I first got the Bilt Rewards Mastercard in November 2021. When the program launched they were with another bank, and launched with Wells Fargo in March 2022. Wells didn’t buy the back book. I suspect the lack of revolve by cardmembers – early adopters like me aren’t a super profitable bunch! – led to this decision.

So there have been Bilt credit cards from two different issuers, although all new cards over the past 27 months have been Wells Fargo cards.

The legacy cards are being sunset December 31. Keeping a Bilt card means having to apply anew for the Wells product.

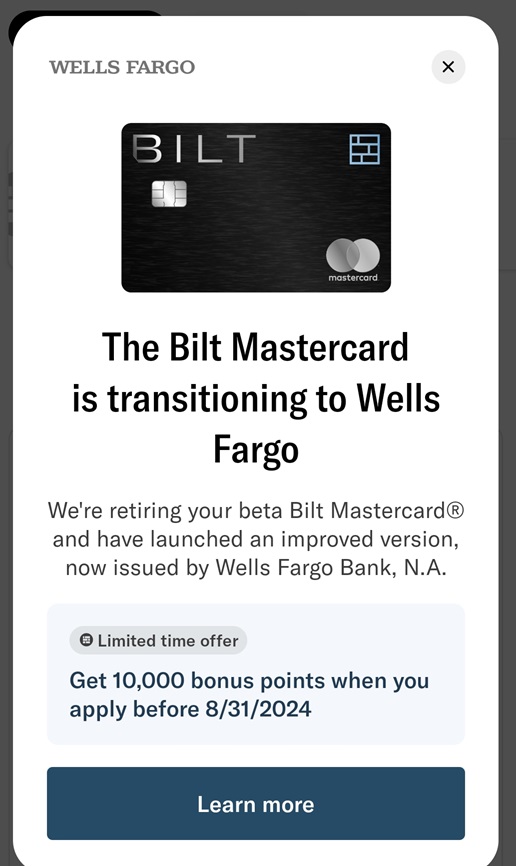

- This option pops up in the Bilt app, and if you accept it’ll take you to a pre-filled application.

- They give you 10,000 points for applying by August 31 (whether you’re approved or not)

I went through and applied. This hurts me with Chase’s 5/24 limits, but I:

- Keep my Bilt engagement. They have better transfer partners than anyone, I love spending on the first of each month, and I love their transfer bonuses. I’ve benefited from 100% transfer bonuses or better with Air France KLM, Virgin Atlantic and Alaska (and sort of regret skipping Air Canada, Hawaiian). I love the benefits of Platinum, like a free Blade helicopter transfer.

- Finally get tap to pay. Probably the thing that kept me from using the card most was not being able to use this feature.

- Pick up 10,000 more points… which will hopefully turn into 20,000 (or more) later on with a transfer partner.

Once I submitted my application I was immediately awarded 10,000 points. I was also instantly approved by Wells Fargo. I don’t currently have any cards with Wells Fargo, and they gave me a $50,000 credit limit which is great.

I find Bilt to be the most interesting and engaging program out there currently. They introduce new features and partnerships regularly so I’m glad they decided to keep me as a co-brand cardmember.

The legacy card is still valid through December 31, 2024. They will ultimately be closed by their issuer. I suppose if there’s one extra step in this that I don’t love it’s that autopay for the Wells card requires setting up a separate Wells Fargo account, rather than just being all handled in the app.

Of course there’s no requirement for legacy cardmembers to apply for a new Wells Fargo card. The old one still works through end of year, and there are plenty of ways to earn with Bilt outside of the co-brand.

is there a direct link to apply? just went through the app and didn’t see the offer.

I’m dropping under 5/24 in September so this is annoying. Gotta decide whether 10k Bilt points is worth pushing my next Chase card out from September to March.

You neglected to mention that the old bank, Evolve, had a data breach and has refused to provide credit monitoring to card holders. This, I gather, has caused a lot of pushback to Bilt

“I’m glad they decided to keep me as a co-brand cardmember”

come on enough with the stockholm syndrome

I appreciate the bonus, but having to open a new credit line and there being no guarantee of even pre-approval for existing cardholders is a pretty crummy way to treat your earliest adopters.

@Jerry 329 – I imagine this would have been in the works prior to disclosure of that data breach

The biggest unanswered question for me, is whether the Bilt “rent rewards“ options still exists. This allows me to use the Bilt credit card to pay my rent via ACH, allowing me to get reward points without paying a credit card fee. This has always been the biggest and best part of Bilt’s promotion.

How about a photo of the othercside of your card?

@ Gary — It sounds like this card failed as I predicted. It lined the pockets of a bunch of investors and left someone else holding the bag. What a shock.

@Gene – failed? The Wells deal runs for 5 more years.

I also applied and was instantly approved. Both cards now show up in the Bilt App so I am wondering if I can earn the 10k maximum monthly bonus on Rent Day on each card for a total of 20k monthly until the old card sunsets at year end…

It is simply outrageous that Bilt isn’t transferring the accounts to WF like Barclays did for Choice.

Is the reason, that according to the WSJ Bilt earns $200 for each new account and wouldn’t earn that if they transferred the accounts to WF? Instead, consumers will have a hard pull and use up a new application to have the same card they already have with no benefit to the consumer.

That is unacceptable. We should all file CFPB complaints.

@Not cool – “It is simply outrageous that Bilt isn’t transferring the accounts to WF like Barclays did for Choice.

Is the reason, that according to the WSJ Bilt earns $200 for each new account and wouldn’t earn that if they transferred the accounts to WF? ”

The reason is that Wells Fargo didn’t buy the old accounts from Evolve. Now, I have to assume Wells chose not to buy them because these accounts are likely unprofitable (being used heavily for rent vs other spend, paying off bills each month in full). But if Wells Fargo doesn’t buy the Evolve ‘back book’ there’s really nothing that Bilt can do here, as far as I can tell this wouldn’t have been Bilt’s decision.

I’m surprised anyone is staying on with Bilt. First the data breach with Bilt refusing to take any responsibility for it, and then, being bought by Wells Fargo, a bank that has abused its members time and again. Good luck!