I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

There’s an increased initial bonus offer for the World of Hyatt Business Credit Card, something we haven’t seen in awhile. You can earn up to 75,000 bonus points with an offer than runs until September 26, 2024.

- 60,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from account opening.

- Additionally, earn 15,000 Bonus Points after you spend $12,000 in the first 6 months.

View From Suite At Park Hyatt St. Kitts

This is a great card to get for the up front bonus. In fact, if you’re eligible for new Chase cards and can get a business card, that’s a rich enough reward to make applying almost a no-brainer. The card is reasonably rewarding for spend, and has some interesting benefits.

Balcony At Park Hyatt Abu Dhabi

I thought I’d lay out what I think are the (5) reasons to get the card, and see if these match with your goals.

- Initial bonus. The World of Hyatt Business Credit Card‘s offer to earn up to 75,000 points: 60,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from account opening and 15,000 Bonus Points after you spend $12,000 in the first 6 months.

I value Hyatt points at 1.4 cents apiece, making the initial bonus worth $1,050. In fact they’re probably worth even more than that to me (revealed preference) since I find Hyatt is the Chase Ultimate Rewards partners I transfer to most.

- Doesn’t add to 5/24. Assuming that 5/24 applies, you’re not likely to be approved if you’ve had 5 or more new cards in the past 24 months. However since it’s a Chase business card it shouldn’t add to your 5/24 total, meaning that it may not trade off with other cards you’ll want to get after.

- Most efficient way to spend for elite status. Spending on the card for elite status is more lucrative than with The World Of Hyatt Credit Card (which earns 2 elite night credits for each $5000 spent): the World of Hyatt Business Credit Card earns 5 elite qualifying nights with each $10,000 in spend on the card in a calendar year. That’s 25% more elite credit per $10,000 spent, though of course you may strand more spend reaching for it than when elite nights are awarded in $5000 spend increments.

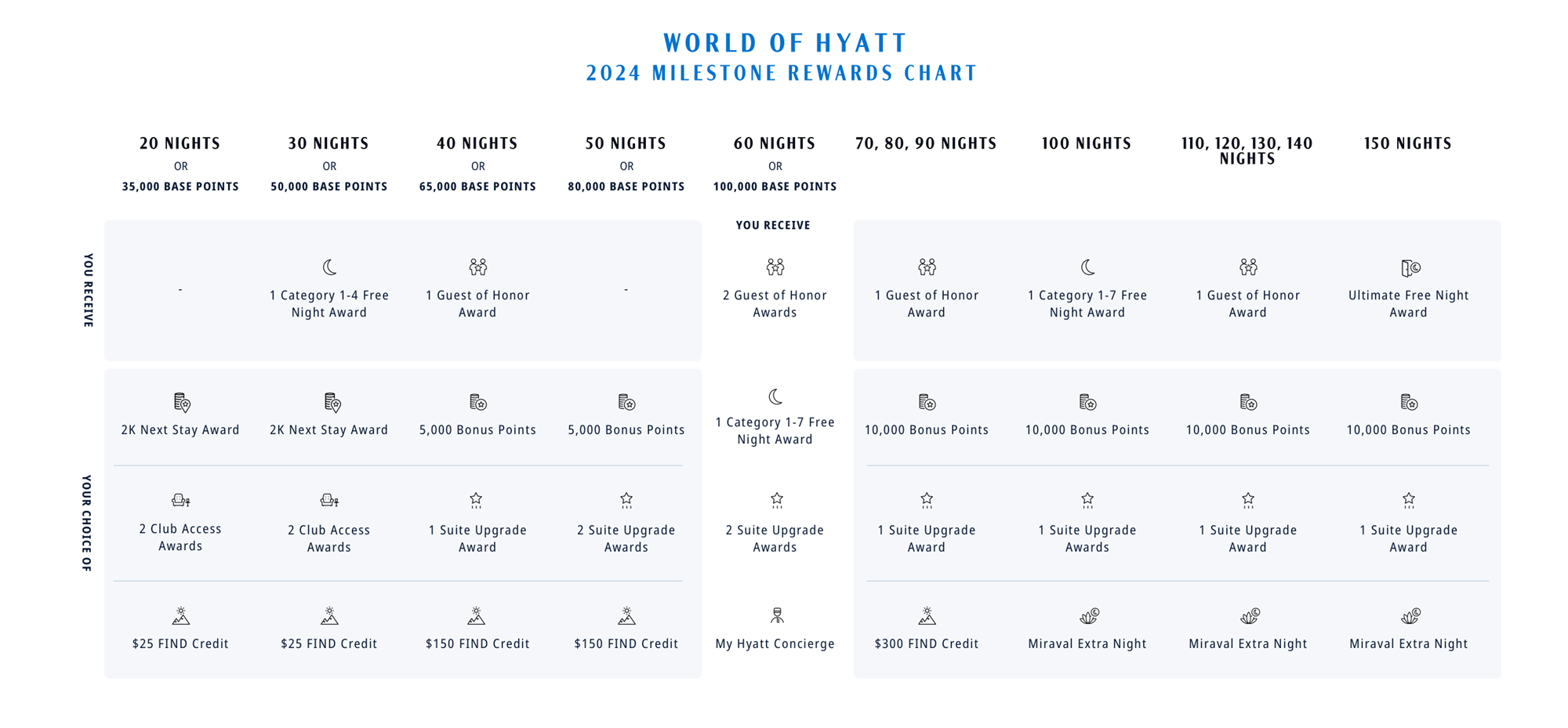

Hyatt’s top tier of elite status (Globalist) is the most rewarding generally accessible elite loyalty tier of any chain in my view, but you actually get rewards at every 10 elite nights earned in the program, up to 150 nights each year.

- Annual Hyatt credit and points rebate make annual fee worthwhile Each anniversary year cardmembers receive $100 in Hyatt credit in the form of two $50 statement credits (spend $50+ at a Hyatt property and receive a $50 statement credit up to two times each anniversary year).

Spending $50,000 or more on the card in a calendar year entitles cardmembers to receive a 10% rebate on points redeemed for the rest of that calendar year, up to 20,000 points back each year (at 1.4 cents apiece, worth up to $280).

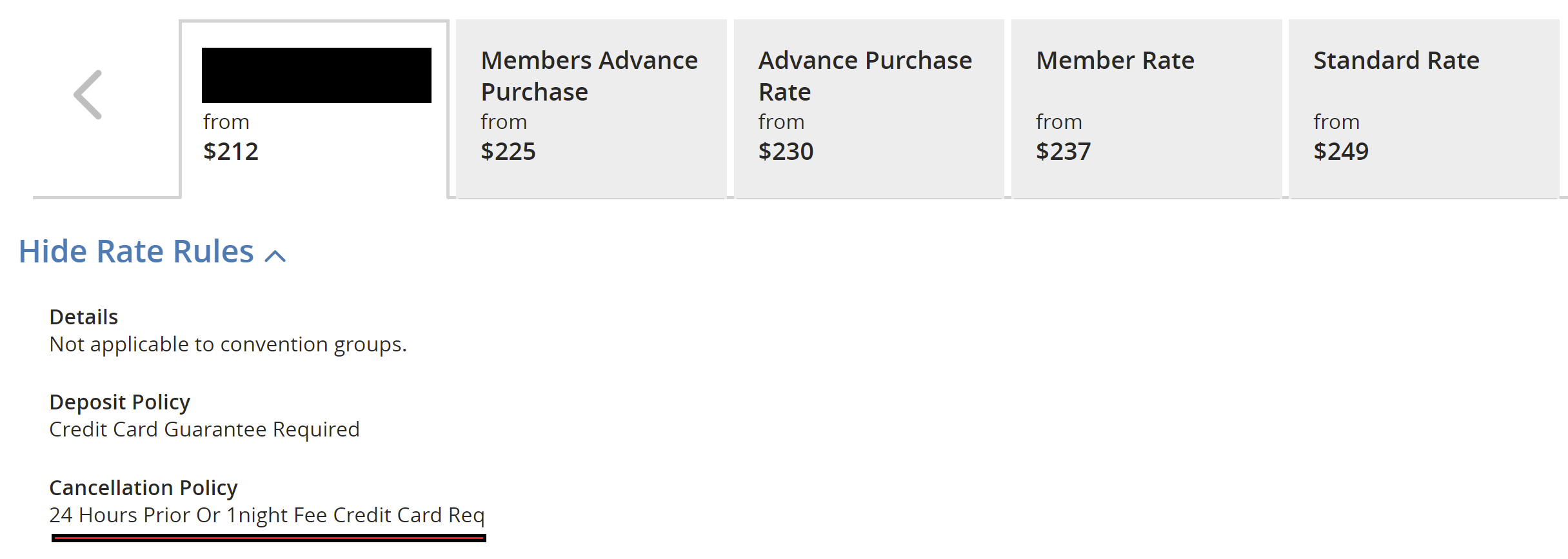

- Waived requirements for the Hyatt Leverage program. The Hyatt Leverage program is a small business room discount program that provides legitimate savings on stays (can be cheaper than member advance purchase rate or AAA rate without advance purchase), and its terms say you need to credit 50 nights a year to remain in the program so having the card is a great way to access it at lower volume since the 50 night requirement is waived for cardmembers. Staying in the Leverage program alone can drive real savings to small businesses that use Hyatt.

Complimentary Evening Treats At Park Hyatt Chicago

Complimentary Globalist Room Service Breakfast at Park Hyatt Paris

I want the up front bonus, and I probably need the card for its more powerful earn towards status tiers. So the World of Hyatt Business Credit Card is one of the cards that is now at the top of my list (that I do not already have).

Will Chase allow a customer to have multiple Hyatt cards associated with different businesses, like they will the Inks?

@ Gary — Spend carries over from year to year, so nothing stranded.

Gene can you explain what you mean about spend carrying over from year to year? I know what it means for something to carry over but not clear how it works in this case.

@ Steve — The spend counter never resets from the day you open your account. When you spend another increment of $5k, you earn 2 QNs.The QNs issued are for the year of the transaction date that causes your counter to cross the next $5k. If you reach the end of your first calendar year with $9,999 spend, you will earn 2 QNs for that year, and your spend counter heading into your second year will be $4,999.

@ Steve — My example is for the personal card, but the business card works the same way.

Do you really need the qual nights with the promos for AA elites each year?

@gary Isn’t the Chase Ink Business Preferred a better option for Hyatt points? Even without the occasional bonus, transferring Chase UR points would net 120,000 Hyatt points on $8,000 in spend versus the 75,000 for $12,000 in spend if we only consider bonus points. That’s 50% more spend for about 60% of the points.

For this to make sense to someone comparing the two cards, you would have to personally put a lot of value behind earning the 5 elite nights on every $10K in spending which comes with its own opportunity cost as the ongoing earn isn’t great.

Gene that makes sense. I’d never thought about whether the meter resets. Thanks for clearing that it doesn’t. Nice to know any spending that doesn’t cross the $5k threshold isn’t lost.