I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Bilt just released the missing details behind its new cards: what the promised 4% “Bilt Cash” actually buys on top of points. The redemption menu is much bigger than expected—ranging from monthly Grubhub and Lyft credits to Blacklane rides, hotel portal credits, and even Blade flights—and there’s a points-accelerator option that can effectively raise your ongoing earn rate if you play it right.

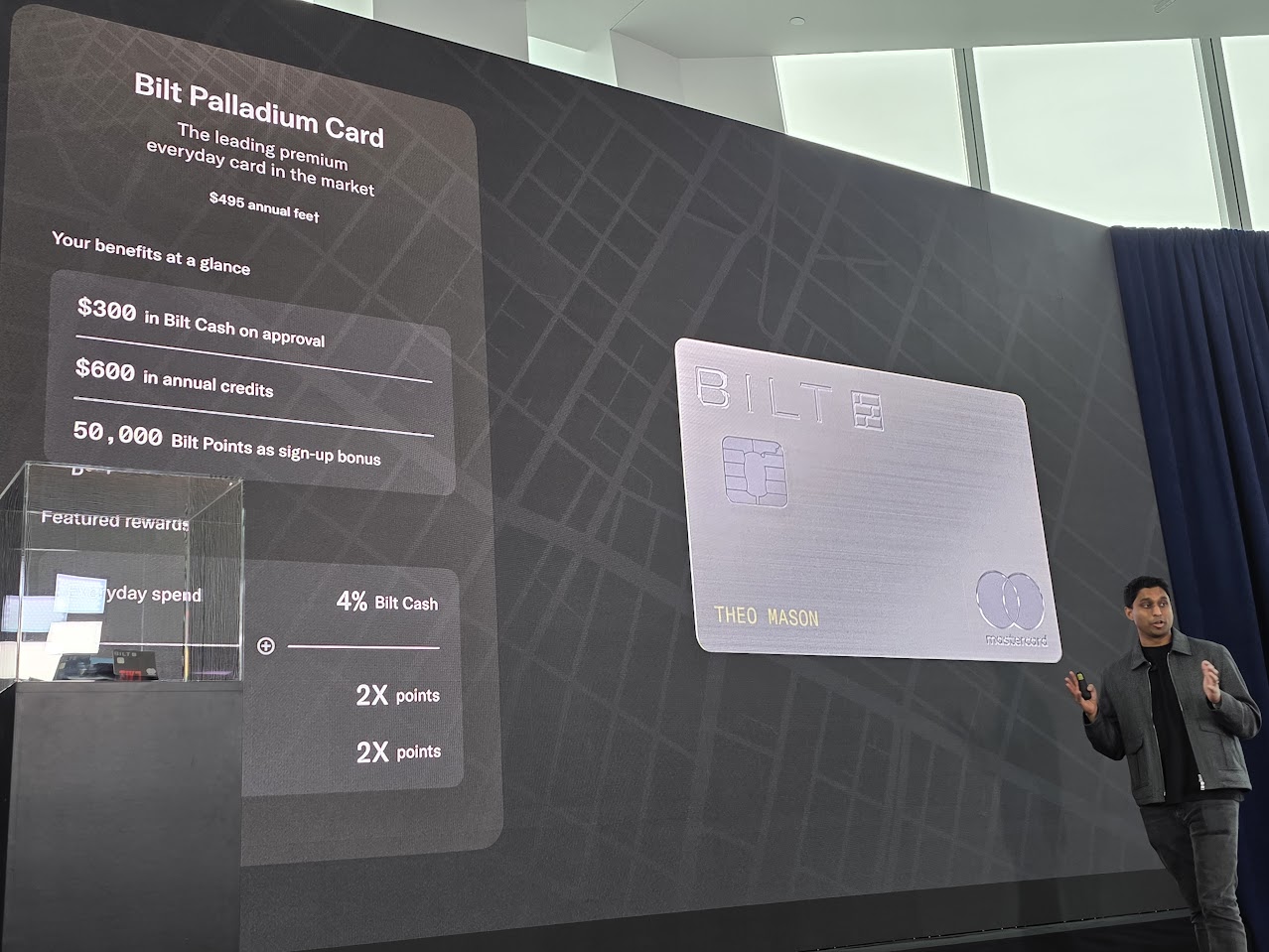

Last week, Bilt Rewards introduced its 3 new credit cards. There’s a $0 annual fee card, $95 annual fee card, and $495 card.

Each one has different earning and benefits. But they all promised 4% Bilt Cash earned in addition to points. I jumped on the premium Bilt Palladium Card (See rates and fees) because I thought it was really valuable even without the Bilt card. Most of my unbonused spend goes on a Venture X card today, Bilt’s transfer partners are better, and Palladium earns 2 points per dollar on all spend (like Venture X) but more because it earns on rent and mortgage, too (effective, 3.3 points per dollar up to the amount of your housing payment each month).

Still, probably the most frustrating thing – aside from my receiving a lower credit limit than with my Wells Fargo Bilt card – was that the details weren’t available on Bilt Cash. They’re finally out, and it’s better than I was expecting.

We’ve known about Bilt Cash since it was announced in the fall. It’s a currency to spend with Bilt partners, through the Bilt travel portal, and on Bilt opportunities like Rent Day experiences and transfer bonuses (a Bilt member might take advantage of an elite-only higher transfer bonus by redeeming Bilt Cash).

- My mental model was that this would be Bilt’s version of merchant-funded offers like Amex Offers.

- That it replaces the coupon book-style credits that American Express and Chase have for their premium cards.

- But they’re available to all members, you earn them through spending on the cards and by earning points in your Bilt account ($50 for every 25,000 points earned aside from card spend).

- And you choose the offers that you’re most interested in.

That’s pretty much right, but there are more offers than I was expecting and some of them have bigger value than early coverage suggested – though most are capped with how much value you can get each use, or each month. Redemptions will be available starting February 1.

Bilt Cash Redemption Options

As expected, there are redemption options with existing known Bilt partners like GoPuff, Bilt partner restaurants, and through Bilt’s travel portal. Some of those are for just $5 or $10 a month. But there are partnerships we didn’t know about (like car service Blacklane and GrubHub) and you can redeem for the full cost of some things as well, like Blade helicopter transfers.

- $120 / year towards grocery or restaurant delivery GrubHub $10 credit available each month, starting March 1, 2026.

- $60 / year of credits 15-minute home delivery GoPuff $5 credit available each month.

- $100 / year Gopuff Fam (Free delivery and discounted groceries) Gopuff Fam membership monthly or annual membership, available 3/1/26.

- $300 / year of restaurant credit at select Bilt Dining partners One visit per month up to $25, “rollout expanding to thousands of restaurants nationwide”

- $600 / year toward dining experience bookings Redeem Bilt Cash towards Bilt dining experiences up to $50 per month (I have often seen these offered for $75, so covering part of the cost), available starting March 1, 2026.

- Bilt card accelerated points-earning when choosing to earn Bilt Cash on your card, Obsidian and Palladium cardmembers can earn an additional 1 point per dollar on card spend for the next $5,000 after redemption. This costs $200 in Bilt cash (earned from $5,000 spend). So $5,000 spend on the card earns 5,000 bonus points on your next $5,000 spend. You can keep doing this up to 5 times a year. (It expires at year-end if you haven’t maxed it out.) Because Bilt Cash is earned on top of points, you’re effectively using the cash rebate to buy an extra 1x on the next $5,000.

This means a Bilt Obsidian Card (See rates and fees) cardmember can earn 4x on dining and grocery with this accelerator (in whichever of those categories they chose, and if they haven’t maxed out the annual $25,000 cap in the category). The option makes it, effectively, a 4x dining and grocery card for heavy spenders in those categories. Obsidian cardmembers would earn 3x on travel and 2x on otherhwise-unbonused spend.

Bilt Palladium Card cardmembers earn 3x on their regular spending with this option. And that doesn’t include mortgage or rent points with the card. (All cardmembers can earn points on monthly rent or mortgage payments where every $30 Bilt Cash redeemed earns 1,000 points, up to the amount of your housing payments.)

Put another way, I can earn as much as 4.3 points per dollar up to the amount of my mortgage each month redeeming Bilt Cash this way using the Palladium card.

- Up to $1,200 hotel credit / year for the Bilt Travel Portal two-night minimum stay per booking, up to $50/month for Blue & Silver members and up to $100/month for Gold & Platinum members (Palladium cardmembers get Gold the first year with the card.)

- Bigger points transfer bonuses. Upgrade Rent Day transfer bonuses to the next status tier. The example they give is a Gold member can upgrade from a 75% bonus to a 100% transfer bonus for $75 in Bilt cash, while Platinum members can redeem for an even bigger transfer bonus (“pricing and availability subject to change”).

- $120 Lyft rideshare credits / year up to $10 per month.

- Up to $150 toward a Blacklane ride / year Blue and silver members can redeem up to $50 per year, Golds can redeem up to $100 per year, and Platinums up to $150 per year. I’ve been using my Citi Strate Elite Blacklane credit, and I’ve found them convenient, so this is another service I’ve found a use for and it’s not just a $10 one-off, either, but real money.

- Up to $700 of BLADE credit / year up to $350 per seat, up to 2 seats per year, available starting March 1, 2026. This should cover a full Blade flight (and often then some, towards any excess baggage charges).

- Unlock Home Away From Home hotel benefits “Blue & Silver members can unlock luxury hotel booking benefits usually reserved only for Gold and Platinum members for $95 Bilt Cash” this is Bilt’s answer to Amex Fine Hotels & Resorts and Chase’s The Edit, with travel advisor services added in. Hotel bookings can come with room upgrades, $100 stay credits, etc. This is available starting March 1, 2026.

- Up to $768 of Priority Pass extra guest credits / year Bilt Palladium Card cardmembers are eligible for a Priority Pass, that covers the member and up to 2 guests. You can redeem Bilt Cash against additional guest fees, up to two guest fees per month (which is $32 per guest, up to $64 statement credit per month) available starting March 1, 2026.

- $60 toward parking / year Redeem $5 per month at participating parking locations, available starting March 1, 2026.

- $480 fitness class credit / year Redeem toward one group fitness class per month in the Bilt app (e.g. SoulCycle, Barry’s) up to $40 per month.

- $120 Walgreens credit / year Redeem $10 per month toward a Walgreens credit

- $600 toward comedy experience bookings per year Bilt regularly offers these are part of Rent Day, and you can redeem up to $50 per month for these events, available starting March 1, 2026.

- $120 Bilt Design Collection credit per year Redeem up to $10 per month toward the merchandise they make available.

How I’ll Spend Bilt Cash

First and foremost I’m all-in on points-earning. I value Bilt points more than any other currency. You can spend them at a value of 1.25 cents apiece through Bilt’s travel portal (which is actually good) and they have more and better transfer partners than anyone else.

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus, Avianca LifeMiles, TAP Air Portugal Miles&Go

- oneworld: Cathay Pacific Asia Miles, Alaska Airlines Mileage Plan, Iberia Plus, British Airways Club, Japan Airlines Mileage Bank, Qatar Airways Privilege Club

- SkyTeam: Air France KLM Flying Blue, Virgin Atlantic Flying Club

- Non-alliance: Emirates Skywards, Southwest Airlines, Aer Lingus Aer Club, Etihad Guest, Spirit Airlines Free Spirit

- Hotels: World Of Hyatt, IHG One Rewards, Marriott Bonvoy, Hilton Honors, Accor ALL – Accor Live Limitless

So my plan is to earn Bilt cash with my Bilt Palladium Card, and max out ‘spend $5,000, earn 5,000 bonus points on your next $5,000 spend’ option five times per year, on top of earning points against my mortgage. (In fact, you don’t necessarily have to spend on the card before starting this accelerator, since the Palladium card comes with Bilt cash each year.)

On top of that, though, I use Lyft regularly already. I use GrubHub, too, because my favorite restaurant to order in from only has its full menu on that platform. So those are as good as cash to me.

And I’ll be able to take a couple of additional Blade trips per year, in addition to the annual free one I’ve been getting as a Bilt Platinum member that I just redeemed last week.

I’ll also make good use redeeming $150 for Blacklane, I expect.

How This All Works

Each month you’ll be able to select how to use available Bilt Cash in the app or on their website. Once a monthly credit is used, you’ll be able to redeem for it again at the start of the next month.

One thing to know is that where a benefit is ‘up to’ a certain amount, like up to $350 for a Blade flight, you don’t get to bank any overage. If you only spend $300 then the $50 isn’t held over for instance.

Bilt Cash expires December 31 each year, and you can only roll over $100 to the next year. That’s disappointing, because heavy spend in November and December could earn a lot of Bilt Cash! But I’m happier than expected with the number of opportunities I have to use the Bilt Cash.

If only all of this information had been available at card launch last week, I think the messaging would have gone over better to cardmembers – not to cardmembers who were only using Bilt to earn points paying for their rent, and doing nothing else at all in the program or on the card. Their earning was heavily subsidized, and all good things eventually end.

Perhaps it’s just one more layer of ‘confusing’ but that’s also where the best benefits often lie. The average consumer might not spend time to understand all the details and get the most value, but that’s where we pick it apart and come out ahead of everyone else. I’m excited to get and use my new card, honestly, I just hope I can boost my credit limit.

I haven’t a rent nor mortgage. Love the transfer partners though. Still with the app?.

So you’re spending 5k to get an extra 5k points on your next 5k spend.

Isn’t that in effect buying points for a penny each ?

Doesn’t seem that good of a deal to me

It’s a worse accelerator – $200 of Bilt Cash gives 6,666 rent/mortgage points as compared to 5,000 with this offering. I suppose it’s fine if you’re routinely spending 100%+ of rent and have a lot of extra Bilt Cash lying around but if I’m spending 75% of rent or less I’d certainly not choose that option.

Sorry, I know that you said the confusion is where we earn the points (assuming this program survives), but my head hurts again. Assuming all we care about is Bilt Points, and assuming we are going with the Bilt Cash option, unless you will have more spend than 75% of your housing payment, the points accelerator is worthless, correct? Let me know if I have this right-

All Bilt Cash should first be applied towards points on a housing payment because that’s at a 3:100 ratio ($200 Bilt Cash earns you 6,666 points).

Any remaining Bilt Cash should be applied to the 5x $200 Bilt Cash points accelerators because that’s at a 4:100 ratio ($200 Bilt Cash earns you 5,000 points)

You earn 4% Bilt Cash on spend, so if you have $50k of housing payments, you need $37.5k of spend to earn $1500 in Bilt Cash to unlock the 50,000 points (well, I guess technically you would earn $1550 in Bilt Cash because you get $50 in Bilt Cash per 25k status point milestone which you would get for spending $25k, assuming I have that right, so it would be slightly less than $37.5k but I can’t be bothered to do the math… maybe Bilt could put out an “official” calculator?). And then the next $25k of spend would use the five $200 accelerators. Ignoring the two extra $50’s in Bilt Cash and the Bilt Cash sign up bonus, I guess that means-

First $37.5k of spend = 75k points on spend (2x) + 50k points on housing ($1500 Bilt Cash redeemed); subtotal 125k points on $37.5k = 3.33x

Next $25k of spend = 75k points on spend (3x; $1000 Bilt Cash redeemed)

Total – 200k points on $62.5k/spend = 3.2x

I think that’s right, but again… geesh.

One other question – how on earth does the end of year roll over work. Are they really saying that if you earn Bilt Cash in December (a heavy spend month) all but $100 of it is worthless? They need to clarify if you’ll have until, say, January 31 of the next year to spend all of your Bilt Cash from the prior year. (If they did that already, apologies if I missed it). Otherwise, that’s insanity.

The bamboozle continues! Has anyone tried convincing Wells Fargo to just come back, continue being our sugar-daddy, and keep BILT 1.0 in-place? I mean, fellas, it’s only $10,000,000 in losses per month. That’s far less than the slap-on-the-wrist ‘fines’ they paid for the multiple-accounts scandal a few years back. Kind of the least they can do.

@Jon – beat me to it, and more succinct too! Brevity is the soul of narrative… just not with Bilt!

And I guess in my example you’d have an extra $300 of Bilt Cash from the sign up bonus plus $100 in Bilt Cash from the $50 per 25k bonuses. So you could have $100 for carry over and then use the other $300 to unlock additional Rent Day transfer bonuses up to 4x? And in that example you’d also spend more than $50k so you’d also earn Bilt Platinum status and get the Blade ride and Flying Blue Gold?

I also meant to say that they should let you have until 1/31 to spend the Bilt Cash that you earn in December, otherwise, you would never put more than $2500 of spend on the card in December which would earn $100 in Bilt Cash (and assuming you’d be able to cash out all other Bilt Cash by 12/31).

Makes my head hurt. I’m out.