This morning’s American Express earnings call meant a lot of discussion of the Platinum card, its refresh, and what it means for Amex strategy going forward.

The Platinum franchise has $530 billion in charge volume worldwide. That includes consumer and business, and cards in all countries. By comparison, Delta cards do about $170 – $190 billion in charge volume at this point and is the largest Amex co-brand (and bigger than United’s which is bigger than American’s).

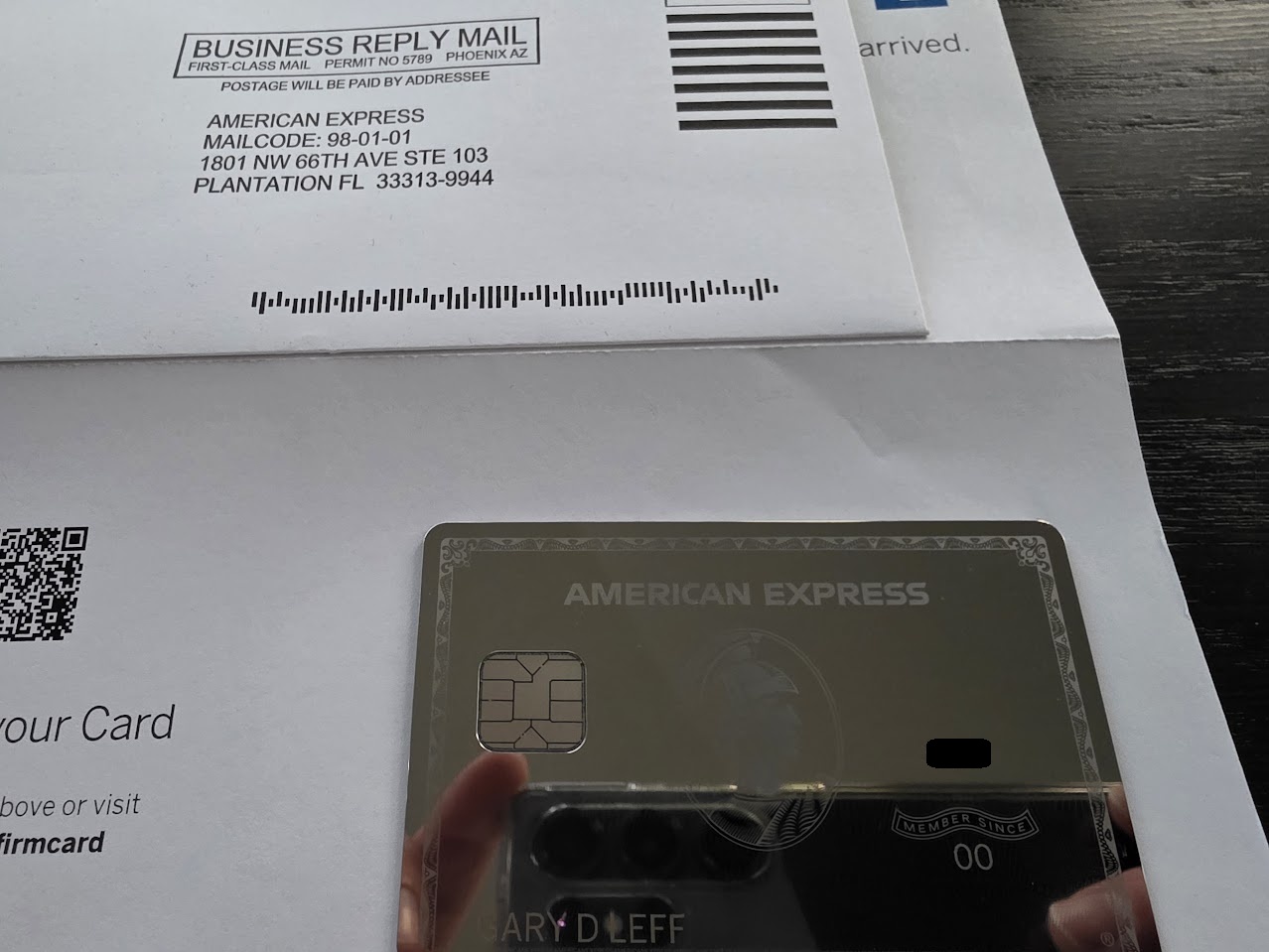

There have been over 500,000 Platinum cardmembers that requested the Mirror card.

Here are 9 key takeaways American Express revealed to analysts:

- Platinum refresh is working (and is expensive now, accretive later). American Express reports that they’re seeing the strongest start ever for a U.S. Platinum Card refresh. New cardmember acquisitions are running at twice the rate compared to before the refresh. They’re seeing record bookings through Amex Travel now (a bigger credit would do this!).

Benefits cost hits immediately, while fee revenue lags. Higher fees don’t kick in right away, and then they’re amortized. Cardmembers effectively get a “free preview” of benefits before having to consider paying a higher fee.

- Annual fees keep rising. This is intentional More than 70% of new American Express accounts are fee-paying. Annual card fees have now hit $10 billion for Amex after 29 straight quarters of double-digit growth. This is their engine.

- Shift away from travel. The Platinum card was originally a travel-focused product. They’ve gone more lifestyle and dining weight. The big shift came in 2021 (digital entertainment, wellness, Resy) and now retail perks are emphasized (e.g., Lululemon) are emphasized.

Redemption is also evolving, and they are rolling out “amount-based redemptions.” Expect more flexible (low value) cash-like redemption options alongside transfer partners. The more uptake that has, the more they drive down their redemption costs.

- Expect fewer retention bonuses. Management says retention offers play a small and possibly smaller role going forward. They expect to retain customers by explaining benefits to them – credits you can use worth more than the fee you pay.

J.P. Morgan’s Rick Shane hypothesized that American Express would see greater expense trying to retain Platinum cardmembers who consider cancelling due to the annual fee increase,

I’d kind of like to follow up…related to retention offers as the new higher fees roll out. I assume that that really sort of cascades over 12 months. I’m curious how we should think about perhaps what % of customers take retention offers or request retention offers, and if you expect that that response rate is going to be higher or lower this time based on the initial responses you’ve seen.

CEO Steve Squeri pushed back,

I think in general, that’s a very low percentage of how we retain our base. Most of the retaining in the base is actually just explaining the product to them. I think when you look at this product and you look at what you pay for the value that you get, it’s pretty easy to come to the conclusion that this is a product that I really want to keep.

I think one of the things that we’ve really tried to do with this refresh is really make it easy to understand what the benefits are and easy to engage in those benefits. I think that’s critical because what that will do will lead to more retention, more engagement, will drive more business to our merchants, and we’ll have more loyalty all the way around.

- Getting partners to pay for your benefits is a key strategy component. I explained merchant-funded offers and how they work four years ago. At American Express they report that partners delivered over $3 billion in value across benefits (including Amex Offers) over the last 12 months. So Amex is not picking up the full cost of richer benefits (while they pocket the increased annual fees).

- Millennials and Gen-Z are their focus. They see younger cohorts as the growth flywheel. Millennials and Gen-Z are now 36% of total spend and transact 25% more than older cohorts. With longer time horizons and increased spend, greater wallet share, they see much higher customer lifetime value than in the past.

- $6 billion in marketing spend is mostly acquisition bonuses. Bank of America’s Mihir Bhatia asked for Amex to break down the $6 billion in annualized marketing spend Amex is doing (“How much is broad-based sponsorships, brand building versus more micro, like, you know, the card member bonuses, retention type stuff?”). CFO Kristina Fink’s answer is it’s mostly initial card bonus offers.

The biggest share and the one that is moving from one quarter to another when it comes to marketing is the size of the welcome incentives, right? That’s the biggest share of this marketing line.

There is tension here in that number between we want to spend more marketing dollars, but we also want that marketing dollar to be more efficient. If you work here in the marketing organization, you’re constantly battling between let’s do more, let’s spend more, and yet at the same time, let’s make sure the dollars work really, really hard for us. The number that we end up spending each quarter and each year is the outcome of those two kind of like pressure points. We are very strict and disciplined about those two…

We’re going to keep investing, and we’re going to keep investing at elevated levels. At the same time, we’re going to subject every single of these dollars to the level of rigor that we have spoken in the past, making sure that the return on that investment, which we treat that as an investment, meets our profitability criteria, right? We are very clear in terms of stopping those investments where they are not meeting these criteria. We are getting more and more sophisticated, you know, and measuring those, tracking those. That’s how we make that decision. It’s not like, let’s spend this year like $6 billion.

- High credit quality even as they grow. Delinquencies are down ~1.3%. Net write-offs are down ~1.9% quarter-over-quarter. Loans and receivables are +7%. The average FICO score of Platinum applicants is up 15 points versus before the refresh.

- They consider a more premium card than Platinum (but below Centurion). CEO Steve Squeri on the ladder from Gold to Platinum and whether there’s room for a card above Platinum:

Gold continues to be a very strong product for us, and we continue to acquire new cardholders there. We haven’t seen gold card acquisition go down. We have seen upgrades, but it’s still early. I mean, we’re only three weeks in here. We will see how that plays out.

Part of our strategy is to provide card members with a path to higher-end products that potentially meet their needs. Is there a product between Platinum and Centurion? Maybe. If you have any ideas, we’re open to those ideas. It’s something that we talk about from time to time. We will see.

We’re really happy with where Centurion is, and we’re happy with where Platinum is. I think this refresh will continue to cement our position as the leading premium product.

I think Chase could potentially do a higher-end card than Sapphire Reserve (indeed, they do sort of have one with J.P. Morgan Reserve but it’s effectively the same card with a United Club membership thrown in). I think that Capital One could definitely do it, given that their premium entry is at the $395 price point and I don’t think has been branded as a status symbol in the same way as Amex Platinum (it’s odd to think of Platinum that way, but it sort of is).

A mass market card above Platinum certainly risks undermining Platinum, since that no longer would be ‘the best’ or ‘top tier.’ Consumers would have less of a reason to get it! Some would shift to the higher-end card, but they’d be cannibalizing their existing business and also risk shedding customers at the same time. So they’d need to be really sure of the numbers – how much higher fee revenue they’d generate, the incremental cost of benefits, and how that compares to their losses.

American Express says the Platinum refresh is off to its strongest start ever, doubling acquisition pace; benefits costs hit immediately while higher fees phase in, and annual fee revenue—now ~$10B after 29 straight quarters of double-digit growth—remains the core engine. The strategy is shifting from travel toward lifestyle/retail perks and more amount-based (cash-like, lower-value) redemptions, with fewer retention bonuses, partners subsidizing benefits (> $3B in the past year), and ~$6B of marketing spend largely directed to welcome offers.

Did they distinguish between the business and personal cards at all? I’m guessing no, but given that people seem to be more excited about the personal than the business, I’m curious to see if Amex is seeing differences in interest levels for the two cards.

We all know that Platinum Pro is the sweet spot 🙂

This is what is called “rubbing salt in Chase’s self inflicted wound” and making a ton of money doing it. Good for Amex and good for all of us who benefit from their credits and benefits. A rare but real win-win.

It makes sense. Platinum is a great product. The recent enhancements are actually good. Chase’s updates to the Sapphire Reserve mostly screw over those who enjoyed the broad 3x travel category. Citi’s Strata Elite is a one-year pump-and-dump for most of us. Capital One won’t approve many of us because we open accounts with their competitors on occasion. Wells Fargo giving up BILT is probably the right call for them, financially, but is a huge blow to those of us who like the program because Cardless is gonna ruin it, undoubtedly. BofA benefits those with $100K with them (75% bonus), and has a chance with Atmos, especially that 3x on all foreign purchases. Barclays is giving up, practically. Who am I missing?

Doesn’t bode well for centurion lounge crowding.

@John — If there’s a wait, just sign up on their app in-advance to save your place in-line. Or, pick a fight with someone and end up on r/AirRage. You do you. I swear, nothing will ever be good enough for some of y’all… sheesh.

Given the limited acceptance of Amex I’m always surprised at its success. I have the platinum card as a free benefit and use the credits but otherwise I put very little spending on this card. I get more value out of cash back cards.

Plat is too lucrative

I would pay up to $50,000 annual fee for a truly premium Amex

– top status on all airlines and hotels

– full fledged membership access to all major airline lounges (AA DL UA)

– full membership to all Equinox gyms

– personal matchmaker who will find me a girlfriend so I can finally stop wasting my life away trolling internet travel blogs

@ 1990 — It’s really great? The waiting area outside of the Centurion lounge at JFK looked like Skid Row last week during our visit. The Delta One lounge was better, but already a complete zoo. It is ridiculous.

@Ken — This isn’t the 90s anymore; Amex is accepted in most developed places around the world, and nearly everywhere in the USA. Or, were you referring to card applications? Even there, Amex is one of the more welcoming companies out there. There are better things to whine about.

I thought Millennials and Gen-Z didn’t have any money.

@1990 – No, he’s right. Amex should build additional or larger lounges first, then increase the number of people who can get in. You lay down track before a train goes on it.

The formula works and works well. The surprising thing over the last few years is the number of younger people who have money, pay their bills contrary to popular belief.

@Christian — Well, they’re opening a massive new lounge at EWR Terminal A next year, so that’s a good start.

@Gene — Peak times? At least there are options. For Amex JFK T4, downstairs, speakeasy, espresso martini is a personal fav.

@PENILE — That would be quite a card product. Don’t give up, on blogs or ladies. We believe in you, sir! Well, I do, at least. Go get’em!

Gary wrote, “The Platinum card was originally a travel-focused product. They’ve gone more lifestyle and dining weight…”

Strictly from a “Points & Miles” point-of-view, I’ve never found the value in AMEX Plat. Yes, you can (probably) make back 100% (or more) of the AF if you are somehow are able to take advantage of all the credits which are offered, but a) how much do you have to spend in order to accomplish that, and b) with 5x points *only* on air travel and pre-paid hotels, I can do much better with other cards when it comes to racking up the points and I don’t have to pre-pay…

FWIW, I personally find the AMEX Gold far more compelling for its bonus categories and credits, access to credits with Uber, Resy, The Hotel Collection, and more — all for a lower AF and no cost to add authorized users.

Amex is not widely accepted in many European countries. Possibly at 5 star properties everywhere..

Was in LHR T3 this week. 3 lounges available to Amex card members, 2 had 30 minute waits and the 3rd couldn’t even provide a time for entry. Lounge benefits are awful at best in busy airports.

I used to carry a Amex card because of their superior customer service. That’s gone.

Amex cards basically coupon books. Use it if it works for you.

@Jason — I put $50-100K/year on the card, and nearly all of that airfare and FHR hotels for the 5x MR; even if I didn’t do that, I use nearly all the credit, and especially with new ones, I take home ample value over the annual fee. P2 does the same. We have four between us, two regular, two Schwab. However, if you never travel, and live in the middle of nowhere, I can see how this product might not work well. Of course, if you cannot afford the annual fee, or to pay off your cards fully, all the time, then, ignore everything above, and try to focus on getting out of debt.

Ironically we signed up for 2 Amex plat because of 175k/350k bonus miles, which seemed like enough to justify it.

Was planning on dropping after a year, but the Resy and Lululemon credits are things we actually use, more or less. Still a little coupon booky but better than it was, so will keep.

Primary card is Capitol one venture X.

I still prefer cash back, as with 800k miles floating around its still basically impossible to get a round trip business ticket to Europe around Christmas. Points are worth much less than people say – you have to have a completely open schedule basically.

@Charles – yep, there’s a reason why Chase eliminating the 1.5cpp redemption is a massive loss of value for most people. Between that and the elimination of 3x travel they changed the fundamentals of the card and people, uh, noticed. PointsBoost! is a joke. They made it more expensive and are delivering less value.

So here comes Amex which has credits that people actually use! So even though the card is not a points earning machine (and C1VX/Savor is an excellent combo to put spend on), it’s a keeper for sure. CSR… I doubt their retention bonus answer is going to match Amex’s. Citi… yikes, what a roll out. C1 though is positioned really well to be a breakout star in 2026/2027.

@ 1990 — The furniture in the JFK Centurion lounge looks like it was designed for 7 year olds. Horrible lounge. Not worth waiting in line for.

I for one could do a higher end card (higher than Amex Platinum and Chase Sapphire Reserve). Pay more annually but need benefits that better target me in this point in my life (ie several international business class and dozens first class domestic flights a year and related travel expenses. Dining from our local favorites to fine dining. Know the customer at that income / spending cohort.

We don’t want quarterly/monthly credit to lululemon; southwest anything; silver/gold status; wait for an hour to get into an airport lounge.

We want priority entry to lounges (skip the line); top tier premium status (ie Delta Diamond; United 1K; Hilton Diamond; Marriott Platinum; IHG Diamond Elite); high pts on flights, hotel, dining, ride share.

Think couples cards (shared benefit and spending) edition.

@ 1990 – thanks for saying that about “Capital One won’t approve many of us because we open accounts with their competitors on occasion.” WTF is their deal? Counting Discover, I now have seven unremarkable Capital One cards that offer far from best-in-market rebates etc, but when i try to upgrade to the Venture X, there is no path and when I try to see if I would be pre-approved, I get denied. It is like they are trying to be cool to have customers. I think I will cancel the seven cards I have with CapitalOne and try again in a year or so. I have the Platinum Amex and don’t want the Sapphire Reserve, but I’d like to get access to the CapitalOne lounges.

Gary, excellent analysis. Decades-long observer of Amex (even worked there more than 30 years ago) and you nailed it here.

The lounges at the Centurion are still overfilled and the quality of the food stinks. Its always chicken thighs. No beef, fish or sandwiches.

I experienced the Chase lounge which had truly awesome food.