American Airlines is quietly improving more than anyone realizes, but even their employees don’t know it. The airline has pivoted to be more premium, no longer saying that all they need to do is be operationally reliable (they’ve still lagged even there) but treating reliability as “table stakes.”

- Customers have become much more willing to pay for a differentiated product when they fly. The opportunity is in generating a revenue premium by delivering more, not delivering commodity transportation.

- And this niche is especially important for American, which is a high cost airline. They aren’t the low cost provider of seats, so don’t win if they’re competing merely on price.

However, American Airlines undersells their improvements and achievements – they keep rolling out improvements, one by one, without putting those achievements in a context and investing in their brand. Meanwhile, competitors oversell their own improvements and achievements and passengers thing airlines like United and Delta are much better than they actually are.

- Delta’s employees are a little friendlier. They’re a bit more reliable of an airline (but not by the degree they used to be). Their lounges offer better food. Their 767 business class is actually the worst hard product across the Atlantic of any major U.S. or European carrier.

- United’s coach seats are hard, their crews hugely variable. They offer seat back entertainment, a better mobile app, decent coach buy on board food and soon Starlink wifi. But their business class seats are only great for the number they can pack into a small space, and because they’re reasonably attractive. The business class wine program is good!

That’s why there’s no real moat or barrier to American’s success if they execute well and make the necessary investments. It’s unclear if they will do that – it’s a long-term game, it’s expensive (though should drive profits), and runs counter to an embedded culture and history that mixes veterans from America West and Northwest Airlines that don’t have a history with this.

I wanted to flesh out something I said earlier today, about the airline needing a coherent narrative about its improvements in order to capture their value (and in order to lock in the kind of focus that’s needed to derive value from the things they’re doing better).

Here’s a list of some key challenges, and a path to overcome each one. They need more premium product (both seats and soft product) to sell. They need better service (from empowered and inspired employees who don’t act as though they’ve given up). And they need better relevance in markets where it’s retreated over the past decade (in the Northeast, especially New York, as well as the West Coast and Chicago).

American Needs Expensive Investment

It isn’t just improved coach buy on board food for sale that American needs to focus on, although they need to do a better job of that. And it isn’t just seat back entertainment that differentiates Delta and United from American, although that’s a differentiator.

American needs planes and clubs, and both are expensive. They retired too many planes during the pandemic (Airbus A330s, Boeing 757s, Boeing 767s, Embraer E-190s) just after retiring their large fleet of MD80s and they haven’t built out their order book as Airbus and Boeing are increasingly backlogged for deliveries into the 2030s.

American doesn’t have the aircraft to compete in all of these places, in some cases the gates, or even the pipeline of orders of planes to rectify their situation going forward.

So they need partnerships. The JetBlue ‘Northeast Alliance’ strategy was genuinely inspired, but they overplayed their hand. It was signed off on by the Trump administration, but the Biden administration reversed course and sued (following an avalanche of lobbying, in part by Delta).

American lost in district court, and United has wrapped up a new partnership with JetBlue which – while they’ve likely overpaid for the privilege – could be a game-changer for New York credit card spend.

Meanwhile, American’s newest lounges are really gorgeous. And while their food offerings trail Delta and United, those are better too. But there aren’t enough lounges in the new design, and in many places there just aren’t enough lounges. Washington National E, Denver and Newark are gorgeous.

So is Philadelphia and Philadelphia Flagship. We’ll eventually see a new primary club and Flagship lounge in Charlotte, and should see a renovation of the old US Airways club at Washington National. Eventually there’ll be a new Austin lounge as well (the November 2021 announced club has changed locations and should deliver in 18-24 months).

American Needs To Grow In The Places They Can’t

At American’s Investor Day last year, they led with AAdvantage and small city flying even as they noted customers wanted something more premium. They led with the assets they had, taking as a given that little about the airline or its strategy would change.

But they also conceded that American’s lead from 7 years ago in spend across its cobrand credit card portfolio had evaporated, and they were now third (behind Delta and United). That’s true even though American’s loyalty program is far better than SkyMiles – and, I’d argue, better than MileagePlus. The airline itself hasn’t been as relevant to consumers. Eliminating traditional mileage upgrades this year doesn’t help maintain what advantage it has.

What American knows now, but didn’t realize six years ago, is that they were actually profitable in New York and on the West Coast when you properly allocate cobrand revenue to flights. American has lost relevance in important spend markets in New York, Los Angeles, San Francisco and Chicago. And there are few opportunities to change that. They should certainly be courting Spirit aggressively to sell assets to them in major markets (while United covets Spirit’s Fort Lauderdale operation, and Delta puts American’s cross-town Miami hub under pressure).

The constraint on aircraft limits their ability to compete in Chicago and makes them vulnerable in Miami. And as they fall behind in these markets, their credit card spend falls behind too, and that’s the driver of profits – which makes it harder to invest. And that’s why they need to act aggressively now.

None of American’s problems are new. In 2018, Vasu Raja told employees that they didn’t have enough premium seats to sell, even as they were in the process of removing premium seats from aircraft.

Increasingly, though, American is at an inflection point. Their attempt to win back business travelers, but without flights, isn’t producing more revenue and American’s financials make that clear. They have debt and debt service, and profitability under strain.

The window to invest big closes when they no longer throw off free cash flow. So now is the time to invest getting into markets through partnerships and strategic acquisiton of assets. They need slots at New York JFK and LaGuardia. (When they had their JetBlue partnership it was a huge driver of AAdvantage enrollments and credit card spend.) They need to expand in Boston and Chicago and LA and San Francisco and Seattle. And they need to deliver a product that customers want to buy badly enough to spend more for it in each of those places.

Unfortunately, with JetBlue now headed into a United partnership there aren’t a lot of places beyond Spirit’s assets to look. They don’t have the sort of premium product that aligns well here, but I increasingly wonder whether a limited partnership in the Northeast and in California might even make sense with Southwest. That airline is delivering the infrastructure for partnerships finally and the ability to earn and redeem miles, accumulate status, and have frequent flyer privileges extend across networks could be a solution to a real problem for both. And this could be crafted in a way that passes antitrust muster.

American Needs New Messaging

American Airlines needs a brand narrative that puts their efforts in context.

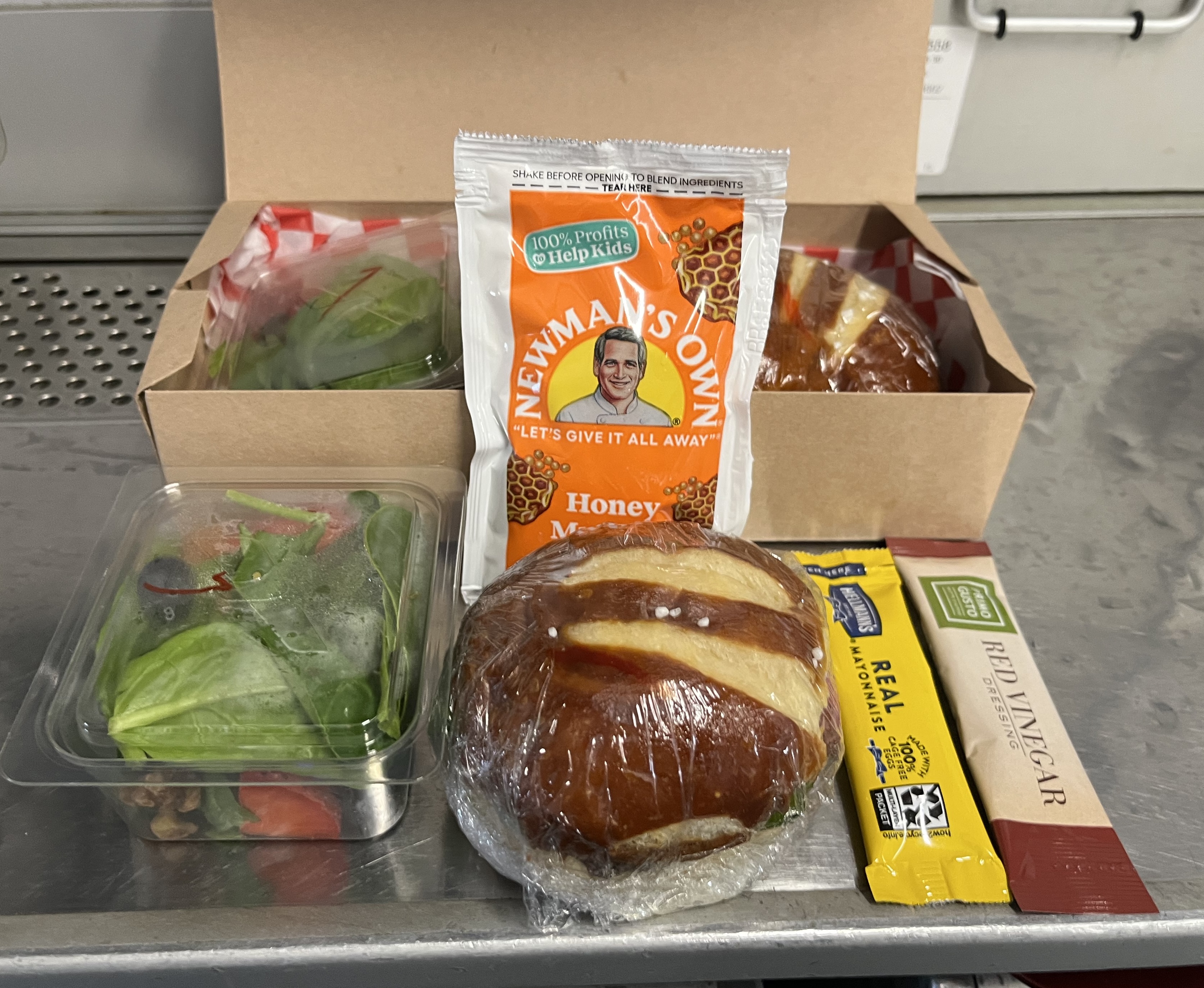

They’ve made a lot of piecemeal changes – like planning for free wifi next year; no longer collecting headphones in long haul business class an hour before landing; removing some of the major frictions they’d introduced to same day flight changes last year; adding more food for sale in coach to more flights (although the steak sandwich is not good). But each one has been a standalone, with no story really being told.

The needed messaging comes down to:

- Yes, there’s still a tremendous amount of work to do

- But they’re trying to get better and better with each trip

For years, American Airlines has lacked a clear mission statement, because they haven’t known who they wanted to be and that’s been communicated to customers and to employees. American needs messaging to employees (that tells them the service they’re supposed to aim to provide) and to customers (to help reset their expectations).

They should create a hub for ‘the new American as we approach our 100th anniversary’ re-dedicating themselves to the customer.

- Include a ‘CEO blog’ and ask for employee and customer input, responding to every message even with just a ‘thank you and here is what we are doing, I admit we need to do more, your suggestion will go into the hopper’

- Highlight meetings with employers, and share with the front line how they can deliver on the mission and be proud of American every day. Show these to customers.

- List key changes being made and why

Put each change under a rubric of: tools for employees to do their jobs better; reduce friction for the customer; improve the premium experience; improve the coach experience (most customers fly coach, and most customers start out buying coach).

Then do wider branding, getting the message out that American is a premium company employees and customers can be proud of.

To be clear, there is no reason to brand without the substance behind it. Great marketing is terrible when the product is bad, because you’re making everyone aware of a terrible product. Better they not know!

Instead, American has lacked a mission and they need to make clear that changes now. End the confusion, tell customers and employees what the plan is so they know what changes mean. That puts it in context and gets greater value from a single change that can otherwise seem like pouring tomato juice in the ocean (the ocean doesn’t turn red, and the investment is wasted as the juice dissipates).

The value American needs to derive from changes needs to be changes greater than each one on its own. And you do that by telling a story. It doesn’t have to be quite as overwrought and disingenuous than what comes out of Atlanta, but there needs to be a narrative that paints a vision for the future, where the airline is going, and trots out changes as proof points that the airline’s quality is looking up – that they’re going to deliver for the customer and this is going to benefit employees (who earn more profit sharing than before!) as well as investors (due to improved financial performance).

Until AA employees stop being actively abusive towards fliers, and also stop actively attempting to screw fliers out of recourse during irr ops, due to a lost bag, etc, they will continue to be the carrier of last resort.

In a truly competitive market, they would place dead last.

As the great American poet Ricky Bobby once said, “If You Ain’t First, You’re Last.”

“…if they executive well and make the necessary investments.”

PLEASE — EITHER HIRE A COPY EDITOR OR LEARN ENGLISH!

Number one a lot of improvements will take place over the long term. An airline can’t open lounges, buy new planes, remodel plan interiors and obtain more gate space over night. It look DL well over five years to make a dent in the NYC market.

Number two, where should the investments be? Making major improvements to the coach product like installing AVOD on narrowbodies may not have a measurable ROI or ROE. It may help to enhance the brand but again that’s also long term.

A simple change they could initiate that would differentiate them- check bags through on separate tickets within one world.

American certainly has lots of opportunities for improvement. While their lounges may lag, I think that’s an area they can leave alone for the time being.

To me, the two areas that receive the most attention from regular fliers are the quality of AA employees and the level of disrepair and cleanliness of their aircraft. If AA successfully focused on these two areas, the flying public would take notice. Certainly the list of issues is lengthy. They can’t fix everything all at once. Address these two areas and they will take a huge leap forward.

AA has to run an operation as good as or better than DL and UA in AA’s own hubs before trying to take on major competitive markets like NYC which is connected to all airlines’ route systems.

and AA can refurbish its current aircraft including the 777s but has to win important corporate contracts but those are heavily tied to volume and AA is at and will be at a size disadvantage in NYC

They need to install IFE in all seats, big differentiator there

@Derek McGillicuddy — Wrong! Gary’s grammatical ‘nuance’ makes his writing seem more human!

@Tim Dunn — Thank goodness American abandoned that awful plan to exclude third-party bookings, scrapping the ‘preferred travel agencies’ plan, but, still, the reputational damage is done. (If anything, it directed T&E spending to Delta and United.)

@Tim Dunn – all of these things work in concert for driving revenue, and they take a long time. Obviously Delta has a nearly 20 year head start, and United began before the pandemic, but American isn’t going to replicate Delta’s slot position in New York for instance.

And American has to be reliable before premium investments are really going to pay off, but that doesn’t mean waiting on premium investments becaue those too take time. Reliability also doesn’t just mean on-time performance. It’s mishandled bags, involuntary denied boardings too to name just a couple of elements.

They will also do a better job winning corporate contracts if their network matches the flights those companies want. They aren’t going to do that on their own right now but need partnerships.

Basically a lot to fix, largely fixable, but they can’t do the ‘chicken and egg’ thing. They’ve been doing that too long, it’s expressly for instance why they haven’t invested more in bag tracking (‘not all of our partners have so it won’t really help’). And then they don’t make the progress they need.

@abhinav — Ahh, winner winner chicken dinner! And, with a subtle Dr. Dao reference, too (assuming that’s what you meant by ‘abuse’). Never Forget. #UA3411

I completely agree with you.

Even if AA delivered a product and operation as good as DL and UA do, I’m not sure AA will see as much success in NYC by being half the size of DL and UA.

Remember, DL is as large in NYC as AA and B6 combined.

UA’s strength is heavily on the other side of the river but DL is AA’s most direct competitor at LGA and JFK; AA does have enough of a presence at LGA and JFK that they could be doing better than they are.

And, apart from NYC, there is undoubtedly more profits to be made by slowing the defection of AA passengers in other regions of the country including the southeast where AA competes w/ DL and DL gets better average fares and in ORD compared to UA.

Of course, AA should start rebuilding but I think they will see better results outside of NYC.

@Gary Leff — Got an email today from Porter (the Canadian airline) that they have a new ‘partnership’ with American Airlines (likely just codeshare or interline, not OneWorld or anything); Porter already had some arrangement with Alaska, Delta, and jetBlue as well (not United). I enjoy their mascot, ‘Mr. Porter,’ a racoon, who is often dressed up in fun outfits, and doing cool things…

Too little. Too late. And you just know, deep down, they’ll F it up.

It’s a real shame, but it’s the truth.

I have never had to wait to get into an Admiral’s Club and they are ok, even in PHX (which could really use upgrades). So there is that. Better lounge food doesn’t matter if you have to wait in line…

For me American’s flight attendants are the very bottom of the industry with their attitude. I would be very hard pressed to fly them again.

Gary, i would suggest the following change to you DL statement: “Their 767 business class is actually the worst WIDEBODY hard product across the Atlantic of any major U.S. or European carrier.” I avoid the DL 767 no question, but it beats narrowbodies with 2-2 J.

American Airlines should shut down.

@This comes to mind — I’ve learned to stop worrying and love the 763, especially when RUCs or GUCs from Main to DeltaOne are possible.

However, as to your ‘narrow-bodies’ comment, I imagine you’re thinking of 2-2 recliners for transatlantic, or the older 75S with Delta, United, etc., which is still lie-flat, but an older aircraft.

I’d say, what American is trying to do with the a321XLR Flagship Suites is akin to what jetBlue has done with their a321neos to Europe.

And, other airlines, also operating ‘narrow-bodies’ like TAP, SAS, etc., are actually quite nice in J, usually doing the 2-2, 1-1, 2-2, etc. configuration, with those 1-1s being the ‘throne’ seats.

Singapore, flyDubai, and a few other carriers have done that with some of their newer 737max, and, again, it’s nice to have lie-flat on a 5-hour regional flight, compared to mere recliners, or 3-3 with a blocked middle like they do on inter-European flights.

comes to mind,

you do realize that DL knows what products it has and their strengths/weaknesses? The 767-300ER is still DL’s most frequently used widebody on their JFK- LAX and SFO routes and DL says that JFK-LAX is their most profitable route.

DL also heavily uses the 767-300ER to compete against UA 757s – which have a worse onboard product in all cabins than the 763.

Finally, scuttlebutt is that DL wants to pull forward (earlier) the retirement of the 767-300ER fleet which had been slated for 2028 for international flights and 2030 for the entire fleet. They can likely do it if they exercise most of their remaining options for Airbus widebodies and/or place an order for 787s.

The 767 opened the Atlantic to new routes but DL knows its end is nearing; it still manages to do well where DL uses it which probably says the competition really isn’t offering as great of a product as you think.

too little too late

The clueless board let Doug dig a hole so deep that they may not be able to climb out of it especially once the cumulative impact of the recent pay hikes kicks in..

A bottle of tequila is not going to make up for the damage that Project Oasis has cause and a nice amenity kit is not going to make for postage sized bathrooms….

The non-cosmetic changes (new interiors etc) will take years to become systemwide and they don’t have the luxury of that kind of time!!m

To compare AA to DL and UA is trying to figure out who is the “best of the worst” and international flyers like me are migrating to other (mainly foreign) airlines who are upping their game..

They can probably hold on until the next business downturn or an inevitable black swan event but….

i can go on for pages but it’s sad to see a once great airline fall apart like AA is doing

I was Exec Plat for many years with American, but hadn’t flown them in a while. I took a cross-country trip via ORD with them last week, and with two segments, the WiFI would have been over $50. That’s inexcusable, especially with no IFE. Delta is free, United costs $8… how can American cost $50? I will not fly AA again until this is fixed.

“veterans from America West and Northwest Airlines” – US Airways?

“They’re [sic] attempt to win back business” – *Their

Don’t get this focus on seat back video screens. They add weight to the plane. Often times they are broken. Many times someone lets their kids gouge and scratch the screens. The picture fades and gets washed out over time. Everyone nowadays has a PED. Most people take care of their PED’s. Give people high speed Wi-Fi. That’s what they want and I believe AA is right on this. Like 8 track players, cassette and CD players seat back screens are becoming dinosaurs. Flame away.

@JAXBA – US Airways was run by America West management, and a bunch of senior leaders cut their teeth at Northwest

@Coffee Please — Pretty sure we’ve discussed this on here before. I’m definitely one of those who have griped about the lack of IFE screens on AA’s narrow-bodies (other than the a321T), namely, because I think it’s better to have the IFE, than not, even if you don’t use it (an optional amenity, if you will; the sign of a ‘premium’ airline, bah). On WiFi at least, you may get your wish, soon enough; American Airlines says it “plans to offer free Wi-Fi to all AAdvantage loyalty program members on most domestic flights starting in January 2026, with the service sponsored by AT&T.”

@Tim Dunn — Great use of the word ‘scuttlebutt,’ sir.

@Tim Dunn – I disagree with you that AA should focus outside of cities like NYC. That’s where the money is. It’s where the cobrand spend is. And, as a result, that’s where the margin is. If Delta is saying it’s their most profitable route I bet they’re (correctly) allocating Amex revenue based on residence of passengers to flights. American just isn’t going to get the juice out of El Paso and Tulsa and Oklahoma City that it could get with relevance in NYC, though their best stab was the Northeast Alliance (which really would have been game changing for them). I’d say they should be leaning in much harder to their West Coast Alliance with Alaska. And do that they can both win more corporate deals given the joint presence in big West coast + NY markets.

In healthcare some of the worst physical locations have the best profitability and consumer satisfaction score. Why? It’s the people. The people make the difference.

Let’s be clear. WN succeeded for decades with a no-frills model. They were successful because they treated their customers AND their employees well. That went away and now look at WN.

DL trails in international hard product due to the inconsistency of its wide body fleet. But, they more than make up for it with their service…which is a major reason for their success.

AA could fix their service excellence issues now, but that’s harder than just zhuzh’ing up a few AC and making sure the planes fly on-time.

Culture eats strategy for breakfast.

For AA, the quickest but most difficult action to complete will be to turn the perception of (most of) their F/A’s from surly, completely uninterested employees to those providing a concern for their for their pax and interested in providing a pleasant experience. Working the flight does not mean a single pass thru the cabin and retreat to the galley for the remainder of the flight. I truly feel badly for the F/A’s that are great and do care. It is a shame that AA inflight has come to this.

@1990 – Porter used to be one of the only reasons to go to EWR, but now Porter flies from LGA as well (albeit only into Pearson). I don’t think the announcement between AA and Porter includes NY-Toronto flights, though. So all this is so far is a way to deliver passengers from secondary cities to secondary cities. Could fly LGA-YYZ AA and then YYZ-YHZ Porter for instance on one ticket which is… fine.. but why do that when you can fly direct from LGA on Delta or from EWR on UA/AC.

I do wonder what will happen with the Porter/B6 interline agreement – feels like Porter has no choice but to get closer to one world with B6 now playing footsie with UA (and therefore AC) and WestJet being aligned with Delta. But clearly no one is cooperating on the NY-Toronto route yet (and the comment the other day about preclearance was so silly – as if US travelers don’t want to get to/from Canada from LGA – sigh).

As for AA… not sure what to say other than Forever Forward! I continue to root for the underdog. So much wasted potential…. Just like the Mets! At least S.A.Cohen apologized profusely today…

At this point, decades into the retreat, continuing to boot the ball with daily operational errors, who would believe they’re making a final stand?

1990.

the fact that the DOJ shot down DL’s JV proposal with WestJet over LGA – and then DL managed to get those slots back – shows that NYC to TOR is too big of a market to share; either you have figured out how to win in it and you don’t want to share or you don’t have what it takes.

Parker is right. Airlines are service businesses. People focus incessantly on airline chat forums like this about an inch or two but neglect the impact of people that are even mildly engaged compared to those that are not.

and Gary, again, the difference is that AA simply cannot get to the size in NYC to match DL and UA. Running a better operation in scores of medium and small cities where AA is strong will help NYC and Chicago and other competitive markets.

and your statement about the west coast points to the same principle as above – why should AS share something that AA walked away from and where AS is relatively strong on their own? AS and AA won’t be JV partners; AA has a stopgap partnership w/ AS but AA growth will remove incentives for AS to give AA even more of what they have while AS isn’t interested in giving back a single passenger that it has gained from AA.

AA has lots it can do better at in markets where it has decent size.

And the gap between AA and DL at LAX is not as great as it is in LAX. There is a better chance of AA winnning back some of those west coast passengers just by running a better and more competitive operation in all of the mid-size competitive markets; and NYC will gain SOME out of it all

In his next piece, Mr. Leff will complain that American isn’t paying down its debt fast enough. It’s sad that there are people who seem to derive pleasure from other peoples problems.

I meant to say

And the gap between AA and DL at LAX is not as great as it is in NYC….

and ghost,

no, Gary is not complaining about AA’s debt reduction efforts – but they are driven by cash flow which is driven by getting enough revenue.

AA does have a young enough fleet; they just need more copies of a few different types as well as modest replacements; they need to do more refurbishment than replacement and expansion.

@JOHN—agree completely WTH your comments. That’s why I chose another airline whenever possible.

I enjoyed Gary’s comment that NYC is where the money is… right on, brother.

@Peter — Yup, I’ve taken that LGA-YHZ route with Delta; it’s far better nonstop than via YYZ or YUL. Wish there was a nonstop from NYC to Newfoundland. (Oof. Poor Metsies…)

@Tim Dunn, @Parker — The people do make the difference. And, I have to say, there are decent, hardworking folks, who try their best every day and care very much, at each of these airlines.

They missed their opportunity when they could have locked out their garbage FA union and hire eager new workers that actually want to do the job. Now they are stuck with overpaid workers who hate their job and their company as front line representatives. They have zero chance to win.

@Mantis — The crews and unions aren’t the problem. Wait a minute, didn’t you say you recently give up on America, and relocated to Asia? Just saying, it’s a bit rich for you to now punch-down on our workers here.

Another idea: they need to return to answering customer complaints with a human being that understands the question, rather than an AI bot.

AA fans’ faith in that airline will forever shock me.

Never say never, but let’s be real, it’ll be at least 5 years before AA feels like a better airline. Improved lounges (most are pretty grim) and Flagship DFW and LA are still below what Polaris and Delta One offer albeit they are more restrictives. Last time at DFW they began clearing food and booting people out 30 mins before close despite a few INTL flight departures still scheduled to depart 60,90 mins out.

Service culture and consistency is last. WiFi costs are offensive and they are years late in offering their members fair or free WiFi. Domestic FC is nothing special but DL has an edge and over both.

I agree that DL 767 is worst J experience, but AA’s 777 seats are definitely battle scarred, often dirty and years away from getting overhauled.

Both nowhere to go but up! And I do think they have the best alliance partners and alliance perks – so at least they have that going.

@ Gary — How about AA try gaining back some lost loyal customers by 1) changing the MM program to be same as DLs. OK, sure, that would trigger a flood of EPs due to the way they used to count EQM from all sources, but they need to get people to actually try their supposedly improving products again. Our household was EP for 10 years, but the barrier to re-entry is too high. Then, make the SWUs actually usable in advance, like DL, so that people can actually be excited to fly AA rather than being stuck at the top of the not upgraded list. Force people to buy E+ to use the SWUs, like DL and UA. It is worth the price. If you can regain some lost elite flyers, you will also regain their credit card spending. We went from $50,000 per year to zero as soon as we lost our EP status. Tim will say that the airline doesn’t care about customers like me, but that is a mistake on AAs part.

@Gene — Well said on the SWUs. I wish those confirmed in-advance moreso like Delta’s RUCs and GUCs. Likewise, I wish I had better luck with United’s PlusPoints. I will say, at least my jetBlue Mosaic ‘move to Mint’ upgrades worked at booking. Any other airlines have something similar?

Just a bunch of piece-meal window dressing. They just thrash around without a clue. Latest hire, with much fan-fare – has little or no background in what it takes to run a premium airline. Another techie with no operations savvy. With her. comes more layers of staff BeamReach and ineptness.

Same story, another verse,

Vasu Raja was the devil, and the amount of time it takes to get out of the hole he dug will take time. The AA board must push the CEO out and find a youthful “Airline Dude”. Somebody that will celebrate the history of AA and is willing to try new things.

I believe there is a possibly notable correlation between American’s small incremental improvements and VASU RAJA’s departure as CCO (Chief Commercial Officer) and subsequent promotion of HEATHER GARBODEN as CCO (though CCO in her title stands for Chief Customer Officer)!

But in reality, American needs to declare a “real bankruptcy” (instead of the last fake bankruptcy which did nothing to help AA’s finances) to have a creditors’ committee the C-suites of legacy US Airways / America West execs. This would truly be the point that AA can turn the ship … their exit financing and strengthened balance sheet will allow them to finally make meaningful long-term investments.

I still predict chapter 11 in the next recession. AA is just one big Spirit Airlines with a larger international reach.

It’s nice to see AA finally making an effort. That said, things won’t really change until there is a change in the company culture, and that comes from the top down. Isom and his cronies have treated the employees like a financial liability for far too long. Employees have felt anything from undervalued to downright abused. Rarely have they been given the tools to do their jobs well. It’s unlikely that Isom or anyone in current upper management has the vision or leadership skills to actually improve things enough to change company culture at the DNA level like is needed. Most employees want to do their jobs well and would thrive with true leadership. We really need to see a CEO in place that can right the ship. Why the board of directors keeps the losers who got AA into this mess is a mystery.

an embedded culture and history that mixes veterans from America West and Northwest Airlines that don’t have a history with this. American didn’t buy Northwest, Delta did.

American will be gone in ten years & broken up similar to TWA and Pan Am. The corporation has terminal cancer and it shows. Just look at the appearance of front line employees at the airports. Their fleet is a broken, horrendous maintenance nightmare & employee morale overall tanked years ago under American West leadership. Doug Parker should be held legally liable for the damage he did to the brand. Isom and the BOD could be sued for not fulfilling their fiduciary duties under US law. American is simply on life support. No company in the world can continue to exist carrying their debt load. And Doug Parker did that in clear view.

No pacific division, the LHR slots will be sold off primarily to United & Delta with South America to the highest bidder. The North American system will be absorbed by competitors. End of story. A miserable excuse for a travel service company.

Braniff

Eastern

Pan Am

TWA

Spirit

American

next?

I disagree that American needs more partnerships. They have plenty of narrowbodies they can redeploy in the cities you mentioned. They need to aggressively expand their own flying in LAX, SFO, SEA, ORD and NYC with the addition of any airlines (Alaska/jetBlue) they can gobble up to do so, and they need a huge widebody order yesterday! Along with seatback screens on every mainline aircraft and mood lighting on every aircraft. These are all things AA should have done 10 years ago. It’s not brain surgery.

Unfortunately the FA’s have become so brazen and entitled and don’t hardly work that no boatload of hard & soft products will save the airline.

I just got off a flight where the bathroom were filthy and I asked for assistance ( I usually help clean the. A bit) and the GA went back to her social media on her phone saying she was too busy.

We have the FAs too many freedoms and now with the smaller galleys in less employees they’re just going to put their foot down and not work except the bare minimum.

American could retreat a little in the West Coast by increasing codeshare with Alaska, they could also sign a mutually advantageous deal of increasing award availability both ways. They should remain in the West Coast for transcontinental.

That may free some assets for the East Coast. They got a good position in LGA they can improve on, and they should be happy that Miami grew so much since the pandemic. They should compete more with LATAM out of Miami, to eat at least some of Delta’s lunch.

American is well positioned for the “budget” market: people willing to pay up for better comfort without being huge spenders. One example is their cheap upgrades to Economy Extra on domestic flights (that get you a lot: dedicated overheads, early boarding, and even booze, apart from the obvious better leg space).

AA is the worst of the big three. I’m a platinum pro flier out of NYC – I stuck with them for years but recently started flying DL again. Delta thinks they are better than they are – but they do run a better airline. More reliable! Nicer FAs, far more flights from NYC. American has reduced frequency so much out of NYC that they are no longer competitive. And their hard product stinks – thanks oasis revamp. I’m trading out of my AA credit card and reducing flights with them – even though skypesos is what I think of DL program