When US Airways management took over American Airlines 11 years ago, they had a conundrum in New York. New York is a competitive market, and they’d generally shied away from direct competition while running US Airways. And they weren’t big enough in New York to be the biggest competitor, either.

So they came up with a strategy of not competing for New York business but instead wanted to become the airline that brought people to New York. They timed their flights, often from smaller cities, to let people travel to New York and back in a day or at least fly up in the morning and leave after the business day.

That strategy didn’t make them money flying, so they pulled down their New York operation. They stopped serving as many destinations. By 2018 they flew to hubs, they served LA (which gave them an advantage pitching corporate contracts there after United pulled out of JFK), and they served London Heathrow where joint venture partner British Airways is based. They had a few other destinations that amounted to what the airline described as a ’boutique operation’.

Then they squatted on slots with inexpensive short distance regional flights, and took advantage of slot waivers wherever they could such as reducing their flying while New York JFK did runway work. They actually lost track of some slots, failed to use them, and had them taken away.

The ’boutique airline’ pitch wasn’t a great strategy either. They weren’t poised to win New York corporate business with a smaller operation. They weren’t poised to attract New York loyalty. And perhaps worst of all, a smaller New York footprint meant ceding the credit card market in one of the most important financial centers in the world. They just didn’t have the relevance to the New York customer.

During the pandemic they came out with a brand new strategy and it seemed brilliant: they would tie up with JetBlue. Together they were the number 3 and 4 carriers in the New York market and would be big enough to compete with Delta (and United at Newark). Far from being anti-competitive, this created a third real competitor in greater New York.

To get signoff from the Department of Transportation, they agreed to give up some slots, and to give up more if they didn’t grow the number of seats offered out of New York (more supply and likely lower prices, the opposite of anti-competitive behavior). The federal government approved the deal – and then set out to sue to overturn it – all within a matter of months and with no new information just a change in administration.

The Department of Justice won its antitrust case at the district court level. An appeals court didn’t find clear reversible error. JetBlue had already moved on to focus on its ill-fated attempt to acquire Spirit, and now to do a deal with United (that has far bigger market concentration issues than the American-JetBlue Northeast Alliance but there’s a new administration).

So what is American Airlines to do?

- They remain undersized in New York and can’t really grow because the airports are slot-controlled.

- They were losing money on New York flights. Vasu Raja claimed to me years ago that cutting back on flying stopped the losses, but I argued years they were doing the accounting wrong – they needed to include co-brand credit card revenue into the equation because an aggressive New York presence was how’d they’d be relevant to the market and attract card acquisition and spend.

- Raja actually adopted this mantra when he became responsible not just for the network but for revenue. He’s no longer at the airline, but the problem remains: what path forward?

Obviously they should optimize their schedules – stop burning peak-hour slots on thin-regional routes and upgauge high yield routes. They should continue to lean into the co-location of their oneworld partners in terminal 8. They should consider growing at Newark (long-term, this month wouldn’t be the time to announce it).

But I actually think there are several additional things that American Airlines can do to compete effectively in New York.

- “We are the second largest global carrier in New York” Newark is not New York and JetBlue isn’t global. “As #2, We Try Harder.” This really did work for Avis for a long time.

- “We serve the largest, most important markets from New York so we’ve got you covered.” They fly from New York LaGuardia to Chicago; Atlanta; Dallas; Orlando; Miami; Fort Lauderdale; Charlotte; Detroit; West Palm Beach; Nashville; Boston; Tampa; Raleigh; DC; St. Louis; New Orleans; Columbus; Pittsburgh; Cleveland; Indianapolis; Fort Myers; Charleston, S.C.; Myrtle Beach; Memphis; Greensboro; Richmond; Buffalo; Greenville; Wilmington, N.C.; Oklahoma City; Norfolk; Grand Rapids; Northwest Arkansas; Asheville; Charlottesville; Des Moines; Columbia; Litte Rock; Portland, M.E.; Tulsa; Madison; Burlington; and Nantucket.

- “We upgrade our best customers more often than competitors.” Only about 13% of first class passengers on Delta are there on elite upgrades. Delta really doesn’t offer upgrades anymore. American upsells aggressively coach passengers for paid buy ups, too, but they’re still behind Delta on this. They should market that.

- “Our miles are worth more.” Every independent observer agrees with this. The latest was the IdeaWorks study. AAdvantage won three Freddie Awards. Delta’s own Vice President for SkyMiles says they aren’t trying to compete on value to the consumer.

- Focus on the product. This may sound odd talking about American Airlines, but Delta flies its worst business class product on premium transcons. Their 767s shouldn’t be branded ‘Delta One’ at all. American still has Flagship First Class (such as it is) and will be bringing on A321XLRs with suites that offer doors in business class to replace their current premium cross-country planes. And while their New York JFK lounge offering doesn’t top Delta’s business class lounge there, they make their lounge products available to far more customers.

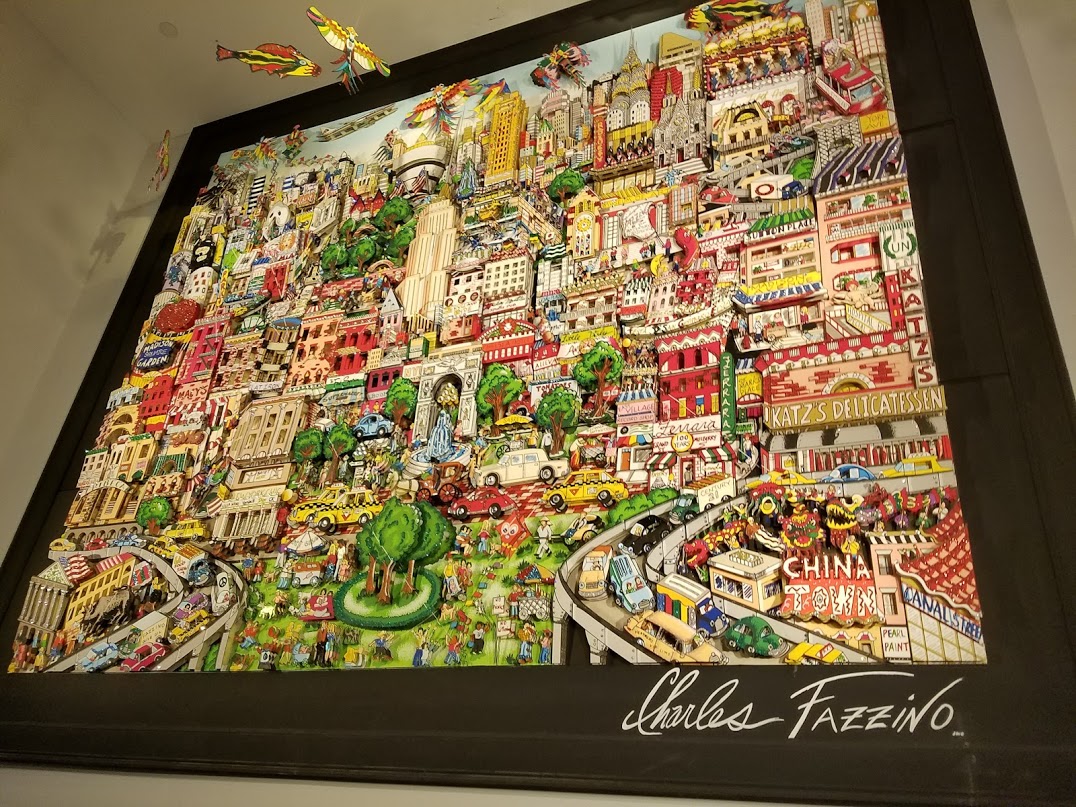

- Focus on small New York-focused changes to the product. Swap Dr. Pepper for Dr. Brown’s on New York flights. Load chocolate syrup in the coach galleys and offer egg creams. The airline needs to build out its buy onboard offerings, so start with New York and do bagels and lox on morning departures and pastrami sandwiches later in the day. Partner with local brands on meals – maybe Katz Deli or Nathan’s Hot Dogs and offer this on a pre-order basis in first class.

- Run promos like crazy. Get aggressive. Pair this with messaging about the relative value of the AAdvantage program. Name and shame, and print some miles. Run 100,000 mile card offers strictly targeted at the New York market.

- Acquire more slots opportunistically. They will never replace the treasure trove of slots that US Airways management gave away to Delta but slots controls at New York airports aren’t going away any time soon, and there’s no use waiting for slots to be marketed ‘openly’. Aggressively call every foreign carrier that has some. See what you can beg, borrow or steal from partners. Expand wherever you can.

But maybe first and foremost… acquire JetBlue. No United deal has been announced yet! And it’s not clear it’ll be a merger (yet) anyway.

United is certainly in a better financial position to do the acquisition. But American is still stronger than JetBlue is – their market cap is low enough American could possibly pull it off.

And while an antitrust case ruled against their partnership that was because they were separate companies that were ‘carving up a market’. The same logic would not have applied to a single company. See broadly Copperweld v. Independence Tube Corp. (1984) where a single company, or subsidiary and parent company, cannot be considered to ‘collude’ under the Sherman Act.

Besides, (1) American-JetBlue is less of an antitrust issue than United-JetBlue, and (2) the Trump administration approved the Northeast Alliance in the first place, it was the Biden administration that reversed that position.

Yep.

NY is not an airline market. It’s a real estate market. Acquire the land (JetBlue), then monetize it over time. And, use the JetBlue service model to improve the American service model, rather than the reverse.

As a New York flyer who used to rely on AA for the vast majority of my flights and still easily agrees that Aadvantage offers the best value for consumers – and not by a narrow margin – there is only one thing that is missing that could get me back to being a loyal customer . . . fly more routes to more places I want to go from NYC.

In the past two decades AA has become expert in NOT flying. They used to have double daily service to Tokyo. They used to fly to virtually every city in South America and Europe year round. Today they have laid off most of their Asian service to JAL and CX – neither of which is what they used to be – and they have drastically cut South American service and many of the services they do still have are seasonal. To Europe they’ve cut many routes and they’re flying many destinations only from Philadelphia! If you want to go someplace, the default is that AA can no longer take you there from New York. I care about that VASTLY more than about what is served on the flight, or even how poorly I’m treated by cabin crew. If you don’t have the routes, you won’t be a viable choice to be my airline, no matter what else you do.

@BTN New York is by significant margin the largest airline market in the United States, about half as large again as second place Los Angeles. It has the highest average fares and the largest percentage of consumers flying in premium cabins. New York is where the money is, and AA has allowed it’s competitors to capture it while it looked for short term gains.

Bring back Houston nonstops … it was good while it lasted…. Although the LGA to JFK connection stinks

honestly, why bother? I dont know why you all are aiming to restore a past that was never quite as grand as you think it was.

People below complain about American to South America. They still fly to all the same places they ever did. Buenos Aires and Sao Paulo. Rio de Janeiro seasonally. Sometimes theyve tried Rio year round but never for long; it always comes back seasonally. Santiago they tried for a hot second during Covid. Didnt work. So they’re fine there.

Honestly, New York was never as big as people think it was.

The S Curve really is a thing. You need a disproportionate amount of shares to really dominate a market, and AA simply is not in a position to make that happen.

Gary, you really dont understand what competition is and the way DOJ looks at competition.

DOJ expects everybody to compete against each other. Just because an alliance made JetBlue and AA stronger versus the others does not mean it was a win – they agreed to NOT compete against each other, and that is not allowed. Sorry, your thought process is flawed here.

While the DOT did let it go, you always miss a key part of their decision – they said they were okay with it, but that other parts of the government still had their chance to review. Clearly, the DOJ thought different and had these competition concerns. You leave that part out.

Anyway, people here wax poetic about “if only they got these slots, if only this, if only that”. Maybe it just wont happen. Having worked in airline profitability at several domestic airlines, I can tell you that flying is just not as great as people think it is in NYC from a profitablity perspective. Sure, there are some markets where fares are high, there are a lot more where fares are low. Until you’re a Delta with a ton of slots or a United with a huge operation at Newark, you’re just a price taker. And even then, you still kind of are.

Point is, the New York ship has sailed. AA still has a good presence in several markets, but thinking that foreign carriers will just sell a slot (in many times, their ONLY slot) to AA is ridiculous. AA should focus on being relevant in its certain markets, and just deal with the reality that it’s not going to be all things to all people. It simply doesnt have the resources to do so. This constant “why cant AA be big in NYC ” really is defeating and a ridculous waste of resources.

I am trying to figure out if vasu or Doug did more lasting and possibly fatal damage to AA

Bottom line in any business – you can put toothpaste back in the tube

They have lost too many loyal customers (me included). It takes years to cultivate a loyal customer buy only a few missteps to lose them

Could go on for hours but

@Gary I appreciate your intake but this incremental growth strategy will take years to implement and fails to address some of the core vulnerabilities in AA’s product that continue to plague it.

AA cannot compete without an economy of scale in its NYC operations. EWR made that happen by consolidating down to EWR (which they regret) and DL has done it across two airports, creating domestic and international hubs. In both cases, they had the slots to do it. Without the slots or a renewed partnership with B6…who seems to have run into the arms of UA…they are SOL.

AA con continue to focus on their also-ran status in NYC or they can focus on their strengths, making them stronger. They do not need NYC. WN has proven they can thrive as an airline without a large operations in NYC. This is just a distraction for AA.

@Chuck – Parker destroyed more value than any other airline CEO in history https://viewfromthewing.com/never-lose-money-again-how-american-airlines-destroyed-more-shareholder-value-than-any-airline-in-history/

The solution to AA’s New York problem is to acquire JetBlue. And it will happen.

AA has done the same thing in Boston.

Pre merger with US, the 2 carriers had 250! Daily flights between them. For this upcoming Summer season, the merged carrier will have a high of 85.

DL & B6 now rule the skies over BOS

@Gary – I DID??? I need to serious rethink my handle on here. Even I’m getting confused…and slightly emboldened when I try to convince myself I have more power than I do. LOL!

Sorry I I had anything to do with the current state of AA. I tried to provide feedback using traditional channels, but it didn’t seem to work.

How do you know American wants to win back New York? It may be that the most profitable move for American to make in New York is to reduce service to bare bones levels. Southwest was more consistently profitable back when it didn’t have as big a presence in New York as it has now. Think about it. LOL

Change the god awful attitude of the FAs, especially those crewed in Miami. Enough said.

Gary, what is it that AA’s network planner Znotins doesn’t know? He’s got this dialed in. He has people flying from JFK to DFW on their way to Europe. How silly of you.

@ Mak

You very much mistaken. I live in Philadelphia and can attest that average premium cabin fares in NYC are anywhere between 20% – 50% LOWER. Everyone I know regularly drives to NYC airports to save hundreds if not THOUSANDS of dollars.

AA should not leverage the notion that “Newark is not New York” as it undercuts the anticompetitive aspect of a United-JetBlue deal. United is bit player at LGA and does not exist at JFK. If AA wants to lean into “we’re #2 global in New York” then a United/JetBlue deal in the long term is less of a threat to the competitve balance in New York.

Kirby has already outmaneuvered Isom in this regard, and a “soft” deal that enables United to reenter JFK, and implement a marketing/codeshare relationship outside of ATI (for now) is probably going to pass regulatory muster.

If AA wants back in with JetBlue, it probably should not invest heavy resources in building out New York independently. At the same time, I don’t think AA has the horsepower to get into a bidding war with United. It’s a catch-22 for sure.

PMAA was giving up on NY and then Parker and company so very little reason to do much with NY. It’s all about DFW and CLT. I don’t see AA investing hundreds of millions to become a market leader in NY.

I gave up on AA when they put the cramped A321s on the JFK-LAX run. They should have put 767s on that run and made it a wide-body ‘luxury liner’ route. I avoid that AA on that route now, preferring the wide-body 767,777 & 787 that Delta & United fly.

“But maybe first and foremost… acquire JetBlue.” Yes!!!

“there is only one thing that is missing that could get me back to being a loyal customer . . . fly more routes to more places I want to go from NYC.” – Mark

Yes, agreed!!!

@George N Romey has it at least partially right – “PMAA was giving up on NY and then Parker and company so very little reason to do much with NY.”

To be certain, PMAA had to relinquish remedy slots in the wake of AA/TW merging (some of which became B6 slots). But the largest portion of the AA slot portfolio that ultimately was wound down was that of the former Business Express/American Eagle.

@Gary,

Thank you for a well thought out piece. AA under USAir management has misplaced focus on PHL, they can’t help themselves be seduced by the low costs of philthedelphia.

AA lost JFK after 9/11 when they decided to grow LGA. This was after spending a significant amount of money building out the new JFK terminal. The victors in JFK were Delta and jetBlue. AA ceded the JFK fortress in 2002 and after the airport became slot restricted in 2007 the end fate was sealed. Understanding history, try to keep up.

I agree, AA should buy JetBlue, period. Or if DOJ doesn’t allow a merger, then buy what they are allowed (25% of the company stock) and JetBlue will in effect have to use AA as codeshare instead of UA. And AA needs to upgrade their domestic experience to become competitive with DL and UA, which will help them everywhere. I think employee attitudes would rebound substantially if they felt that AA is serious about upgrading its hard product to Delta levels. AA actually has an opportunity to leapfrog DL/UA right now because they dragged their feet in product upgrades: they could install next generation seatback better than competition, and they are going to update their A319 and 320 fleets with larger overhead bins and new seats, plus more first class, going from 8 to 12 seats on the A319 and from 12 to 16 on the A320. They could put the new seatback entertainment in this large fleet, also could add yet one more row of first class so that they have more than DL/UA, with 16 on the A319 and 20 on the A320. The first class on these airlines are almost always full, even when coach is half empty, these days…before upgrades. They could even sell 2 of the 4 extra seats as advanced paid upgrades, then use the other 2 as elite upgrades. Also use the fleet update process to install winged first class seats like they are putting in the new A321xlr premium economy section, which would compete with Delta’s new winged first class seats. While you might think “this will take a lot of money,” yes especially the seatback entertainment would, but their main competitors are doing it already. A couple hundred million is not a lot in the legacy airline world, and if you look at AA’s revenue / yield deficits versus DL/UA, it’s in the BILLIONS….PER YEAR. Their refusal to put in seatback entertainment is the definition of penny wise, pound foolish. If AA did these things, plus consider those that the author suggests in the article above, and AA could win back New York, at least enough to gain corporate back.

Hey Gary, just wanted to let you know that Aviation A2Z has plagiarized your article. It’s not exactly word for word, and your original is linked, but the content is almost identical, and that’s not acceptable for an opinion piece.

https://aviationa2z.com/index.php/2025/05/19/american-airlines-united-are-trying-to-win-at-new-york-jfk/

@O.K. as far as I can tell, ‘aviationa2z’ is a set of instructions to an AI to rewrite articles from other sites. Sad that Google seems to feature them quite a lot!

I live in NY and am a varied flyer in that I fly a good mix of domestic and international rather than a lot of one route. AAdvantage used to be the best for this type of mix, I got low or mid tier status without much hassle.

I used to travel out to EWR because it was cheaper enough to fly to offset the hassle of getting there. But now there isn’t enough OneWorld presence to get me out there.

I used to hate LGA because if you were stuck, it was in a swamp. Now I take flights from there regularly and delays are less misery inducing while you wait.

I have super easy public transit to JFK; a 5 minute walk, a commuter train to Jamaica and the Airtrain. All for less than $20. So while T8 ain’t what it used to be, being through security in less than an hour from leaving home is a benefit.

This is an example of how a NY’er relates to AA. Yeah, I did LAX-SYD in first and didn’t think it was special. Yeah I get to sit up front but generally sit mid plane so I don’t have to fight with elites for overhead space.

My most valuable perk in lieu of great service is I can buy basic economy fares but the CC and status void the no seat until boarding, last to board and pay to check bags.