American Airlines has very good international business class seats. They have new business class lounges and sit down dining for first class customers in some markets. They have gone to great lengths to improve the treatment of their ConciergeKey members.

I would argue that today they offer the best overall business class of any US or European airline, and their treatment of the customer they identify as most important is at least on par with United’s and possibly better than at Delta.

At the same time their domestic product is getting worse. American is cramming more seats into planes — their workhorse Boeing 737-800s went from 150 seats before US Airways management took over to 172 seats as the new standard — as well as removing seat back video screens and reducing the size of lavatories. Seats have less padding and less recline.

The reduction in seat pitch and less comfortable seating even extends to ‘Main Cabin Extra’ and first class. Where American is going is disjointed. They send mixed messages to employees with Basic Economy, going so far as to ban full-sized carry on bags for basic economy customers (even Spirit lets you pay for a carry on), before backing away from that restriction.

Employees don’t know whether they’re striving to offer a premium experience or a lowest common denominator one. In May American Airlines President Robert Isom explained in a closed session with employees that their domestic product aims to mirror Spirit and Frontier.

[T]oday there is a real drive within the industry and with the traveling public to want to have really at the end of the day low cost seats. And we’ve got to be cognizant of what’s out there in the marketplace and what people want to pay.

The fastest growing airlines in the United States Spirit and Frontier. Most profitable airlines in the United States Spirit. We have to be cognizant of the marketplace and that real estate that’s how we make our money.

We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.

American’s CEO Doug Parker calls Southwest Airlines ‘the cattle car’ but his domestic economy product is too, and less customer-friendly. Indeed American seems to see customers as the thing that gets in the way of their airline operation.

Southwest Airlines is clear about what their product is. I fly them reasonably frequently and have A-List status because they offer the most flights from my home airport of Austin. They have the only non-stop to Washington’s National airport for instance.

- I do not like their boarding process because I have to line up at the start of boarding and be one of the first to board in order to get my preferred seat.

- But their people are friendly, and their product straightforward for a short flight, an internal motto is ‘we do short better.’

I don’t want to fly Southwest on a cross country flight, or to Hawaii. But with American’s new product I don’t want to fly them on a cross country flight either, even with their new less comfortable domestic first class.

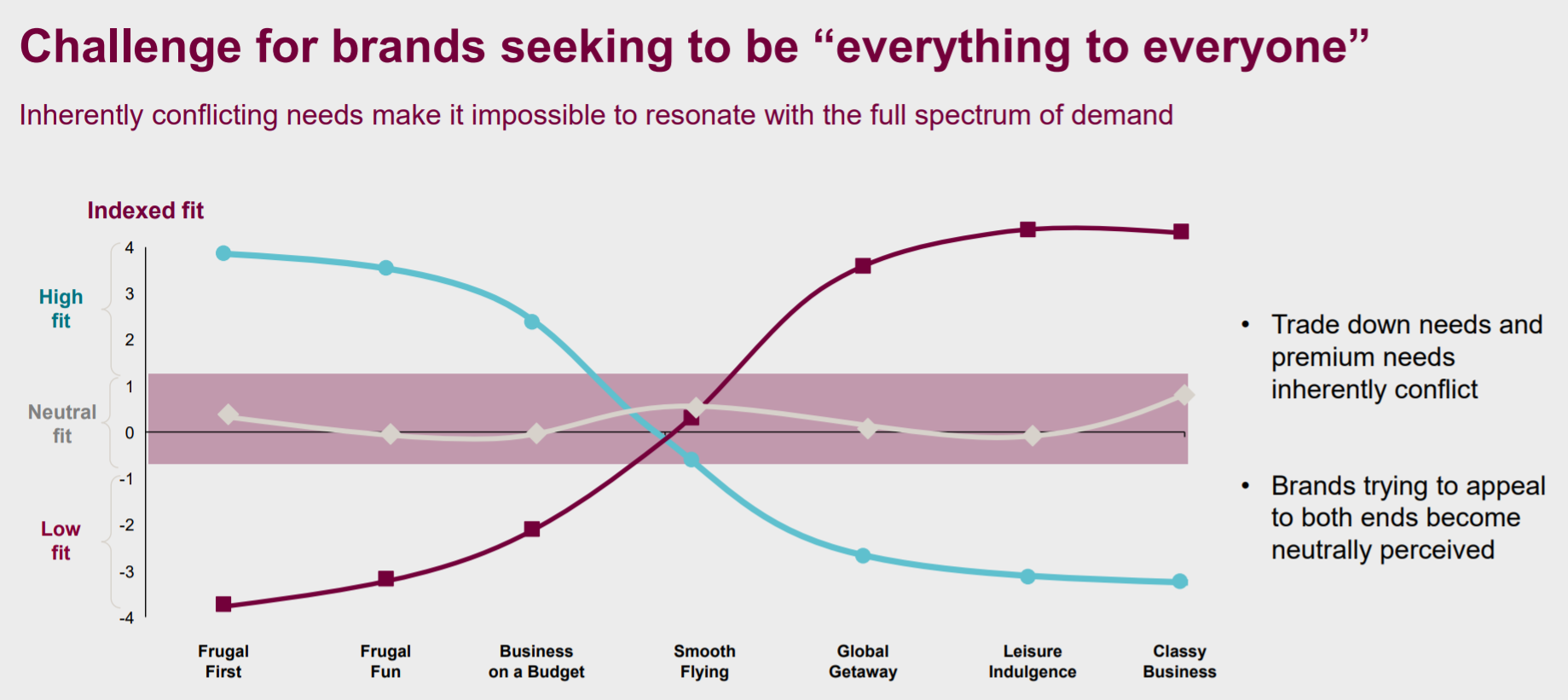

British Airways and Iberia are close partners of American Airlines. They coordinated prices and schedules and share revenues on transatlantic services. At Friday’s Investor Day for the parent company of British Airways and Iberia, IAG management has come to the recognition that you cannot be all things to all people.

British Airways has tried to be a budget holiday brand with cut after cut, for instance charging for food and even for hot water if you bring your own tea bags. Their premium cabin seats are legions behind competitors. Cutback after cutback under IAG head Willie Walsh and now ex-Vueling CEO Alex Cruz has gutted the carrier’s brand. Cruz reassures often that ‘British Airways will always be a premium brand’ but the reason he has to say that is because it no longer is.

American management is confused. American employees are confused. And British Airways is confused. This phenomenon isn’t at all limited, though, United is similarly confused as they invest in new business class seats and lounges while remaining the only US airline that still forbids customers on basic economy fares from bringing a carry on bag onto their aircraft.

Delta has basic economy fares, but they aren’t as punitive as United’s. They also haven’t see sawed their fare restrictions. They’re continuing to add seat back video to planes as part of their effort to drive loyalty to the Delta brand.

The Delta strategy has never been to deliver greater value through its frequent flyer program. United and American customers were willing to stick to those airlines when their loyalty programs were more generous. However they’ve given up that competitive advantage.

It’s important to recognize your core capabilities and leverage those, and to know who your customers are and focus on delivering value to them. An airline cannot be all things to all people, and an airline with relatively high costs can’t win as a low fare carrier. It needs to earn a revenue premium. It’s really no surprise that American’s President says they have a premium revenue problem.

Great article Gary. Very interesting analysis. Cheers!

American and United certainly have NOT given up the competitive advantage for their frequent flyer programs. Though they have been devalued, the redemptions available through AA and UA beat the pants off anything Delta offers. For example, I need a one way ticket back from Tel Aviv to the DC area next june. On Delta, there’s only one option in J – for 360K miles one way, 130K in coach. Nothing available on any of delta’s partners, just on the solo DL operated flight to JFK. Meanwhile, AA has TONS of saver business available for 70k miles one way (many itineraries bypass London Heathrow and BA, so I dont have to pay the huge taxes there), and tons of economy availablity for 40K. United has tons of partner availability for 85K one way in business, and lots of Y availability at various price points, including on their own metal on the new TLV-IAD nonstop. As long as this difference lasts (an I see it every time I try to use my miles), then UA and AA still have an advantage with their programs. DL is just not competitive, and I wont fly them and contribute to such a garbage program.

“I don’t want to fly Southwest on a cross country flight” – in economy, at least, gotta disagree with you there. Southwest has the most legroom of any of the “Big 4” carriers, reasonably comfortable seats, pretty free good snacks, and a solid streaming system now in place. That extra inch or two of legroom comes in real handy on a 5 hour flight.

The cattle boarding process on Southwest is a small price to pay for the relative comfort once you’re on board. I recently suffered through a 5-hour 29-inch pitch flight and will never do that again.

@Jason. Don’t give United and American any ideas on the next place to cut. 🙂

Can anyone explain that bizarre figure?

American just seems to be run by consultants, who tell them to do something and when it doesn’t work they are told oh you just didn’t do it well enough. If you listened to us you would be doing better. That will be another $10 Million for that advice thank you very much. Once the consultants get everyone to switch over to revenue instead of mileage for the FF programs they will come up with the brilliant idea that they should differentiate and go back to mileage and that will increase their competitive advantage.

We are looking at bench seats with a 4 x 4 configuration in coach on our 77-800’s

737-800’s

Can’t imagine why AA isn’t flying from DCA (hub-ish) to AUS (one of the highest growth airports in the country)? Seems crazy.

@UA-NYC Austin is just outside the 1500 perimeter rule for DCA. They would have to get an exception.

Isom: “We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.” Please. GUAF(ing)B.

I only fly American for two hours or less typically an hour so I no longer care if its

a wood barrel they use for a seat.

They can continue to destroy the airline & program/benefits/recognition

one day at a time till no one likely wants to fly them.

There are always other options/brands to fly most of the time

I will have like 4 or 5 short segments for the whole year

instead doing 100k or a bit more in other programs

The first thing you notice when you leave American is how much kinder agents are

And that they are empowered to help customers with most any reasonable issue

Life after leaving American for the most part is a life changing in a very positive way where they have your back!

So glad I took the chance and there are some extra connections involved but the slight inconvenience is nothing when you see the hard rewards in return and great customer service

Geography plays a role here though. Yes, there is competition but … not really. You said so yourself — WN is only carrier that flies non stop to Reagan. So you fly them, boarding process and experience on a mid-con be damned. Some of the hubs (Denver, Chicago, Phoenix) are a more interesting study of competition than others (DFW, Houston, Atlanta, SF). Having just recently moved from a fortress hub to a multi-carrier hub airport, I’ve become far less loyal. FFPs make no difference to me now. Who flies the cheapest, on the schedule I want. There’s little differentiation anymore when all I earn is 200 RDMs on a 900 mile flight these days. Airlines want to be all things to all people, so when all things are equal, when it’s just a commodity, I choose based on price and convenience, period.

@mike- DCA perimeter rule is 1,250 miles. That’s why flights to DFW (1,192 miles) are not restricted, but flights to AUS (1,315 miles) are restricted. I am not 100% sure, but it looks like the perimeter was drawn where it was specifically to allow flights to hubs like MSP, DFW, and IAH, but no further west.

http://www.flyreagan.com/dca/dca-reagan-national-slot-perimeter-rules

@UA-NYC: Southwest flies AUS-DCA

Management it’s so confused it doesn’t even understand the meaning of “profit”. Spirit is lousy at making profits: for each dollar invested in them over the last 12 months it returned 5.6% in profits, while Delta returned 10.0% (and AAL a measly 4.2%). Spirit may make a higher *margin* (profit per dollar of sale), but it’s so bad at transforming capital invested in high sales that investors are worse off.

It is this kind of financial slight that is driving AA to the ground — modeling itself on a low-profit company while lying to your employees that it’s a high-profit one.