Lots of folks are familiar with the exorbitant fuel surcharges that are charged when booking award travel on British Airways. But it’s costly to fly out of the UK even when not traveling on BA because taxes are high as well.

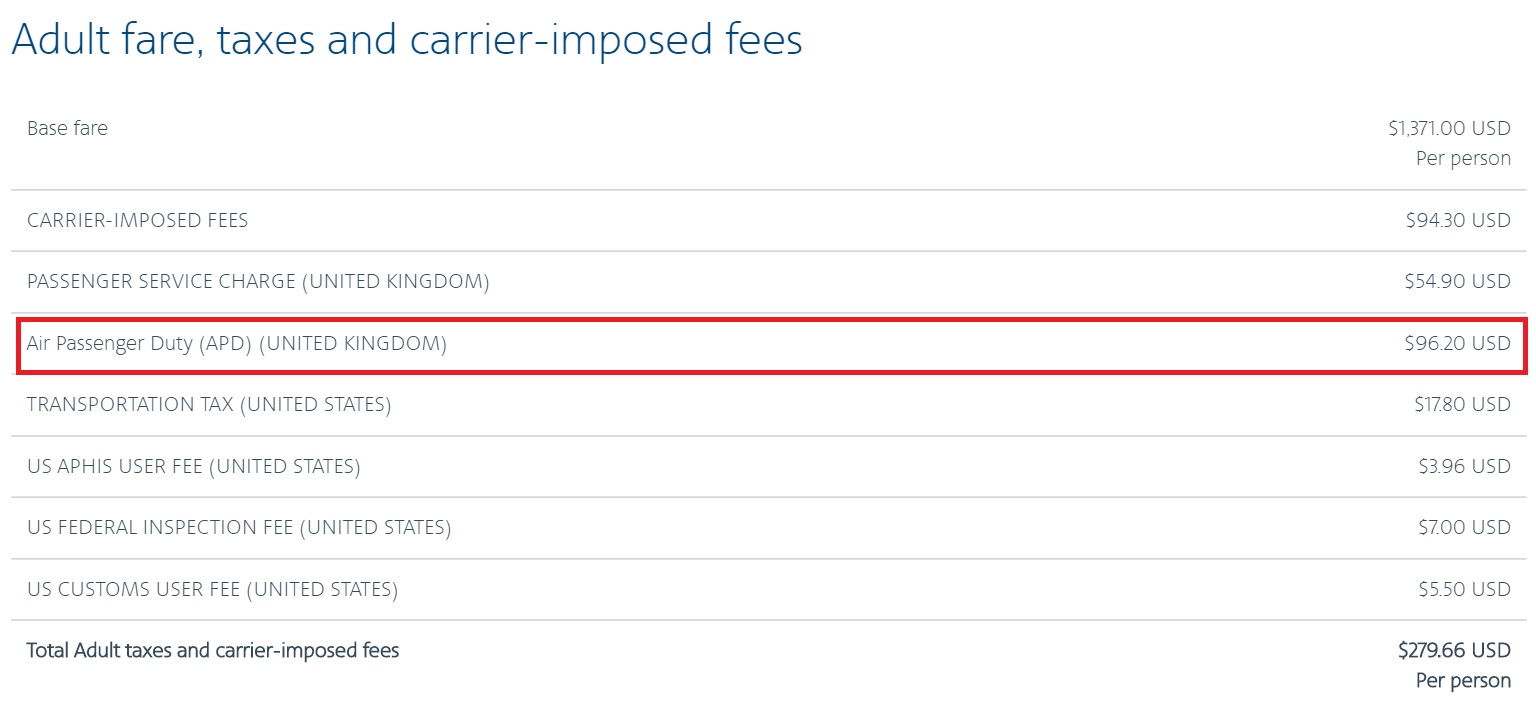

The UK has a departure tax (‘Airline Passenger Duty’) that’s high in coach and higher still in premium cabins, and is often referred to as a ‘premium cabin departure tax’ or ‘luxury tax’.

This tax applies to journeys which originate in the UK, but not to trips that connect through the UK. (Here are some ways to avoid the tax.)

One improvement, implemented a little over a year and a half ago, is that children under 12 flying economy no longer pay this tax. On a London – New York ticket that’s a savings of $96 per child, which really adds up for a family traveling with several kids.

However American Airlines is still collecting the tax on award tickets.

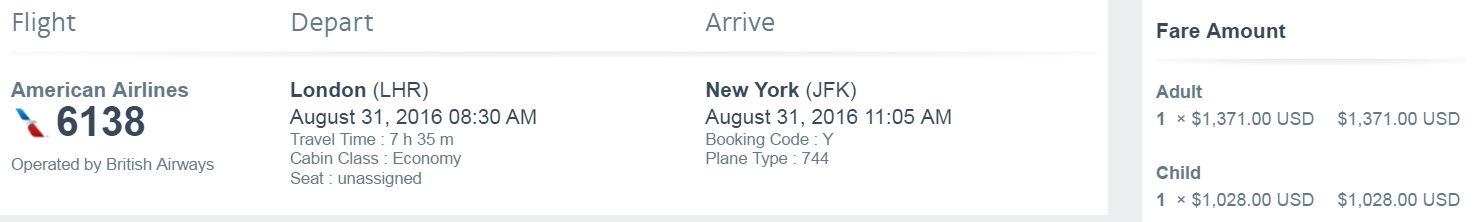

If you buy a paid ticket for travel New York – London, American’s website will correctly price the child less expensively than the adult.

The adult taxes are higher because they include the Air Passenger Duty.

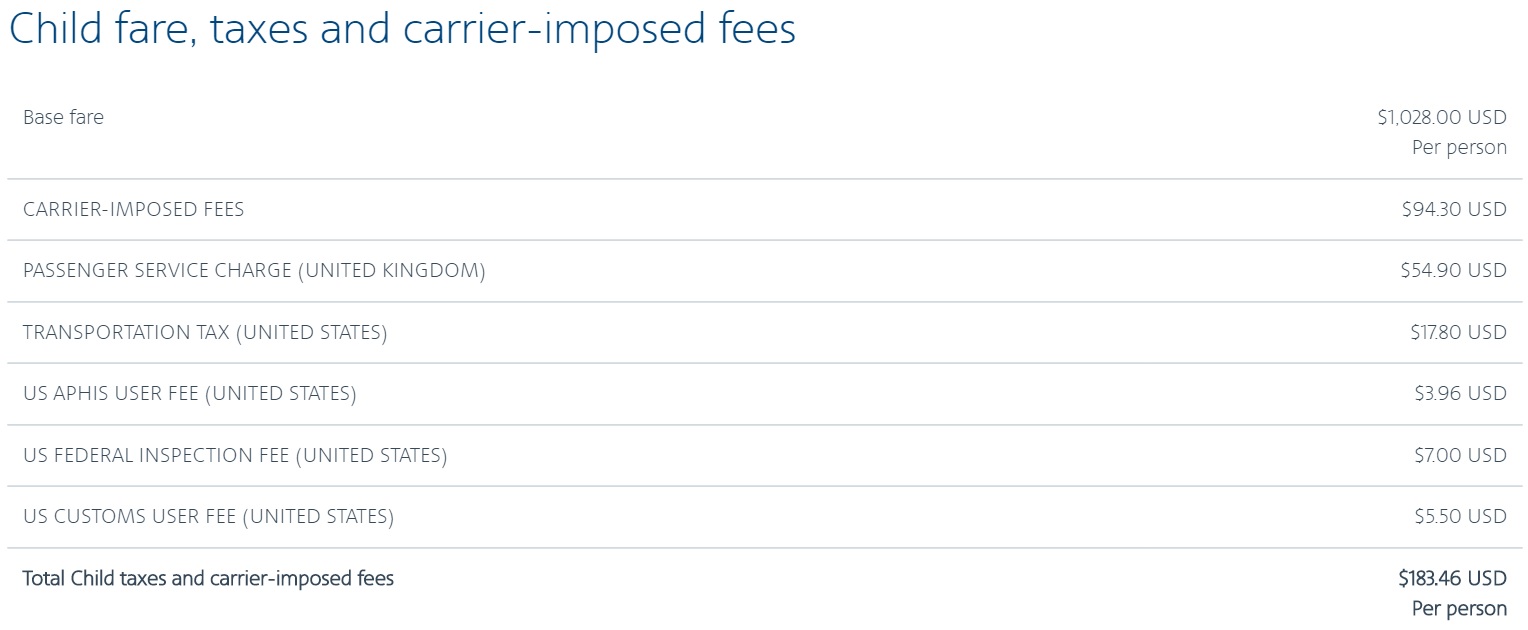

Taxes for the child do not have this line at all.

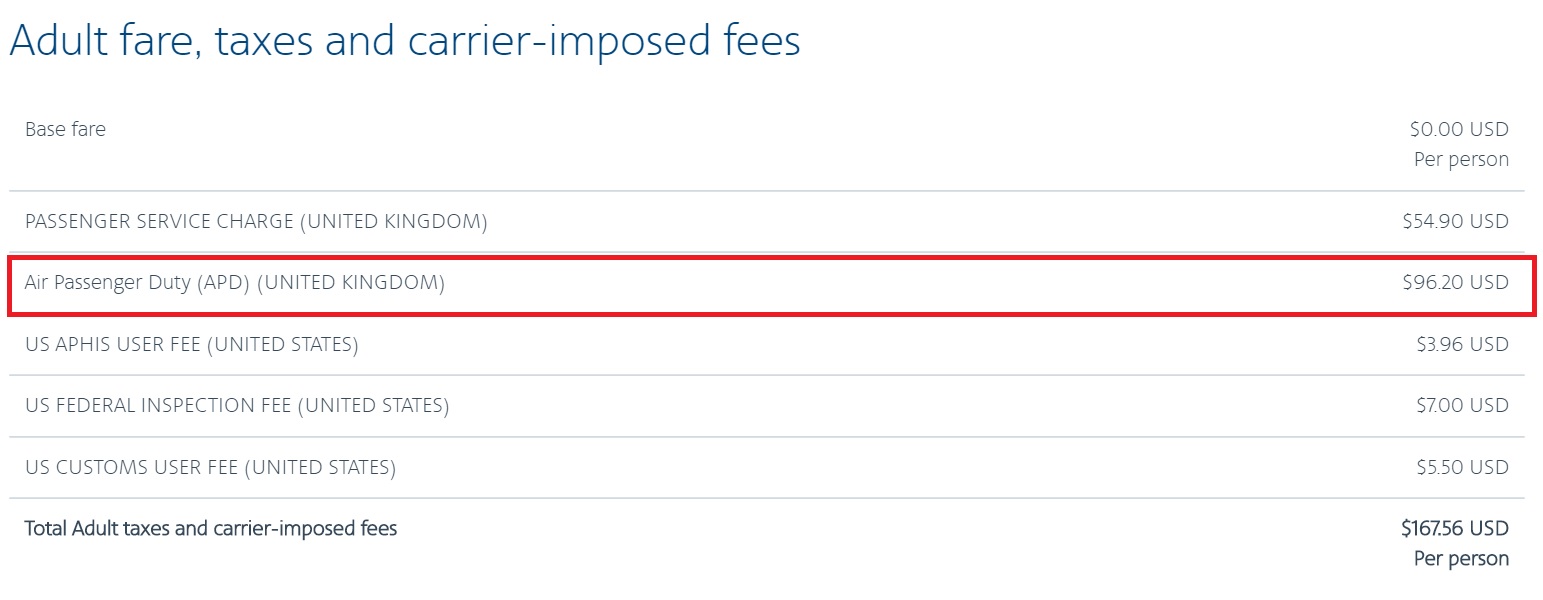

When you book award tickets at AA.com, however, and use the same passenger criteria — one adult and one child aged 2-11 — the website will charge the same taxes for both passengers. American is collecting the departure tax for the child under 12 even though the tax isn’t supposed to apply and even though they wouldn’t collect this tax on a paid ticket.

I reached out to American and learned that they are working to solve the over-collection issue. In the meantime they are making sure people get their money back

- They’ve asked agents to handle this at the check-in counter, to the extent they notice on the spot that a passenger under 12 is traveling on an award ticket, agents now know to watch for this departure tax having been charged and to refund it.

- Refunding when people ask.

- Going back through historical collection to proactively issue refunds.

Most passengers don’t realize they’re being overcharged. American tells me those passengers will get their money back anyway.

Why don’t you “reach out” to AA & get an explanation as to the reason behind the fundamental changes in award availability?

Dans Deals laid out the situation quite clearly. Or do you not wish to ruffle the feathers of your AA contacts?

As of March 1, 2016, the exemption from paying the APD was extended to children under age 16, an extension of the earlier exemption for those under age 12. I assume that American and other airlines should update their systems accordingly.

See, for example:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/385074/Air_Passenger_Duty_-_child_exemption.pdf

Since you’re on the subject, I’d love your input on Aeroplan charging a “U.S. International Transportation Tax” for crossborder award tickets. United MP doesn’t charge the tax on the same itineraries so something is rotten in Denmark…err Canada.

Gary — FYI (as I’ve mentioned other times you discuss this tax) it is for under 16, not just 2-11. It was changed about a year ago.

@AI I’m pretty sure I’ve been on AA award inventory more than anyone. Eg:

http://viewfromthewing.com/2016/02/20/45514/

http://viewfromthewing.com/2015/07/05/american-award-space-back-to-normal-cough/

And I’ve covered how they seem to approach it.

And I’ve spoke with senior executives about it.

The idea that Dan is somehow a lone truthteller is absurd.

How about a class action lawsuit?

AA has enough ,money to cough up now that they are getting fatter by screwing passengers and Frequent Flyer

@Gary: “…And I’ve spoke with senior executives about it”

So what is their excuse for this ‘enhancement’?

It’s actually for children under 16 now, I’m 15 and just flew on a VS award and they just refunded the APD to credit card before we flew.

@Brian – that international premium cabin award availability is getting better [true — it’s not great, but it used to be completely nonexistent]: http://viewfromthewing.com/2016/01/28/theres-a-new-award-availability-day-for-american-aadvantage/

Bear in mind that American’s lack award domestic award space is an extreme take on what US Airways used to do. At least US Airways used to offer good FIRST class availability, although US Airways first was so bad that it was really like paying double miles for just something incrementally better.

@Brian you won’t get anywhere with a class action lawsuit. For what? See Northwest v. Ginsberg.

I’m a little confused?

Is this tax refund for everyone or just children?

Will AA go back several years for refunds?

Thank you

Hello, I have this booking VRN-LGW-UVF (oneway).

First leg in C, second leg in F all on BA metal.

It was a regular award booking via AA – for 2 passengers

Taxes & Carrier-Imposed Fees

Taxes Euro 81.84

Carrier-Imposed Fees: Euro 341.08

So I pay 422 Euro for two just for Taxes/Fees. Aprox 240 USD each.

Unfortunately there is no way to find again the detailed calculation with all the thinks summing it up. Do you think this might include the not due fee?

2 adults.. no kids/teenagers

What’s the best way to request a refund?

What about those who paid the taxes unnecessarily and have not gotten a refund? They’ll just keep the money? And if agents don’t process it at the airport because they are too busy? Or what if the pax are flying BA and are checking in with BA? Will they refund?

Unless the answer to these questions is that they will refund past bookings and have plans to handle it if/when agents won’t, then yhis is all lip service.