason for the constant rants but smart for airlines

@Ken Y – You may benefit until you reach the miles errrr point limit for the transaction at 75,000 per purchase. For a 1K on a ticket costing more than $6818 the fine print maxes out the points earned. I have bought a lot of $10k plus tickets for international biz. So how does this incentivize HVFs? United blindly follows Delta but doesn’t have the service or reliability. Airlines know that this is bad for fliers but do it anyway. Travelers that continue to patronize such airlines are collectively part of the problem. AA and AS for now refuse to do so and get my business.

@SkiCO Except that hile AA is officially not going revenue based, they are in fact is doing something even worse: a Stealth Devaluation.

The AA 62.5K mile FC TATL award is pure fantasy. Even booking 331 days out, 99% of the time the best you can do is 140K miles for a o/w FC TATL award. Often you have to pay 175K, sometimes 215K miles, even if you only need one award seat on a flight.

75% of FC TATL for August 2015, a slow time for business travel to Europe, is currently pricing at 175K miles o/w. Even a 1K flyer is going to need almost 4 years of flying to qualify for a pair of FC TATL awards at that price. And of course, by the time you do that 4 years of flying, award prices will probably have gone up much higher, and you still won’t have enough miles.

Who cares what scheme is being used to calculate miles earned when you have to pay that much for an award ticket? 🙁

Gary – AA has a revenue-based program for businesses – BusinessExtraa. Have you ever done a profile of that program? My earnings there are MUCH less valuable that in AAdvantage, but still occasionally useful.

My transpac J tickets from the west coast are usually $6k RT. I’d much rather earn 66,000 UA miles than 34,000 AA miles, esp when I sit on about a million of the latter.